The following story is an excerpt from the 40-page 2017 Rural Lifestyle Dealer Business Trends & Outlook Report. Email Lynn Woolf for a copy of the complete report, lwoolf@lessitermedia.com.

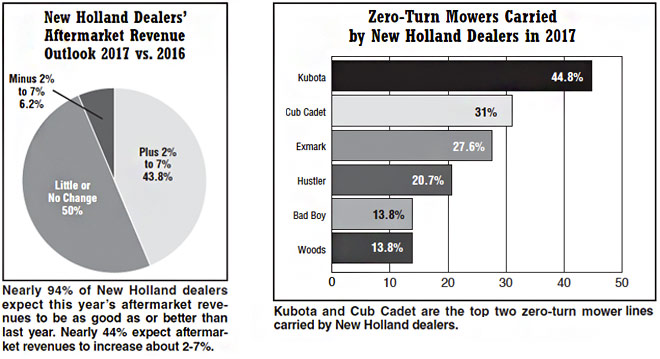

New Holland dealers see a good year ahead for total and aftermarket revenue and they’re expanding their offerings of hay tools/ balers. They are unique in optimism for this product category among dealers of other leading manufacturers.

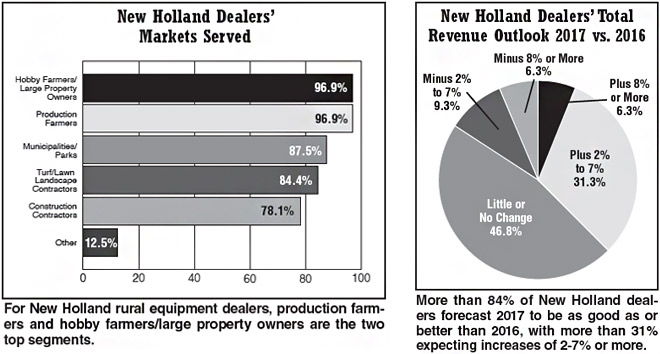

New Holland dealers match North American dealers as a whole in terms of optimism over total revenue. More than 84% of New Holland dealers as well as 84% of North American dealers forecast 2017 to be as good as or better than 2016 for total revenues.

About 31% of New Holland dealers expect increases of 2-7%. About 15% see some pessimism ahead and forecast revenue declines of 2-8% or more.

New Holland dealers are slightly more optimistic about aftermarket revenues than North American dealers. Nearly 94% of New Holland dealers expect this year’s aftermarket revenues to be as good as or better than last year. This compares with 90% of North American dealers who are optimistic about this year compared with last year. About 6% of New Holland dealers expect aftermarket sales to decline 2-7%.

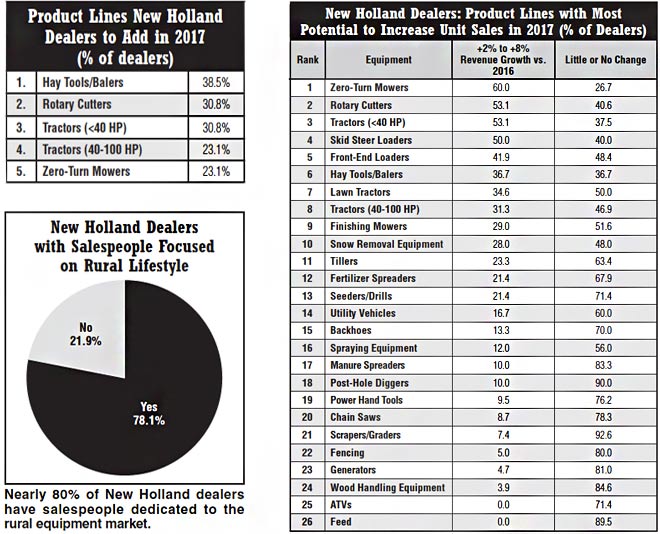

Zero-turn mowers top the list of equipment categories in terms of the most potential to increase unit sales in 2017, followed by rotary cutters, tractors less than 40 horsepower, skid steer loaders and front-end loaders.

New Holland dealers place fencing, generators, wood handling equipment ATVs and feed at the bottom of the list for unit sales growth.

About 40% of New Holland dealers expect to add hay tools/balers about 31% expect to add rotary cutters and tractors less than 40 horsepower.

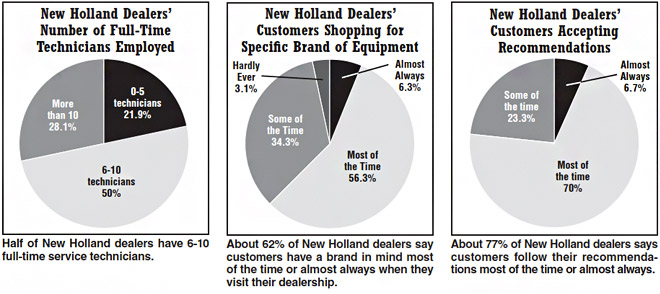

New Holland dealers also match North American dealers in terms of brand awareness and respect for expertise. About 62% of dealers from both groups say customers have a brand in mind most of the time or almost always when they visit their dealership.

And, about 77% of both groups say customers follow their recommendations most of the time or almost always.

Nearly 80% of New Holland dealers have salespeople dedicated to the rural equipment market and half employ 6-10 full-time technicians.

Production farmers and hobby farmers/large property owners are the two top segments.

See the charts below for additional details as well as comments from New Holland dealers.

New Holland Dealers’ Commentary:

What’s the best mistake you ever made and how did it change your dealership or how you approach business?

“As farming has declined in our area, we have gone with the trend. We still have production farms and beef and hay production dominate the area, along with some specialty and tourism farms. We still have a strong consumer market as well. Our service to the consumer market was something we lacked, so we created more shop space, added small engine mechanics and increased our equipment set-up department.” … “Stayed with a supplier too long. We eliminated them and picked up business by concentrating on other in-house lines.” … “Paying too much interest on tractors. We have to more carefully plan inventories.”

What recent changes have you made in your service or parts department and how has it helped your dealership?

“Specific people for specific jobs makes everything run smooth.” … “We added small engine mechanics and increased our equipment set-up capacity as well as shop space.” … “We lowered the average age of technicians and provided more specialized training for younger technicians.” … “We have specialization of technicians and two different parts counters, which helps us accommodate outdoor power equipment.” … “We improved our lighting.” … “We started paying service technicians and the service management team based on performance against flat rate — per Bob Clements’ program.”

Post a comment

Report Abusive Comment