As overall U.S. retail sales continue to spiral upward, so do the fortunes of rural lifestyle equipment dealers. The ongoing strength in consumer and commercial markets is further borne out by the result of Seaport Global Securities’ most recent survey of North American landscape contractors. “Our latest quarterly survey revealed that the capex outlook for 2018 improved for the second consecutive quarter, in line with an improvement in revenue expectations,” says Michael Shlisky, SGS analyst.

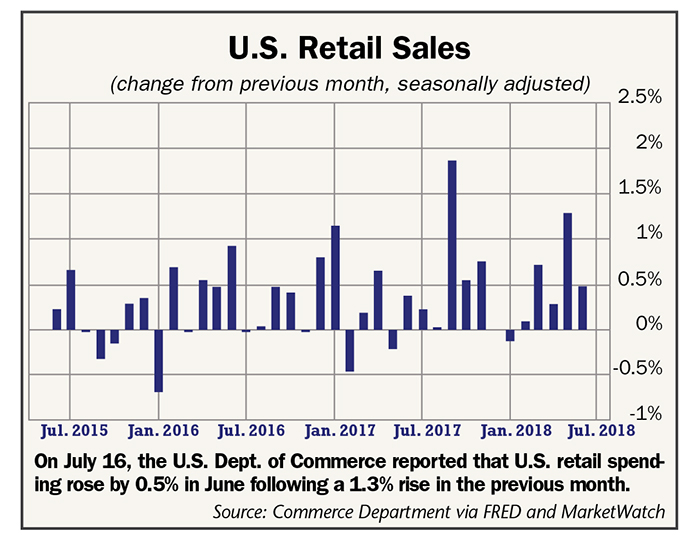

On July 16, MarketWatch, a Dow Jones news service reported, “Sales at retailers such as auto dealers, restaurants and internet sites rose again in June after a mammoth gain in May, underscoring the strength of the U.S. economy as spring turned to summer. Sales at retailers nationwide grew 0.5% last month, the government said. That matched the MarketWatch forecast of economists.

“The increase last month followed an even bigger burst of spending in May, when sales grew a revised 1.3% instead of the previously reported 0.8%. Retail sales have increased 6.6% over the past 12 months, slightly above the long-range average since 1980.”

Also, on July 10 the Assn. of Equipment Manufacturers reported that year-to-date North American sales of compact tractors (under 40 horsepower) were up by 8%, or by more than 6,700 units vs. the same 6-month period in 2017. U.S. sales of small tractors were up by 8.3% and in Canada by 3.8%.

Landscapers’ Capex Trending Up

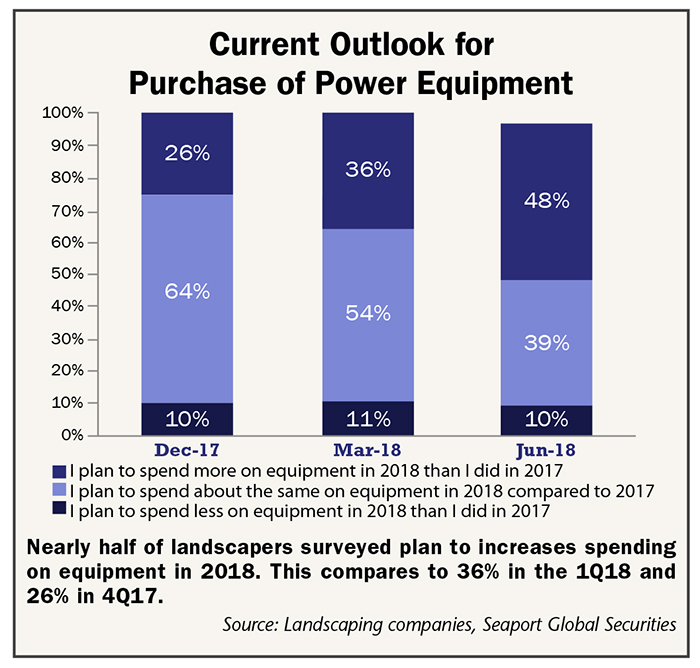

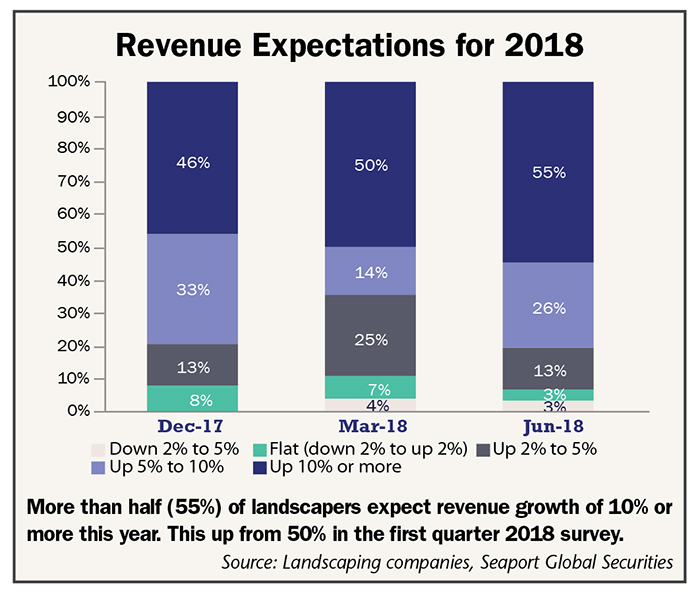

Overall, the SGS survey revealed that 48% of landscapers noted plans to increase power equipment capex in 2018, up from 36% in the first quarter 2018 survey and 26% in the fourth quarter 2017 survey. Only 10% plan to reduce expenditures. “From a revenue standpoint, 55% of landscapers expect growth of 10% or more in 2018, up from 50% in the first quarter survey, and 26% expect revenue growth of 5-10% up from 14% in last quarter’s survey,” says Shlisky.

Revenue Rising

“We believe high employment rates may be helping drive landscapers’ business, with many people unavailable to self-perform yard work or making enough money to afford to outsource this task. Improved revenues are likely to lead to improved cashflow along with new equipment needs,” he says.

According to the SGS landscape survey results, 55% of landscapers expect revenue growth of 10% or more this year, up from 50% in the first quarter survey. In addition, 26% expect revenues to increase by 5-10%, an improvement from 14% in the first quarter. Only 6% expect a flat or down year, down from 11% in the first quarter.

“Net/net, the improved revenue outlook mirrors that of the power equipment outlook, or perhaps underpins it,” says Shlisky. “Potential reasons for increased revenues range from high employment (meaning less time to do landscaping), to higher pricing for services, to increased economic prosperity leading to more outsourcing of mundane tasks.”

Post a comment

Report Abusive Comment