It’s probably all the talk about the “fiscal cliff” or a general uncertainty in the overall economy that seems to have businesses feeling they’re operating in business limbo these days. But dealers selling equipment to hobby farmers, large property owners and professional lawn and landscape services are hanging on to a generally positive view about their business prospects for 2013.

There doesn’t appear to be any real signs that things are getting a lot better, and nothing indicates that business levels will decline significantly any time soon, either. Just a feeling that things should be pretty good — probably about the same as last year, maybe even a little better.

Considering everything this market segment has been through since 2009, dealers’ responses to Rural Lifestyle Dealer’s 2013 Business Trends & Outlook survey remains remarkably stable.

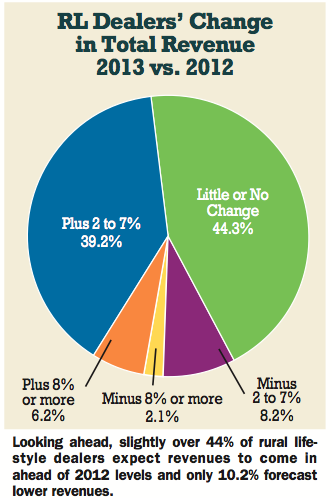

Based on the results of the survey conducted by Rural Lifestyle Dealer in late November and December, nearly 90% (89.7%) of dealers serving the rural lifestyle equipment market believe their total revenues will be as good as or better than what they saw in 2012. Only 10.2% of survey respondents expect revenues to decline in 2013 vs. 2012.

Compared to last year at this time, though, slightly fewer equipment dealers serving the rural lifestyle market are looking for significant gains in overall revenues for the full year of 2013 — 48.1% in 2012 vs. 44.9% for 2013. At the same time, fewer dealers are expecting their revenues to decline vs. a year ago — 10.2% for 2013 vs. 16.1% in 2012.

What it boils down to is more dealers (44.9%) are forecasting little or no change, or essentially flat revenues, in 2013 compared with 2012. Since most dealers are reporting they had a pretty good year last year, the overall outlook for the rural lifestyle market segment this year is positive.

As the residential housing market, which is a strong indicator of the health of rural lifestyle and lawn and landscape equipment segments, continues to stabilize, most dealers, though cautious, see solid prospects in the year ahead.

The bottom line of dealer expectations: Far more expect their business levels to improve or stay at about the same levels in 2013 as they saw in the past year than are expecting business to decline — and that’s always a good sign.

An Uptick in Confidence

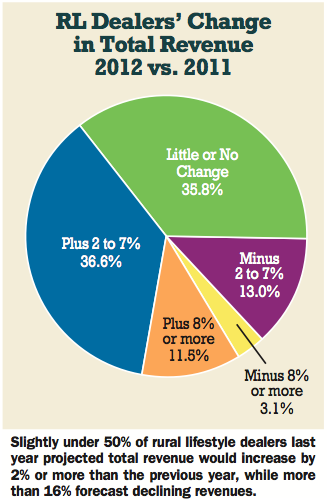

A year ago, 48.1% of equipment dealers responding to Rural Lifestyle Dealer’s annual business trends survey expected their revenues to improve by 2% or more during 2012 and 16.1% projected a decrease in overall revenues for the year.

Broken down further, 6.2% of dealers are anticipating revenue gains of 8% or more during the year ahead vs. 11.5% who forecast increasing revenue by 8% or more last year. Slightly more dealers, 39.2%, expect increases in the range of 2-7% for 2013 compared with 36.6% who forecast this level of improvement last year.

The biggest shift in dealer responses came in the category of “little or no change.” Last year, 35.8% of dealers anticipated generally “flat” revenues compared with 2011. This year, looking ahead, 44.3% of dealers are projecting flat revenues going into 2013.

Another positive sign is that fewer dealers who serve the rural lifestyle market expect a significant drop off in revenues for the year ahead compared to a year ago. Overall, 8.2% of those responding to the business trends survey are forecasting a falloff of 2-7%, while only 2.1% anticipate a decrease in revenues for 2013 of 8% or more.

Solid Aftermarket Revenues Expected

Rural lifestyle dealers are also expressing a similar, but an even more positive, outlook when it comes to their aftermarket revenues in 2013.

Increasing aftermarket revenues is also a positive sign that dealers’ confidence is improving. The growing sales in their parts and service business is a good indicator that rural lifestylers are willing to invest in maintaining equipment, which many will put off in a difficult economy. It also provides dealers another touch point with customers and an opportunity to assess their needs and pursue sales of newer or upgraded equipment.

Overall, 92.6% of dealers surveyed say they expect their aftermarket revenues to be at least as good as or better in the year ahead than that of the previous year. Only 7.5% are forecasting a decrease in aftermarket revenues in full year 2013.

Nearly half (49.5%) of dealers see sales of parts and service increasing by 2% or more in the year ahead: 41.1% by 2-7% and 8.4% by 8% or more. This compares with 52.4% of dealers who last year projected aftermarket sales growing by 2% or more: 47.7% by 2-7% and 4.7% by 8% or more.

In terms of declining aftermarket revenue, only 7.4% of responding dealers are projecting a falloff of parts and service sales, with 4.2% expecting a drop of between 2-7% and 3.2% projecting sales to decline by 8% or more. Last year at this time, nearly 12% of dealers were anticipating a decline in aftermarket revenues: 7.8% by 2-7% and 3.9% by 8% or more.

Top Performers for 2013

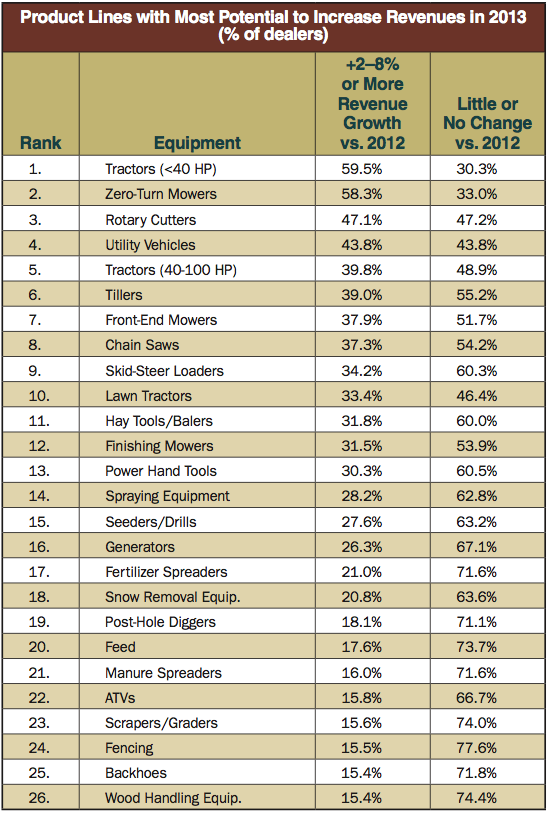

In ranking the product lines where they see the best opportunity to improve revenues in the year ahead, a higher percentage of dealers see the potential for increasing revenues than in their 2012 ranking.

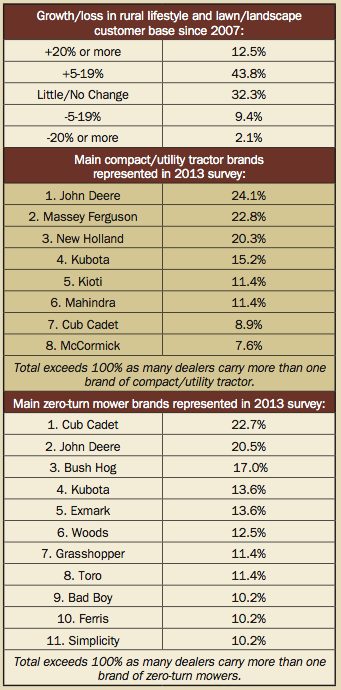

For example, last year 50% of dealers who responded saw the potential for compact tractors (<40 horsepower) to increase revenues by 2% to 8% or more. This year, 59.5% of dealers see the same possibilities. In the case of zero-turn mowers, last year 49.6% of dealers expected revenues from sales to increase by 2% to more than 8%. For 2013, 58.3% are projecting that level of increases.

For example, last year 50% of dealers who responded saw the potential for compact tractors (<40 horsepower) to increase revenues by 2% to 8% or more. This year, 59.5% of dealers see the same possibilities. In the case of zero-turn mowers, last year 49.6% of dealers expected revenues from sales to increase by 2% to more than 8%. For 2013, 58.3% are projecting that level of increases.

Other lines offering solid potential for growth include, rotary cutters (47.1%), utility vehicles (43.8%) and utility tractors in the 40-100 horsepower range (39.8%).

Expanding Product Lines

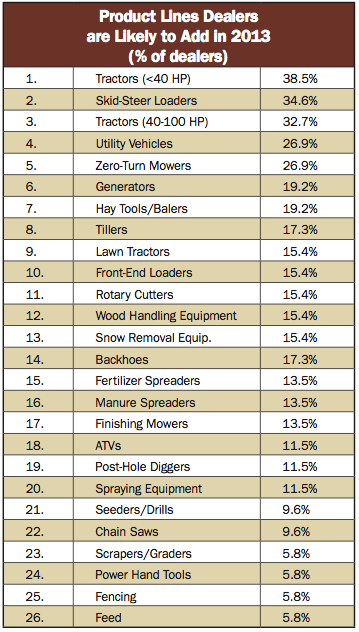

Another sign of confidence, or that rural lifestyle dealers are taking a longer term approach to expanding, is their plans to add new products to their existing lineups. Survey responses indicate that one-third or more of dealers are likely to add compact tractors (38.5%), skid steer loaders (34.6%) and utility tractors (32.7%).

Nearly 27% of dealers participating in the 2013 survey say they’re likely to add utility vehicles and zero-turn mowers to their product offerings in the coming year. Other strong prospects for expanding dealer product lines include generators (19.2%), hay tools and balers (19.2%) and tillers (17.3%).

A Connecticut dealer indicated that he’s becoming more aggressive in adding to his product lineup and has begun stocking items that he previously would order on special request.

“We have started to put some products in inventory that we have always had access to but didn’t stock or try to push. Generators have been a hit with the storms in the recent years. We have also added more mid-grade lawn and garden tractors and zero-turns for our customers who desire a better built machine than the entry level stuff. It has also helped not having to bottom feed against the big box stores.”

|

|

An AGCO dealer in California says he’s begun to push parts harder and is taking advantage of a dealer-friendly program offered by his supplier.

“Our dealership has added the AGCO ‘POD’ — parts on demand — program. With this program, customers can have parts on hand at their location so they have access to a lot of common wear parts seven days a week, 24 hours a day with no need to contact the dealer. They know their shelf will be restocked and they will be charged for the parts only when they use them. It’s like having the parts on consignment.”

|

Another dealer says he’s adding more new products in 2013 than he’s added in the past, listing more Bad Boy lawn mowers, Scag mowers, litter spreaders, no-till drills and more feed mixer wagons.

Little Demand for ‘Green’ Products

While many dealers in this year’s survey are planning to expand their product offerings, they were specifically asked about consumers’ interest in “green” or environmentally friendly equipment.

The general consensus among these dealers is that customers are showing little or no interest in these types of products. Of the dealers responding to this question, less than 10% say they’ve received few, if any, inquiries from customers about purchasing “green” machines. A few dealers indicated they’ve seen “some minor interest in propane mowers and zero-turns.”

A California dealer says he has not picked up on any growing interest in environmentally friendly products. “But most customers are intrigued when the subject comes up of the Tier 4 engines with the diesel exhaust fluid additive. Most people do not realize that this is an industry standard now, from new diesel pickups to new diesel tractors. But it does seem to help make some customers more comfortable in buying this equipment.”

A dealer in Minnesota indicated that he’s picking up on some interest in “propane and products that can do more than one function in a pass.”

A Virginia dealers adds, “Some are asking about and purchasing ‘battery’ powered handheld equipment.”

“There is interest in what is going on, but most are wary of new technology. They’re not sure the extra cost and complexity is of benefit for tractors that are used for only 50 hours per year,” says one New York dealer.

A South Carolina dealer seemed to sum up the situation in general. “There’s not a lot of interest in our area. A few are looking into propane, some battery operated handheld tools. This just does not seem to be a big concern, maybe because we don’t offer a lot of choices. The folks looking at propane I feel are doing so to save money not to be ‘green.’ ”

What’s on Dealers’ Minds?

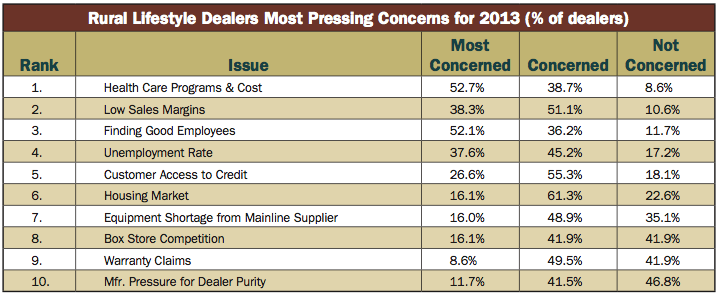

What is keeping dealers up at night hasn’t changed much going into 2013 compared with what was on their minds a year ago. As retailers serving the rural lifestyle and lawn and landscape markets, this group of dealers tends to be smaller in terms of employment. And, like so many smaller businesses, health care programs for their employees and rising costs continue to challenge them.

Like last year, the cost of health care tops dealers’ list of concerns for 2013 with 52.7% indicating this is the issue that concerns them most. Another 38.7% said it “concerns” them. Only 8.6% of responding dealers said they are “not concerned” with health care programs and costs.

Like last year, the cost of health care tops dealers’ list of concerns for 2013 with 52.7% indicating this is the issue that concerns them most. Another 38.7% said it “concerns” them. Only 8.6% of responding dealers said they are “not concerned” with health care programs and costs.

Competitive pressures are clearly evident as second place on the dealers’ 2013 list of concerns is low sales margins, with a combined 89.4% ranking it as “most concerned” (38.3%) or “concerned” (51.1%). And apparently that competition isn’t coming from the box stores as one might expect. Competition from the likes of Lowe’s or Home Depot, or the mid-boxes, like Tractor Supply or Rural King, ranked number eight of 10 on the dealers’ roster of concerns for 2013.

Finding good employees is a recurrent problem for rural lifestyle dealers and little change is seen for the year ahead. As number three on their list of major issues, more than half (52.1%) of dealers rated it as “most concerning,” while another 36.2% said it was “concerning” (88.3% combined).

Rounding out the top five list of challenges dealers say they’re facing this year are the unemployment rate (37.6% “most concerned,” 45.2% “concerned”) and customer access to credit (26.6% “most concerned,” 55.3% “concerned”).

Investing in Facilities & Systems

Despite some uncertainty for the coming year, another sign that dealers are feeling generally positive about the coming year is that more than half of those polled say they’re planning to invest in upgrades to their shop and service areas, as well as their business information systems.

Some 53.3% of rural lifestyle dealers indicate they will spend to upgrade their service capabilities, and 52.7% say they’re planning to spend on their business systems.

When it comes to spending on their showrooms, a healthy 43.2% of dealers expect to invest in modernizing or generally improving their retail facilities in 2013.

In their write-in responses, several dealers say they’re going all out to upgrade or expand their facilities in the next year.

In their write-in responses, several dealers say they’re going all out to upgrade or expand their facilities in the next year.

A dealer in Ontario says he’s going all the way in 2013 and building a new facility with large showroom on a highly traveled highway.

When asked about investing in his facilities, a Texas dealer replied, “Yes! We’ve built a 19,000 square-foot showroom and added things like clothing and more JD toys, plus we’re able to house lots of equipment. This allows the family to have a total shopping experience besides just shopping for equipment.”

In Alberta, a dealer said, “We constructed a 30 x 50 foot building to house lawn and garden equipment and operations. Now, we can retail in all weather conditions and properly display our products.”

An Iowa dealer says they’re making extensive changes to their facility. “We are changing the footprint of our store to make more inside sales/display area. We are also exploring the costs of expanding our shop area by adding on to the building.”

An Iowa dealer says they’re making extensive changes to their facility. “We are changing the footprint of our store to make more inside sales/display area. We are also exploring the costs of expanding our shop area by adding on to the building.”

Going Forward

Dealers serving the rural lifestyle segment of the ag equipment business continue to maintain the same positive outlook they demonstrated a year ago, and their viewpoint goes beyond the numbers of dealers looking for increased or decreased business levels.

Their confidence is showing up in various ways, from the number of dealers planning to expand their product lineups in the year ahead, to those making major investments in their facilities.

Barring any major events that slow or halt overall economic growth in 2013, the rural lifestyle market segments should continue the pick-up in business levels that it began seeing in 2011.

|

Post a comment

Report Abusive Comment