2017 Award Recipients

Tractor Manufacturer: LS Tractor Gold Level: Branson Tractor | OPE Manufacturer: Scag Gold Level: Echo, Exmark, Ferris, Grasshopper, Gravely, Hustler, Shindaiwa, STIHL, Toro, Walker and Wright Manufacturing Full-Line Manufacturer: John Deere Gold Level: Kubota | Shortline Manufacturer: Borgault Industries Gold Level: Bush Hog, Claas, Degelman, Great Plains, H&S Manufacturing, Highline Manufacturing, Krone NA, Kuhn NA, Landoll, Land Pride, MacDon, Meyer Manufacturing, RhinoAg, Unverferth, Vermeer, Woods | Most Improved: RhinoAgOutdoor Power Equipment (OPE) manufacturers ranked higher than manufacturers as a whole in terms of 12 criteria, according to 2,371 individual dealer contacts in the 2017 Equipment Dealers Assn.’s (EDA) Dealer-Manufacturer Relations Survey.

Extra Content

Dixie Chopper Trending Up Say Dealers

Earning Gold in 2017 EDA Dealer-Manufacturer Relations Survey

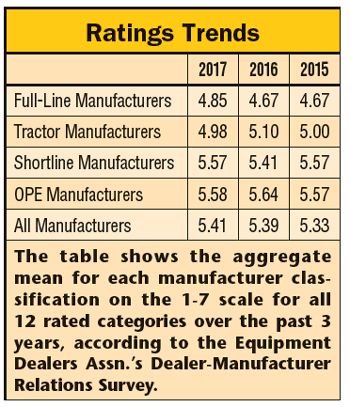

The OPE segment ruled over the full-line manufacturers and tractor manufacturers and beat shortline manufacturers by one-hundredth of a percentage point in the 2017 survey. (See the table, “2017 EDA Dealer-Manufacturer Relations Survey.”)

Scag snagged the top Dealer’s Choice honors for the OPE category, to go along with its first Dealer’s Choice earned in the 2014 survey. And, LS Tractor, a compact tractor manufacturer, earned the Dealer’s Choice award in the tractor category for the third consecutive year.

Gold Level recipients in the OPE category include Echo, Exmark, Ferris, Grasshopper, Gravely, Hustler, Shindaiwa, STIHL, Toro, Walker and Wright Manufacturing. Branson Tractor was the only tractor manufacturer to achieve Gold Level status.

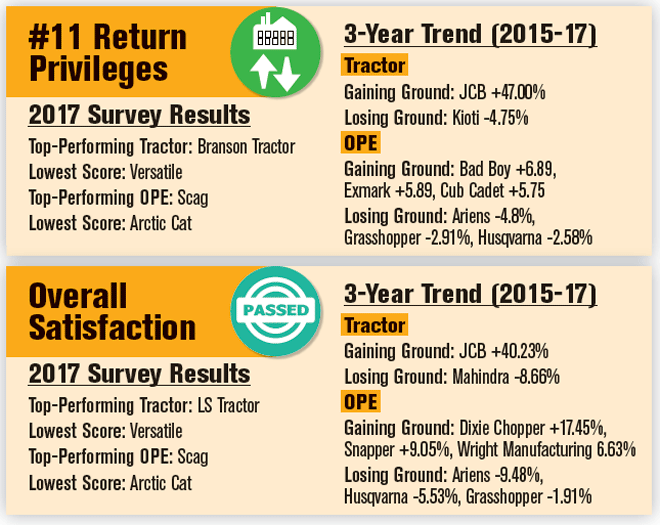

RhinoAg, one of the Gold Level Award recipients in the shortline category earned the Most Improved distinction this year, achieving the greatest percentage increase in overall ratings from 2016 among all manufacturers. (See the boxes on this page for a list of the 2017 award recipients as well as how the manufacturer segments have performed over the last 3 years.)

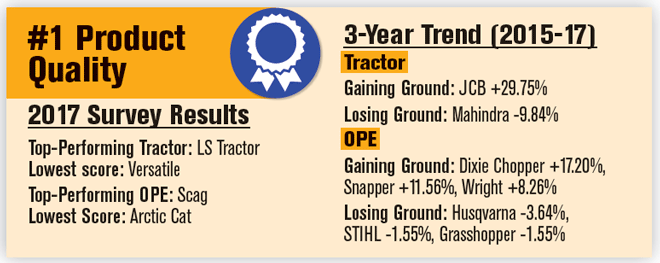

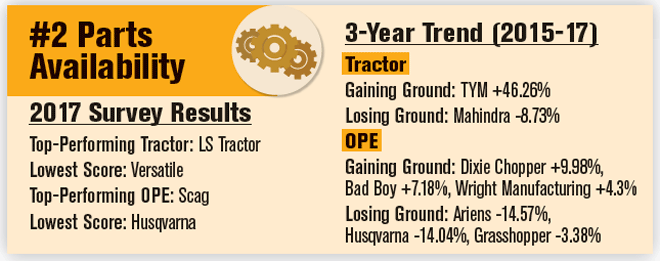

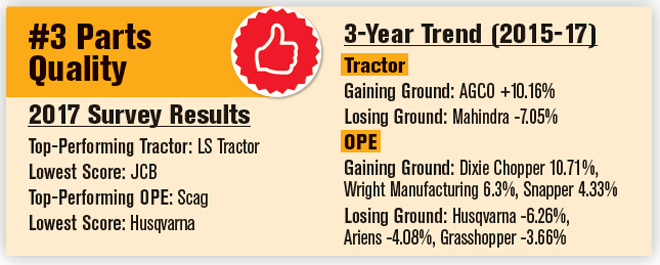

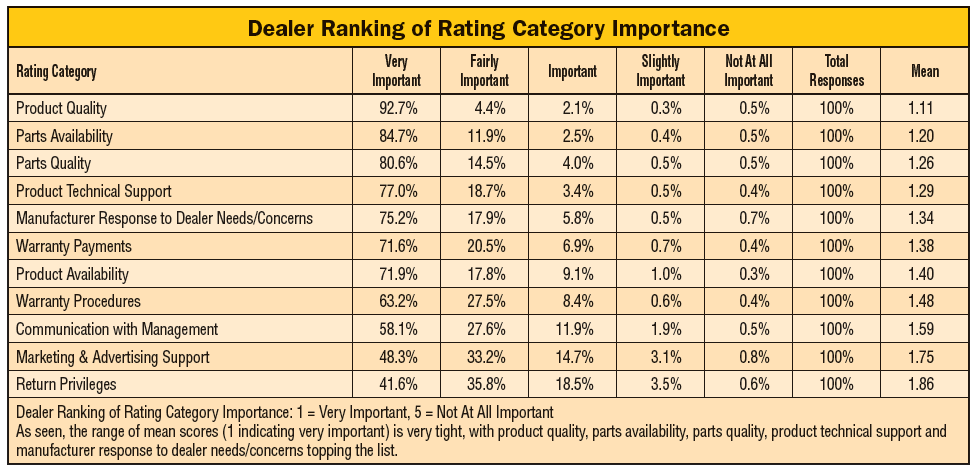

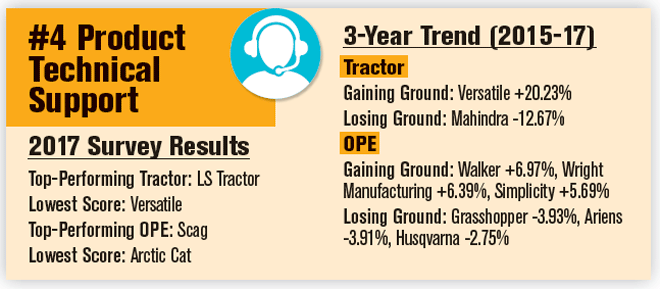

EDA’s survey results represent dealer attitudes on the lines they carry during Feb. 15 through March 17, 2017. Dealer responses were collected anonymously by a third party research firm. The survey asks dealers to rank manufacturers on scale of 1 to 7, with 1 being extremely dissatisfied and 7 being extremely satisfied. In terms of ranking the importance of the criteria, product quality, parts availability and parts quality hold the top 3 spots in terms of being “very important” to dealers. (A breakdown of the ratings for each category are presented throughout this feature. See the chart “Dealer Ranking of Rating Category Importance” on pg. 12 and the box “Survey Methodology Statistics,” on

pg. 18 for additional details.)

“We’ve seen a lot of consistency in the OPE category. OPE manufacturers have grown in sophistication over time. Many started as family-run businesses, with the guy who started the company often remaining as president. They had to develop a strong relationship with dealers to get them to sell their products. Those product categories are different than ag and may be slightly more manageable. OPE dealers carry a mix of manufacturers, while ag dealers predominantly carry one brand — and they may expect more from that brand since it’s their ‘bread and butter,’” says Joe Dykes, EDA’s vice president of industry relations. He has worked with the survey since its beginnings, helping transition it from a survey used internally to one shared publicly.

Dykes says many OPE manufacturers sell to dealers through distributors and an effective distributor can help elevate the perception of the manufacturer. “In the end, no matter what the differences are, fundamentally, either you’re doing a good job and performing well with dealers or not,” he says.

Analyzing OPE Ratings

OPE manufacturers had an average mean score of 5.58 across all the criteria with a total score of 66.94. This compares with an average mean score of 5.64 and total score of 67.66 in 2016.

Scag earned Dealer’s Choice with its total score of 75 and an average mean score of 6.25. The company ranked highest in 9 of the 11 categories about dealer operations and support with STIHL ranking higher than Scag in the areas of product availability and marketing adverting and support.

Scag also ranked highest in the category of overall satisfaction scoring 6.38 compared to the OPE average mean of 5.69. Its highest scores across the criteria were in the areas of product quality and parts quality.

Trends: Scag has been near the top for the last 2 years, finally taking the top spot from Grasshopper, which earned the Dealer’s Choice award for OPE manufacturers in 2015 and 2016.

For the 2017 Equipment Dealers Assn.’s Dealer-Manufacturer Relations Survey, dealers were asked to rate the importance of each of the 12 rated categories as it relates to the overall relationship with a manufacturer. As shown in the table, most respondents rated each category as Important to Very Important. The mean number represents the degree of importance, and the lower the number, the more important the category.

Other manufacturers who have gained ground in terms of total score over the last 3 years include Dixie Chopper, up 8.51%; Wright Manufacturing, up 7.43%; and Hustler, up 4.38%. Dixie Chopper’s most significant gains were in overall satisfaction and product quality. Wright Manufacturing and Hustler had the biggest gains in product availability.

Click here to continue reading...

2017 EDA Dealer-Manufacturer Relations Survey (Does Not Include Full-Line Manufacturers)

A total of 2,371 individual dealers participated in the 2017 Equipment Dealers Assn.’s (EDA) Dealer-Manufacturer Relations Survey, ranking a total of 58 manufacturers. Here’s a breakdown of the ratings for all manufacturers, OPE, tractor and shortline manufacturers as well as a breakdown of individual rural equipment manufacturers. Kubota does not appear on this list as it was included as a full-line manufacturer for the first time in the 2017 survey.

Survey Methodology Statistics

- Dealers were able to rate up to 7 manufacturers and provided a total of 9,312 individual manufacturer responses in 2017 compared to 9,180 in 2016. On average, dealers rated four manufacturers.

- Compared to last year’s survey, 34 of the 58 manufacturers experienced an increase in dealer responses.

- There were 2,371 individual dealer contacts who participated in the survey compared to 2,321 in 2016.

- About 55% of the respondents were OPE dealers.

- The survey is sent to EDA’s dealer list, which includes members and non-members, as well as names provided by manufacturers. Each dealer contact can only respond once.

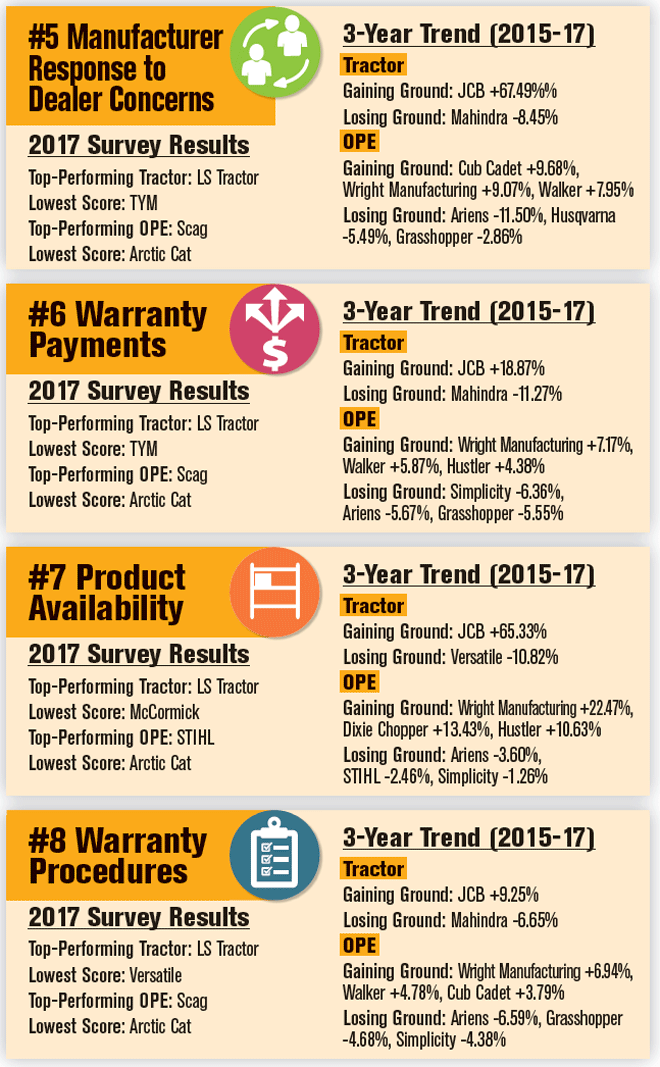

Those companies that are losing ground over the last 3 years include Ariens, down 6.76%; Husqvarna, down 4.63%; and Grasshopper, down 3.14%. Ariens and Husqvarna had the biggest declines in parts availability, while Grasshopper saw the biggest decline in warranty payments.

Analyzing Ratings of Full-Line, Tractor and Shortline Manufacturers

The July/August issue of Farm Equipment magazine, a sister publication to Rural Lifestyle Dealer magazine, includes an analysis of dealer ratings for full-line, tractor and shortline manufacturers. Go to www.Farm-Equipment.com to learn more.

In terms of product quality — the criterion most important to dealers — OPE manufacturers’ average mean was down slightly in 2017 vs. 2016, 5.88 vs. 5.93, but up from the 5.83 rating in 2015. Scag’s average mean for product quality in this year’s survey was 6.6 — 0.72 points higher than the average mean for OPE manufacturers.

Tracking Tractor Ratings

Tractor manufacturers as a group had an average mean across all 12 categories of 4.98, which is down from last year and from 2015.

LS Tractor earned the Dealer’s Choice with its total score of 75 and average mean score of 6.08. The company ranked highest in 10 of the 11 categories about dealer operations and support with Mahindra ranking higher in terms of marketing and advertising support. Branson Tractor was the only other tractor manufacturer who scored high enough to earn Gold Level status.

More from the Manufacturers

The digital edition of this summer issue will feature comments from the Gold Level recipients and others, such as Bush Hog, on initiatives that are bringing success. We will also feature comments from Dixie Chopper on improvements that are resonating with dealers.

LS Tractor ranked highest among all tractor manufacturers in terms of overall satisfaction scoring 6.35, compared with the average mean score of 5.22 for the category. It also achieved the highest score of all tractor manufacturers in product quality, with a score of 6.41, compared with the average mean for all tractor manufacturers of 5.56.

An 86-page comprehensive report — including historical charts and data — is available to all EDA dealer members as a benefit of membership and to the manufacturers participating in the survey. Manufacturers also have the opportunity to obtain additional survey data that includes company breakouts by region, detailed statistical data and additional information. For more information about the survey or membership in EDA, contact Joe Dykes at JDykes@EquipmentDealer.org.

Trends: LS Tractor appears to have a firm hold on the Dealer’s Choice award, having achieved it for 3 years in a row.

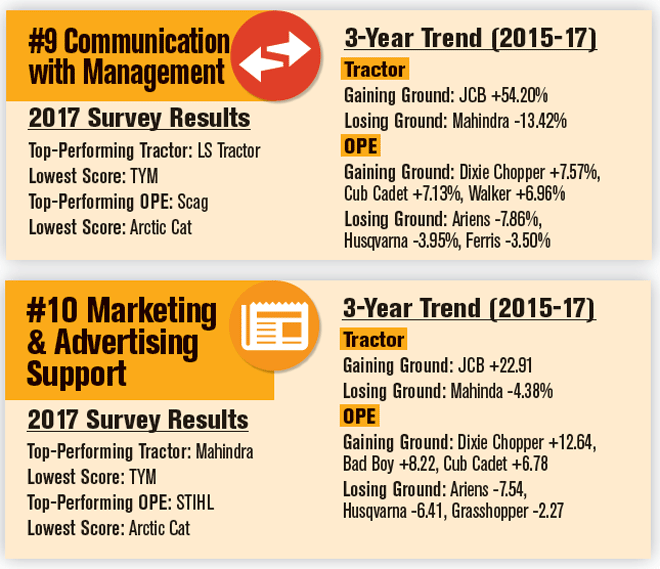

Looking at a 3-year trend, JCB has made the largest gain in its total score, with an improvement of 30.95%, followed by TYM, with an improvement of 12.19%. JCB had the biggest gain in product availability while TYM had the biggest gain in the category of parts availability.

The 3-year trend shows companies that are losing ground with total score include Mahindra, down 7.78% and McCormick, down 0.09%. Mahindra’s biggest percentage declines came in communications with management. McCormick had the biggest decline in product availability.

Using the Data

Regardless of whether your manufacturers’ ratings are up or down, Dykes of EDA says the impetus for improvement is the most important takeaway. “This is a customer satisfaction survey, with the dealer being the customer. Manufacturers have to consider the dealers as their primary customers. If the dealers are not doing something right, they would definitely want their customers to tell them so — and the same thing should be said for manufacturers,” Dykes says.

Three Dealers Share Perspectives on 2017 EDA Dealer-Manufacturer Relations Survey

LS Tractor: Dealer’s Choice 3 Years and Counting

Scag: Repeat Recipient of Dealer’s Choice Award

Mahindra: New Initiatives Increase Dealer Resources, Communication

Post a comment

Report Abusive Comment