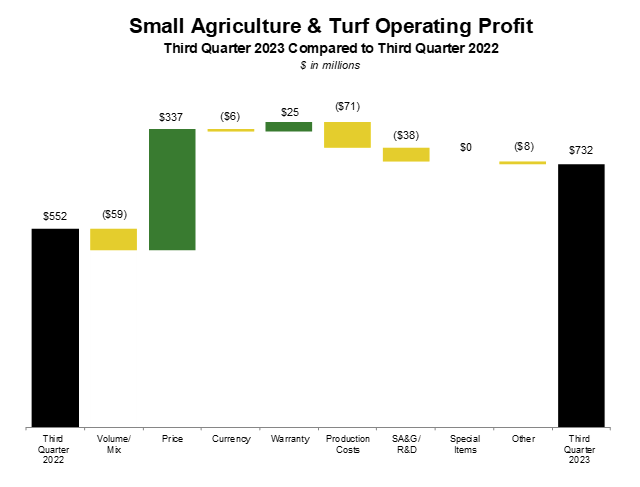

In its earnings release for its third quarter fiscal year 2023 earnings, Deere reported $15.8 billions in total net sales, up 12% year-over-year. Revenue in Deere's Small Agriculture & Turf (SAT) segment rose 3% to $3.7 billion in the quarter. SAT operating profit for the quarter was $732 million, up 33% year-over-year. John Deere forecast its small ag & turf net sales for its full fiscal year 2023 to be up around 5% year-over-year.

Deere said in its earnings release that, "Small agriculture and turf sales increased for the quarter due to price realization, partially offset by lower shipment volumes. Operating profit improved due to price realization, partially offset by higher production costs, lower shipment volumes, and increased SA&G and R&D expenses."

In a note to investors, Managing Director, Senior Research Analyst with D.A. Davidson Michael Shlisky said Deere's results were ahead of the firm's models and consensus, saying the following:

Revenues beat our model by ~2.5%; segment operating profit was ~17% ahead and EBITDA was ~20% ahead. Gross margin expectations for the year were raised for the third straight quarter. DE also noted a "strong advance-order position," although no specifics were shared about FY:24. It's difficult to quibble with strong numbers like these, although some could question the outsized role of taxes in the guidance increase and the sustainability of pricing trends.

Post a comment

Report Abusive Comment