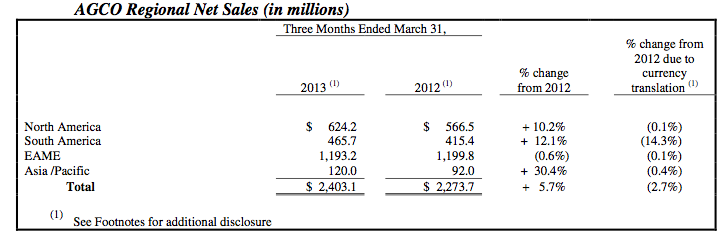

AGCO reported net sales of approximately $2.4 billion for the first quarter of 2013, an increase of approximately 5.7% compared to net sales of $2.3 billion for the first quarter of 2012. Net income for the first quarter of 2013 was $1.19 per share. These results compare to net income of $1.21 per share for the first quarter of 2012. Excluding unfavorable currency translation impacts of approximately 2.7%, net sales in the first quarter of 2013 increased approximately 8.4% compared to the first quarter of 2012.

First Quarter Highlights

-

Strong revenue growth in South America and Asia/Pacific. Regional sales results(1): South America +26%; Asia/Pacific (“APAC”) +31%; North America +10%; Europe/Africa/ Middle East (“EAME”) -1%

-

Regional operating margin performance: North America 11.6%, South America 10.4%, EAME 8.4%, APAC 4.6%

-

Full year EPS guidance increased to $5.50 to $5.70

(1)Excludes currency translation impact. See reconciliation of Non-GAAP measures in appendix.

“AGCO delivered healthy sales growth in the first quarter and exceeded its first quarter operating margin targets,” stated Martin Richenhagen, Chairman, President and Chief Executive Officer. “We benefited from strong market demand in North and South America as well as from our margin improvement initiatives focused on purchasing actions and factory productivity. In addition, production rates at our new Fendt assembly facility in Germany increased to normal levels during the first quarter. As expected, sales mix and Fendt productivity negatively impacted EAME’s first quarter operating margins; however, we remain on track to deliver significant EAME margin improvement for the full year of 2013.”

Market Update

Industry Unit Retail Sales

Tractors Combines Quarter ended March 31, 2013 Change from

Prior Year Period Change from

Prior Year Period North America 13% 52% South America 23% 49% Western Europe (5%) (22%)

“Attractive farm economics are in place across the developed farm equipment markets,” stated Mr. Richenhagen. “Industry demand in North America continues at high levels, driven by strong farm income in 2012. Winter precipitation throughout much of the U.S. has alleviated some of the impact of last year’s drought, and farmer planting intentions are near record levels. Crop prices have declined but remain at healthy levels. A cold wet spring across much of Europe is negatively impacting industry demand offsetting the benefit of elevated crop prices. Industry sales were softest in the United Kingdom, Finland and Southern Europe while demand remained at high levels in the key Western European markets of Germany and France. Market demand was strongest in Brazil as a better harvest, attractive government financing programs and favorable grain prices are supporting farm equipment industry sales. Looking longer-term, the trends that have increased demand for grains and lowered global grain inventories are expected to intensify, supporting healthy long-term fundamentals for the agricultural industry.”

Regional Results

North America

AGCO’s North American sales grew 10.3% in the first quarter of 2013 compared to 2012, excluding the impact of unfavorable currency translation. Elevated levels of farm income in 2012 continued to support industry demand in the first quarter of 2013 from the professional farming sector and produced strong growth for AGCO. The most significant increases were in high horsepower tractors, implements and combines. Higher sales and margin improvement initiatives contributed to growth in income from operations of $21.9 million for the first quarter of 2013 compared to 2012.

South America

South American net sales improved 26.4% in the first quarter of 2013 compared to the first quarter of 2012, excluding the negative impact of currency translation. Higher sales in Brazil produced most of the increase. Brazilian farmers benefited from more favorable weather in the first quarter compared to the drought conditions that existed in early 2012. AGCO’s profitability in South America improved during the first quarter of 2013, with operating margins rising to 10.4% compared to 5.8% in the same period of 2012. Income from operations increased $24.4 million for the first quarter of 2013 compared to 2012 due to higher sales and the benefit of cost reduction initiatives.

EAME

Net sales were approximately flat in AGCO’s EAME region in the first quarter of 2013 compared to the first quarter of 2012 despite softer market conditions. Sales growth in France and Germany was offset by declines in the other European markets. EAME operating income declined by $36.1 million in the first quarter of 2013 compared to the same period in 2012. AGCO’s results were negatively impacted by a weaker sales mix, increased engineering expenses and transition costs associated with the new Fendt tractor assembly facility.

Asia/Pacific

Excluding the negative impact of currency translation, net sales in the Asia/Pacific region were 30.8% higher in the first quarter of 2013 compared to the first quarter of 2012. Growth in Australia, New Zealand and China produced most of the increase. Income from operations in the Asia/Pacific region improved $4.6 million in the first quarter of 2013, compared to the same period in 2012, due to higher sales partially offset by increased market development costs in China.

Outlook

Global industry demand is expected to be relatively flat in 2013 compared to 2012. Growth is projected in South America; North America is expected to remain stable; modest declines are anticipated for Western Europe. AGCO is targeting earnings per share in a range from $5.50 to $5.70 for the full year of 2013. Net sales are expected to range from $10.5 billion to $10.7 billion. Gross margin improvement is expected to be partially offset by increased engineering expenditures to meet Tier 4 final emission requirements and market development expenses.

“Industry fundamentals remain solid, and we have increased our 2013 sales and earnings outlook,” continued Mr. Richenhagen. “We will maintain our focus on improving profitability throughout 2013, while also increasing our investments to support our longer term objectives. These investments include construction of a low horsepower production facility in China and our important investments in new product development and market expansion. We are also forecasting another year of solid cash generation after funding our growth investments.”

AGCO will be hosting a conference call with respect to this earnings announcement at 10:00 a.m. Eastern Time on Tuesday, April 30, 2013. The Company will refer to slides on its conference call. Interested persons can access the conference call and slide presentation via AGCO’s website at www.agcocorp.com in the “Events” section on the “Company/Investors” page of our website. A replay of the conference call will be available approximately two hours after the conclusion of the conference call for twelve months following the call. A copy of this press release will be available on AGCO’s website for at least twelve months following the call.

For full financial tables, go to AGCO's Investor Relations Page here.

Post a comment

Report Abusive Comment