There now appears to be at least two schools of thought developing regarding the economy and credit. This is nothing new, but at times, it seems that the gap is widening.

The first is a more optimistic view based on recent trends including:

• An improving labor market

• Improvements in the housing industry

• The fact that the stock market rose by more than 30% in 2013

• Expected stabilization of commodity prices

All of the above should cause interest rates to begin climbing slowly. However, there is also the proverbial “other side of the coin” that develops from information that is also true and not as positive. These facts include:

• Higher than normal equipment inventories, especially for used equipment

• An unsustainable housing market

• Stock market volatility

• Lower commodity prices

• Predicted lower demand for equipment

This should lead to low interest rates for an extended time. Who do you believe? The answer lies in what’s important to your business.

Long-Term Trend is Positive

When looking at 2014, we understand that some industry economists anticipate a challenging year for ag equipment sales, with only a moderate prospect of improvement. We’ve already seen some of this in the industry. Changes in the economy and regulatory environments continue to be a challenge.

In terms of long-term prospects for the ag equipment industry, when you consider the global population reaching 9 billion people by 2050, the demand for agricultural equipment will remain increasingly important. Despite a variety of economic influences and seasonal variations, this reflects well for agriculture. We expect short-term fluctuations, but the trend long term is positive.

With that in mind, it’s important dealers choose a credit company that is invested in long-term relations — one that will align its business objectives with yours. For example, look for a credit company that is willing to seek out your business. At Agricredit, we’re taking that stance and expect to grow our originations by double digits in 2014.

Becoming a Good Credit Partner

While there are considerable headwinds in the environment, there are still factors within your control. Here are ways dealers can position themselves so they’re viewed as a good partner and can leverage credit to grow long term.

1 Stick to the basics of good business. Pay special attention to your profit, working capital and equity in the business. Regarding equity, the higher the better, especially as the ag sector is cyclical. There is no right number to achieve, but positions over 30%, especially when the equity dollars become material, should help you get better conditions.

2 Maintain profitability. Look not only into the actual profitability, but also focus on its composition. Parts and service revenues and margins are key. They help demonstrate the sustainability of your business. At a minimum, your pre-tax profit should be in the 3% range, and ideally, over 5%.

3 Establish a favorable working capital ratio. Look into the balance between current assets over current liabilities. That number should be greater than 1.2. Additionally, evaluate how liquid your current assets are. You will need cash.

4 Take care of customers. Customers have options. What are you doing to remain their top choice? There is a difference in lenders and there are more issues than just equipment prices and interest rates. Are you aligned with a lender that:

• Has a strong history of stability in the industry?

• Has a solid reputation for integrity and service?

• Offers multiple finance options?

• Is easy to do business with?

• Understands your business and your customers?

• Believes your customers belong to you, not them?

Your customers are looking for partners who can recognize their concerns and resolve them. The right lending partner can enhance this process by hiring outstanding people. This is especially important if your salespeople also handle financing. Not all salespeople are comfortable (or competent) in discussing financing and not all customers are comfortable discussing their financial needs.

To discuss financing effectively, an individual needs effective listening skills, diplomacy, patience and a good understanding of such things as financial options, cash flow, common tax penalties, payment options and acquisition alternatives.

5 Manage favorable inventory turns. You should try to turn your inventory (at least) three times per year. Two should be your minimum. If that is not the case, you might run into profitability and cash flow difficulties.

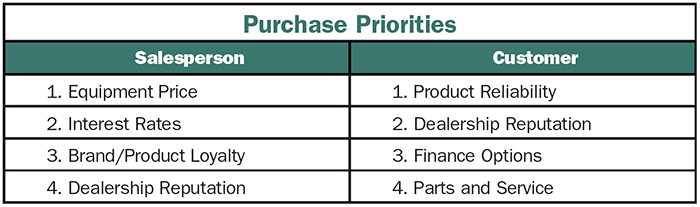

6 Segment your market and understand the needs of your customers as well as they do. Surveys show how salespeople and customers prioritize factors in a purchase — and the two can often conflict. (See the following chart.)

Being a good credit partner also allows your business to grow, such as in adding a new equipment line. Most lenders will evaluate line expansions for the dealers they consider reliable partners. Quite often, the manufacturers have a credit solution to offer, too. However, the size of your relationship, good repayment history and compliance with inventory terms will influence how credit companies view you as a partner.

Enabling the Sale

In general, we believe the outlook is more positive than negative. Certainly things could change if the economy takes a nose dive. Barring that, we’re focusing on enabling our partners to sell more equipment. Financing is often the mechanism that enables the sale. The vast majority of customers do not want to pay in cash. If you had to wait until a customer saves enough cash to buy, you could be waiting a long time. Financing enables the customer to buy now.

Gustavo Lichtenberger is vice president of strategic marketing and Jim Falk is director of knowledge management for Agricredit. Agricredit is part of De Lage Landen (DLL) Financial Services and operates in North America under the Agricredit brand. Agricredit has its roots in the former Massey Ferguson Credit Corp. DLL was formed more than 45 years ago, and has a long history in agricultural equipment finance. DLL’s parent, Rabobank, is one of the world’s largest food and agricultural banks.

Post a comment

Report Abusive Comment