USDA’s Farm Service Agency (FSA) launched its Microloan program in January 2013 with the goal of better serving the needs of small farms, beginning farmers and ranchers, farmers and ranchers from historically socially disadvantaged groups (or SDA — women and racial and ethnic minorities), and veterans.

The maximum size of a microloan was originally set at $35,000 and was raised to $50,000 in November 2014 by the Agricultural Act of 2014. Compared to FSA’s traditional Direct Operating Loans (DOLs), which have a maximum limit of $300,000, microloans are designed to be more convenient and accessible to groups not traditionally served through FSA’s credit programs.

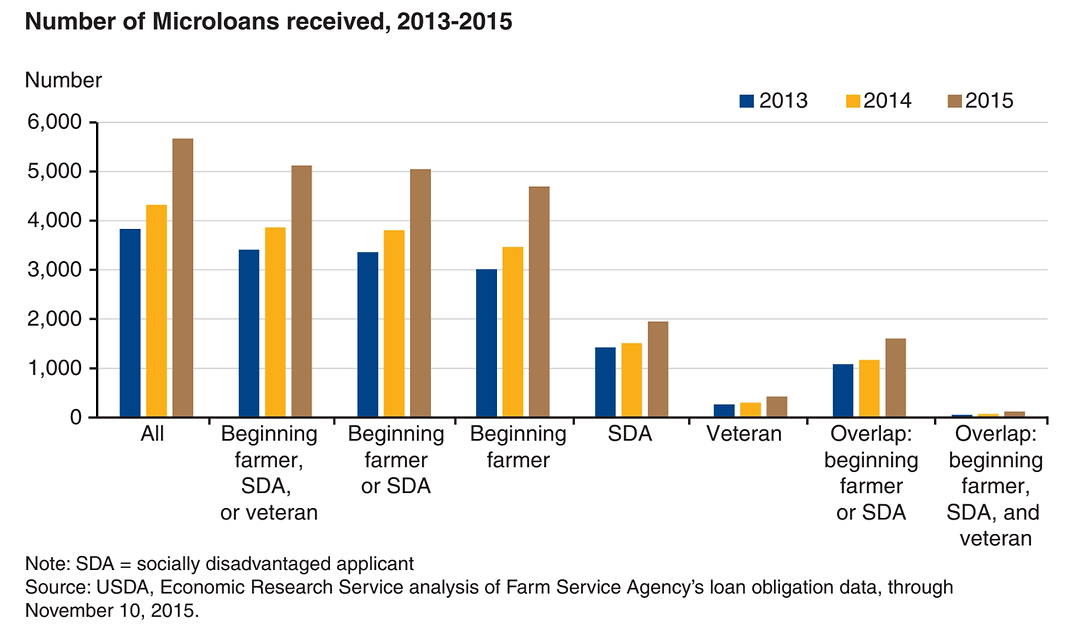

From January 2013 to November 2015, the Microloan program grew from 3,833 loans with total loan obligations of $88.8 million in 2013 to 5,674 loans and total loan obligations of $162.2 million in 2015 (through mid-November).

Here are some highlights regarding those loans, according to USDA:

- Farmers belonging to targeted groups received 89% of all microloans, of which beginning farmers accounted for the majority, at 81% of all microloans. SDA farmers accounted for 35% of all microloans, and 79% of those were received by borrowers who were also beginning farmers.

- Farmers in targeted groups received a larger share of microloans than of small OLs. However, they also received a sizeable share (82%) of small operating loans (OLs), with 74% going to beginning farmers and 26% to SDA farmers.

- In 2013-15, microloans attracted 8,182 borrowers who were new to FSA’s direct loan programs — substantially exceeding the 1,228 new borrowers who received small OLs during that time.

- The number of microloans received by new borrowers also substantially surpassed the number of new borrowers (3,606) who received small OLs in 2010-12 — the 3 years preceding the introduction of the microloans program

Post a comment

Report Abusive Comment