The following story is an excerpt from the 40-page 2017 Rural Lifestyle Dealer Business Trends & Outlook Report. Email Lynn Woolf for a copy of the complete report, lwoolf@lessitermedia.com.

Rural lifestyle dealers have been enjoying several years of strong growth and they’re forecasting yet another positive year in 2017. The rural equipment market remains the bright spot, while those selling to production agriculture customers still continue to struggle with slow sales because of low commodity prices.

Most U.S. rural equipment dealers, more than 84%, expect 2017 revenues to be as good as or better than 2016, with about 9% expecting increases of 8% or more. Some dealers aren’t as optimistic. About 16% expect revenues to decline 2-8% or more.

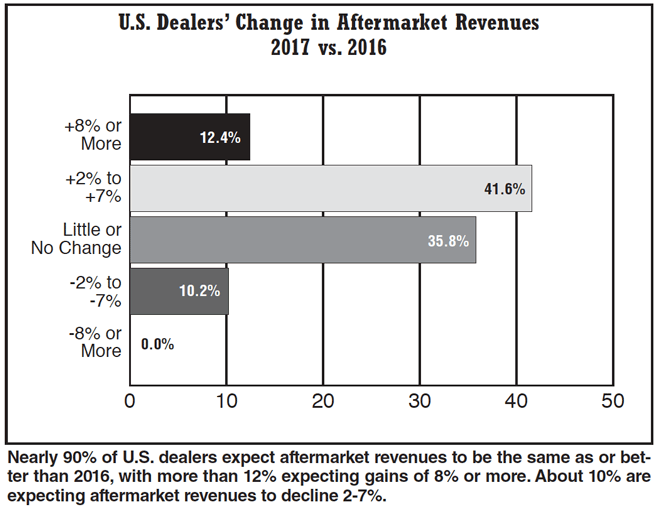

U.S dealers are even more optimistic about aftermarket revenues. Nearly 90% of U.S. dealers expect aftermarket revenues to be the same as or better than 2016, with more than 12% expecting gains of 8% or more. There are some dealers that are pessimistic, with about 10% expecting aftermarket revenues to decline 2-7%.

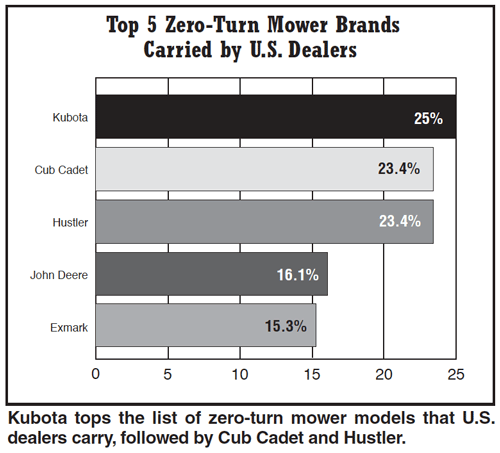

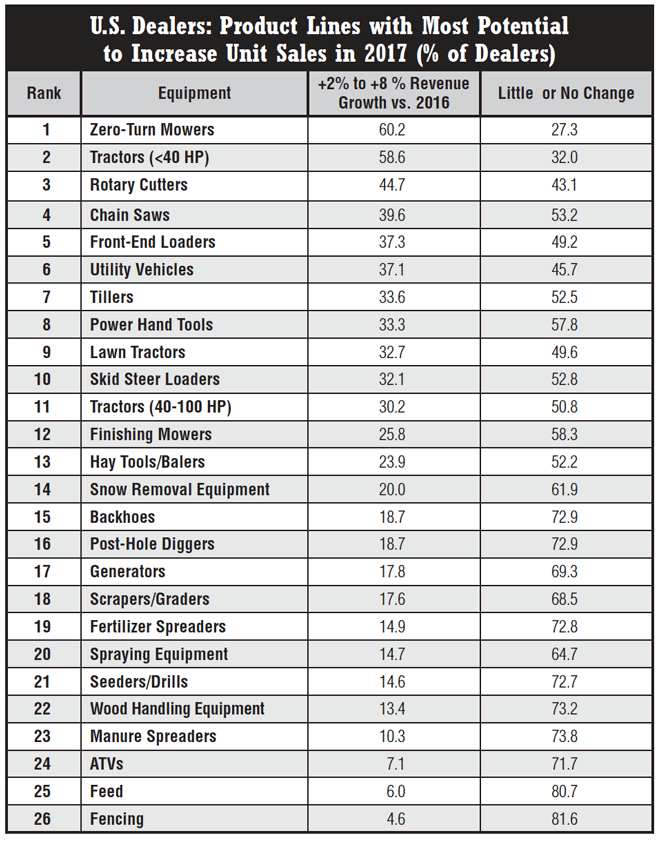

What are the top products driving growth for U.S. dealers? U.S. dealers expect sales to be strong for zero-turn mowers in 2017. About 60% of dealers expect unit sales to increase 2-8% or more. Dealers are also optimistic about tractors less than 40 horsepower, with about 58% expecting unit sales to increase by 2-8% or more.

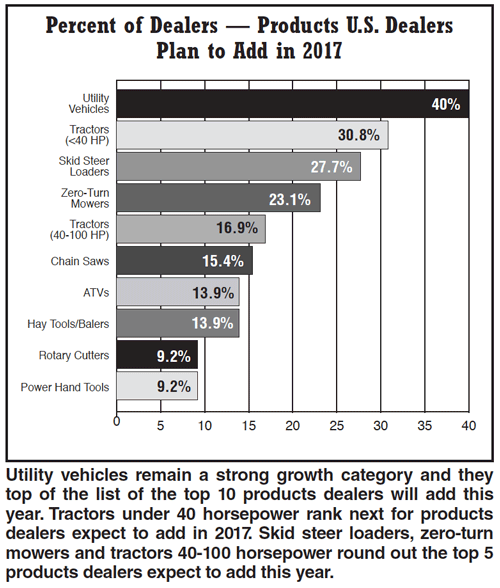

Utility vehicles remain a strong growth category and they top of the list of the top 10 products dealers will add this year. Tractors under 40 horsepower rank next for products dealers expect to add in 2017.

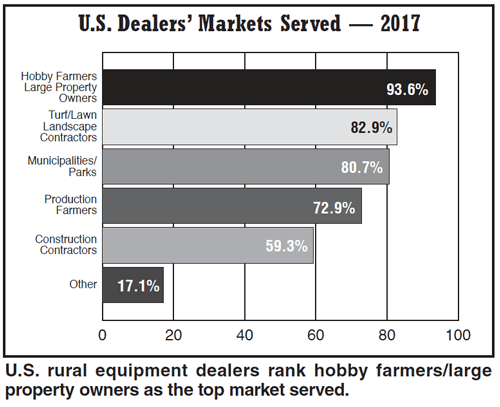

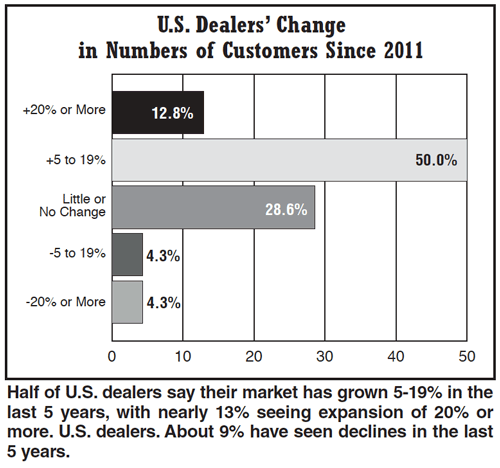

U.S. dealers have a diverse base of customers. In addition to hobby farmers and large property owners, more than 80% are also serving landscape contractors and municipalities. The customer base is growing and about 63% of U.S. dealers say their market has grown 5-20% or more in the last 5 years. Dealers are also reaching customers through their rental departments, with skid steer loaders, tractors 40-100 horsepower and tractors under 40 horsepower being the most popular rental products.

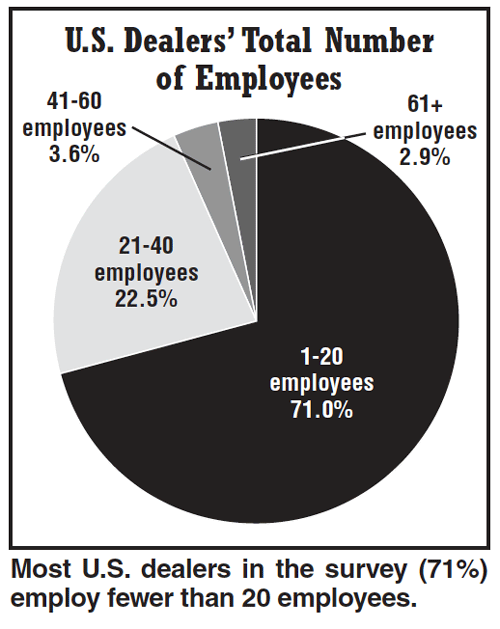

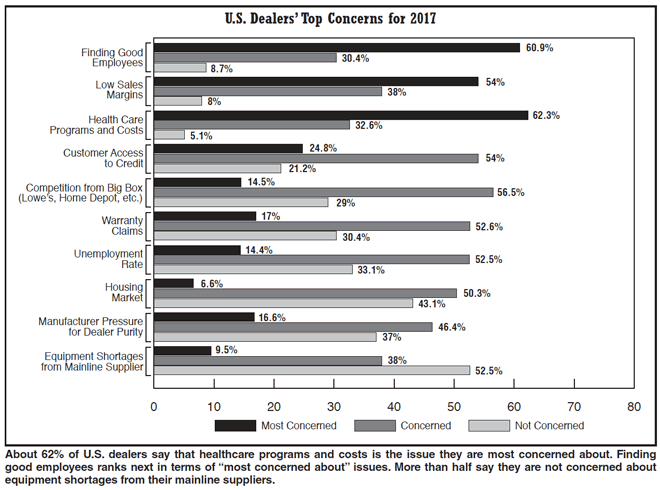

U.S. dealers are watching several issues, with healthcare programs and costs topping the list of “most concerned about” topics. A majority of U.S. dealers (71%) have 20 or fewer employees.

For more details, see the following tables and charts:

- Total Number of Employees

- Change in Total Revenues

- Markets Served

- Top Products Offered for Rent

- Top Zero-Turn Mowers Carried

- Products Dealers Plan to Add

- Change in Number of Customers Since 2011

- Change in Aftermarket Revenues

- Top Concerns

Post a comment

Report Abusive Comment