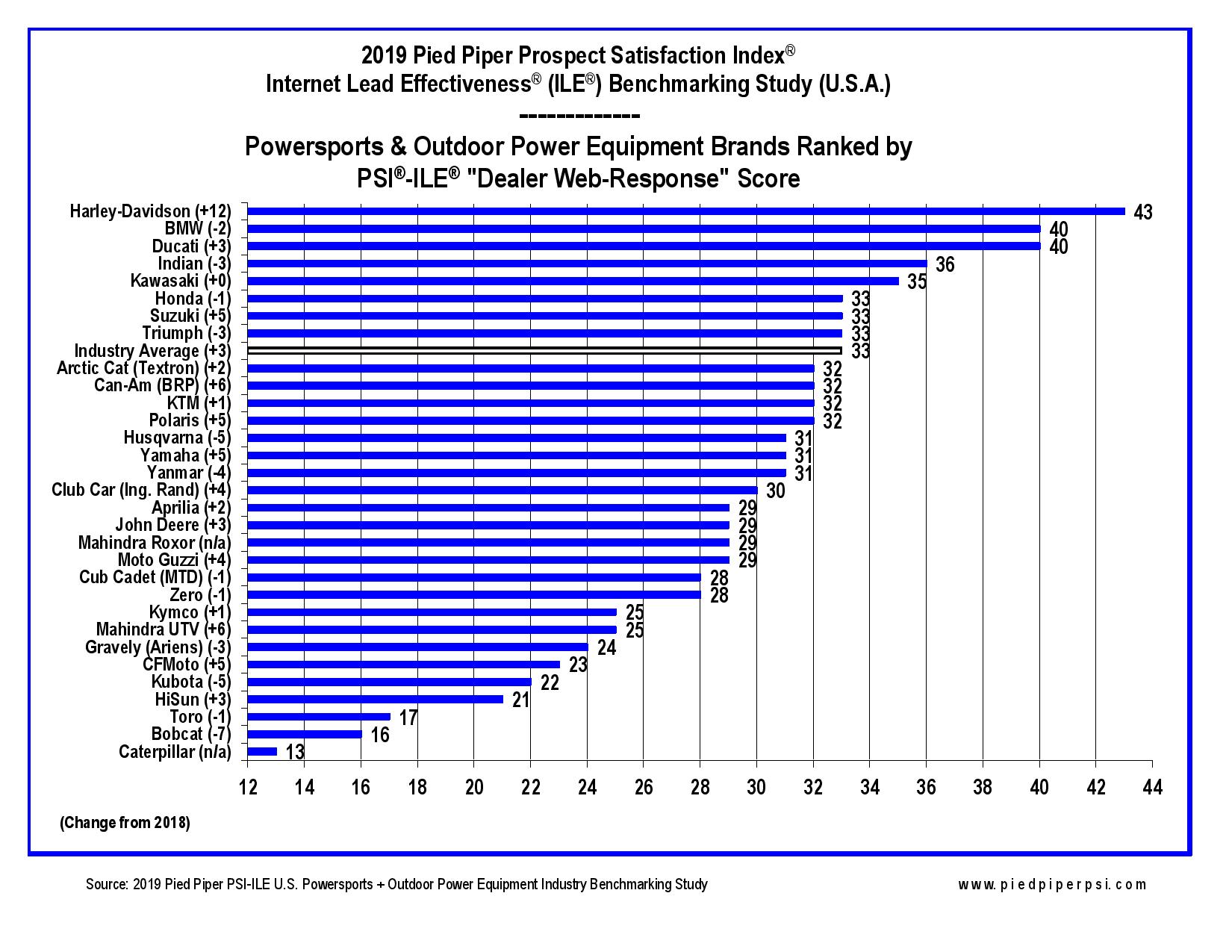

The Pied Piper Management Co. of Monterey, Calif., recently released the results of its annual PSI Internet Lead Effectiveness (ILE) Study. The study is an industry-wide, comprehensive study that ranks brands, dealers and individual dealerships on a scale from 0 to 100 based on how they answer this question: What happens when UTV or motorcycle customers visit a dealer’s website and inquire about a vehicle? (See the chart below for the rankings.)

In the following Q&A, Pied Piper’s President and CEO, Fran O’Hagan, deciphers the 2019 ILE’s data and explains what it means for the industry. Looking from individual dealerships to the brand-by-brand perspective, O’Hagan identifies areas for growth and methods of problem-solving that have proven effective.

Fran O’Hagan: The way that Americans buy things, whatever those things are, has changed dramatically in the last 10 years, especially in the last three to five. Ten years ago, it was easy to find somebody who’d never bought anything through Amazon. Today, that’s the way we shop for commodities. Amazon has tripled their revenues in the past 5 years — it now accounts for just under half of total online sales. Another thing that’s changed with that is smartphones: 8 out of every 10 Americans has one. We, in turn, use our phones to order things online.

For many UTV customers today, it would never occur to them to visit a UTV dealership in person. Their first move is going to be to look up the dealer online and form their opinion from there. Let’s say you walk out of a restaurant and see a Caterpillar UTV parked in the lot. You think, “I didn’t know Caterpillar made UTVs.” You take out your phone and search for the closest Caterpillar dealer to your location, and all of a sudden you’re well on your way to shopping for a Caterpillar UTV.

So we have to focus on what happens when a customer visits a dealer’s website and inquires about a vehicle. Our survey looks at all the aspects of this process. How quickly does the dealership respond, and in what manner — over the phone, or email? We’ve found that, today, some brands send an email 90% of the time, while some average less than half, so there’s a large gap between the best and worst performers.

Rural Lifestyle Dealer: Looking at the survey, it’s evident that a lot of brands in the rural equipment market are falling below the industry average. Can you explain that?

O’Hagan: The outdoor power equipment brands that sell UTVs are a few years behind powersports brands in this regard. For example, if you look back 2 or 3 years, power sports brands such as Honda, Kawasaki and so forth performed at the level that OPE brands have reached today. Based on that, I would say that 2 or 3 years from now we’ll see a lot of improvement from outdoor equipment brands.

RLD: What are you seeing from key rural equipment brands?

O’Hagan: The top-performing brand in our study was Harley-Davidson, and they scored 43 out of a possible 100. So, the bar is very low. Narrowing the scope, individual dealers actually do a wonderful job, scoring in the 70s and 80s. There are just so many dealerships that only respond with an automated email, if at all, within the first 24 hours, that the numbers are dragged down. But powersports dealers’ numbers say that individual OPE brands should start scoring in the 50s in a year or two.

This past year, Mahindra saw the biggest improvement on the rural equipment side, adding 8 points to their score. But that only brought them up to a 25, which is abysmal. The three brands that finished at the bottom of the study were Caterpillar, Bobcat and Toro. If a customer reaches out to a Caterpillar dealer, 49% of the time they get nothing, not even an automated response, in 24 hours. Looking at the industry average, a customer can expect to receive a response over the phone 45% of the time — for Caterpillar, it’s 12% of the time, Bobcat 18%, and Toro 6%. We want to see every customer getting an email and a phone call, so we have a lot of room to grow.

RLD: Why are response numbers so low in the first 24 hours?

O’Hagan: This is a difficult part of the business to get perfect. The auto industry spends millions of dollars on perfecting this part of business every year, and they’re far from achieving that. Car dealerships have a number of employees only dedicated to responding to customers who contact them through their website. Contrast that with a typical rural equipment dealership, where the salesperson, sales manager or even owner is too busy interacting with a customer in person to immediately respond to someone online. But the customer that’s sitting in front of an empty inbox doesn’t know that. They expect someone to get back to them: certainly within 24 hours, but ideally within one hour.

We’ve found that dealerships that follow three basic steps can shift their performance from well-below the industry average to out-performing 80% of their competitors. The first is to make sure that your dealership has an automated response system, and that it’s set up correctly.

Second, make sure you don’t go home at the end of the day with digital customers locked up in your store. In other words, respond to everyone before you leave your desk for the day. By doing that, you’ll at least get to everyone within 24 hours.

Finally, always pick up the phone and call the customer the moment you hit send on that email. 40% of the time you’ll get a voicemail, which is fine — leave a short message. The majority of the time, you’ll get the customer on the line and can start talking to them.

RLD: Why is it important to call the customer even after you’ve reached out over email?

O’Hagan: We’ve found that a surprisingly large percentage of the time dealer-response emails don’t make it to the customer and sit in the spam folder. They could be the auto-responses, or straight from a salesperson — either way, the dealer has no idea. This varies by brand, but industry-wide it’s about 1 out of every 10 dealer emails; for some brands, it’s as high as 1 out of 5, and specific dealers see it climb even higher. Regardless, if you follow up with the customer over the phone, you can still keep that customer. Even if they don’t end up picking up the phone or checking their voicemail, you have a much higher chance of reaching the customer if you reach out via both email and calling.

Harley-Davidson is at the top in terms of calling within 24 hours: they attempt to call these customers 70% of the time. On the low end, at Toro it’s less than 10% of the time. But remember: 10 years ago in the auto industry, a third of the time customers wouldn’t receive a response of any type, not even automated. Now look where they are. Power sports brands are following suit, and I’m quite sure that outdoor power equipment brands will do the same.

RLD: You also emphasize including a price for your products. Why is this important?

O’Hagan: If a customer is figuring out what they are or are not buying, price is a product’s primary attribute. If you list a product and don’t include a price, the customer can’t rule it in or out, so it won’t sell. It’s completely up to the individual retailers to figure out what their attitude toward pricing is. You could absolutely list something like MSRP. It doesn’t have to be a deal. The customer just wants a price.

Industry-wide, customers are provided a price 30% of the time. Looking by brand, Caterpillar does not provide a price, period. BobCat provides a price 6% of the time, same with Club Car. If we look at the other end of the spectrum, Polaris does 45% of the time. Honda does 56% of the time and Arctic Cat 46%. But notice — none of these are close to 100%.

RLD: Do you get the sense that digital customers are a lower priority than people actually standing in the dealership?

O’Hagan: They’re not less of a priority, they’re just invisible, which makes them easier to blow off than a customer standing in front of you. If you own a dealership and you see one of your salespeople reading the paper while a customer is waiting, you’re going to take care of that right away. But unless you go looking for them, you’re not going to see if digital customers are being ignored.

RLD: Is it worth the effort to interact with the customer if they’re invisible?

O’Hagan: It’s absolutely worth the effort to improve this part of the business. We can see how much better dealerships that behave like this perform over dealerships that don’t with cars, and now we’re starting to see change in the power sports and OPE brands.

It’s important to note that we’re not selling UTVs online, we’re meeting our customers online. Only 1 customer in 20, at most, actually wants to carry out the whole transaction without ever coming to the dealership. You have to assume that this is the objective: The customer wants to come to the dealership and get their UTV. The objective for the dealer, then, is to speak to the customer and get them in the door so they can drive that sale.

Post a comment

Report Abusive Comment