The past couple of years have been difficult for machinery dealerships that serve the rural lifestyle market, but based on the results of the Rural Lifestyle Dealer 2011 “Dealer Business Trends & Outlook” survey, dealers are more than ready to put the recession behind them and get on with business.

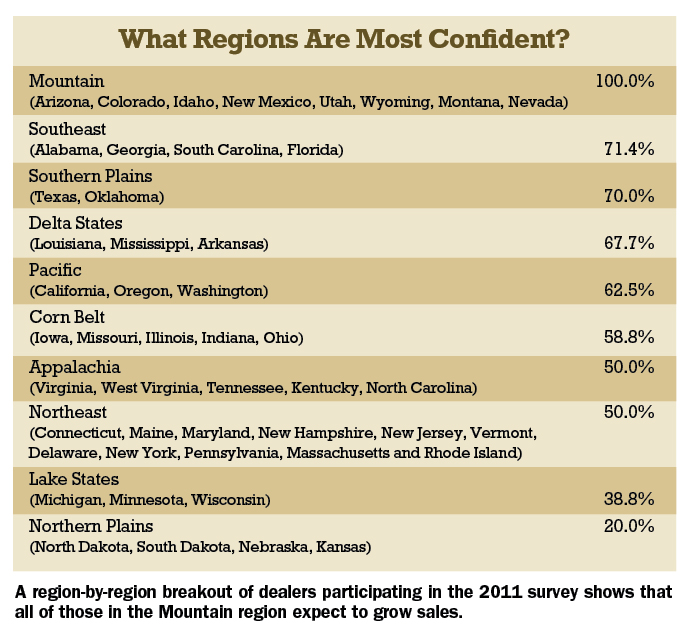

This year’s survey shows a jump in dealer confidence compared to Rural Lifestyle Dealer’s previous surveys of North American rural-consumer focused dealers, with 96.8% expecting revenues from rural lifestyle customers will be about the same or better in 2011 over the previous year. That’s up from 85% in 2010 and a far cry from 2009, when only 53% of rural lifestyle-focused dealers surveyed believed their revenues would be flat or increase. In 2009, simply surviving was the goal of most dealers who counted on hobby farmers, large property owners and others that comprise the rural consumer market.

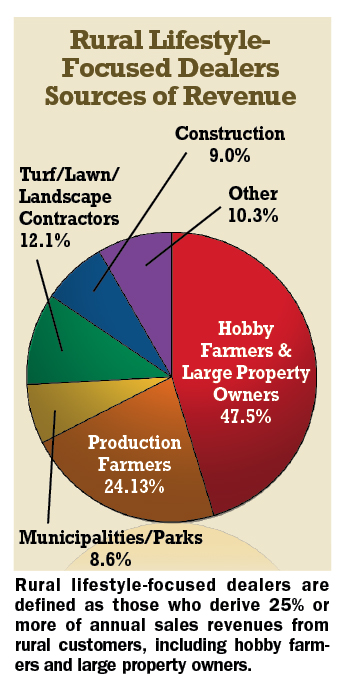

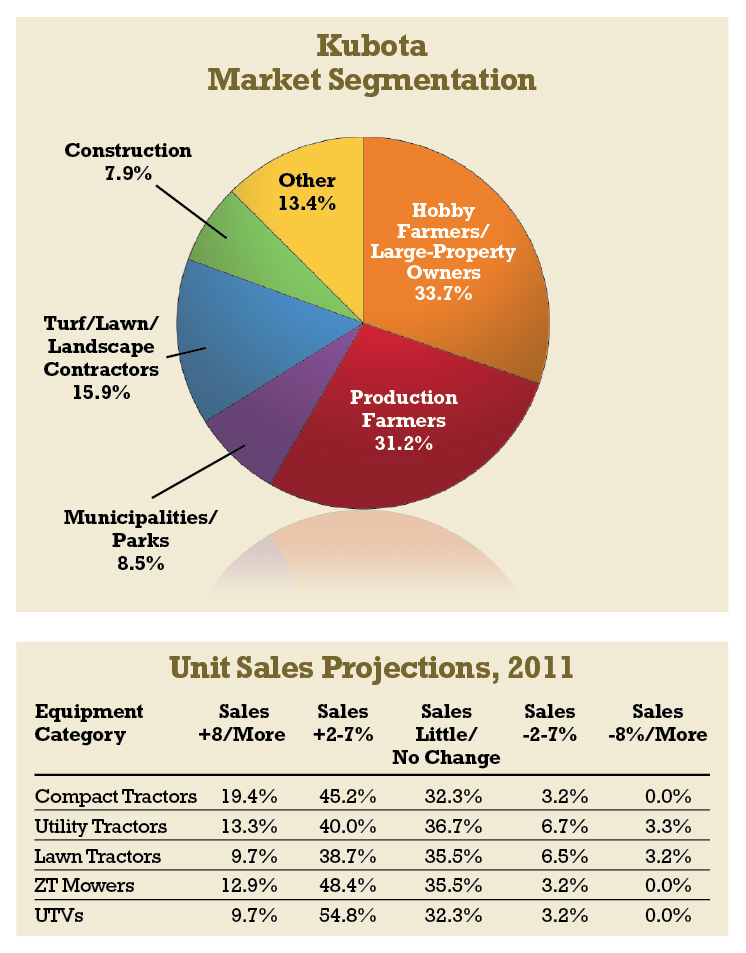

Data in this report is based on the responses from dealers who derive at least 25% of their annual sales revenue from the rural consumer market.

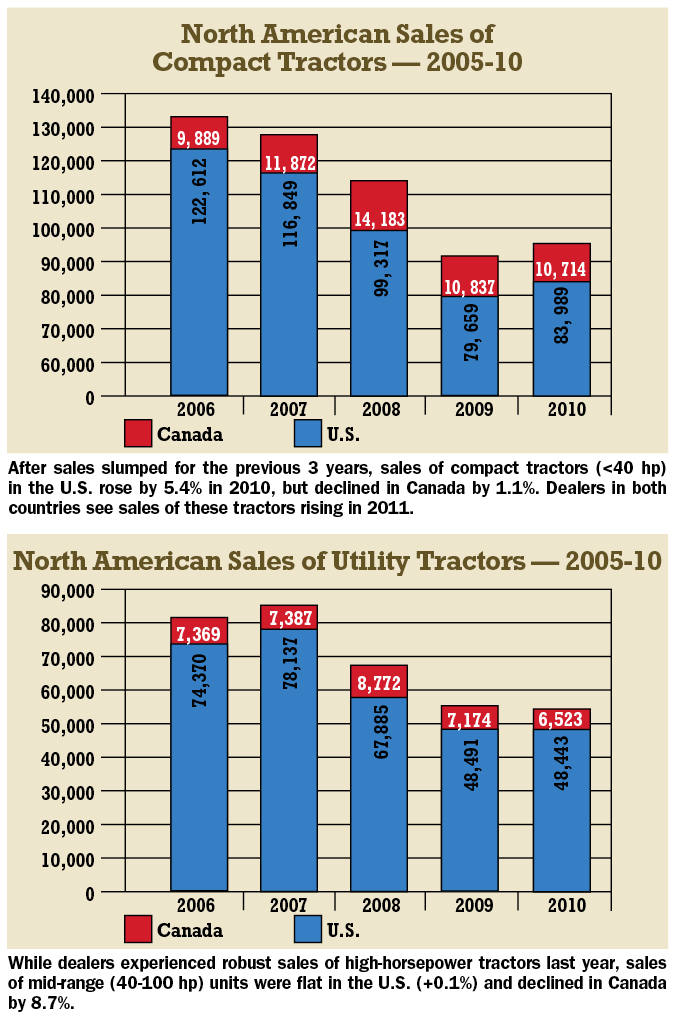

These were difficult years for equipment dealers. With the U.S. in a severe economic downturn and much of the world in the same boat, unemployment rose as the housing bubble burst, reducing home values to their lowest in more than a decade. Beyond the bright lights of the city, the flood of people migrating to rural areas seeking the “country life” slowed to a trickle, and the growing equipment sales that rural lifestyle dealers enjoyed since the late 1990s followed suit.

Post-Recession Outlook

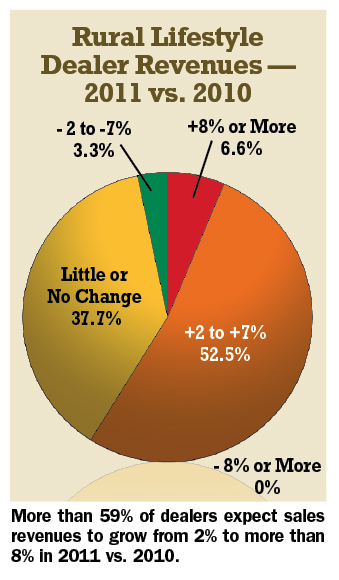

The year ahead holds the potential to reverse those trends, according to the dealers surveyed by Rural Lifestyle Dealer. Of the 123 dealers who responded to the late-December survey, 95% expect as good or better revenues from rural lifestyle equipment sales in 2011, with 48.3% forecasting revenues to be up 2-7%. Another 6.7% believe revenues will increase by 8% or more. Only 3.3% anticipate sales falling by 2-7%. The remainder, 37.7%, are forecasting sales to come in at about the same level as in 2010.

One of the open-ended questions that dealers were asked in the survey was, “How do you expect your rural lifestyle customer’s shopping habits for equipment to be different post-recession?” One Southeast dealer said, “Instead of keeping old equipment running beyond its economic life, I believe we will see people starting to replace old, worn-out equipment with new. However, there will still be a strong market for good used equipment.”

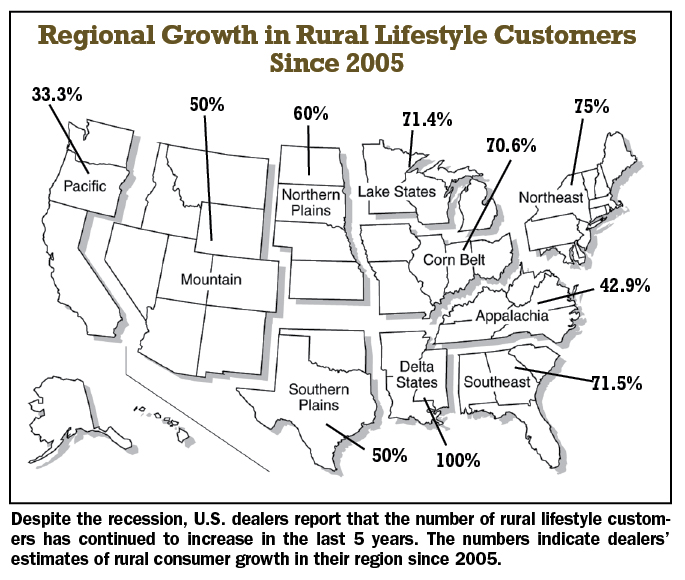

Data from the survey also show the dealers believe the number of rural lifestyle customers has actually grown over the past 5 years, in spite of the recession and a certain amount of out-migration from rural communities in the past 3 years. Of the rural lifestyle-focused dealers, 65.7% say the numbers of the customers in their area has increased 5% or more in the past 6 years. Nearly 20% say their customer base has gone up by 20% or more.

Equipment Segments to Watch

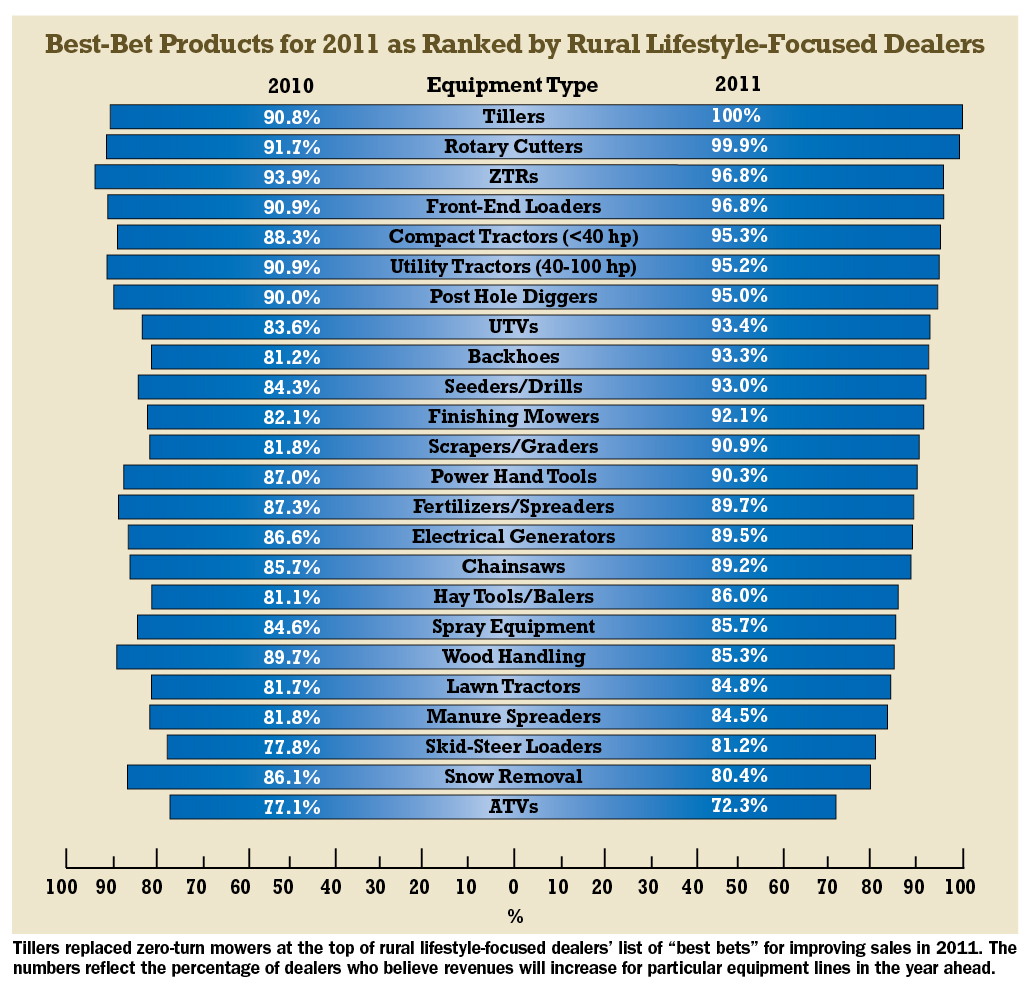

With the outlook for customer spending improving, dealers’ unit sales projections for 2011 show optimism for several types of machinery. Leading the way are tillers, rotary cutters, zero-turn mowers, front-end loaders and compact and utility tractors.

Tillers showed the biggest climb from 2010, bouncing up more than 9% to knock zero-turn mowers off of their top spot of the “Best Bets” list of equipment with the most potential for growth in the coming year. Of the rural-consumer focused dealers, a full 100% believe tillers will do as well or better in 2011, no doubt buoyed by the popularity of home gardening. In both urban and rural settings, reducing carbon footprints through activities such as “foodscaping” — planting edible plants rather than ornamentals — and buying locally produced goods are gaining momentum. More home-owners are looking for ways to convert expanses of Kentucky bluegrass into asparagus, heirloom tomatoes and other specialty crops to save money, time and gasoline. For others, it’s a way to mitigate food safety issues.

Today’s rural consumers may be more interested in living off the land than working on it, but keeping up appearances helps maintain property values as well as neighbor relations. This meant that the popular zero-turn mower segment of the lawn equipment industry didn’t go far after tillers knocked it out of number 1. It moved down to number 3, with 96.8% of the dealers who expect their sales of zero-turn mowers will be as good or better in 2011. Rotary mowers maintained its second-place ranking with 99.9% of the dealers believing sales in that segment will be maintained or increase.

Last year, snow removal equipment lost its top spot to zero-turn mowers on the “Best Bet Products” list. For 2011, cold-weather equipment continued to slip, with 80.4% of dealers expecting their sales to be as good or better — down from 86.1% in 2010.

Dealers note that sales of snowplows and blowers can be difficult to forecast as they are largely weather dependent. Also, many consumers choose to wait until their long rural driveways are impassable before investing in this equipment.

Post-Sales Support

Most dealers aren’t as concerned with competition from big box (Lowe’s, The Home Depot) or mid-box stores (Tractor Supply, Farm & Fleet) as only 35.9% report these competitors for rural lifestyle dollars as a problem for their business.

The ability to offer after-sales service gives dealers a leg up with those rural customers concerned with maintaining and repairing their equipment. As one dealer from a Mountain State said, “Servicing dealers will survive and customers will lean toward servicing dealers for their major purchases.”

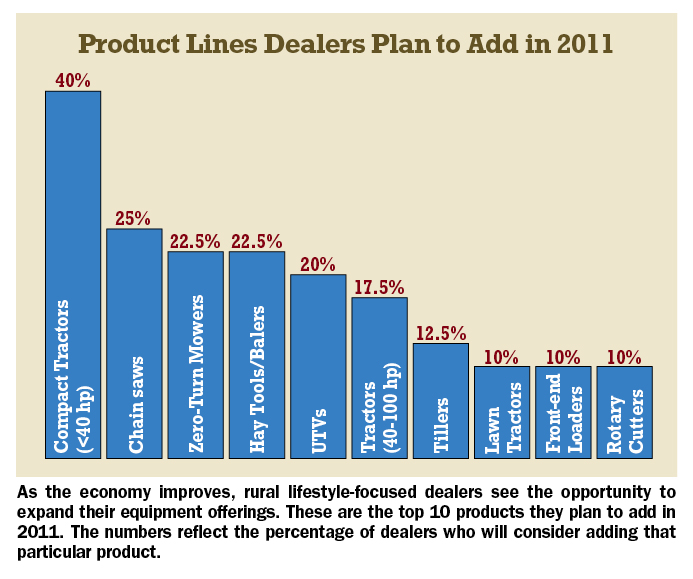

With sales expected to improve during the coming year, 62.5% of the dealers plan to take on additional product lines, with compact tractors (under 40 horsepower) leading the list of equipment that dealers are planning to add. Chain saws, necessary keep the property looking good as well as feeding wood-fired furnaces, have the attention of 25% of the dealers planning to expand their product offering this year. Zero-turn mowers and hay tools tied for third, with 22.5%. Finishing out the top 5 were utility vehicles at 20%.

Dedicated Selling Efforts

Selling equipment to rural lifestylers can present some unique challenges for the dealership staff. For example, the consumer will often need recommendations for equipment that can perform specific jobs on his property. This year’s survey found nearly 92% of the dealers polled employ staff dedicated to specifically selling equipment to hobby farmers and owners of large acreage. Specialization is key, especially when you consider that only 6.3% of the dealers say their customers enter the dealership with a specific brand of equipment in mind. This is down from 7.3% in 2010.

Far more customers arrive with little or no idea about what brand or type of equipment they need to buy. Nearly half — 46.9% of the dealers — said that was the case.

Some 87% of dealers surveyed say customers accept their salesperson’s recommendation about a specific product brand “almost always” or “most of the time.” That figure is up from 76.8% in 2010.

Dealership sales people also need to be at the top of their game as these customers are becoming increasingly savvy, and are capable of challenging the sales staff because they’ve done their homework via the Internet.

“I expect to see a better informed consumer” post-recession, writes a dealer from one of the Corn Belt states. “Internet access is the key. Many customers come in spouting specs from web pages about our products. They know who our competition is and what they offer. They also know where the next dealer of a specific brand is located. All of this makes selling more challenging.”

“More customers are becoming better informed on equipment,” writes a dealer in the Northeast. “Our sales staff needs to have the energy and experience to convince the customer we are the dealership that is ready to make the sale and service the unit after the sale. Customers seem to be searching for someone who can take care of their needs after the sale.”

Most rural lifestyle-focused dealerships expect to grow aftermarket revenues — the sale of parts and service — in 2011. Some 60.7% (up from 53% last year) of dealers expect their aftermarket revenues to increase by 2-7% while 11.5% of that group expects to see revenues increase 8% or more. Only 36.1% expect “little or no change” in aftermarket revenues this year, and just 3.3% anticipate a drop of 2% or more in revenue.

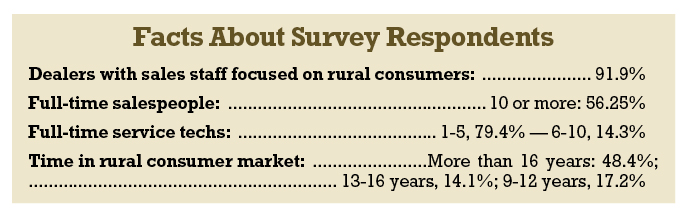

Case IH, Kubota Dealers Most Optimistic for ‘11

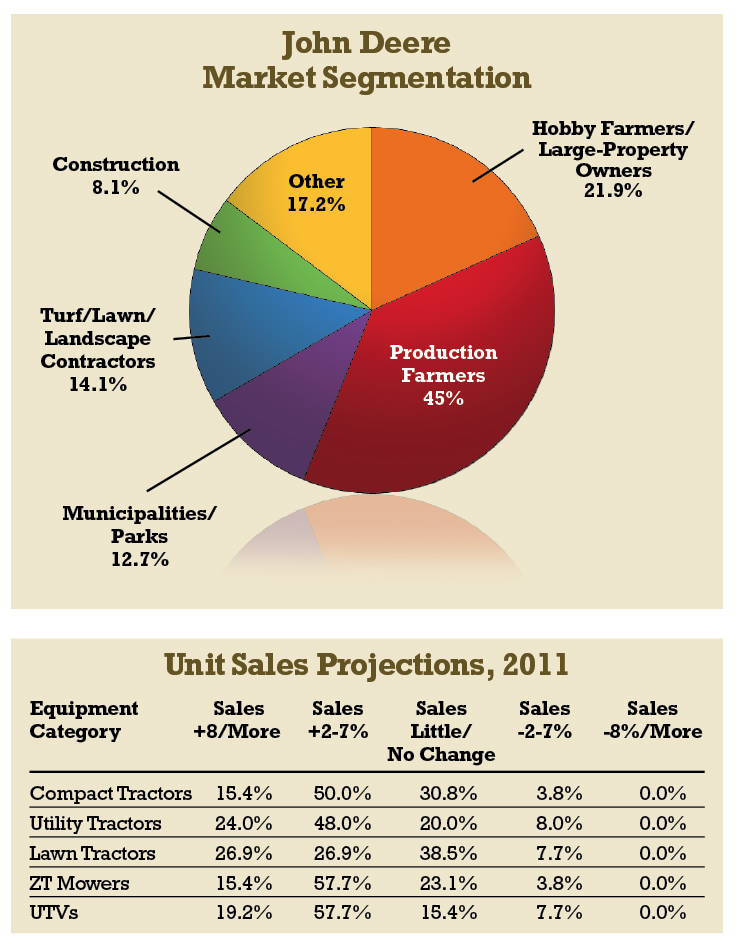

Of all the tractor brands represented in this year’s survey, Case IH and Kubota dealers are the most optimistic about improving sales revenues going into 2011.

More than 73% of Case IH dealers expect their sales to rural consumers to grow at least 2% to more than 8% during the next 12 months. This group of dealers sees farm loaders, lawn tractors, snow removal equipment and rotary cutters as having the best potential to increase revenues in the year ahead.

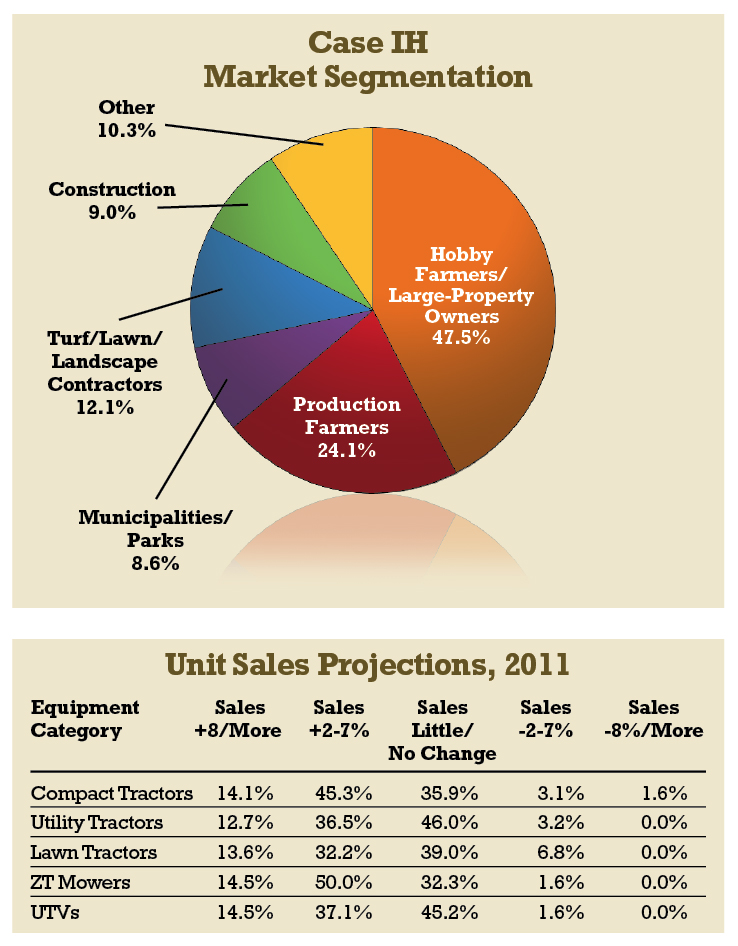

John Deere dealers came in third place when it comes to confidence in improving sales in 2011 with 64% projecting sales revenues would improve by at least 2% to more than 8%. This group sees farm loaders, zero-turn mowers and utility tractors (40-100 horsepower) as their best bets in 2011.

They were followed closely by dealers who sell New Holland tractors as their primary tractor brand, as 63% expect improving revenues of 2% to more than 8% during the year. Their best bets for increasing sales levels include zero-turn equipment, compact and utility tractors.

Following New Holland were dealers that handle Cub Cadet equipment with 57.1% of this group anticipating sales will grow by 2% or more for the year. Less than 24% of dealers that handle Massey Ferguson tractors as their primary brand are projecting sales revenues to improve by at least 2% in the next 12 months.

At the high end, the Case IH (13.3%) and Kubota (10%) brands had the most dealers forecasting sales revenue growth of 8% or more from rural lifestyle customers in 2011.

Dealers in this year survey represent 18 different compact and/or utility tractor brands. The top 5 lines carried by dealers participating in the survey are Kubota, with 30.6% indicating that’s the brand they sell, New Holland (22.6%), Massey Ferguson (16.1%) Cub Cadet/Yanmar (14.5%) and John Deere (12.9%).

Dealerships with the largest share of revenue coming from hobby farmers and large-property owners are selling Kubota (33.7%), Cub Cadet (33.6%) and New Holland (29%).

A more detailed breakout of dealers’ outlook by major brand can be seen here.

Dealer Concerns

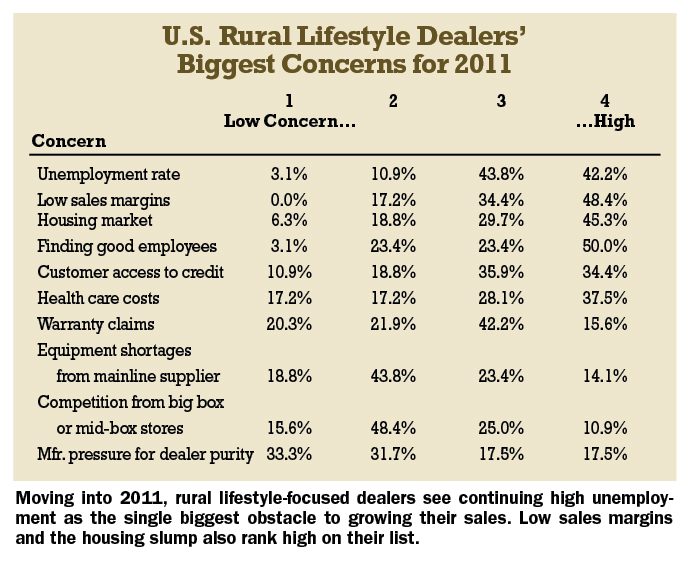

Despite their high level of confidence going into 2011, dealers also have plenty that concern them. Topping the list are issues that directly impact sales. The number of folks without jobs was ranked as their biggest concern by 86% of dealers polled.

“Low sales margins” finished second on the list by 82.8% of the dealers. The poor condition of the housing market was number 3 by 75% of the U.S. dealers.

Representative of the need to have the right person on the job, “finding good employees” rated number 4, with 73.4% of the dealers reporting that’s what keeps them awake at night.

Rounding out the dealers’ major concerns going into 2011 is customer access to credit and financing.

Dealer Spending Plans

While dealers have confidence in their staying power vs. the big boxes and other competition, they’re not resting on their laurels. Survey results indicate many equipment dealers are planning to invest in improving and upgrading their dealerships.

However, the money that will be invested in the service end of the business has gone down compared to what the dealers were planning last year. For 2011, 47.5% of the rural consumer equipment dealers reported they would be investing 2% or more in the shop and service areas of their business vs. 55.7% last year at this time.

Dealers have likely turned their major focus to equipment sales, believing service will follow.

This theory can be supported with their planned investments in the showroom, as nearly half (49.2%) of the dealers are planning to invest 2% or more. This is 3% higher than last year. Of these, 14.8% said they would spend 8% or more in upgrading their retail operations.

They will also spend dollars to ensure everything is working smoothly behind the scenes. Nearly 27% of dealers plan to increase their spending by at least 2% in business information systems. Some 10% of these dealers are planning to hike computer system investment by 8% or more.

Onward & Upward

There is a considerable amount of optimism among the dealers who serve rural lifestyle consumers, as the Rural Lifestyle Dealer “2011 Dealer Business Trends & Outlook” survey shows. They’re positive about expanding their customer base in their territories, as well as increasing the dealership’s sales revenue.

To achieve their growth goals, their staffs will need to be proactive and focused.

Government programs (such as recently announced USDA grants to help create a higher quality of life in rural areas) and an improving economy will help maintain the appeal of living in the country.

For equipment dealerships, developing a sales approach that focuses on the needs and wants of rural consumers, while offering a variety of different equipment, will help ensure sales figures buck the downward trend of the past several years. RLD

Breakouts by Major Brand

Case IH

Case IH dealers are bullish about zero-turn mowers and compact tractors.

John Deere

Utility vehicles (UTVs) are among the favorites for John Deere equipment dealers when it comes to leading unit sales in 2011.

Kubota

Compact tractors and zero-turn mowers will likely lead in equipment sales for Kubota dealers in 2011.

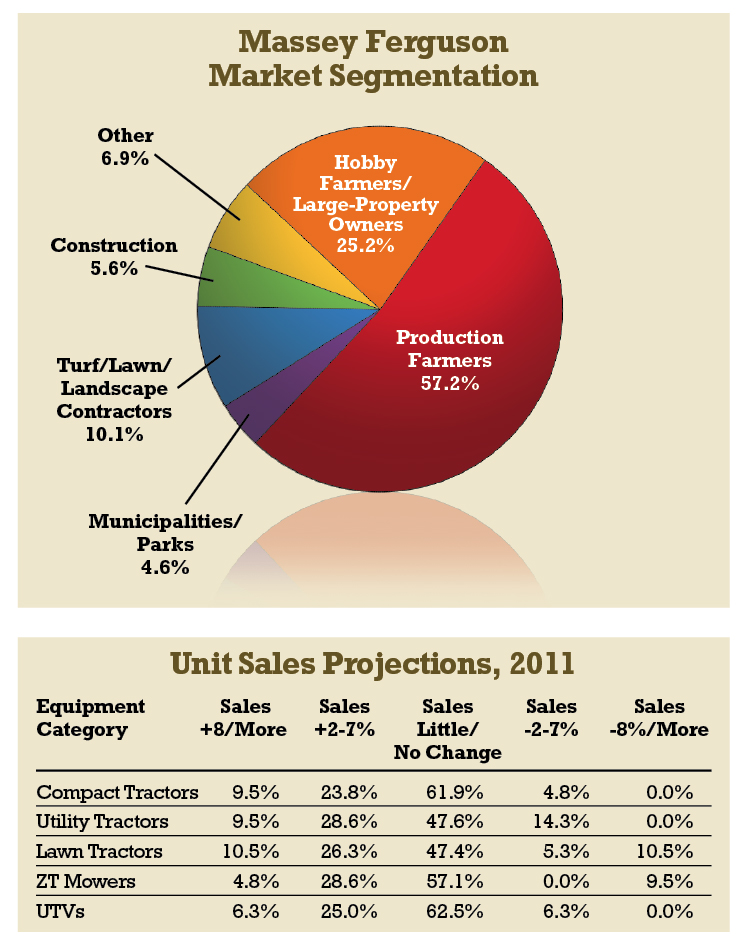

Massey Ferguson

According to dealers of AGCO's Massey Ferguson brand, tractors are their best-bet this year.

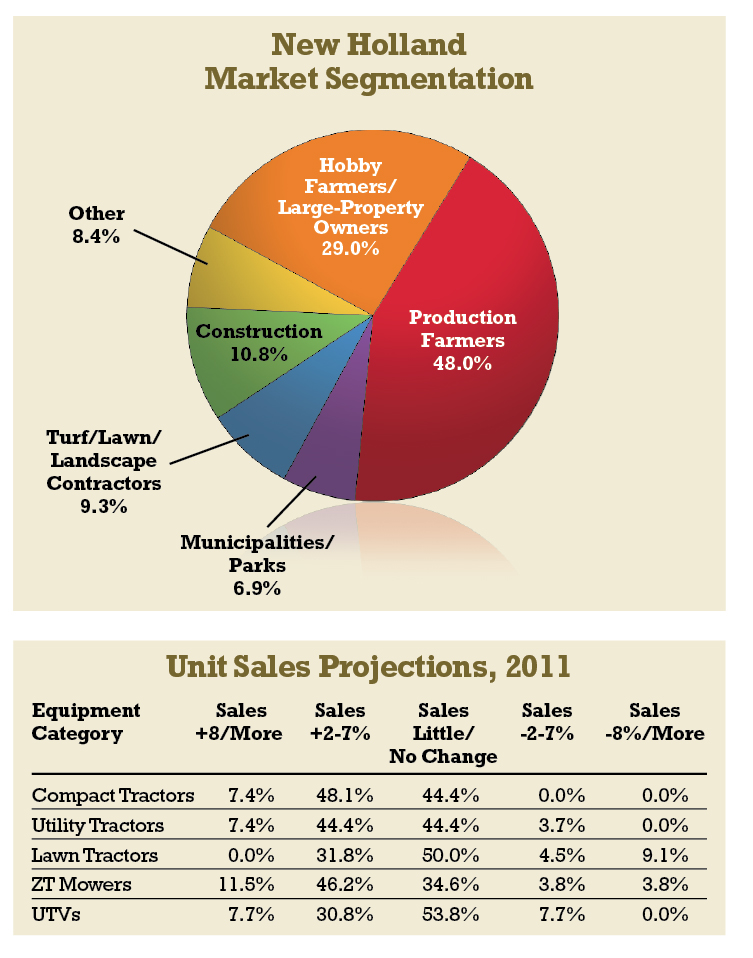

New Holland

New Holland dealers see zero-turn mowers and compact tractors as their greatest sales growth areas for 2011.

Post a comment

Report Abusive Comment