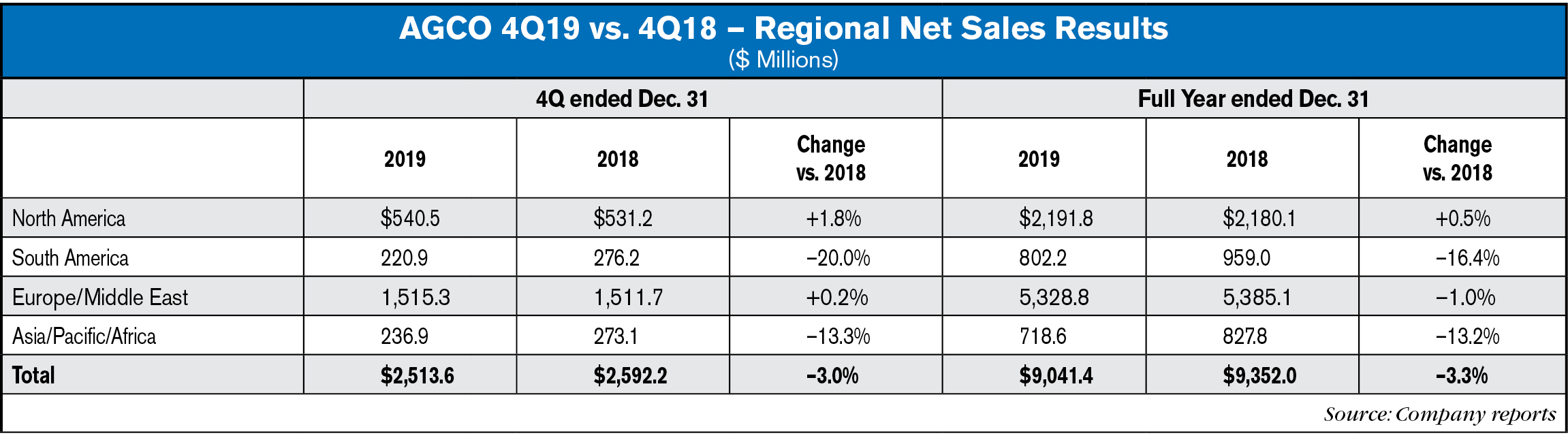

DULUTH, Ga. — AGCO, a manufacturer and distributor of agricultural equipment and solutions, has reported net sales of approximately $2.5 billion for the fourth quarter of 2019, a decrease of approximately 3% compared to the fourth quarter of 2018.

Excluding unfavorable currency translation impacts of approximately 2.4%, net sales in the fourth quarter of 2019 decreased approximately 0.6% compared to the fourth quarter of 2018.

Net sales for the full year of 2019 were approximately $9 billion, which is a decrease of approximately 3.3% compared to 2018. Excluding unfavorable currency translation impacts of approximately 4.2%, net sales for the full year of 2019 increased approximately 0.8% compared to 2018.

Gross margin was 20.4% for the fourth quarter of 2019 (down 35 basis points compared to the fourth quarter of 2018) and 21.9% for the full year of 2019 (up 60 basis points year-over-year). Operating (loss) income for the fourth quarter of 2019 was $(49.8) million (down 131.3% compared to the fourth quarter of 2018) and $348.1 million for the full year of 2019 (down 28.8% year-over-year). Operating margin for the fourth quarter of 2019 was (2)% (down 810 basis points compared to the fourth quarter of 2018) and 3.9% for the full year of 2019 (down 140 basis points year-over-year).

Retail unit sales for full year 2019 were down year-over-year for both tractors and combines in North America (tractors down 1%, combines down 6%), South America (tractors down 16%, combines down 5%) and Western Europe (tractors down 2%, combines down 18%).

Fourth Quarter Highlights

- Reported fourth quarter regional sales results year-over-year: Europe/Middle East (“EME”) 0.2%, North America 1.8%, South America (20)%, Asia/Pacific/Africa (“APA”) (13.3)%

- Constant currency fourth quarter regional sales results: EME 3%, North America 1.6%, South America (14.6)%, APA (10.8)%

- Warranty expense increased approximately $23 million compared to the fourth quarter of 2018 due primarily to field product improvement campaign costs to support new harvesting products

- Grain and protein brand and product rationalization resulted in charges of approximately $7 million to reduce complexity and improve product offerings

- Generated approximately $696 million in cash flow from operations and approximately $423 million in free cash flow in 2019

“AGCO’s fourth quarter results reflect the impact of challenging market conditions, particularly in Europe and South America,” stated Martin Richenhagen, AGCO’s chairman, president and chief executive officer. “In addition, our results were impacted by higher than anticipated new product warranty costs as well as charges associated with brand and product rationalizations within our grain and protein business. Despite the lower sales, we made solid progress with our margin improvement efforts and delivered strong cash flow for the full year. Looking forward to 2020, we are forecasting relatively flat global market demand.”

“A late harvest and lower crop production in North America were mostly offset by better production in Brazil and the European Union, keeping grain inventories relatively high and pressuring commodity prices during 2019,” continued Mr. Richenhagen. “Global industry retail sales of farm equipment in 2019 were lower across AGCO’s key markets with fourth quarter industry retail sales significantly lower than the prior year in both Europe and South America.”

“For the full year, industry retail sales were down modestly in North America during 2019 due to a difficult growing season and concerns involving trade. The USDA is projecting 2020 farm income in the U.S. to remain challenged due to low commodity prices and uncertainty with Market Facilitation Program payments. We project North American industry tractor sales to be modestly down in 2020 compared to 2019.”

“In Western Europe, industry demand trended progressively lower throughout 2019 due to the impact of lower wheat and milk prices and higher input costs for dairy producers. Industry sales declines across most of Western Europe were partially offset by growth in France, Finland and Spain. For 2020, EU farm income is expected to be down modestly, driven primarily by lower milk prices and partially offset by more normal crop production. Based on these assumptions, we expect sentiment to remain weak and 2020 industry demand to continue to soften modestly across the European markets.”

“Industry sales in Australia and New Zealand were down significantly in 2019 from 2018 levels due to drought conditions and will likely remain down in 2020. Fourth quarter industry retail sales in Brazil did not recover as we expected, resulting in a strong decline for the full year. Industry demand is expected to improve in Brazil in 2020. Brazilian farmers should benefit from a weaker Real and strong crop production. However, uncertainty around export demand and potential changes to the subsidized financing program are likely to temper farmer sentiment.”

“Our long-term global view remains positive. Increasing demand for commodities, driven by the growing world population, rising emerging market protein consumption and biofuel use, are expected to support elevated farm income and healthy conditions in our industry.”

North America

Net sales in the North American region increased 0.9% for the full year of 2019 compared to 2018, excluding the negative impact of currency translation. Increased sales of compact tractors, combines and parts were mostly offset by lower sales of protein production equipment and utility tractors. Income from operations for the full year of 2019 improved approximately $18.5 million compared to 2018. The benefit of improved pricing and cost control initiatives contributed to operating margin improvement.

South America

AGCO’s South American net sales decreased 11.1% for the full year of 2019 compared to 2018, excluding the impact of unfavorable currency translation. The loss from operations increased approximately $29.3 million for the full year of 2019 compared to 2018. The South America results reflect low levels of industry demand and company production, as well as unfavorable cost impacts of newer product technology into our Brazilian factories.

Europe/Middle East

AGCO’s Europe/Middle East net sales increased 4.4% in the full year of 2019 compared to 2018, excluding unfavorable currency translation impacts. Sales growth in France, Germany and Italy was partially offset by declines in the United Kingdom and Eastern Europe. Income from operations increased approximately $37.1 million for the full year of 2019 compared to 2018, due to the benefit of higher sales and margin improvement resulting from pricing, improved factory productivity and a favorable sales mix.

Asia/Pacific/Africa

Asia/Pacific/Africa net sales decreased 8.9%, excluding the negative impact of currency translation, in the full year of 2019 compared to 2018. Lower sales in China, South East Asia and Africa accounted for most of the decline. Income from operations dropped approximately $6.2 million for the full year of 2019 compared to 2018, due to lower sales and production.

Outlook

AGCO’s net sales for 2020 are expected to reach approximately $9.2 billion reflecting improved sales volumes and positive pricing. Gross and operating margins are expected to improve from 2019 levels, reflecting the positive impact of pricing and cost reduction efforts.

Post a comment

Report Abusive Comment