MINNEAPOLIS — Polaris Inc. (NYSE: PII) (the "Company") released fourth quarter 2020 results with reported sales of $2,156 million, up 24% from reported sales of $1,736 million for the fourth quarter of 2019. The Company reported fourth quarter 2020 net income of $199 million, or $3.15 per diluted share, compared with net income of $99 million, or $1.58 per diluted share, for the 2019 fourth quarter. Adjusted net income for the quarter ended Dec. 31, 2020 was $211 million, or $3.34 per diluted share compared to $115 million, or $1.83 per diluted share in the 2019 fourth quarter.

Retail demand and industry tailwinds remained strong during the quarter benefiting Company performance as both new and existing customers continued taking advantage of off-road vehicles, snowmobiles, motorcycles and boats to enjoy the outdoors while maintaining social distancing etiquette.

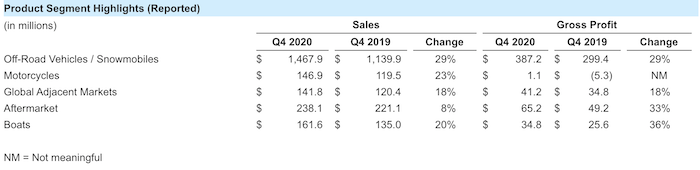

Gross profit increased 30% to $550 million for the fourth quarter of 2020 from $423 million in the fourth quarter of 2019. Reported gross profit margin was 25.5% of sales for the fourth quarter of 2020, up 112 basis points compared to 24.4% of sales for the fourth quarter of 2019. The improvement in gross profits was primarily driven by positive product mix and lower promotional costs incurred during the quarter, offset somewhat by costs related to supplier constraints. Adjusted gross profit for the fourth quarter 2020 was $552 million, or 25.6% of adjusted sales compared to the fourth quarter of 2019 adjusted gross profit of $428 million, or 24.7% of sales. Adjusted gross profit for the fourth quarter of 2020 and 2019 excludes the negative impact of $2 million and $5 million of restructuring and realignment costs, respectively.

Operating expenses decreased 1% for the fourth quarter of 2020 to $304 million from $308 million in the same period in 2019. Operating expenses were lower due to decreased compensation expense related to the CEO departure, in addition to lower non-essential expenses driven by the Company's ongoing cautionary approach to spending given the pandemic-generated economic uncertainty.

Income from financial services was $17 million for the fourth quarter of 2020, down 17% compared with $21 million for the fourth quarter of 2019. The decrease was primarily the result of a decrease in wholesale financing income during the quarter due to lower dealer inventory levels.

Off-Road Vehicles (“ORV”) and Snowmobiles segment sales, including PG&A, totaled $1,468 million for the fourth quarter of 2020, up 29% compared to $1,140 million for the fourth quarter of 2019 driven by broad based strength across ATV and side-by-side sales. PG&A sales for ORV and Snowmobiles combined increased 35% in the fourth quarter of 2020 compared to the fourth quarter last year. Gross profit increased 29% to $387 million in the fourth quarter of 2020, compared to $299 million in the fourth quarter of 2019. Gross profit percentage increased 11 basis points during the 2020 fourth quarter compared to the prior year due to strong retail demand, positive product mix and lower promotional and floor-plan financing costs offset somewhat, by higher logistical costs and plant inefficiencies from supply chain constraints.

ORV wholegoodsales for the fourth quarter of 2020 increased 33%. Polaris North American ORV retail sales increased low-thirties percent for the quarter with side-by-side vehicles up high-thirties percent and ATV vehicles up high-teens percent. The North American ORV industry was up high-twenties percent compared to the fourth quarter last year.

Snowmobile wholegood sales in the fourth quarter of 2020 were $183 million, up 4% compared to $176 million in the fourth quarter last year. Polaris snowmobile retail sales were up low-twenties percent during the fourth quarter of 2020 compared to the prior year while North American industry retail was up mid-teens percent for the fourth quarter compared to the prior year.

2021 Business Outlook

The Company announced its sales and adjusted earnings guidance for the full year 2021. Sales are expected to increase to the range of $7,950 million to $8,150 million, an increase of 13-16% over 2020 adjusted sales of $7,025 million and adjusted net income is expected to be in the range of $8.45 to $8.75 per diluted share for the full year 2021 compared to adjusted net income of $7.74 per diluted share for 2020. The full year 2021 earnings guidance includes an increase in tariff costs of approximately $40 million for the full year 2021 as exemptions and refunds received in 2020 are not contemplated to continue into 2021.

CEO Commentary

The Polaris team once again demonstrated its strength and agility to deliver a strong finish to an exceptionally unusual year. While 2020 brought many unforeseen challenges, we emerged from the abrupt shutdown of the global economy early in the year to leverage the surge in demand across the Powersports industry and outdoor recreation, growing full year adjusted sales and earnings 4% and 22%, respectively. Our highly innovative product line-up of ORVs, snowmobiles and boats brought in new customers and powersports enthusiasts to Polaris. Over the year, we introduced over 120 new products across our portfolio and over 900 new accessories in our PG&A business and Aftermarket segment, combined. While supply chain challenges remain front and center for Polaris and most of the industry as we enter 2021, the operational track record of our team gives me great confidence in our ability to navigate those constraints, rebuild dealer inventories, and continue to bring to market the highest quality, most innovative products and services in the powersports industry.

-- Mike Speetzen, Interim Chief Executive Officer of Polaris Inc.

Post a comment

Report Abusive Comment