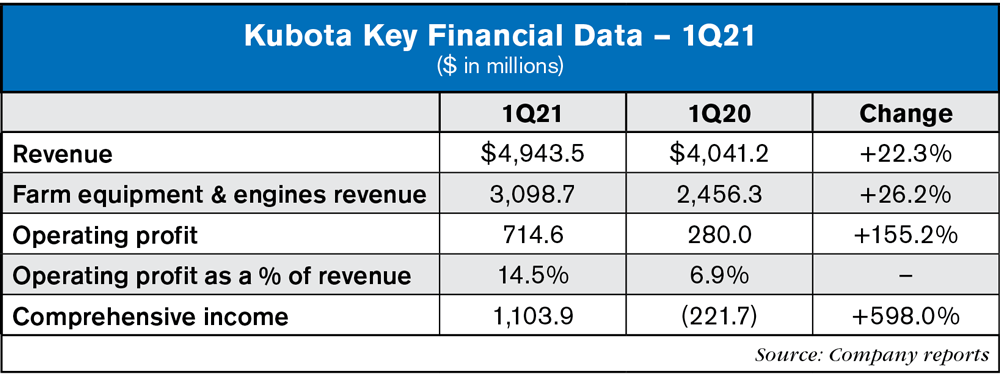

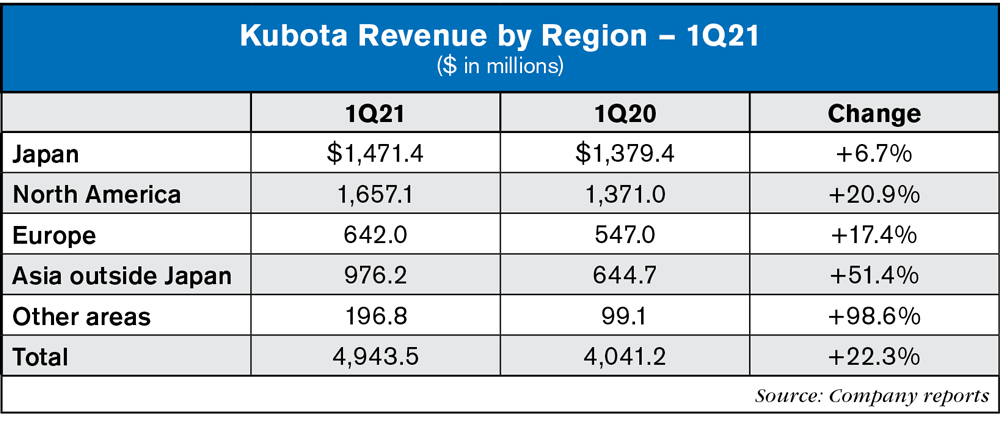

For the three months ended March 31, 2021, revenue of Kubota Corporation and its subsidiaries increased by $902.3 million (+22.3%) from the same period in the prior year to $4.9 billion.

Domestic revenue increased by $91.9 million [+6.7%] from the same period in the prior year to $1.5 billion because of increased revenue in Farm & Industrial Machinery mainly due to increased sales of farm equipment, while revenue in Water & Environment was almost at the same level as the prior year.

Overseas revenue increased by $809.9 million [+30.4%] from the same period in the prior year to $3.5 billion because of significantly increased sales of farm equipment and construction machinery. In addition, revenue in Water & Environment also increased from the same period in the prior year.

Operating profit increased by $434.6 million [+155.2%] from the same period in the prior year to $714.6 million due to increased revenue in the domestic and overseas markets and improved foreign exchange gain/loss. In addition, there was a negative effect from deteriorated profitability of products, which had been shipped in the same period in the prior year, in its manufacturing bases along with a significant reduction in production in the fourth quarter of 2019. Profit before income taxes increased by $434.8 million [+152.4%] from the same period in the prior year to $719.8 million due to increased operating profit. Income tax expenses were $196.7 million. Share of profits of investments accounted for using the equity method was $4.6 million. Profit for the period increased by $314.4 million [+147.4%] from the same period in the prior year to $528.6 million. Profit attributable to owners of the parent increased by $287.7 million [+150.7%] from the same period in the prior year to $478 million.

Farm & Industrial Machinery

Farm & Industrial Machinery is comprised of farm equipment, agricultural-related products, engines, and construction machinery.

Revenue in this segment increased by 28.1% from the same period in the prior year to $4.1 billion and accounted for 82.7% of consolidated revenue.

Domestic revenue increased by 14.7% from the same period in the prior year to $699.6 million. Sales of farm equipment and agricultural-related products increased due to a recovery from adverse reaction from rushed demand before the consumption tax hike and increased demand resulting from subsidies for business continuation of farmers.

Overseas revenue increased by 31.3% from the same period in the prior year to $3.4 billion. In North America, sales of tractors and construction machinery increased significantly mainly due to strong demand along with trend in move to suburbs despite delay in shipment caused by port congestion and other effects. In Europe, sales of construction machinery, tractors, and engines increased due to a recovery from sluggish sales along with the infection spread of COVID- 19 in the prior year. In Asia outside Japan, sales of farm equipment in Thailand significantly increased mainly due to eased concerns about drought along with rainfall in the prior year and stable crop prices at a high level. In addition, sales of farm equipment in China, Philippines, and India were strong as well. In Other areas, sales of tractors and construction machinery in Australia increased significantly due to more rainfall than usual and government stimulus measures.

Operating profit in this segment increased by 123.1% from the same period in the prior year to $626 million mainly due to significantly increased revenue in the domestic and overseas markets and deteriorated profitability of products, which had been shipped in the same period in the prior year, in its manufacturing bases.

Assets, liabilities, and equity

Total assets at March 31, 2021 were $31.1 billion, an increase of $1.8 billion from the prior fiscal year-end. With respect to assets, the yen value of assets denominated in foreign currencies, such as finance receivables, increased significantly due to the yen depreciation compared with the prior fiscal year-end. In addition, trade receivables increased due to increased revenue in the domestic and overseas markets.

With respect to liabilities, the yen value of bonds and borrowings denominated in foreign currencies increased mainly due to the yen depreciation compared with the prior fiscal year-end and an increase in working capital. Equity increased due to an improvement in other components of equity along with fluctuations mainly in foreign exchange rates and the accumulation of retained earnings. The ratio of equity attributable to owners of the parent to total assets stood at 46.2%, 0.1 percent lower than the prior fiscal year-end.

Cash flows

Net cash used in operating activities during the three months ended March 31, 2021 was $206.8 million, a decrease of $46 million in net cash outflow compared with the same period in the prior year. This decrease was mainly due to an increase in profit for the period, despite an increase in cash outflow related to an increase in finance receivables and the changes in working capital, such as trade receivables.

Net cash used in investing activities was $169.2 million, a decrease of $12.9 million in net cash outflow compared with the same period in the prior year. This decrease was mainly due to an increase in cash inflow related to net decrease in restricted cash, despite an increase in cash outflow related to acquisition of property, plant, and equipment and intangible assets.

Post a comment

Report Abusive Comment