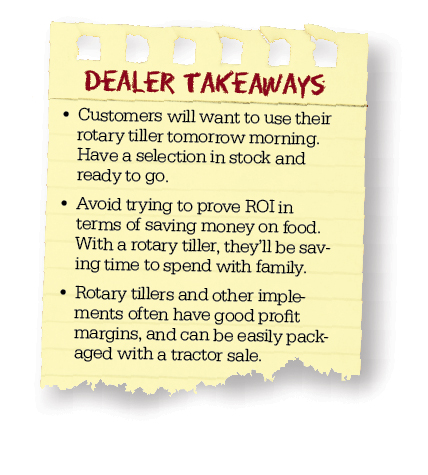

Picture this: It’s a Friday afternoon in May, and the warm, dry weather is expected to continue through Sunday. Then, a couple shows up at your dealership and walks straight to the rotary tillers. Is your staff ready to close the sale?

Days before leaving the house, these rural lifestylers did their research. They’ve studied their tiller options or watched their neighbor use a tractor with a tiller to prepare the garden for planting. They’re already excited about owning one. And, while still standing on your lot, they’re planning to use it tomorrow morning.

An opportunity such as this is when preparation and careful pre-season planning pays off, says Spencer Coleman of Coleman Tractor Co. “You must have this equipment ready for immediate delivery. Instant gratification is very important to the rural lifestyle customer.”

Coleman’s approach to customer service is working. Nearly one third of the several hundred Kubota tractors he sells each year leave the dealership equipped with a new rotary tiller.

With two locations in Paris and Clarksville, Tenn., the dealership’s focus is the rural lifestyle consumer. Because the stores are within a couple hours of Memphis or Nashville, more than half of the tillers he sells go to urban professionals who own rural land for hunting, where the implements are used to prepare food plots. Others go to small- to medium-sized landowners who put them to work in gardens and small organic farming operations.

“It took several years for us to figure out how to market implements — and I do believe they must be actively marketed to the rural lifestyle customer. The absolute biggest factor is stocking adequate inventory,” he says. “They want a wide selection of implements that are in good shape and nicely displayed. You can’t drop them along the side of the building in the weeds, or leave them in shipping crates behind the shop. The rural lifestyler usually has an urban background, and they’re not accustomed to those conditions.”

While consumers are at ease buying certain items out of a catalog or online, their comfort level with tractors and rotary tillers is different. “It’s difficult to sell this machinery out of a catalog,” says Coleman. “Customers want to touch the equipment before they buy. They may prefer to buy from a dealership, but many are unwilling to wait a few weeks before they can get the equipment they want. If we don’t have the tiller in stock and ready to go, they’ll drive over to the big box store.”

|

Tractors Sell Tillers

Having rotary tillers on the floor ready for delivery helps sell the equipment, but installing them on a tractor is better yet. On its lot in Rickreall, Ore., Rickreall Farm Supply displays Woods rotary tillers and other implements mounted on the Kubota tractors it sells. “We have found that the rural lifestyle consumer wants to see what it’s going to look like hooked up to the tractor,” says Jay Hayes, sales manager for Rickreall.

The majority of Rickreall’s rotary tiller customers own 5-50 acres and want something to work their garden. The area has also become a popular one for specialty crops such as grapes, where they use tillers to maintain the soil between vines.

Coleman Tractor puts implements on nearly every tractor on both of its lots. Between the two stores, says Coleman, there are nearly 250 new tractors in stock. When a customer calls to price equipment, they’re usually interested in a tractor. Being fair with tractor prices allows the dealer to increase profit margins on tillers.

“Once they come in the door and decide to buy a tractor, we try to upsell them with a tiller or other implement to go with it,” he says. “They’re already buying a tractor, and aren’t likely to start comparing prices on the tiller. If we’ve given them a good deal on the tractor, they’re happy. I see less price competition on implements.”

At the end of the year, the profit margins on implements can be better, too. “We’re in 20-25% margin on implements across the board,” says Coleman, “and by the end of the year the margin will be at 10% or less on new tractor sales.”

Ranchers & Farmers Supply of Amarillo, Texas, is a one-stop shop where hobbyists, mainly horse owners, can get almost everything they need for their animals and land. It has been selling livestock feed and horseshoes since 1961.

“Most of our customers are backyard horse people,” Timmy Snider says. We work with some ranchers, but most of our customers are weekend warriors.”

While consumers are comfortable buying items out of a catalog or online, when it comes to rotary tillers and other equipment, says Spencer Coleman, customers want to touch the equipment before they buy it.

|

Ranchers & Farmers Supply sold a few mowers to its equestrian clientele over the years. But not until it added tractors — Branson tractors two years ago and Kioti last year — did its customers start thinking about the store as a place to buy tractor-mounted implements. These days, Snider says they sell a lot of equipment.

The store has carried Tarter Farm and Ranch’s livestock equipment for years, and when it started selling tractors it added Tarter’s rotary tillers, as well. According to Snider, horse owners usually buy 6 foot wide tillers, while gardeners buy smaller tractors and 4 foot tillers.

Most of its customers are using tillers to prepare arenas. “They’ll till it 5 inches deep so they are not running their horses on a hard surface, which prevents them from slipping and falling. It’s a lot easier on the horses, too, because it gives them a little cushion.” It’s a weekly job in most cases. The tillers see a lot of hours and they are used hard.”

Keeping tractors on the lot allows Ranchers & Farmers Supply to sell this equipment as a complete set. “We will package anything: tillers, rotary cutters, box blades, posthole diggers, you name it,” says Snider. “We don’t have a set package, we let them pick and choose. If they buy a tractor from us, we’ll often sell the equipment at cost to help sell the tractors.”

For Richard Straub, Tri-County Equipment, Poseyville, Ind., offering the rural lifestyler a range of implements is sometimes the best way to ensure that the customer will continue to spend money at the dealership. “The quality of these little tractors is so good and the hours they’re putting on them are so low, that you don’t see them return for anything big as far as tractor service goes. You’ve got to ensure they have a good experience with you so they’ll come back and buy more attachments. That’s your lifeline — if the customer only buys a filter and a jug of oil, you’d go broke.”

While having a compact tractor line can help boost sales of rotary tillers and other tractor mounted equipment, a few of the dealers Rural Lifestyle Dealer spoke with said tillers can help sell a bigger tractors than the customer was initially considering.

“A customer will ask, ‘Why should I buy a subcompact tractor instead of a lawn tractor? I’m just going to mow my lawn,’” says Hayes. “But by showing him the equipment we have on the lot, we can talk about doing more than just cutting grass. I’ll say, ‘you’re going to spend a considerable amount of money on a lawn mower, but here you’ve got a tractor. It’s a machine that will be your prime unit. It can be your lawn mower as well as garden tool.”

Jay Hayes, sales manager for Rickreall Farm Supply in Rickreall, Ore., says rotary tillers can often convince customers to move up from a lawn tractor to a larger multi-purpose machine. Hayes is shown in the middle with Rickreall’s John Hochstetler, general manager (l) and Chad Hochstetler, marketing manager (r). |

Out-Pricing the Competition

Big box stores are often the first place rural lifestyle consumers see rotary tillers and begin to compare prices. While box stores can present a challenge to equipment dealers who sell rotary tillers, they don’t have to — especially if the dealer is not carrying the same brand as the chain store. “I know some guys who do carry the same brands as box stores, and that’s bad,” says Coleman.

Sticker price may be the biggest reason a box store is considered, but dealers say the game is still not lost. “We take advantage of the volume ordering discounts from the equipment manufacturers, and have found we can always beat a box store’s implement price,” Coleman says. “A customer has never come back from one of those stores with a low price that I can’t beat and still make money.”

Coleman admits that the profit margin may not be as high as he’d like in these situations, but winning the customer is the goal. “If you have them on your lot, you are two steps ahead. At that point you can control the dialogue and start appealing to their impulses. I’ll suggest, ‘Let’s load it up right now so you can get in the garden this afternoon.’”

Coleman Tractor was formed from separate dealerships in Paris, acquired in 2006, and Clarksville in 2010, where the previous owners sold Taylor Pittsburgh and Woods rotary tillers, respectively. “We now sell both brands at each location to benefit from volume ordering programs,” says Coleman. “Maximizing the ordering discounts is key to staying competitive in the implement business.”

Hayes says Rickreall Farm Supply also buys at the “deepest discount the manufacturers can give us. That makes us competitively priced on the units and we still get a good margin. Tillers come in a wide variety of sizes, so I match them up to the majority of the tractor sizes I sell. Overall, I can make more money selling tractor-mounted implements.”

Planning for Spring

Rural lifestyle customers don’t buy rotary tillers in the winter. Most will decide to make the investment while they’re outside preparing their gardens for the new year.

Coleman says it’s this cyclical, impulse-buy nature of selling rotary tillers that makes it important to order and have them assembled during the winter. “Once weather starts to clear, we have to get them out in front, primed and ready to go.”

There’s some guess work in forecasting tiller sales, but Coleman says, “We keep very good records, with graphical representations of what we sold last year. I know down to the model how many I sold, and compare that from year to year.

“At the end of the season, I would rather have too many rather than too few. If I get stuck with five or six extra tillers in stock they’re not going to sink the ship. I’m ready for next year. But I don’t want to have a customer come to me and then have to go down the road to a competitor. I want to keep them coming back, not out there discovering other stores.”

Keeping implements such as tractor-mounted rotary tillers in stock is a critical step in selling these products. Rural lifestyle consumers may do some research online, but they will visit a dealership to see the equipment and understand how to operate it. Once on the lot, they’re most likely ready to buy. |

Selling it On the Lot

The typical rural lifestyle consumer hasn’t grown up around equipment. They show up at a dealership knowing the work they want to do, but may be unaware of the variety of implements that will help them get it done.

To that end, Rickreall Farm Supply has a demonstration area where customers can see how the equipment operates. “We have found this is really valuable for the rural consumer,” says Hayes. “You don’t see rural lifestylers at many farm shows, and they do a lot of reading on the Internet. Consumers want to go to a dealership and get comfortable with the machine before they buy. That’s something the box stores don’t offer.”

During the product demonstration, it’s important to remember that in most cases, the consumer is not making a business decision. They’re not thinking about depreciation or ROI. “You can buy a lot of tomatoes for the price of a rotary tiller,” says Straub. “If that’s the approach you take, you will lose every time. It’s better to talk about ease of operation, and how much time they are going to save in the garden.”

“You have to get into the emotional side of the buying decision they’re making,” says Coleman. “There’s a lot of impulse buying with this customer base. For them it’s almost entirely emotional.”

However, “return on investment” may figure into the decision when the build quality of a rotary tiller is discussed. “If a customer is buying this to keep for a long time, the price difference becomes negligible over the long-term when you prorate it. If the higher quality tiller is $500 more than an economy brand, and they’re going to keep it 10 years, that is only $50 a year,” he says. “With that purchase, he will have a heavy-built unit with better features.”

The purchase decision on tillers usually comes down to price as opposed to quality.

There are extremes on both ends of the spectrum, so the sales staff must have a keen sense of where the customer falls — along with the appropriate inventory to supply them. Some will only want the cheapest price and care little about long-term quality, while others prefer to buy the top-of-the-line equipment. There’s no single answer for all customers.

Giving the sales staff an extra push may help, too. “I pay my sales team a slightly higher commission on implements than tractors,” says Coleman.

“This gives them an extra incentive to put together equipment packages for the customer, especially if they’re already buying a tractor. It can be hard to see the correlation in business, but I did see a jump in implement sales when I started doing that. In many equipment dealerships, implements are usually a low-commission item.”

Post a comment

Report Abusive Comment