North American equipment dealers are confident that sales in the rural lifestyle market will remain stable or even increase over the remainder of the year, according to Rural Lifestyle Dealer’s 2010 Mid-Year Business Trends & Outlook.

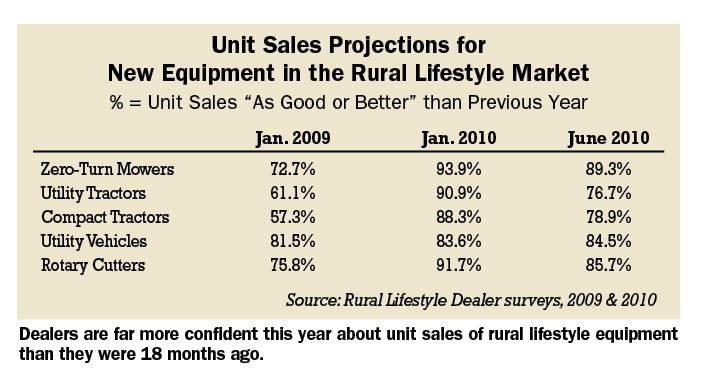

The optimism seen in the magazine’s annual outlook last January has cooled just a bit, perhaps because dealers have a better feel for the pace of the economic recovery in the U.S. But unit sales projections for key equipment types — utility and compact tractors, utility vehicles, zero-turn mowers and rotary cutters — are still much higher than 18 months ago.

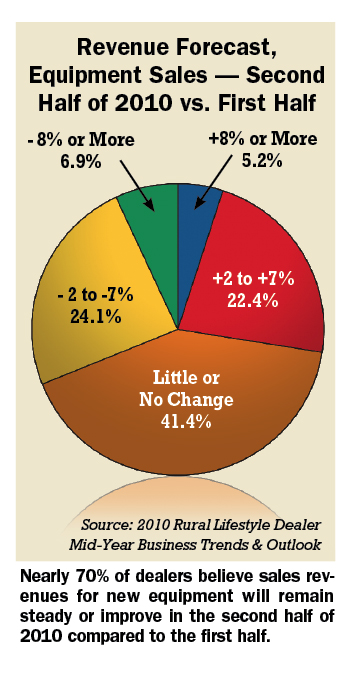

Almost 70% of dealers responding to the survey believe sales revenue for new equipment will be as good or better in the second half of 2010 than the first half. Nearly 28% feel sales revenue will increase in the second half, while just over 41% predict “little or no change” in revenues. Approximately one-third of dealers feel revenues will decline in the next 6 months.

High Hopes for Zero-Turn Mowers

The sales outlook for zero-turn mowers, utility vehicles and rotary cutters remains hot. About 89% of dealers predict unit sales of zero-turn mowers will be as good or better in 2010 than the previous year, followed by rotary cutters (85.7%) and utility vehicles (84.5%). More than 75% of dealers expect sales of both compact and utility tractors to be as good or better in 2010 than in 2009.

The highest unit-sales growth may come with zero-turn mowers. Almost 18% of dealers surveyed believe sales of zero-turn mowers will increase 8% or more in 2010 compared to last year, followed by compact tractors (12.3%), utility tractors and rotary cutters (both 8.9%) and utility vehicles (3.8%).

More than half of dealers believe unit sales of utility vehicles will see “little or no change” compared to 2009, but only 15.4% predict sales will decline.

The survey also shows a clear rebound for sales of compact tractors (<40 hp) — which had been contracting every year since 2004 — and a strengthening in the market for utility tractors (40-100 hp).

Issues of Concern

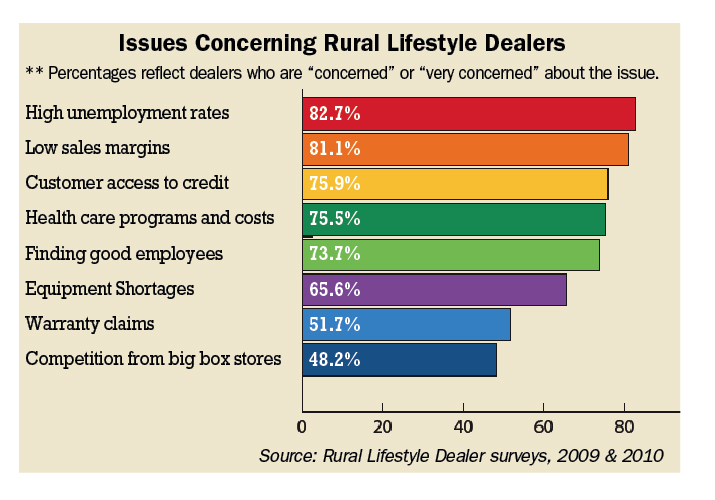

Rural Lifestyle Dealer also asked equipment dealers what issues they were most concerned about in running their business. Dealers were asked to rank these issues on a scale of 1-4 — “1” meaning “little concern,” and “4” meaning “very concerned”.

The issues getting the most “concerned” and “very concerned” responses were high unemployment rates (82.7%), low sales margins (81.1%), customer access to credit (75.9%) and health care programs and costs (75.5%).

Finding good employees (73.7%) and the housing market (70.7%) also ranked high, while competition from big box stores (48.2%) and warranty claims (51.7%) ranked the lowest. Some 65.6% of dealers are concerned about equipment shortages from their mainline supplier.

Caution May Be Lifting

Many economists say the U.S. recession that began in December 2007 is over. Some good news has emerged about consumer debt levels and household net worth.

But many dealers responding to Rural Lifestyle Dealer’s survey worry a credit crisis, or continued high unemployment levels could stall the recovery. They’re also concerned about the economic and tax policies of President Obama’s administration and the outcome of the November elections.

“If I didn’t watch the national news I would be all smiles,” says one dealer from Mississippi. “Overall, sales are up 50% over this time last year. The customers that are buying are the same ones that have been coming in for the last 2 years but were afraid to buy based on the negative news reports.”

“Customers are reluctant to spend money and are looking for value,” another dealer from Arkansas comments, adding that year-over-year sales are “up considerably” for zero-turn mowers.

Equipment shortages are becoming a problem for some dealerships relying on the majors. “We’ve had only 1 compact tractor in stock all spring, and we’ve been told that we have to wait until fall before we can get any more,” says one Deere equipment dealer. “We’ve lost more sales because of Deere’s poor judgment on the growing economy and lack of production than because of customers being unwilling to buy.”

Plunging home values narrowed the customer base in one California dealer’s market, but he thinks the worst is over. “Not everyone suffered a big financial downturn, but everyone became cautious. We are seeing that caution lift a little.”

Here's a sampling of what other dealers participating in our survey said:

- "The economy still feels sluggish. There seems to be little willingness on the part of buyers to take risks or finance equipment. We recently had a small business owner cancel his compact tractor purchase because one of his major clients declared bankruptcy. So althoguh it seems a little better than 2009, it is moving upward very slowly."

- "It's going to get worse before getting better. We are trying to do more with less people. Fuel costs are up from a year ago, health insurance costs are up 29% from last year, and Maryland unemployment insurance is up 400%. Sure isn't getting any easier."

- "I think folks want to see things go back to normal, or at least figure out the new normal. We are selling lifestyle and ideals today and we need people feeling good about the future so they will invest in their own future with the things that will make their quality of life what they dreamed it would be. We need to be sure to pass along the value of making a good investment, regardless of what that investment might be."

- "We feel the economy is on a slow rebound. We're adjusting our business to prosper with a more conservative customer base."

- "People are listening too much and not getting out and seeing that things are still moving. We will be down at least 5% this year because of this."

Post a comment

Report Abusive Comment