The Equipment Dealers Assn. released the results of its Dealer-Manufacturer Relations Survey with compact tractor manufacturer LS Tractor earning the Dealer’s Choice award for tractor manufacturers.

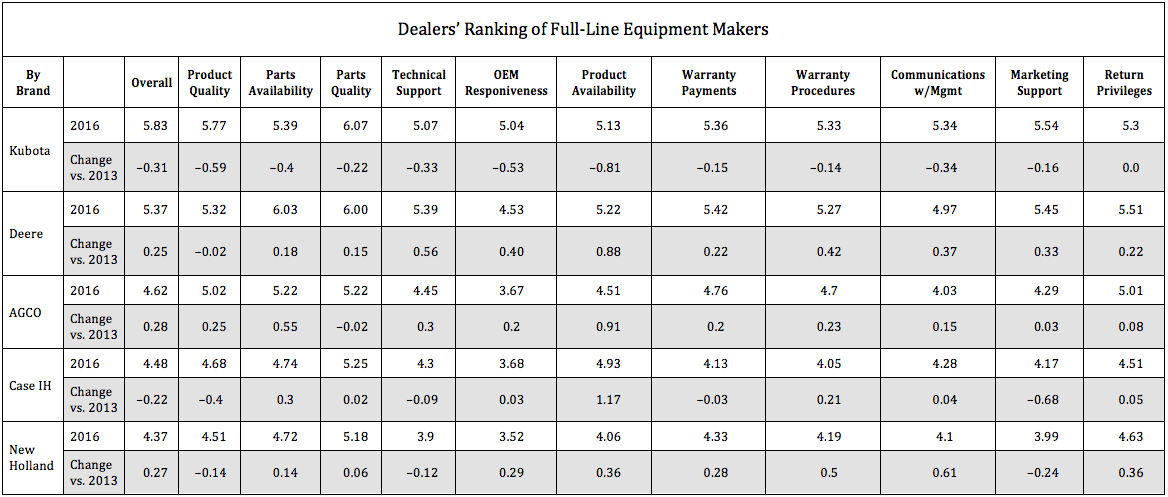

The survey has been conducted since 2013 and the editors at Ag Equipment Intelligence (from Lessiter Media, the publisher of Rural Lifestyle Dealer) recently took a look at how manufacturer scores have changed since then. Looking at manufacturers who produce rural equipment, here are the gains:

- McCormick: +0.97

- AGCO: +0.28

- New Holland: +0.27

- John Deere: +0.25

And, here are the OEMs producing rural equipment who posted a loss since 2013:

- Kubota: -0.31

- Case IH: -0.22

Kubota was down in every category in 2016 compared to 2013, but the most significant changes came in product availability, product quality and technical support. In the article, George Russell, a member of the Machinery Advisory Consortium, says Kubota’s drop may be the result of a lot of the changes taking place within the organization in its efforts to become a full-line ag equipment manufacturer.

“There are a lot of changes going on and dealers are seeing that, but they’re not getting the same level of support and responsiveness that they may have had in the past. Particularly when in the past, Kubota had always said, ‘The dealer is our customer.’ Previously, they were always rated very highly by dealers,” he says.

However, Russell says it’s important to note that despite Kubota seeing the largest drop in its overall score, it was still the highest rated of the major manufacturers. (See the chart below.)

Analyzing Small Tractor Makers

Looking at the tractor and engine manufacturers, there are a number of smaller manufacturers rated in 2016 that were not on the list in 2013. “Those newer entrants into the smaller tractor business really need to try and serve their dealers well,” Russell says.

With the exception of TYM, which was at the bottom of the list, the smaller tractor manufacturers rated very high. However, Russell says the smaller product line at some of these manufacturers puts them at an advantage in terms of the ratings over the majors. “The majors have a harder time making dealers happy with a full line of equipment vs. a focused line. You have to put that into perspective. When you mix a company like Branson in with Deere and Case IH, it’s an apples to oranges comparison,” he says.

For more results and analysis for the rural equipment market, read “Making the Grade”in the summer issue of Rural Lifestyle Dealer.

Post a comment

Report Abusive Comment