Here are highlights from the September 2017 Ag Equipment Intelligence Dealer Sentiments & Business Conditions Update survey of North American dealers, which includes data about the commercial and consumer lawn equipment segment:

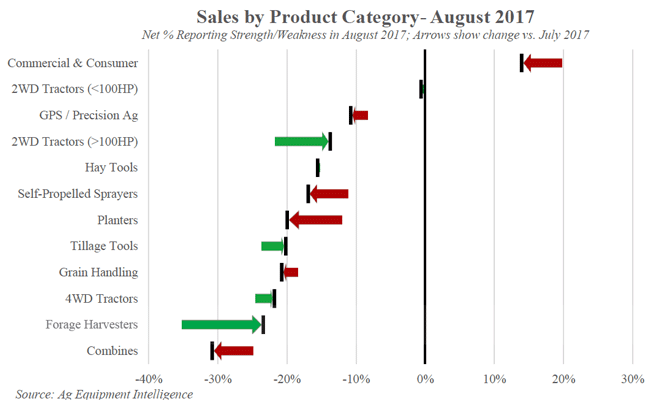

- Sales – Average dealer sales were reported down 1% y/y in August, an improvement from the 3% declines in July. A net 6% of dealers missed their sales budgets in August vs the 19% that missed last month. Commercial and consumer lawn equipment and GPS/precision farming sales showed strength, while large equipment demand remains weak.

- Outlook – The 2017 sales growth forecast was reported down 1%, better than the 3% declines expected in July. A net 3% of dealers reported they are less optimistic, an improvement from the 11% reporting less optimism in July. The 2018 forecast is for 2% growth vs. the flat forecast in July- a net 23% of contacts expect growth in 2018 vs the 2% that expect declines in 2017.

- Inventory – A net 25% of dealers reported new equipment inventories too high, an improvement from the 32% in July. Used equipment inventories remained elevated as a net 15% of dealers reported used inventory as too high, better than the 27% last month. Overall, inventories have come down from 2016 levels.

- Pricing – Dealers reported relatively flat new equipment pricing as OEM price increases have been offset by discounting at the dealer level. Used equipment values deteriorated in the month with large tractors reported down 5% y/y, inline with July. Combine pricing was worse than July at down 7% y/y.

Commercial and consumer lawn equipment and GPS / Precision ag sales showed strength, while large equipment demand remains weak. Sequentially, the majority of equipment category sales softened from July. In 2Q, nine of twelve categories saw sequential improvement from 1Q compared to eleven categories improving from 4Q to 1Q. See the corresponding data in the following charts.

Post a comment

Report Abusive Comment