The Equipment Leasing & Financing Foundation recently released its 2018-2019 Vertical Market Series, Construction Report. Here's an excerpt related to equipment sales forecasts:

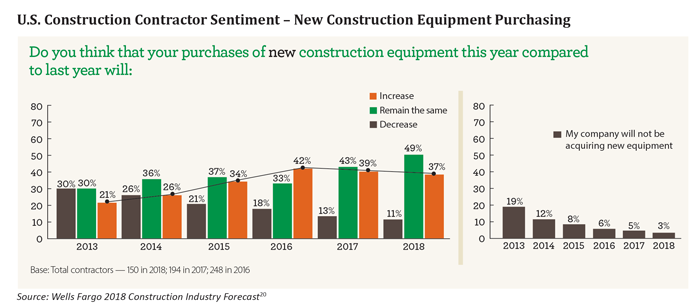

2017 was a good year for equipment sales in the construction sector, and according to the industry, 2018 could see further improvements. Seventy-six percent of distributors said that their sales of new equipment will increase, while 78% say their sales of used equipment will increase. On the contractor side, 37% indicate that they will purchase more new, while 27% indicate they will purchase more used. The percentage of contractors who commented that they would buy less new and used equipment in 2018 shrunk to the lowest levels in 5 years.

Distributors and rental companies indicated that their rental fleets will increase in 2018 over 2017, with 55% indicating their intention to expand. Notably, only 7% say they will decrease the size of their fleets.

According to a recent nationwide survey conducted by Wells Fargo Equipment Finance, U.S. construction firms indicated that given the possibility of increased equipment rental costs in the range of 5-15%, the majority (63%) of those surveyed would consider purchasing equipment rather than renting.

“That such a small increase in rental costs would make companies who rent equipment consider buying instead of renting indicates that the industry is at equilibrium between availability and pricing of rental equipment,” explains John Crum, senior vice president and national sales manager, Construction Group, Wells Fargo Equipment Finance.

Post a comment

Report Abusive Comment