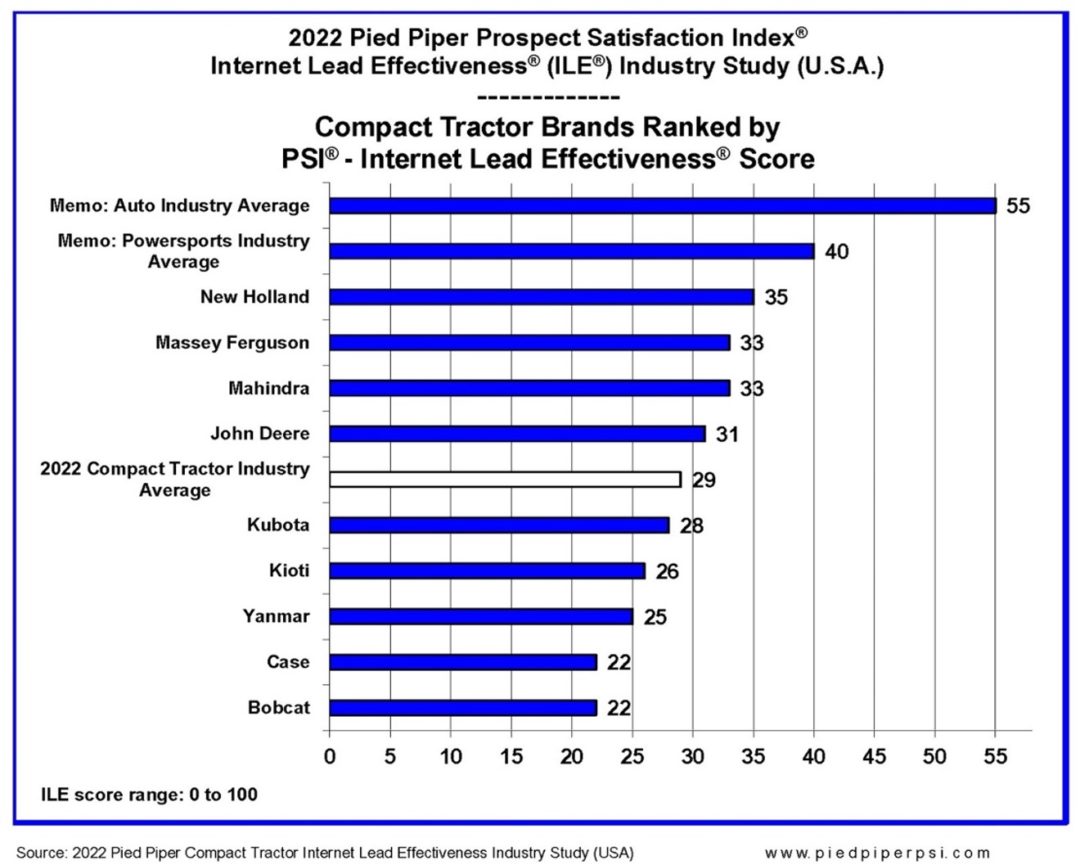

Monterey, Calif. — Dealers selling CNH’s New Holland compact tractors ranked highest in responsiveness to Internet leads from dealership websites, according to the 2022 Pied Piper PSI Internet Lead Effectiveness (ILE) survey released today. AGCO’s Massey Ferguson brand and Mahindra were tied for second, followed by John Deere and Kubota.

However, even among the top brands, the overall responsiveness of the compact tractor industry to customer queries to dealer websites is poor – especially when compared to the automotive and powersports industries.

To create the 2022 Compact Tractor ILE study, Pied Piper submitted customer inquiries through the individual websites of 760 dealerships between July 2021 and December 2021, asking a question about a tractor listed in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone and text message over the next 24 hours.

Twenty different measurements generate dealership ILE scores, on a scale of 100. However, only 6% of compact tractor dealerships nationwide scored above 70 (providing a quick and thorough personal response), while 59% of dealerships scored below 30 (failing to personally respond in any way to their website customers).

In comparison to ag dealers, auto and powersports dealers today are much more likely to quickly respond to website customers. In fact, the powersports industry average is better than the score for compact tractor study leader CNH New Holland, while even the worst-scoring automotive brand outperformed New Holland.

However, the performance of auto dealers ten years ago, and powersports dealers four years ago, was similar to that of the ag dealers today. For example, in 2018, about two-thirds of the 1,200 U.S. dealers that sell the Polaris powersports brand also failed to respond to website customer inquiries. With a focus on improvement by Polaris and their dealers, their website customer response rate today has doubled compared to 2018.

“When you see dealers improve their responsiveness to Internet queries, their sales numbers respond accordingly,” said Fran O’Hagan, CEO of Pied Piper. “Dealers who quickly respond to website customer inquiries on average sell 50% more units to the same quantity of website visitors compared to dealers who fail to respond. Those retailers are leaving money on the table – both in terms of sales but also in the lucrative after-sales service that follows.”

Compact tractor dealers are also much less likely than auto or powersports dealers to phone or text their website customers, often relying on merely sending an email. The ag dealers phoned their website customers only 13% of the time on average, compared to 36% of the time for powersports dealers, and 66% of the time for auto dealers.

Ag dealers were even less likely to use text messages to communicate with their website customers – only 4% of the time on average, compared to 20% of the time for powersports dealers and 52% of the time for auto dealers.

Best-practice analysis of website responses suggest that either dealer emails or dealer phone calls will fail to reach about one-third of the customers they do attempt to reach. Customers tend to screen their phone calls and ignore voicemails, while emails often get routed to spam folders. In contrast, by sending an email and following-up with a phone call, dealers will reach more than 95% of website customers.

Response to customer web inquiries varied by brand and dealership, and the following are examples of performance variation by brand:

- New Holland, John Deere and Massey Ferguson dealers on average sent an email or text that answered the customer’s question within one hour 20% of the time or more. Kioti, and Case dealers on average emailed or texted an answer within one hour less than 10% of the time.

- Massey Ferguson dealers on average phoned website customers within one hour more than 10% of the time, while Yanmar, Kioti and John Deere dealers on average responded with a phone call within one hour less than 1% of the time.

- John Deere and Mahindra dealers on average sent a text message at least 5% of the time, while Yanmar, Kioti, Case and Bobcat dealers on average texted less than 1% of the time.

“Customers today begin their shopping online regardless of product, and it’s simple to measure how quick response to website customer inquiries directly drives sales,” O’Hagan said.

Most dealers today accept that website customers are critical to sales success, but website customers are also invisible and easy to ignore. Pied Piper has found that the key to drive improvement in website response and sales is to show dealers what their website customers are really experiencing – which is often a surprise.

PSI Internet Lead Effectiveness (ILE) Industry Studies have been conducted annually since 2011. The 2022 Pied Piper PSI-ILE Compact Tractor Industry Study (U.S.A.) was conducted between July 2021 and December 2021 by submitting customer inquiries to dealership websites from a sample of 760 dealerships nationwide representing all major brands.

Examples of other recent Pied Piper PSI studies are the 2021 PSI-ILE U.S. Auto Industry Study (Nissan’s Infiniti brand was ranked first), and the 2021 “Omnichannel PSI for UTVs” U.S. Industry Study (Polaris was ranked first for omnichannel selling).

Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations — in-person, website or telephone—as tools to measure and improve the sales effectiveness of their dealerships. For more information about the fact-based Prospect Satisfaction Index (PSI) process, go to www.piedpiperpsi.com.

Post a comment

Report Abusive Comment