Dealers across all of the major tractor manufacturers are expecting total revenue and aftermarket revenues to be very positive this year. Again, the rural equipment market is strengthened by economic factors, such as a good housing market and low unemployment, and market factors, such as increasing consumer demand, especially for zero-turn mowers and utility vehicles.

Here are highlights from the 2018 Rural Lifestyle Dealer Dealer Business Trends & Outlook survey regarding how the manufacturers compare in terms of total revenue and aftermarket forecast, brand recognition and customer relationships.

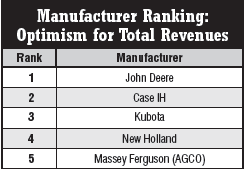

Total Revenues: Deere Dealers Most Optimistic

John Deere dealers are most optimistic about total revenues in 2018, slightly edging out Case IH dealers. All of the responding Deere and Case dealers say 2018 will be as good as or better than 2017. However, about 25% of Deere dealers also expect revenue growth of 2-8% compared with 10% of Case dealers expected similar growth.

Kubota dealers rank next with 97% saying 2018 will be as good as or better than 2017 and more than 9% expect increases of 8% or more.

New Holland dealers rank fourth, with 95% expecting this year to be as good as or better than last year and nearly 6% expect increases of 8% or more.

Massey Ferguson (AGCO) dealers rank fifth, but still indicate strong optimism. Nearly 93% of Massey Ferguson (AGCO) dealers say 2018 will be as good as or better than 2017 in terms of total revenues and close to 11% expect increases of 8% or more.

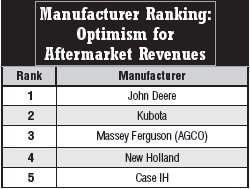

Aftermarket Revenues: Deere Dealers Also Most Optimistic

Deere ranks first among the five manufacturers in terms of aftermarket revenue forecasts. All of the responding Deere dealers say aftermarket revenues will be good as or better than 2017 and about 17% expect increases of 8% or more.

Kubota ranks second with about 94% saying aftermarket revenues will be as good as or better than 2017 and about 16% expecting increases of 8% or more.

Massey Ferguson (AGCO) ranks third. Slightly more than 93% of Massey dealers expect aftermarket revenues to be as good as or better than 2017 and 11% expect increases of 8% or more.

New Holland ranks fourth, with more than 92% of the dealers saying aftermarket revenues will be as good as or better than 2017. About 72% expect increases of 2-7%, with none of the dealers expecting increases above that level.

Case IH ranks fifth in terms of optimism about aftermarket revenues. Ninety percent of the responding Case dealers say aftermarket revenues will be as good as or better than 2017 and 20% expect increases of 8% or more.

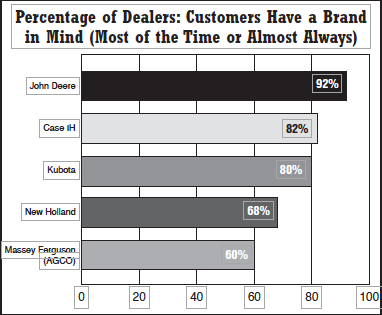

Brand Recognition & Dealership Expertise

The survey asked dealers to weigh in on brand recognition by answer-ing this question: “How often do your rural lifestyle customers arrive at your dealership with a brand in mind?” Here’s how the manufacturers stacked up in terms of the percentage of dealers answering “most of the time” or “almost always:”

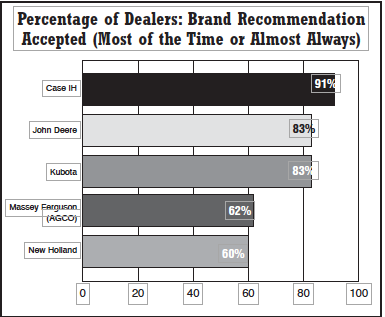

The survey also looked at how dealers are following up by adding their expertise. Dealers were asked to respond to this question: When asked this question, “When you recommend a specific product brand to a customer, how often is your recommendation accepted?” Here is how the manufacturers ranked in terms of the percent-age of dealers answering “most of the time” or “almost always:”

Post a comment

Report Abusive Comment