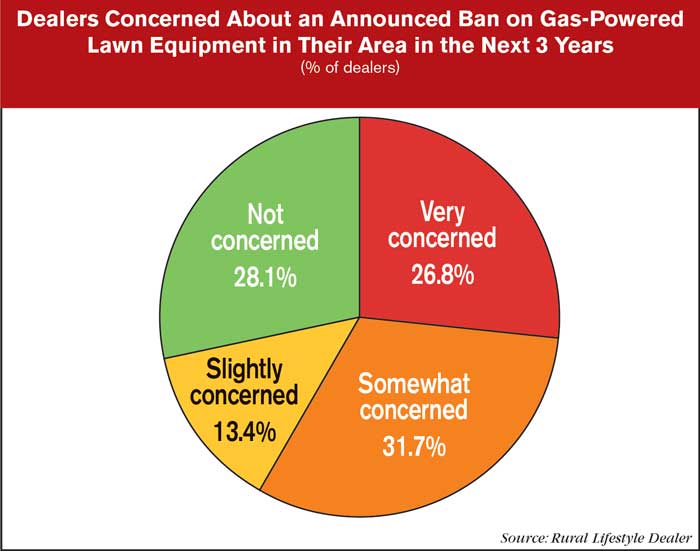

According to a recent poll from Rural Lifestyle Dealer, 71.9% of dealers are concerned to some degree about being impacted by bans on gas-powered lawn equipment over the next 3 years.

Some 26.8% of dealers said they were very concerned about the potential for a ban on gas-powered lawn equipment to be announced in their area over the next 3 years. Another 28.1% said they were not concerned at all.

The most popular category for dealers to choose was "somewhat concerned" at 31.7%.

The catalyst for the poll came from a Nov. 28 report from The Dallas Morning News, which reported officials in Dallas, Texas, are planning to phase out the use of gasoline-powered lawnmowers, leaf blowers and landscaping equipment by 2027 or 2030 within the city. "The city in August estimated it would cost $6.5 million to fully convert more than 5,400 pieces of gas-powered municipal equipment, and the cost for residents and business owners to switch was estimated to be $23 million," the report stated.

“Instead of a ban, the city could limit its proposal to a reasonable rebate fund that would make battery-powered equipment more cost competitive and allow companies to purchase commercial-grade equipment as it became technologically feasible,” Ryan Skrobarczyk, the Texas Nursery and Landscape Assn.’s director of legislative and regulatory affairs, told The Dallas Morning News.

How Bans Impact Dealers

According to a custom research report from Ag Equipment Intelligence, "Electric Farm Machinery: Outlook Through 2027," restrictions and bans surrounding gas-powered equipment are already driving equipment purchases in areas where they've taken effect.

Martha Hennigan, director of sales operations and marketing at Solectrac in Windsor, Calif., told Ag Equipment Intelligence that California law requiring non-emissions for handhelds and operating equipment up to the zero-turn mower range “already has landscapers stockpiling like crazy.

“Some of the demand was already there because of noise ordinances,” she said, noting that the vast majority of buyers already accepted the handheld equipment.

In March 2022, Ag Equipment Intelligence asked California dealers how many “advance sales” (sales coming faster than normal buying behaviors) they expected to see in their AOR in the next 2 years as landscape contractors, municipalities and residential buyers try to beat the large expenses of new equipment that complies with the new regulations.

About 22% of dealers who responded to the survey predict a 71% increase or more in zero-turn sales, another 22% estimate a 50-70% change, about 44% predict less than 50% change, and the remaining 11% anticipate little to no change.

Post a comment

Report Abusive Comment