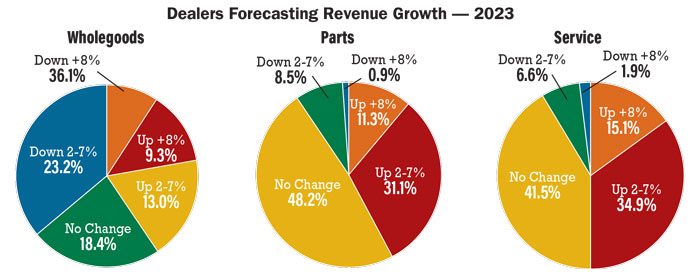

According to the results of Rural Lifestyle Dealer’s annual dealer survey, the crack in rural lifestyle dealer optimism that emerged last year has widened a bit more. Just 27% of dealers anticipate wholegoods sales growth in 2023, compared to 33% and 56% in each of the 2 previous years. At the same time, 58% of dealers are anticipating a down year in 2023, compared to just 32% a year ago.

Most of the anticipated losses are expected to be in the wholegoods area. Roughly 59% of dealers are anticipating negative growth in wholegoods sales while just 22% expect growth. A myriad of factors are contributing to this weaker forecast, from equipment shortages and increased prices to the impact of rising interest rates on consumers.

One dealer said, “We are cautioning our sales team to not over order because things are slowing down. We are reminding our team that the past couple of years have been historic, not realistic.”

To some dealers, 2023 will be “business as usual,” as one dealer put it. “Then it’s up to the manufacturers to step up and deliver,” the dealer added.

For other dealers, 2023 will be business as usual, albeit with a few minor tweaks. “We are pedal to the floor on ordering products with a 12-month or longer floorplan,” one dealer said.

“We are cautiously optimistic,” another dealer said. “Preselling is our new normal. Our customers need to plan ahead, as opposed to impulse buying.”

Another dealer said they are carefully watching for any signals that the current supply shortage may begin turning into a supply flood. “We are ready at a moment’s notice to begin cancelling orders above a level we feel comfortable with,” the dealer said.

Dealer Takeaways

- 59% expect a decrease in overall sales, 22% expect an increase

- 42% expect an increase in parts sales

- 50% expect an increase in service business

- 68% charge more than $100/hour for service

- 68% plan increased investment in the service department

- 90% said rural lifestyle customers typically accept their product recommendation

While there appears to be varying degrees of caution on the wholegoods side, parts and service is another story. Like during most economic downturns, dealers are anticipating parts and service business to remain strong in 2023. Inflation, high interest rates and weakened GDP don’t stop grass from growing, trees from dying, animals from eating or other chores from needing to get done. If rural lifestylers and landscapers aren’t buying new equipment, they’re spending more money on fixing the equipment they already have.

Stepping Up with Service

Roughly 50% of dealers are anticipating an increase in service business in 2023. Roughly 42% expect to grow parts business. Less than 10% expect to see a decrease in either area.

To capitalize on the emerging opportunity to service more equipment, more dealers are employing more technicians than in the past. Just over half (51%) of dealers employ 6 or more technicians, up from 43% just one year ago. Roughly 23% employ 10 or more technicians.

But the challenge for most dealers is simply finding enough technicians to hire. Roughly 70% of dealers said the technician shortage is their most concerning issue heading into 2023. To tackle that issue head on, dealers are using some different tactics.

“We are trying to reach out more to technical schools and high schools to create a better pipeline,” one dealer said. “We are also trying to create a better tech training program within our dealership to better retain who we have.”

Another dealer is looking to adjacent industries for potential talent. “We are working hard to recruit people with a mechanical aptitude and then train them,” the dealer said.

Some dealers are focused on making their dealership a more desirable place of employment where good technicians will want to work. “We are increasing our labor rates so we can increase wages,” one dealer said. “We’re also promoting our awesome culture and schedule flexibility. We’ve minimized the number of required Saturdays to 1 per month. We’ve also increased the paid time off amount at the time of hiring.”

Several dealers said the battle for qualified technicians comes down to one thing: better pay. One dealer increased their starting wage by 20% to make the dealership more competitive in the broader job market. Another dealer is increasing base pay while reducing commissions. That should resonate with technicians who are looking for more financial predictability these days.

As dealers look to increase technician wages, they’re also recognizing that labor rates should increase simultaneously. There has been a big jump in the number of dealers charging more than $100 per hour over the past year, climbing from 48% to 68%. Furthermore, 29% of dealers are charging more than $125 per hour. Just 2% of dealers remain under $75 an hour.

In addition to adjusting wages and labor rates, dealers are looking to make investments in service department efficiency. In fact, 68% of dealers said they are planning to increase investment in service department improvements this year. At the same time, 57% are looking to spend more money on retail improvements while 35% want to invest in business information system (BIS) technology.

The Right Pitch for the Right Mix

Rural lifestyle dealers continue to serve a range of customers. Nearly all surveyed dealers (96%) serve hobby farmers and large-property owners. Roughly 86% serve municipalities, parks and landscape contractors. Production farmers are a core customer segment for 69% of dealers, and construction contractors are served by 63%.

Two customer segments that continue to grow are rural lifestylers and landscape contractors. Roughly 78% of dealers said they’ve added customers in these segments since 2017. Furthermore, roughly 60% said at least a quarter of their business comes from these two customer segments.

Depending on which dealership they visit, rural lifestylers and landscape contractors typically have options when looking to buy equipment. Roughly 37% of dealers carry at least 6 brands, but 62% only carry up to 5. However, it’s not so much how many brands a dealership carries, but which brands they carry. Nearly two-thirds of dealers said customers typically walk into a dealership with a specific brand name in mind. Another 35% said that happens some of the time.

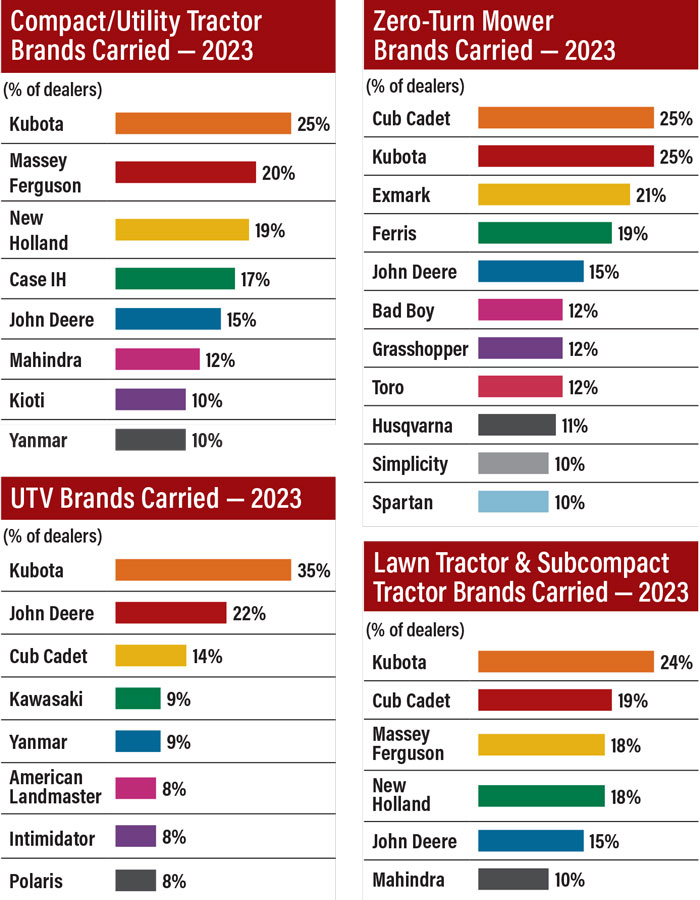

NOTE: Percentages on charts will not equall 100%, as dealers could choose more than one brand.

Source: Rural Lifestyle Dealer 2023 Business Outlook & Trends survey

Even though today’s consumers are armed with more product information than ever before, they still value a dealer’s expertise. Roughly 72% of dealers said rural lifestyle customers accept their brand recommendation most of the time, and 18% said their recommendation is almost always accepted. Another 11% of dealers said customers follow their advice at least some of the time.

To make the most of these one-on-one sales opportunities, 82% of dealers said they employ a sales professional who is focused on selling equipment to the rural lifestyle customer segment. That kind of personal attention can go a long way, especially when 5-star customer service is backed up by a well-rounded staff that makes the entire sales-and-service experience more favorable. Most dealers (63%) employ up to 20 people per store. Just 9% employ more than 40.

Most Common Brands

The most carried compact/utility tractor brand among surveyed dealers was Kubota at 25%. For zero-turn mowers it was Cub Cadet at 25%, the most-carried UTV brand was Kubota at 35% and for lawn/subcompact tractors, the top carried brand was also Kubota at 24%.

Equipment Most Poised for Growth

Over the past couple of years, many dealers say they could have sold even more equipment if they could have gotten their hands on it. Perhaps that is why the number of dealers turning inventory more than 4 times per year was sliced in half over the past 12 months. Roughly 14% of dealers said they turned inventory more than 4 times last year, down from 29% the year prior. Most dealers (57%) made 3 or 4 turns, and another 29% made 1 or 2.

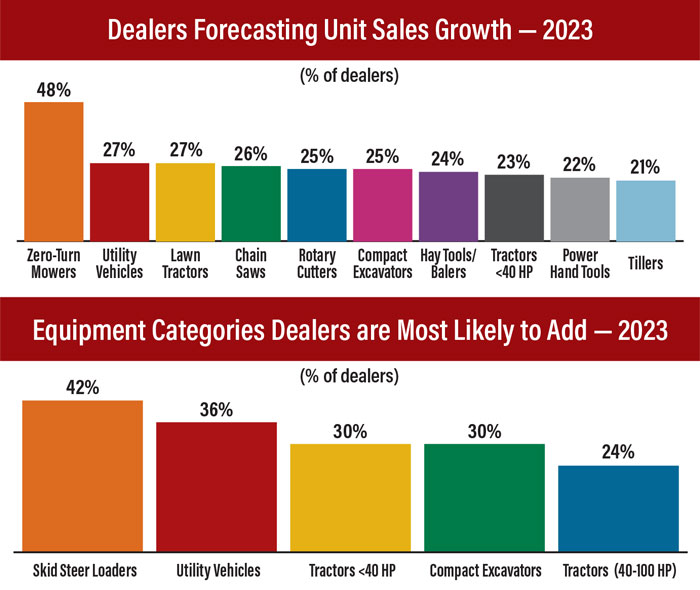

How quickly inventory turns in 2023 will be impacted by several factors, including which equipment categories a dealer stocks up in. The most popular category was zero-turn mowers, where 48% of dealers forecast unit sales growth for 2023.

One expanding product category is battery-powered equipment. Some dealers are hoping for battery power to come to even larger machines like tractors and rugged terrain vehicles. Others aren’t nearly as enthusiastic.

One dealer thinks that within the next 5 years, 30% of new residential mowers will be powered by battery. But another doesn’t see market share growing beyond 10%, although handheld equipment will garner 95% of the market. Another dealer said it is inevitable that battery-powered equipment will continue to capture market share as battery technology becomes more reliable and affordable.

One dealer said any significant growth in battery power will come down to consumers’ choices or lack thereof.

“Battery equipment will grow quite a bit, but not necessarily because it is what consumers want,” the dealer said. “It will grow because that is what consumers will have available to purchase. I’m not sure if that will be due to the government trying to influence purchasing, or manufacturers shifting more production capacity to battery products.”

That same dealer is worried their typical customer will not take a liking to battery-powered equipment. There is also concern over the “throwaway” nature of some battery-powered equipment, which can be a drag on a dealer’s aftermarket business.

Critical Issues Change with the Times

Financing continues to be an important sales tool for dealers, particularly when it comes to the rural lifestyle customer segment. Most dealers (77%) said customers request financing on at least half of purchases. That’s up 10 percentage points from a year ago. Furthermore, 34% of dealers said financing is requested on at least three-quarters of purchases nowadays. Not a single dealer said financing is never requested by rural lifestyle customers.

Considering the pivotal role financing plays, one must consider the impact high interest rates could have on sales in 2023. That is probably why interest rates tied with technician availability as the issue of most concern to dealers. Those two issues were followed closely by the cost of equipment and equipment shortages — 2 more factors in a dealer’s ability to sell equipment.

Over the course of 2023, most dealers (68%) do not plan on adding equipment lines. For those dealers who are considering it, the most common to add is skid steer loaders at 42%.

Over the next 12 months, most rural lifestyle equipment dealers plan to pivot to parts and service. Most still plan to move iron, just not at the historic pace they did over the past couple of years.

One dealer put his forecast for 2023 into perspective. “Since we are coming off a couple of fantastic record years, we will probably lower our inventory levels a little,” the dealer said. “And keep in mind, when I project lower sales in 2023, it will be lower than 2020-2022, but perhaps still better than 2017-2019.”

Another dealer said: “With the (past) drastic increase in sales, it’s good to see a slowdown so inventory levels can start returning to normal.”

If we are indeed headed into a downturn, it’s a good thing dealers are in a strong position. The survey found 94% of dealers were profitable in 2022. Given that, returning to normal could be just what is needed for the long run.

Post a comment

Report Abusive Comment