California-based electric tractor manufacturer Solectrac announced March 27 plans to prioritize “direct-to-consumer sales and partnering with select dealers in key markets.” The company said it was refocusing efforts previously placed on expanding its dealer network.

“This move … aims to leverage government EV subsidy programs and cooperative purchasing agreements that incentivize electrification as part of the larger DTC strategy,” the company said.

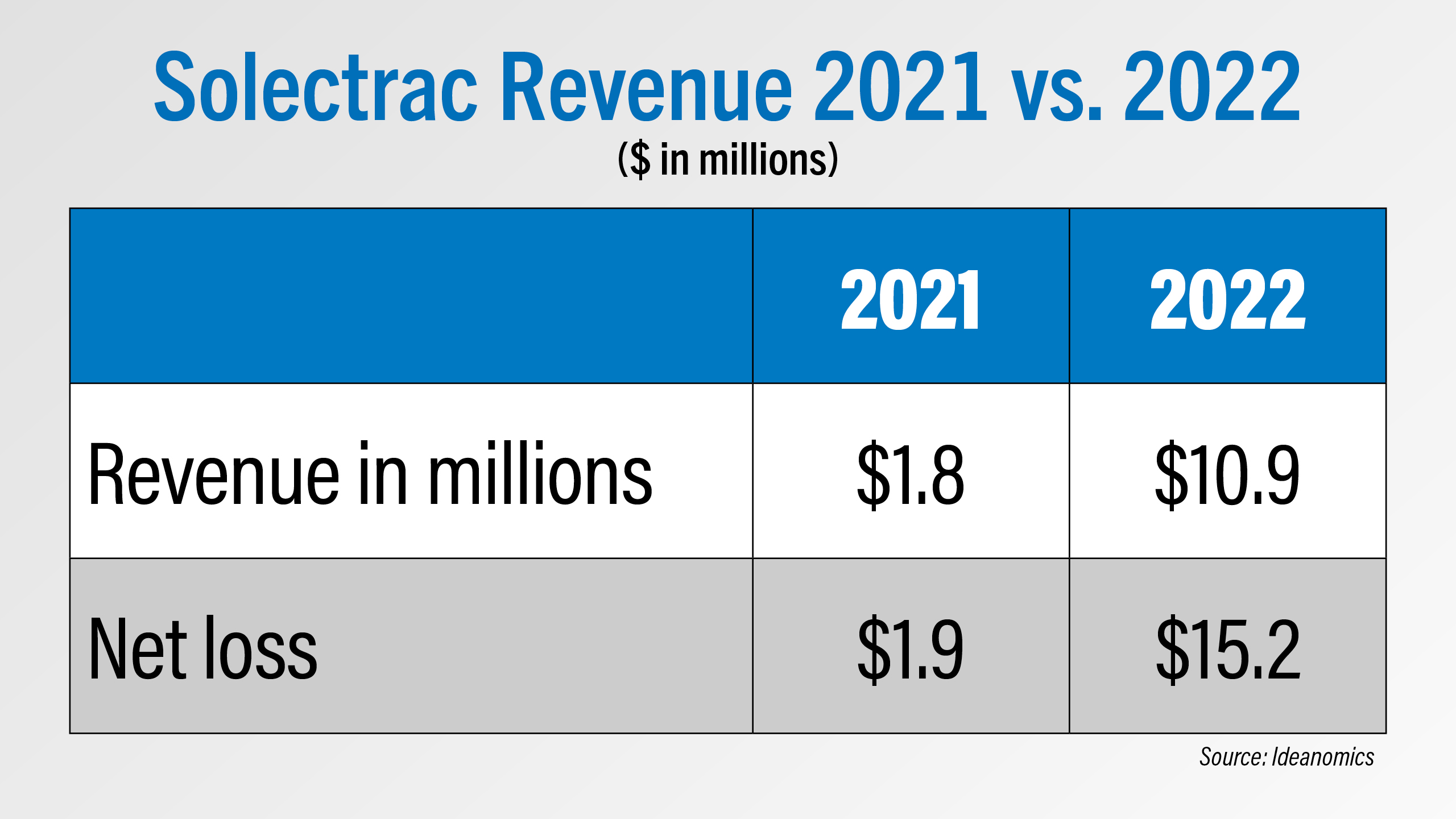

This follows reports last November of Solectrac being divested by its parent company Ideanomics and searching for a new investor. Ideanomics reported total revenue for Solectrac in 2022 was almost $11 million, up from $1.8 million in 2021. However, net loss for 2022 was $15.2 million, also up from a net loss of $1.9 million in 2021.

In November 2023, then Solectrac Vice President of Sales and Marketing John Grooms told Rural Lifestyle Dealer the company had over 100 stores in its dealer network and was looking to add more.

A former Solectrac dealer Rural Lifestyle Dealer spoke with said they’d been a dealer for several years but never sold any of its units.

“I spoke to a few Solectrac dealers before we took on the brand,” the dealer said. “The ones that I'd spoken to had not sold any units either. When things started going a little sideways, we started reaching the calendar date where we were going to have to make a decision: do we cut bait or continue with Solectrac? There were other dealers who were considering the cut bait approach, just because they didn't have the sales either. We saw this [direct-to-consumer approach] coming.”

The high price point of the tractors, coupled with an initial lack of marketing problems, was part of the problem, the dealer said.

“When the product first came out, they were very expensive, there were not many marketing programs, and they were trying to sell on the green initiative,” the dealer said. “When units weren't selling, they started throwing a lot of marketing programs at the units. I think by that time, the green initiative bubble had popped a little bit.

“Even with those large marketing incentives and settlement discounts, they still weren't gaining any traction. And so the only way they're going to f get rid of the units they produced somewhat economically is going to be a manufacturer-direct approach because there is going to be no margin left in there for a dealer.”

This former dealer said they were confused by where Solectrac wanted to go as a company, citing inconsistencies with marketing resources and advertising that made the go-to-market approach difficult to follow. Ultimately, the dealer said they don’t believe the subcompact tractor market is willing to pay more for an electric tractor vs. its diesel equivalent.

“I do think the electrification bubble has popped,” he said. “The model they have — the little 25 horsepower equivalent — is a nice tractor but really about a 75 horsepower tractor is what people look at. It'll move around a bale of hay, it'll pull a 15 foot cutter, it'll do some work. But the subcompact market is a different market, and I just don't know if that market will pay extra for an electric vehicle or even purchase an electric vehicle.”

He said they’ve become more conservative in their outlook on electric tractors in the market but believe there’s still niche applications where they fit.

“Solectrac were the first ones to have an electric tractor running,” the dealer said. “The product wasn't exactly what I wanted, but the main reason I took on the contract was to see if customers accepted it, and if they did, the majors are going to come out with their own. If I saw a path forward with these small ones, then when the majors come out, I’d know to jump in. It hasn't dissuaded my opinion of them going forward, but it's definitely made me be a little bit more conservative.”

However, this dealer also says Solectrac does have a place with starting buyers and select fleets and ultimately believes the company is taking the right approach in pursuing the market directly until a more viable one is established.

A potential consequence of the difficulties Solectrac has experienced, the dealer said, could be that the majors become more hesitant in their own electric offerings.

“Right now, the price point on the majors’ electric units is so high that the only customer that could consider buying is a government entity that's getting huge subsidies,” he said. “It's not a unit a consumer could purchase when the equivalent diesel option is — in some cases on these larger ones — 200% cheaper. That’s a non-starter to try and talk somebody into an electric vehicle. I think there’s applications, but I do think this is going to set a lot of the manufacturers back, and they’re going to go, ‘Well, people said they wanted electric, but I guess they don’t.’

Rural Lifestyle Dealer reached out to Solectrac for commentary and will update this story with any statement it receives.

Post a comment

Report Abusive Comment