Economic indicators point to 2014 starting on a positive note and rural lifestyle equipment dealers are reflecting that good feeling, according to Rural Lifestyle Dealer’s 2014 Dealer Business Trends & Outlook survey. This is in spite of unresolved and perennial concerns, such as implementation of the Affordable Care Act and the unemployment rate.

One Wisconsin dealer put it this way: “We’ve had good growth the last 2 years. If you don’t turn on the TV, the ‘doom and gloom’ is not there. We do what we have to do every day, no matter what the economy does.”

Industry Stats are Positive

People with properties to care for and money to spend are key drivers for rural equipment sales. Compared with the past few years, recent house building and unemployment rates are positive. For instance, the National Assn. of Home Builders/Wells Fargo Housing Market Index shows that for much of the last half of 2013, more builders viewed market conditions as good than poor. The industry is not without its challenges, however.

“Policy and economic uncertainty are undermining consumer confidence,” says David Crowe, National Assn. of Home Builder’s chief economist. “The fact that builder confidence remains above 50 is an encouraging sign, considering the unresolved debt and federal budget issues cause builders and consumers to remain on the sideline.”

The unemployment rate has been on a slightly downward trend. Last year started with unemployment at 7.9% and it was down to 6.7% in December. Experts say the unemployment rate for a healthy economy should range from 5-6%.

And, in its fourth quarter earnings statement, John Deere says it expects turf and utility equipment to be up about 5% in 2014 for the U.S. and Canada.

Revenue Forecast Trending Up

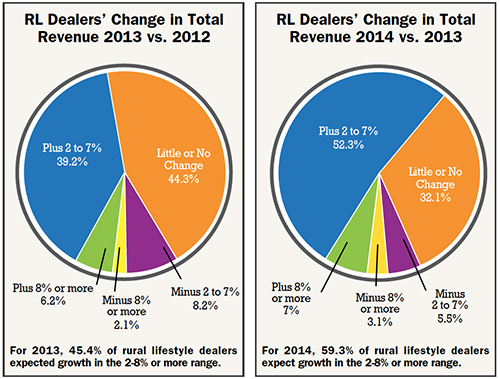

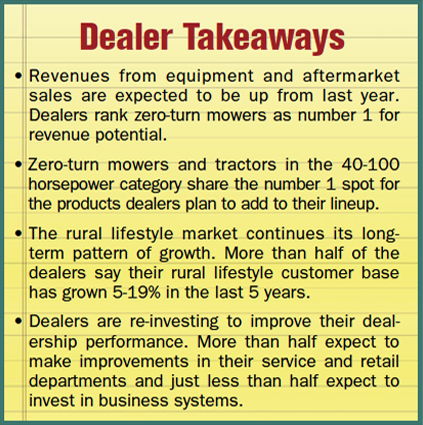

Dealers may be influenced by these economic or industry stats — or they may just be seeing growth in their local markets. When asked what change they expect from rural lifestyle and landscape customers in 2014 vs. 2013, 91.4% of dealers expect revenues to be as good as or better than last year. That compares with 89.7% having the same sentiment for 2013.

The biggest change occurred in the segment of dealers who expected growth in the 2-7% range — 52.3% for this year compared with 39.2% for last year. The percentage of dealers who expect 2014 revenue to be worse is lower than those who were pessimistic about growth last year. Slightly more than 8% of dealers expect revenue declines of 2-8% or more in 2014, compared with 10.3% of dealers predicting similar declines for last year.

On a weighted average basis, where forecasted increasing levels of business are compared directly with forecasted decreasing levels of business, and the “about the same” or “flat” responses are not considered, the outlook for 2014 came in at 2.42%, better than the 1.72% for 2013.

Dealers are also optimistic about growth in aftermarket sales. When asked about how much they expect aftermarket revenues from rural lifestyle customers to change, 93.7% of dealers expect revenues to be as good as or better than last year. That’s up slightly from the 2013 survey when 92.5% of dealers expected revenues to be as good as or better than 2012. (See chart on page 12.)

Those who are very optimistic — expecting aftermarket revenues to increase by 8% or more — increased to 12.6% from 8.5% in the 2013 survey. Also, a lower percentage of dealers are expecting declining aftermarket revenues of 2-8% for 2014, 6.3% compared with 7.5% in the 2013 survey. The weighted average scale, looking at straight gains vs. losses, also bears out this positive tone, 2.79% for 2014 compared with 2.10% for 2013.

The bottom line: Revenue forecasts continue their upward trend. The gains might not be huge, but dealers are seeing incremental growth year to year.

What’s Driving Growth?

Manufacturers show off new products and trusted standbys at the Green Industry & Equipment Expo, held each October in Louisville, Ky., and zero-turn mowers continue to capture attention. Some say the market is saturated with zero turns, but a new manufacturer recently introduced its first model for the category. It’s the “give the people what they want” mentality: Rural lifestylers love to mow and zero turns are fun to use.

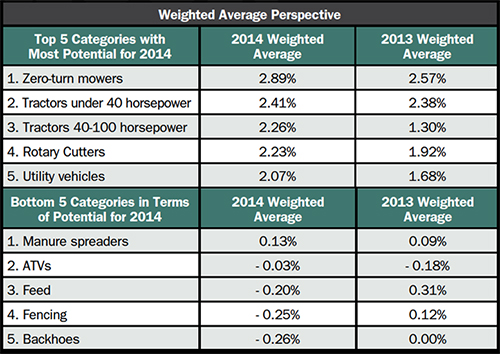

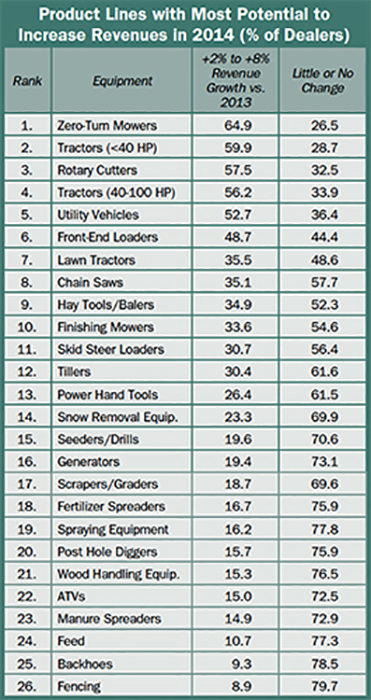

In 2014, dealers gave zero turns the top spot for the most growth. About 65% of dealers project 2-8% growth for 2014 vs. 2013 and 26.5% of dealers expect sales to remain the same. (See the table on page 19.)

Tractors under 40 horsepower, rotary cutters and tractors 40-100 horsepower ranked fairly close together in the second, third and fourth positions for the equipment with the most potential. About 60% of dealers expect tractors under 40 horsepower to have 2-8% or more revenue growth over 2013, with 28.7% expecting little or no change. About 58% of dealers expect rotary cutters to have 2-8% or more revenue growth over 2013, with 32.5% expecting little or no change. And about 56% of dealers expect tractors in the 40-100 horsepower range to have 2-8% or more revenue growth over 2013, with 33.9% expecting little to no change.

Utility vehicles rounded out the top 5 products with the most potential. About 53% of dealers expect a 2-8% increase in revenue over 2013, with 36.4% expecting little to no change.

These top 5 products for 2014 were the same as those projected for 2013, with some swapping of positions. Last year, tractors under 40 horsepower ranked first; zero-turn mowers, second; rotary cutters, third; utility vehicles, fourth; and tractors 40-100 horsepower, fifth.

The weighted average perspective shows the top 5 products in terms of potential are all more positive than last year. (See table on this page.)

The survey shows that 70-80% of dealers expect sales for the bottom 5 categories (ATVs, manure spreaders, feed, backhoes and fencing) to have little or no change. The weighted average shows that ATVs and manure spreaders have better potential in 2014, however. Feed, fencing and backhoes are expected to be down from last year.

Products Dealers will Add

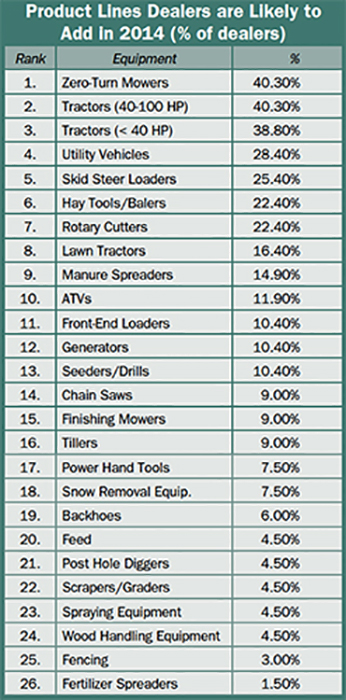

Dealers are acting on demand and adding to product lines that show the most potential for growth. Zero-turn mowers and tractors 40-100 horsepower share the top spot in the top 5 products dealers will add in 2014. (See table on page 21.)

Slightly more than 40% of dealers will add zero turns and tractors in the 40-100 horsepower category to their lineups. Tractors under 40 horsepower, utility vehicles and skid steer loaders ranked third, fourth and fifth. Nearly 39% of dealers will add tractors under 40 horsepower; 28.4% of dealers will add utility vehicles and 25.4% of dealers will add skid steer loaders.

The top 5 products for this year matched 2013, with some position switches. The top 5 list for products to add last year were: tractors under 40 horsepower; skid steer loaders; tractors 40-100 horsepower; utility vehicles; and zero-turn mowers.

It’s interesting that skid steers made the top 5 in products to add for 2014 as they ranked 11th in revenue potential. It could be related to the improved housing market and equipment needed for building. It’s a category to watch.

Also, ATVs and manure spreaders made the top 10 for equipment to add, even though they ranked at the bottom for revenue potential. This could be linked to dealers providing more options for working and playing on rural acreages as well as planning for future purchases.

Changes for Dealerships in 2014

Dealers are taking advantage of a good 2014 outlook by re-investing in their operations. More than 67% of dealers say they will modernize their shop or service departments this year. That’s up from last year, when 53.3% of dealers planned shop or service upgrades.

These service improvements may help dealers battle big box stores. For now, dealers have the edge in terms of true service expertise, with technicians ready to counsel rural lifestylers on maintenance and operation. This level of investment also supports dealers’ view on positive aftermarket revenues for 2014.

Dealers are also trying to replicate a big box retail experience, with more than half (54.8%) planning improvements to their retail areas. That’s also up from 2013, when 43.2% expected to upgrade their retail space.

For 2014, a slightly lower percentage of dealers are investing in business systems. For 2013, 52.7% of dealers planned to invest in business systems, compared with 45% of dealers expecting to do so for 2014. However, this is a category that dealers don’t necessarily invest in every year, so the numbers are still impressive regarding business investments.

What Dealers are Watching

Economic and industry pressures can test even the most successful owner and dealers are staying in tune with the issues.

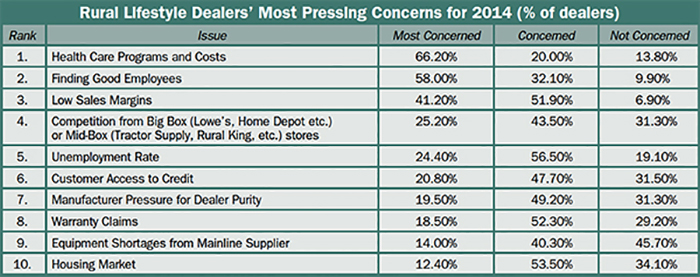

The most pressing concern in 2013 and again for 2014 is affordable health care programs. Whether you call it the Affordable Care Act or “Obamacare,” the federal mandate regarding a business’s obligation for employee healthcare coverage weighs on dealers’ minds. (See table on page 16.)

‘Slow, But Positive’ Leads the Way

The word on the street — rural Main Street — is for a slow growing, but positive economy, according to Ernie Goss, Ph.D., MacAllister Chair and professor of economics at Creighton Univ.

He’s been taking the pulse of the rural economy each month since 2005 by polling community bank presidents and chief executive officers from Colorado, Illinois, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming. Their feedback is reflected in an index that measures from 0-100. An index below 50 is negative growth; 50 is neutral; and above 50 is positive growth.

“The economy is moving forward in rural areas. The growth is not as strong as it has been since ag commodity prices are down from what they were,” Goss says. The December index rose to 56.1 from 54.2 in November. Last year began with a 55.6 index for January.

Goss says there are several positive signs.

“I think we’re going to see unemployment rates lower than what they were a year ago,” he says. “Housing prices are running at a good pace. Farmland prices are not nearly what they were, but land prices had been growing at an unsustainable pace.”

He says other economic factors could be better, such as inflation, which is about 1% for 12 months ended in October, and wage growth, which is about 2% annually.

“There’s not enough inflationary pressure to cause individuals to spend today to avoid higher prices tomorrow.”

Other major influences for the rural economy are:

• The status of the Farm Bill, specifically the uncertainty over federal support of crop insurance. (A partial extension was passed on January 1.)

• The EPA’s changing requirements for the Renewable Fuels Standard, which affects the corn market and other commodity markets.

• The Federal Reserve tapering off its “quantitative easing” bond buying program. This decision increases the value of the dollar.

• The costs to large businesses for implementing the Affordable Care Act.

Goss says interest rates are something dealers can use to their advantage right now. “With interest rates rising, it may be time to take advantage of long-term interest rates. Think about what financing you’ll need down the road and consider borrowing now, rather than waiting.”

Some parts of the Act have been resolved, such as improvements to the sign-up website. And others have been delayed, such as the postponement to January 1, 2015 for large businesses to comply with the act. It remains to be seen how dealerships will be affected by the expected increases to their portion of insurance costs. Could this remain a top concern for 2015?

Coping With Order Lag Times

Dealers mention frequently that order lag time, the delay between when they place an order for inventory and when they have it on the lot, is a big issue for them. In Rural Lifestyle Dealer’s 2014 Dealer Business Trends & Outlook survey, dealers shared their strategies for getting the inventory they need to make sales.

“We have many manufacturer options in our store for good reason. If one manufacturer doesn’t have enough inventory of a particular size tractor or mower, we go on to the next one. We only offer high-end brands, so any way we steer the customer is toward a good piece of equipment,” says a dealer in Kentucky.

Other dealers turn to their manufacturers for help. “We get our manufacturers involved with discounts or a rental machine,” says a dealer in Montana.

Many say their dealer network is their best way to get what they need. “We maintain good relationships with dealers that sell like brands. They provide a good source to draw out their inventory. We normally stock excess, so we have inventory on the shelf. We will sell off some to other dealers that aren’t as likely to stock up,” says a dealer in New York.

Another dealer in Virginia had a similar comment, “We have a strong network of other dealers that we have formed an alliance with. I refuse to bring in extra inventory and be loaded up or have slow inventory turns just because manufacturers are turning to just-in-time methods to control their costs, but lack concern for the dealer.”

Some say they offer discounts or even equipment on loan until the new equipment is available. Many say that dealers just have to be honest about the situation.

“This has not been a big issue, but when it does come up, we are up front with customers and explain exactly what we know about any delays. We have found customers are very understanding when they are informed up front about delays and accept them. If they are told after a sale that there are going to be delays, they tend to be upset about not being informed,” says a dealer in Wisconsin.

Another perennial concern is finding good employees, which ranks number 2. This is a concern for any business owner, but may be more so for dealers in rural areas. Some dealers have had success hiring from outside the industry, such as for sales positions. However, they can’t do the same in the service department.

Low sales margins ranked third this year, compared with second place last year. Second or third place is a matter of semantics — it continues to be a top concern for the industry. The investments in parts and service may help dealers cope, as that area brings in higher margins than equipment sales.

Tackling Time Consuming Tasks

Rural Lifestyle Dealer’s 2014 Dealer Business Trends & Outlook survey went beyond the forecast to learn about the challenges dealers face today and every day. We asked this question: What management task is the most time consuming and what ways have you found to be more efficient?

Inventory management was among the most time intensive. “We have a big problem getting the right parts,” says a dealer in West Virginia. A dealer in North Carolina says they’ve “added control procedures in all departments. Not just one person is responsible.”

A Montana dealer shared this solution: “Ordering whole goods … We started giving them a stock number at the point of order and then including that as a P.O. number.”

Another dealer in Ohio says the right timing builds efficiencies: “Following up on parts orders … I find it easier to do this first thing in the morning when the customer interruptions are slowest.”

Warranty paperwork was another hassle dealers listed, especially when compared to the process at big box stores where it’s handled in just a few steps at the check-out counter. No real solutions were offered, other than this from a Kentucky dealer: “I have to do them myself, because if they are filed wrong, they could be rejected or we could lose money.”

Accounting tasks were also mentioned. “Accounting and billing has become the most consuming task here at the dealership. To combat this issue, we have implemented worksheets for our mechanics to fill out for every job they do. They are required to ‘time clock-in and off’ to make it easier to do billing for customer repair work as well as monitor employee work performance,” says an Ohio dealer.

A dealer in Virginia shared their improvements regarding accounting tasks. “We hired a payroll company to do it for us. Insurance audits are still a pain. We’re doing financial statements several times a year. I will make one and the different companies will accept it or we will do our own financing plan and retail financing.”

Another dealer from New York mentioned hiring an outside company to help with promotions. “It has been very time-consuming to manage and to maximize our budget to the fullest and to handle all the co-op dollars from our vendors. We were able to hire an independent consultant and that has worked very well. I feel like I’m making the most of my advertising budget.”

Dealers also mentioned it takes time to manage other people’s time. Here’s a solution from a dealer in Indiana: “Call reporting/call scheduling is something I always strive to condense and make it more meaningful and less of a hassle and more of an asset to the sales staff. We’ve moved to a pipeline format where the salesmen categorize the customers, thus laying out his call schedule and report.”

And, these time-wasters are always hard to avoid: “Customer relations (just wanting to chew the fat!) and visits from manufacturers’ reps. That takes over 50% of my time with the majority of that time being non-productive,” says a dealer in Indiana.

The big “mover” this year is competition from big box stores. It’s the fourth most pressing concern for 2014, compared with ranking eighth last year. The growing numbers of home improvement box stores seems to have stabilized. Lowe’s opened 10 stores in 2013, about the same number for 2012. In a recent interview, Home Depot’s chief executive officer said, “We’ve pretty much built all the Home Depots we need to build.”

However, there are plenty of other big box competitors. Tractor Supply Co., for instance, added 94 stores from September 2012 to September 2013 and continued its westward expansion. Cabela’s is also proving to be a competitor on the equipment front with its new wildlife and land management product line. Last August, Woods Equipment Co. announced a partnership to supply attachments for the line and Cabela’s began selling tractors online and in six test markets. The company plans to add 16 new stores over the next 2 years to its current count of 44 stores.

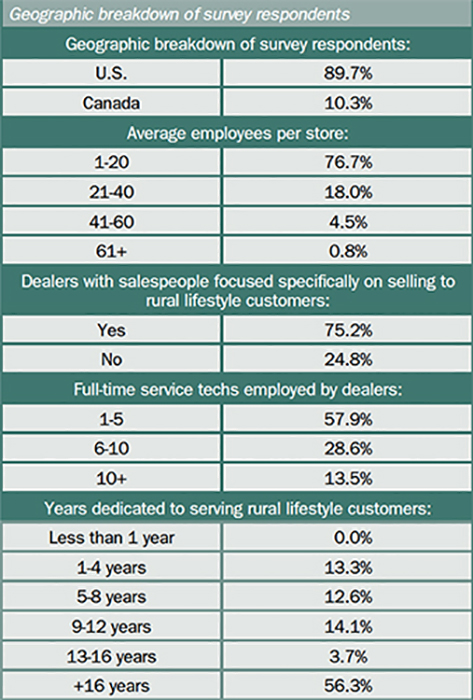

Facts & Figures About 2014 Survey Respondents

The following information was provided by the dealers participating in Rural Lifestyle Dealer’s 2014 Dealer Business Trends & Outlook survey. It is compiled to provide our readers and other interested parties basic demographic data on the equipment dealer universe serving the hobby farm, large property owner and lawn and landscape segment. (Percentages=Dealer Responses)

Rounding out the top 5 most pressing concerns is the unemployment rate, which ranked number 4 last year. The unemployment rate for 2013 was slightly down from 2012. However, this concern may always rank high.

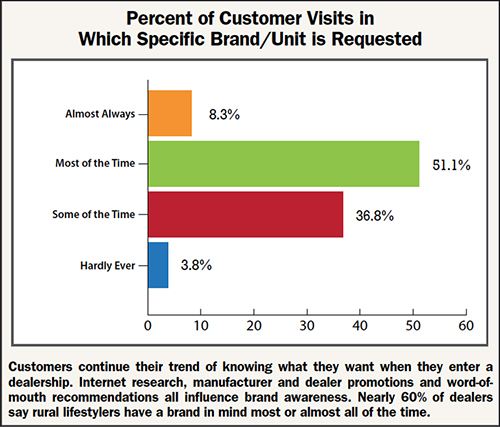

Dealer Continues Consultant Role

When they’re ready to buy, a majority of consumers have a specific brand in mind. Rural lifestylers are often influenced by Internet research, manufacturer or dealership promotions and word-of-mouth recommendations. More than half (51.1%) of dealers say rural lifestyle customers arrive at the dealership with a specific brand or unit in mind most of the time. About 8% of dealers say customers have a specific brand or unit in mind almost always. That’s up just slightly from the 2013 survey, when 43.8% of dealers said “some of the time” and 6.3% of dealers said “all of the time” regarding branding preference. (See chart on page 14.)

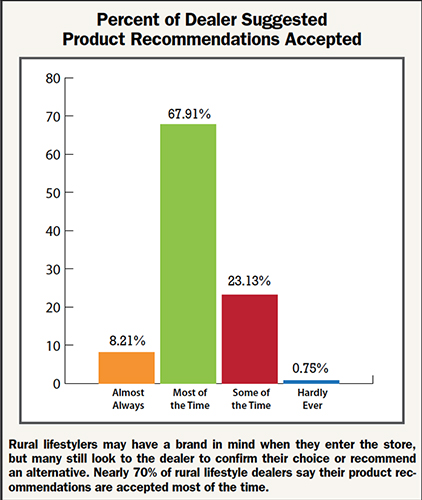

The good news is that dealers may have a head start in closing the sale. The clincher is building trust and dealers indicate customers are seeking their expertise. Nearly 70% of dealers say customers accept their recommendation for a specific product or brand most of the time and 8.2% say almost always. That “most of the time” percentage is also up from the 2013 survey figure of 58.3%, but the “almost always” is down slightly from 12.5%. (See chart on page 16.)

Generally, the trend continues upward regarding branding and dealer influence.

Opportunities Ahead

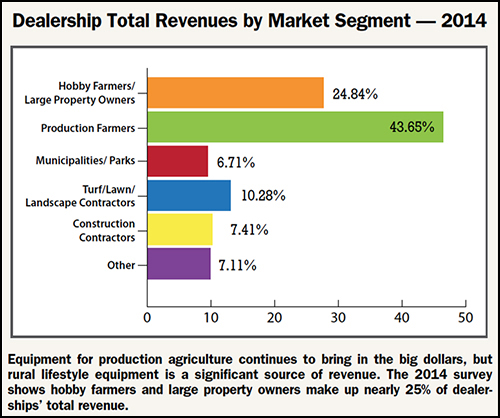

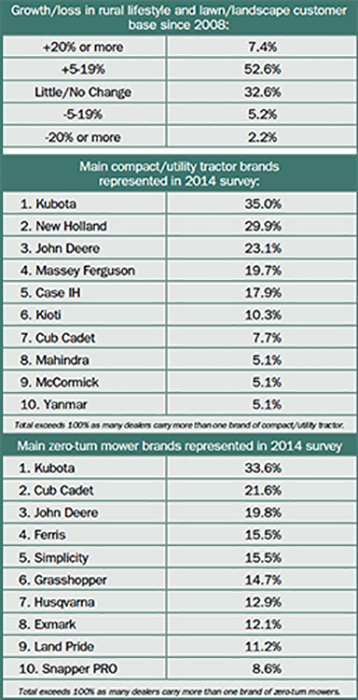

Finally, rural lifestyle dealers indicate there are good opportunities ahead in terms of sheer numbers of customers who need rural lifestyle or property maintenance equipment. More than half of the dealers surveyed say the rural lifestyle market has grown 5-19% over the last 5 years. More than 7% say the 5-year growth has been in the 20% range. Think about it: For some dealerships, one out of every five customers is a rural lifestyler.

That growth is stronger than was projected for 2013. The total for 2014 of 60% of dealers expecting growth of 5-20% or more compares with 56.3% of dealers expecting similar growth last year.

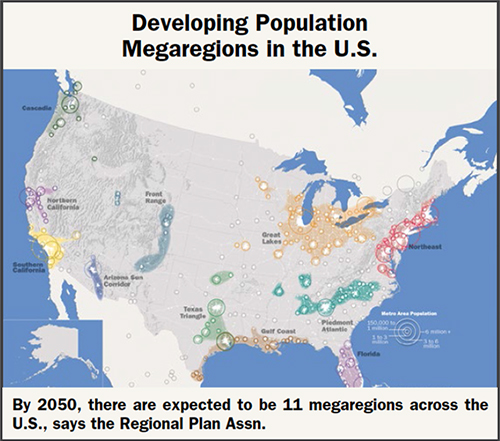

Long term, dealers may want to watch a land development trend called megaregions. By 2050, there are expected to be 11 megaregions across the U.S., says the Regional Plan Assn. The Great Lakes megaregion, for example, will include the cities of Chicago, Cleveland, Detroit, Indianapolis, Minneapolis, Milwaukee, Pittsburgh and St. Louis. This megaregion is expected to experience a 28.3% growth in population by 2050. The Texas Triangle is another megaregion and includes the cities of Austin, Dallas/Fort Worth, Houston and San Antonio. About 70% of the Texas population is expected to live in this region by 2050. (See chart, “Developing Population Megaregions in the U.S.,” below.)

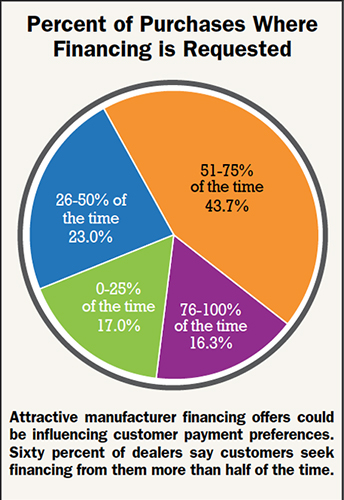

What to Leverage Now

Manufacturers are continuing their rapid pace of introducing new models. It may give dealers administrative hassles, but it does give customers more reasons to buy new or upgrade. And, they’re turning to dealers to help them finance their purchases. The numbers are slightly up from 2013 regarding the percentage of purchases where customers seek financing. In this year’s survey, 60% of dealers say customers request financing more than half of the time. That’s an increase from the 2013 survey when 57.9% of dealers said customers requested financing more than half of the time. (See chart on page 16.)

This increase could be linked to customers taking advantage of compelling manufacturer finance offers. The “buy now and pay much later” offers like 0% for 84 months make it easier to budget for larger purchases.

What else should you do now? Make a big deal about upgrades in your retail and service departments and push your new or existing business systems to give you data. Make every part of your dealership do more. With back-to-back years of growth and a stable to slightly positive economy, it’s a good time to be in the rural lifestyle equipment market.

Post a comment

Report Abusive Comment