A recovering housing market and an increase in disposable income indicate new opportunities for equipment dealers who sell to commercial cutters. Combine these factors with the drive to have the best-looking property, and commercial cutters — and dealers — should expect good business growth in the year ahead.

Research group Global Industry Analysts shares this positive news in a recent report: “Post-recession economic recovery, resurgence in consumer spending, growing emphasis of homeowners on backyard beautification, and the imminent rise in remodeling activities will be the latent demand drivers triggering long-term economic growth in the U.S. landscaping services market.”

IBISWorld says growth should be strong into 2019, citing the rapid construction sector recovery. Their forecast also says, “Steady per capita disposable income growth is projected to encourage households to return to outsourcing yard care.”

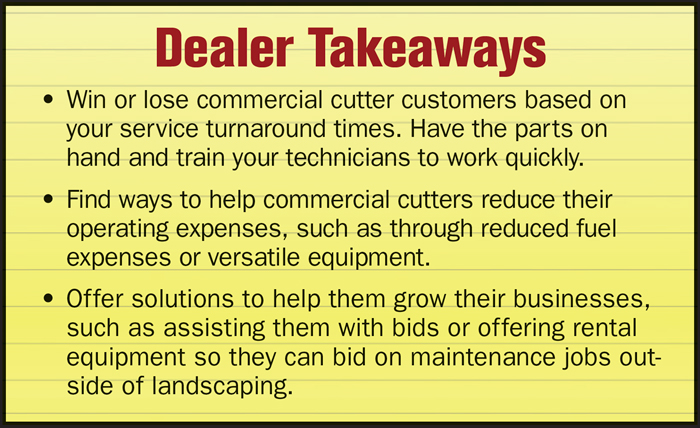

Dealers who have had success in this segment say they focus on commercial cutters’ two main challenges: Keeping machines running and keeping operating costs low.

Thinking Business

David Norris, owner of Norris Equipment Co., says about 75% of his revenue comes from the commercial cutter segment. His dealership is located in Gardner, Kan., with much of his business coming from Johnson County, which often tops the list of the state’s wealthiest counties. Norris carries the Grasshopper and Red Max outdoor power equipment lines.

“The biggest change in the commercial cutter industry happened in 2008 after the economy collapsed. A lot of people became unemployed and they needed to find ways to create revenue. If they had a mower of their own, they entered the business. It has become more and more competitive with a lot of two-man crews compared with the 30-man crews,” Norris says.

“If you don’t have the right skill level, don’t even take on commercial cutters...”

Cutters chase two different kinds of customers, according to Norris. “One wants quality and one wants price. Good companies can get more customers and still do quality work,” Norris says. “A lot of commercial cutters work on volume — covering acres rather than trying to make them ‘show places.’ The big thing commercial cutters are all looking for is reliability. For every hour they are broken down, they are losing money.”

Norris says time and trust help him win commercial cutter business. “To win new customers you have to take a lot of time with them. Commercial cutters are very loyal to their dealerships. I may spend a year or two with them and do 2 or 3 demonstrations to build the relationship and to point out the reliability of the machine. It’s a long-term process. Commercial cutters don’t usually drop a line without a good reason. You have to show them the value of the machine,” he says.

Norris also demonstrates the value of his dealership and his parts and service departments. “A dealership is almost an employee of theirs. They count on me to get them back running,” he says. “The #1 key for commercial cutters is you have to stock parts. We keep a lot on hand and they can get everything in one trip. You also need the knowledge to fix the machine. If it’s a 30-minute fix, I fix it on the trailer. They appreciate it and are willing to pay for it because they’re back at it in 30 minutes.”

Parts & Service are Key

Norris Equipment has 2 full-time service techs and others fill in when needed. “My employees and I know a lot about one line. A lot of dealerships try to be everything to everybody. They know a little bit about 15 lines. We know a lot about one,” he says. His parts inventory and expertise have also earned him customers in surrounding states.

Tracking Landscape Spending

In 2013, PLANET, the Professional Landcare Network, surveyed more than 2,200 adults about their lawn and landscape purchases. They found that 35% hired professionals to perform lawn and landscape services. Average spending for the next year was expected to be up for the services of mowing, edging and leaf clean-up, increasing from $600 to $700. Landscape design and installation was expected to increase to $1,200 from $1,000. The biggest spending increase was expected in the design/build area. Those who responded to the survey expected to double their spending to $2,900 from $1,400 for the coming year.

Here’s the breakdown of what homeowners actually spent in 2012:

• 18% on landscape maintenance/care ($600 average spent)

• 16% on lawn care ($400 average spent)

• 11% on tree care ($400 average spent)

• 7% on landscape design and/or installation

• 5% on building of patios, decks, walkways or outdoor kitchens

• 3% on outdoor lighting

• 3% on holiday outdoor lighting and décor

• 2% on installation of an irrigation system

• 2% on water features

Norris uses that knowledge to bid repair times. “When they are trying to plan their workload, don’t tell them you’ll have something fixed in a day and it takes you 2 or 3. He knows how long it should take and he’s going to see right through you,” he says. “You can’t over promise and under deliver. That will run them off quicker than anything.”

For repairs that are under warranty, Norris offers a free loaner and tries to complete those jobs in a day. The dealership earns off-season parts and service business with a free “warranty checker” service. “It does generate additional jobs. They’ll say ‘Do this while you have it,’ ” he says.

Offer Versatile Products

Regarding the models of Grasshopper mowers he sells, Norris says it again comes down to understanding their business and helping customers save money. For example, he sells a lot of mid-mount models because that style, as opposed to a front mount, allows more mowers to fit on each trailer, meaning less trucks and trailers on the road. He says diesel engines are popular because of their fuel efficiency. Many of his cutter customers trade their machines when they hit 3,000 hours.

Norris says carrying the Grasshopper line, which has numerous attachments, helps him win a related segment, municipalities. “The dollars aren’t as big of a deal for them. Versatility is a big thing for municipalities. They want snow blades and blowers for the winter and aerators, sprayers and blowers for the summer,” he says. One customer even uses a leaf blower attachment to drain fountains at the end of the season. Generally, they trade when the machines have 1,000 hours, which is about every 4 years.

Parts availability is also important for equipment such as blowers, string trimmers and hedge trimmers, especially because of how they are handled during transport and on job sites. “They roll around in back of the trucks or are strapped to lawn mowers and take years of abuse,” Norris says. “Commercial cutters want to have everything one brand, so they don’t have to run all over for parts. Service, power and dependability are things they look for.”

He says his most popular trimmer model is the Red Max BCZ2460S because it’s light, but powerful and mid-priced. Norris also promotes the canned Red Max fuel. “The #1 problem with hand-held equipment is fuel issues related to fuel quality. The canned fuel is becoming more and more popular because it’s ethanol free and has a consistent mixture and cutters don’t have to worry about employees making a mistake in mixing fuel.”

Cutting Expenses

Chris Harrawood, owner of Harrawood Equipment, Leslie, Mo., opened his dealership about 3 years ago after owning a snow removal business. He started in the landscaping segment in college. “A small investment in Exmark mowers got me through college,” he says.

Leckler’s in La Salle, Mich., tries to have all parts in stock because commercial cutters don’t want to wait for repairs. The dealership team includes CEO Melanie Leckler, seated, and from left: Gary Keenan, master technician; Adam Leckler, vice president and general manager; Denise Brasseu, officer manager; Dennis Langland, sales manager; Jae Smith, parts manager; and Rob Mize, service manager.

He now carries Exmark, Mahindra, Stihl, Woods, Trailerman and Doolittle Trailers as well as an extensive rental inventory. His dealership is located on his rural property, which is an hour west of St. Louis. About 30% of his business comes from commercial cutters, many of whom live in neighboring rural areas and have customers in St. Louis.

Harrawood wins business by offering value on different levels, such as business advice, rental options and service expertise. For instance, he offers to help his cutter customers bid jobs. “New contractors always underestimate the cost of operation and ownership. We help them with bid assistance and have depreciation value discussions. We’ll talk through what size mower works best and the equipment they’re going to need and the cost per hour. We’ll go onsite as well and take a demo mower and have them try it out, so they can figure out the timeframe to cut a certain area. That helps them bid jobs more accurately. We get them into equipment that will save them time and money,” he says.

EFI engines and Exmark’s RED technology, which help boost fuel efficiency, are selling points for commercial cutters, he says. “Fuel costs are driving what they’re purchasing. They’re more interested in engines that don’t consume as much fuel.”

Harrawood’s rental fleet helps his customers bid more jobs. His rental lineup includes mowers, skid steers, dump trailers, concrete saws, stump grinders, mini excavators, concrete floats, compact discs and more.

“Commercial cutters usually don’t have the extra funds. Rental helps them bid bigger jobs and they don’t have to make the investment,” he says. For instance, in the winter, cutters can rent his skid steers and bid snow removal jobs.

His service department helps maintain his commercial cutter business, especially in terms of parts availability and fast repairs. “It’s so important to have a quick turnaround on repairs. They make a living on their mowers and they don’t even want them in here for 10 minutes.”

Harrawood offers other incentives to win business, such as service packages, multi-unit discounts and business hours from 7 a.m.-6 p.m. “We open early and stay late. We’re their first and last stop of the day.”

Locating Regional Opportunities

The Bureau of Labor Statistics lists the top metropolitan and non-metropolitan areas for commercial cutter employment. These statistics indicate which parts of the country offer dealers a strong customer base.

Metropolitan areas with the highest employment in this occupation:

1. Chicago-Joliet-Naperville, Ill., metropolitan division

2. Los Angeles-Long Beach-Glendale, Calif., metropolitan division

3. New York-White Plains-Wayne, N.Y.-N.J., metropolitan division

4. Phoenix-Mesa-Glendale, Ariz.

5. Santa Ana-Anaheim-Irvine, Calif., metropolitan division

Nonmetropolitan areas with the highest employment level in this occupation:

1. Hawaii/Maui/Kauai nonmetropolitan area

2. Low Country South Carolina nonmetropolitan area

3. Balance of Lower Peninsula of Michigan nonmetropolitan area

4. Western North Carolina nonmetropolitan area

5. Kansas nonmetropolitan area

His commercial-grade inventory also appeals to the growing numbers of rural lifestylers and large property owners in his area who are looking for larger, more durable equipment.

Adapting to Market Changes

Melanie Leckler, CEO of Leckler’s Inc., La Salle, Mich., says about 25% of their business is commercial cutters and 15% are municipality customers. The dealership carries John Deere turf, Husqvarna and Stihl lines. She sees business increasing for the commercial cutter segment.

The dealership is located about 30 miles south of Detroit and 10 miles north of Toledo. “We started seeing the economy going down in the late 1990s. While everyone else was marching along just fine, many of the small automotive part suppliers and R&D shops that were supplying the auto manufacturers were closing their doors. China started replacing many jobs and we started seeing an exodus of customers of the middle class moving to other parts of the nation.”

Her first indication of the area’s declining economy was the return rate on their direct mailers, which started increasing to 3-4% from the usual 1-2%. “I began tracking these customers down and asked them why they moved. Our housing foreclosures began in 2001, many years before the rest of the country,” Leckler says.

Because of the turmoil of the past years, the dynamic of home ownership in the area is changing, especially as the aging, higher wage, working class population is retiring. “You have a 50-plus age group who are downsizing. As soon as the housing market shows any potential for them to sell at a breakeven point on their homes or properties, they are getting out and taking that money and holding onto it,” she says. “Some are now becoming renters or condo dwellers, which in turn hire commercial cutters to maintain their grounds. Some are now smaller property owners or moving in with family to conserve cash. This group does not need larger lawn equipment and are becoming the walk mower and smaller zero-turn mower group,” Leckler says.

Like other dealers who serve this segment, parts and service are critical departments. “When we took on Husqvarna 4 years ago, we went through the parts schematics and ordered first and secondary parts for every commercial model we carried. That was a $50,000 parts order. Commercial cutters are business people and expect dealers to have the parts in stock. The biggest mistake that dealers make is to say, ‘I can get the parts in a day.’ To keep margins up in your parts department and labor billing, you need to have the parts in stock. Otherwise, this group will wait 1 day and order the parts on-line to save the money and fix the equipment themselves,” she says.

Harrawood Equipment, Leslie, Mo., wins business from commercial cutters by offering value on different levels, such as business advice, rental options and service expertise. Commercial models, such as this Exmark Lazer Z, also appeal to the area’s rural lifestyle customers.

When selling equipment, Leckler says her sales team keeps customer budgets in mind. “To get customers into the ‘Leckler experience,’ we try to keep continuity in their fleet of equipment. We find out what equipment they already have and what engines are in these units. We then match engines with their new purchase. They begin to use us for all their engine parts and are amazed on how fast we can supply them. This, in turn, leads to more unit sales every year. Commercial cutters are business owners and need to trust their dealers because their business depends on it,” she says. The staple equipment for most fleets in her area is 60-inch zero-turn mowers with 36-inch or 48-inch walk behind mowers.

Leckler watches out for the business interest of smaller commercial cutters when recommending hand-held outdoor power equipment as well. For instance, her sales team recommends Stihl’s KombiSystem (one motor with many optional attachments) because it reduces the investment in separate equipment.

Leckler keeps her own business in mind when serving commercial cutters. When selling a new customer a chain saw, she says, “We ask the customer to bring us their chaps and safety apparel so we can see what it looks like. Our customers’ safety is very important to us. If the equipment is not sufficient and they will not purchase new, we will walk away from the sale,” she says.

Leckler says that, ultimately, relationships and expertise are the winning strategies. “Commercial cutters all talk to each other and ‘word of mouth’ recommendations are any dealership’s best marketing tool. Having a dealership with the right skill level and parts inventory is pertinent in serving the commercial market,” Leckler says.

Post a comment

Report Abusive Comment