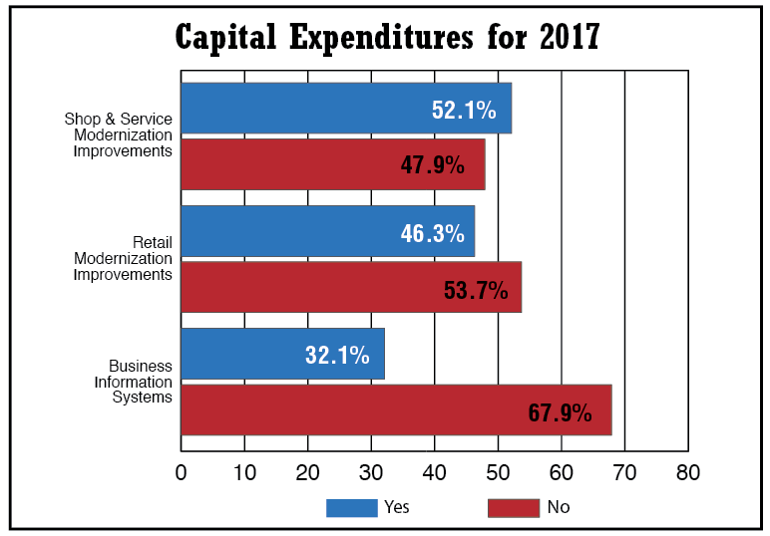

About half of dealers (52%) expect to modernize or make other improvements to their shop and service departments this year, according to the 2017 Rural Lifestyle Dealer Business Trends & Outlook Report. That’s down from last year when 73% of dealers expected to make similar improvements. Perhaps that signals dealers have made progress in the last year or so on those key areas of their dealerships.

Bob Clements, Rural Lifestyle Dealer columnist and industry consultant, has been offering tips and strategies on how to develop a high performing service department. Go here to view an archive of his columns.

“The parts counter is often the first interaction new customers have with many dealerships. If there is a place to make a good first impression inside your dealership, this is where it would happen,” says Clements.

The dealership’s retail environment, one that is attractive, inviting and intuitive, is also something dealers will improve on this year. About 46% expect to modernize and improve their dealership’s retail spaces. That compares with about 59% of dealers who planned to make improvements last year.

Mike Wiles, Rural Lifestyle Dealer columnist and retail expert, has also been sharing his expertise with readers and offers this advice, “Make your place look as good as, or better, than the local car dealerships. Any money invested in additional indoor display areas will yield big returns.” Read his latest column.

Business information systems is another area for investment and about 32% of dealers expected to make investments in technology this year. That’s also down from the 47% of dealers who expected to make similar investments last year.

Collecting and monitoring data is critical to driving the right decisions and to understanding your customer base as a whole as well as individual customers’ buying habits. (View a round-up of the latest innovations in dealership management systems.)

As a whole, investments in dealership improvements are slightly down, but a good share of dealers recognize the importance of ongoing internal investments.

Post a comment

Report Abusive Comment