The following story is an excerpt from the 40-page 2017 Rural Lifestyle Dealer Business Trends & Outlook Report. Email Lynn Woolf for a copy of the complete report, lwoolf@lessitermedia.com.

Massey Ferguson (AGCO) dealers are optimistic about 2017, even more so than North American dealers as a whole. They think tractors under 40 horsepower and UTVs will drive growth this year.

In terms of total revenue, 90% of Massey Ferguson (AGCO) dealers say 2017 will be as good as or better than 2016 and 10% expect total revenues to increase 8% or more.

About 10% of Massey Ferguson (AGCO) dealers expect total revenues to decline 2-8% or more.

That compares with 84% of North American dealers who expect this year to be as good as or better than last year. About 16% of North American dealers expect total revenues to decline 2-8% or more.

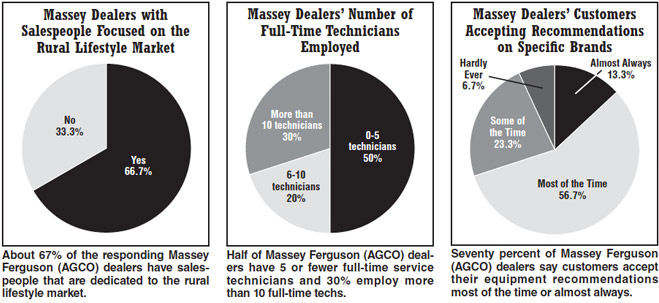

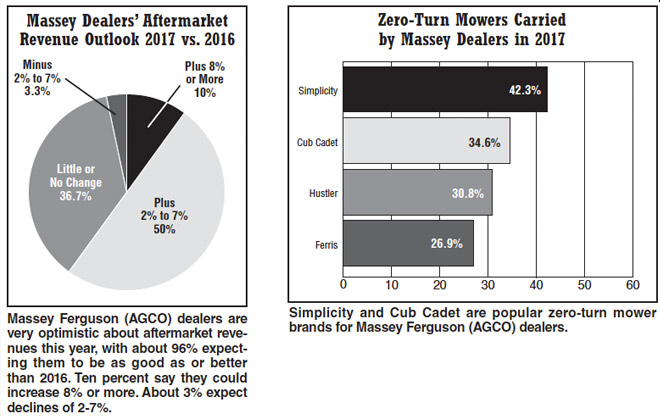

Massey dealers are also more optimistic than North American dealers as a whole about aftermarket revenues. About 96% expect aftermarket revenues to be as good as or better than 2016, compared with about 90% of North American dealers who expect similar results.

About 3% expect declines of 2-7%, compared with about 9% of North American dealers.

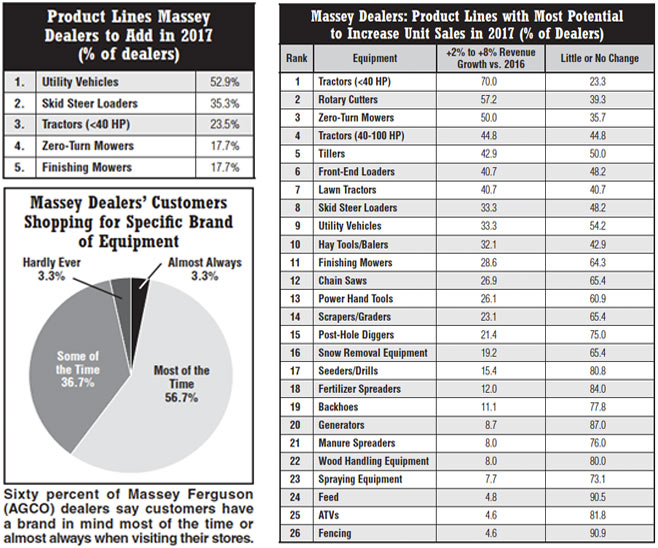

Tractors less than 40 horsepower top the list of categories in terms of product lines with the most potential to increase unit sales for Massey dealers (sales increases of 2-8% or more). Rotary cutters, zero-turn mowers, tractors 40-100 horsepower and tillers round out the top 5.

The bottom 5 categories for potential of increasing unit sales are wood handling equipment, spraying equipment, feed, ATVs and fencing.

Massey dealers also see growth coming from utility vehicles and skid steer loaders. Dealers say they plan to add those two categories to their product lineups this year along with tractors under 40 horsepower.

In terms of brand awareness, Massey dealers rank closely to what other dealers reported. Sixty percent of Massey Ferguson dealers say customers have a brand in mind most of the time or almost always when they visit dealerships, compared with about 62% of North American dealers.

Seventy percent of Massey Ferguson dealers say customers accept their equipment recommendations most of the time or almost always, compared with 77% of dealers across North America.

Half of Massey dealers employ 5 or fewer full-time service technicians and about 67% have salespeople dedicated to the rural equipment market.

Hobby famers/large property owners, production farmers and municipalities/parks are the top three customer segments for Massey Ferguson dealers.

See additional details in the following charts along with comments from Massey Ferguson dealers.

Massey Dealers’ Commentary:

What’s the best mistake you ever made and how did it change your dealership or how you approach business?

“Assuming what customers wanted. We assumed that most customers were like us — price-driven — and mostly wanted preowned equipment. (We always buy used cars.) Turns out, way more customers purchase new tractors, rather than used.” … “Many times until I learned better! I never argue with a customer. I ask what his expectations are to resolve our problem and then work to a solution right then if possible. It is better to get any pain over with and then move on. But I will fire the occasional unreasonable customer. You will never make them happy or make any money on them.” … “Trusting employees too much. We require all miles be logged on service vehicles.”

What recent changes have you made in your service or parts department and how has it helped your dealership?

“Hiring more experienced employees has been a huge help to the parts and service department. It is amazing what having knowledgeable, seasoned parts people can do for customer satisfaction. Also, we have implemented some workflow processes that are improving tech time and overall efficiency in parts sales.” … “Added shop space to set up, display and show equipment to customers.” … “Added a new young mechanic in the service department and one in the lawn and garden department.” … “Quadrupled counter space and increased staff. Our parts sales have more than quadrupled.” … “Expanded our hydraulic fittings for making up two- and four-wire hoses, with many more metric fittings.” … “We’ve invested in higher quality employees that have experience in our industry. It is going to cost us a little more in payroll, but we expect to see better efficiency and ultimately better sales and ROI in that department.” … “Incorporated the parts and service counters and cross trained employees to reduce the amount of total hours worked without reducing open hours.” … “We have just started concentrating on the four-minute turnaround for parts customers by rearranging counter area display and fast moving parts locations, but no results yet.”

Post a comment

Report Abusive Comment