The following story is an excerpt from the 40-page 2017 Rural Lifestyle Dealer Business Trends & Outlook Report. Email Lynn Woolf for a copy of the complete report, lwoolf@lessitermedia.com.

Most Case IH dealers have a positive outlook about revenue in 2017, especially aftermarket revenue, and many will add tractors 40-100 horsepower and utility vehicles to their lineups.

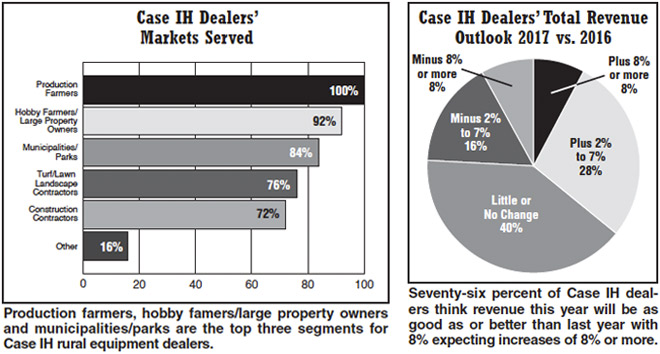

Seventy-six percent of dealers think 2017 revenue will be as good as or better than 2016 and 8% expect revenue to increase 8% or more.Eight percent also forecast revenue declines of 8% or more.

That outlook is slightly less positive than North American dealers overall, where more than 84% expect this year to be as good as or better than last year and 5% expect declines of 8% or more.

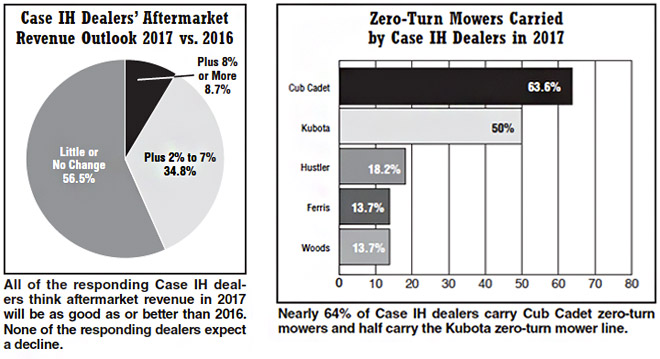

Case IH dealers are very optimistic about aftermarket revenues, with all of the responding dealers expecting this year to be better than last year and nearly 9% expect increases of 8% or more. That compares with North American dealers as a whole where 90% aftermarket revenues to be better than last year and 9% expect declines of 2-7%.

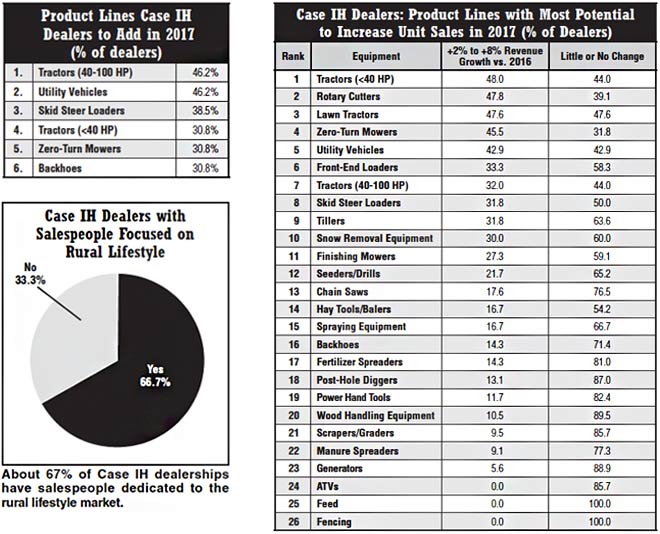

Case IH dealers say that tractors less than 40 horsepower will drive unit sales this year. That product category tops the list of 26 product categores with the most potential to increase unit sales in 2017, followed by rotary cutters, lawn tractors, zero-turn mowers and utility vehicles.

The product categories at the bottom of the list for increasing unit salesthis year are manure spreaders, generators, ATVs, feed and fencing.

Nearly half of Case IH dealers plan to add tractors 40-100 horsepower and utility vehicles to their lineups. Skid steer loaders are another expansion opportunity, with about 40% planning to add that category this year.

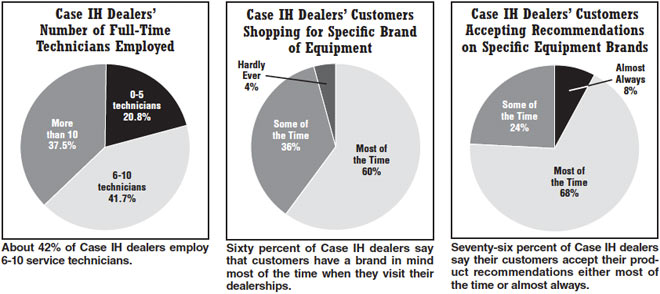

Case IH dealers have similar brand awareness as North American dealers as a whole. Sixty percent of Case IH dealers say that customers have a brand in mind most of the time when they visit their dealerships. That compares with 62% of North American dealers who say customers have a brand in mind most of the time or almost always.

When it comes to recognition of product expertise, 76% of Case IH dealers say their customers accept their product recommendations either most of the time or almost always. That compares with 77% of North American dealers.

About 67% of Case IH dealers have salespeople focused on the rural equipment market and 42% employ 6-10 full-time technicians.

Production farmers, hobby famers/ large property owners and municipalities/parks make up the top three customer segments for Case IH rural equipment dealers.

See the charts below for additional details as well as comments from Case IH dealers.

Case IH Dealers’ Commentary:

What’s the best mistake you ever made and how did it change your dealership or how you approach business?

“When I lose a deal, always offer or ask customers to come back.” … “Allowed too many new partners in. It changed the dealership’s philosophy, but has been okay going forward.” … “Dealing with difficult potential customers and their misconceptions and go out of the way to change their thought processes.” … “Stayed with a supplier too long. I eliminated them and picked up business by concentrating on other in-house lines.” … “Ordering too much inventory. We now look at history and try to order for a 6-month supply instead of a 1-year supply. It’s much easier to reorder than have too much.”

What recent changes have you made in your service or parts department and how has it helped your dealership?

“Incentivized the service department to bill more hours and show up to work on time by paying them a commission based on just that.”… “We came up with our own incentive plan for the service mangers and service techs to get customer work orders closed in the 30-day window.” … “We added new lifts and new shelving. It keeps the production level high and increases organization.” … “We raise our labor rate every year.” … “Added on-the-farm service.”

Post a comment

Report Abusive Comment