Dixie Chopper ranked near the bottom of the list in the 2017 Equipment Dealers Assn.’s Dealer-Manufacturer Relations Survey in terms of total score for 12 criteria of operations and support. However, when looking at 3-year trend for three criteria in particular — product quality, parts availability and parts quality — the company is trending up in dealers’ minds, leading other manufacturers in terms of gains.

Dixie Chopper’s 3-Year Trend*

- Product quality +17.20%

- Part availability + 9.98

- Parts quality +10.71

- Overall satisfaction +17.45%

*Equipment Dealers Assn.’s 2017 Dealer-Manufacturer Relations Survey

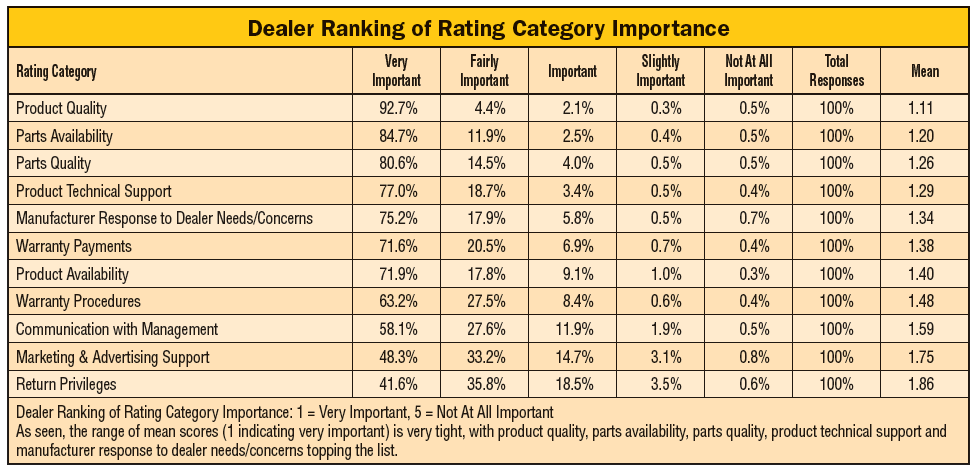

Those three categories top the list of criteria in terms of importance, as ranked by dealers. Dixie Chopper is also trending up in terms of overall satisfaction. (See the box, “Dixie Chopper’s 3-Year Trend” as well as the tables, “2017 EDA Dealer-Manufacturer Relations Survey” and “Dealer Ranking of Category Importance.”)

Rachel Luken Thompson, the new vice president of the turf division at Textron Specialized Vehicles (TSV), which owns Dixie Chopper, shares with Rural Lifestyle Dealer what’s behind these improved dealer attitudes.

Rachel Luken Thompson is the new vice president of the turf division at Textron Specialized Vehicles.

Rural Lifestyle Dealer: How do you feel about how dealers are rating Dixie Chopper?

Thompson: When Dixie Chopper was acquired by Jacobsen in early 2014 and since rolled up into the larger organization of TSV within the Jacobsen business integration, we have had the opportunity to pull from an additional knowledge base. We’re seeing some upside from our focus on dealers, product quality and parts availability and we anticipate additional bumps in the future.

In terms of product quality, the uptick in perception is being reflected from some of our initiatives, such as end-of-the-line quality audits and standardized work within the assembly lines. The increase in the parts availability score is a reflection of our initiatives over the last several years, such as tracking our fill rate of “ABC” items, the top-wear items like belts, pulleys and blades, all the way down to “D” parts. We have individuals who are looking at those parts and safe stocking levels so that as we go into the retail season, we are stocked appropriately and our dealers and end users can count on us to have the parts on the shelves.

We would have liked to see an uptick on a couple of other ratings. We will dive in a little deeper on those items and what we can do differently and what else we can do to communicate with dealers. Internal and external communication is key and there is still room for improvement in our support for our dealer network.

RLD: What’s coming up in terms of new products from Dixie Chopper?

Thompson: From Day 1 after Jacobsen’s acquisition, we kicked off substantial projects. For instance, the design for our Blackhawk series started with a clean sheet of paper and we’re continuing to invest in our product range, bolster our lineup and bring in new “clean sheet of paper” products.

We want to bring in a lot of products to meet a price point and offer a features set. Dixie Chopper’s focus is on zero-turn mowers and we will continue to invest in building out an industry-leading full range of zero-turn mowers for rural dealers.

We’ve seen a shift in the zero-turn space of customers wanting and deserving power and performance. For all of our new products, we want to ensure that the power, performance and appearance are still what people know and love about Dixie Chopper. Our price points will range from the entry-level residential mower to prosumer and commercial models — with the performance, speed and fuel capacity our customers desire.

For instance, the Blackhawk has a MSRP of $6,000-$8,500, so it fits that price point of a prosumer, entry-level commercial mower offering speed as well as comfort with the suspension seat. We’ve also added other features, like the operator controlled discharge chute and the password protected push button start, which were based on requests from dealers and customers.

RLD: What’s ahead for your dealer network?

Thompson: We are expanding our network across North America and beyond. We’re looking for dealers who carry zero-turns but who may not have a line that speaks to our segment of customers or who don’t yet carry zero-turns. Dealerships that sell off-road vehicles could be an additional opportunity and our products are a good tie-in for ag dealerships as well.

We have local, regional and national advertising campaigns to help support dealers. We’re continuing our relationship with the Duck Commander brand and are highlighting out relationship with race car driver Tony Stewart, who has used our equipment for 11 years in a number of recent commercials and point of purchase items

RLD: What equipment trends are you watching?

Thompson: We’re watching the different power methods. The vast majority of zero-turn mowers sold are gas-powered and we’re watching the movement into diesel and liquid propane as well as hybrid power and battery power.

Jacobsen golf turf products and E-Z-Go are also part of TSV. E-Z-Go just launched a new lithium-ion powered golf car and hybrid powered-vehicles are already part of the golf space and Dixie Chopper has access to these technologies.

With alternative power, we have to keep the purchase price in mind so the customer can see a rate of return.

RLD: Anything else you would like to share with our readers?

Thompson: Our strategy is to become the sector leader for ruralists that value power and speed. This customer base and the dealers that serve them are who we keep in mind as we go forward and develop new products.

For the 2017 Equipment Dealers Assn.’s Dealer-Manufacturer Relations Survey, dealers were asked to rate the importance of each of the 12 rated categories as it relates to the overall relationship with a manufacturer. As shown in the table, most respondents rated each category as Important to Very Important. The mean number represents the degree of importance, and the lower the number, the more important the category.

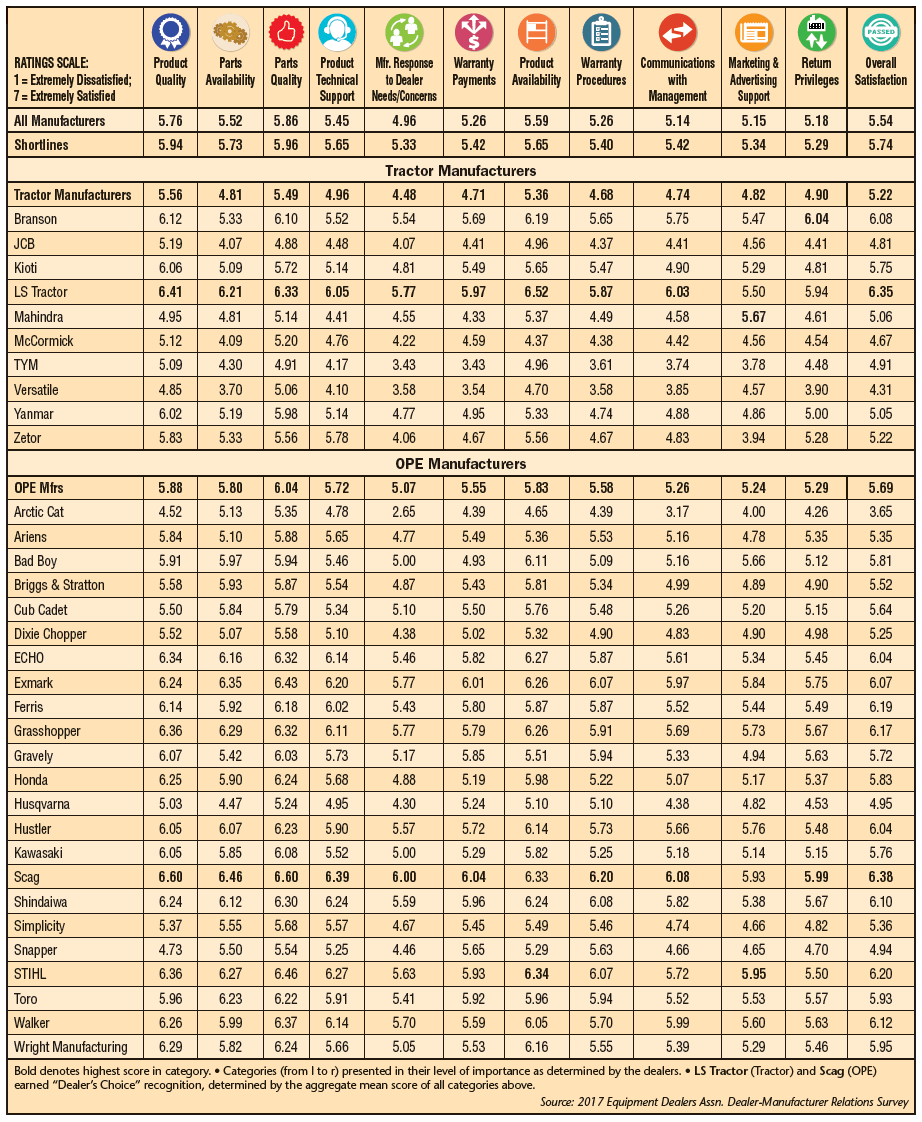

2017 EDA Dealer-Manufacturer Relations Survey (Does Not Include Full-Line Manufacturers)

A total of 2,371 individual dealers participated in the 2017 Equipment Dealers Assn.’s (EDA) Dealer-Manufacturer Relations Survey, ranking a total of 58 manufacturers. Here’s a breakdown of the ratings for all manufacturers, OPE, tractor and shortline manufacturers as well as a breakdown of individual rural equipment manufacturers. Kubota does not appear on this list as it was included as a full-line manufacturer for the first time in the 2017 survey.

Post a comment

Report Abusive Comment