Are you feeling good about 2018? You should be, based on the results of Rural Lifestyle Dealer’s Dealer Business Trends & Outlook survey. And, if you’re not, it’s time to make quick adjustments to tap into the momentum that other dealers are experiencing.

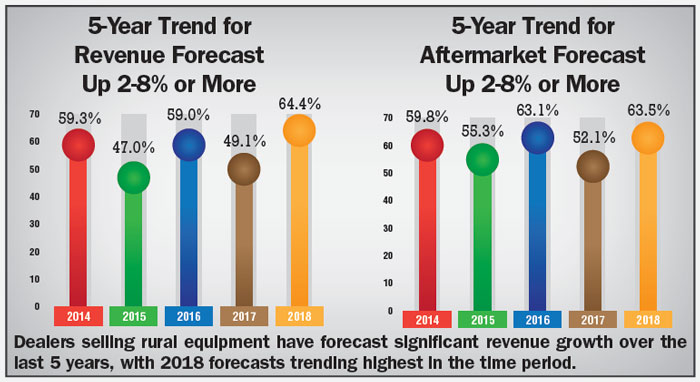

Here’s what dealers from across North America told us about their expectations for 2018: More than 64% of the responding dealers expect total revenue to be up 2-8% or more this year. That’s significantly up from last year when about 50% expected revenue growth in that range and even up from the 60% of dealers who forecasted that level of growth for 2016. Overall, nearly 92% of dealers expect 2018 to be as good as or better than 2017, up from 84% in the 2017 survey. (See the charts below.)

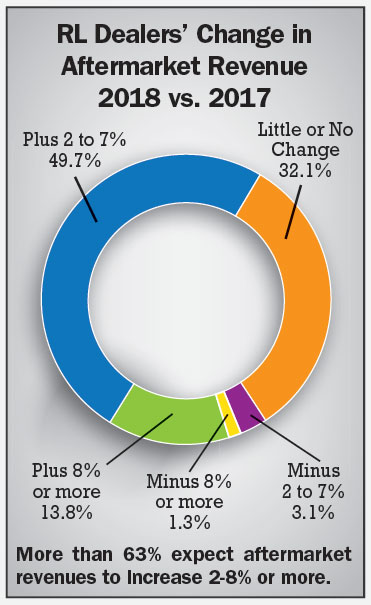

Forecasts are also good for aftermarket revenue, which typically brings better margins. More than 63% of dealers expect aftermarket revenue to grow 2-8% or more. (See the chart, "Change in Aftermarket Revenue".) That compares with about 52% of dealers who expected that growth in 2017 and back to the similar percentage who forecast aftermarket revenue growth for 2016. Overall, more than 95% of dealers expect aftermarket revenues to be as good as or better than 2017, compared with 90% in last year’s survey.

The charts on page 27 show the trends over the last 5 years, according to Rural Lifestyle Dealer’s Dealer Business Trends & Outlook Report, and the recent increases in total and aftermarket revenues.

Supporting Factors

Economic indicators support dealer forecasts. The housing market and unemployment rate are strong influencers in particular on the strength of the rural lifestyle market.

For instance, builder confidence in the market for newly-built, single-family homes rose to a level of 74 in December on the National Assn. of Home Builders/Wells Fargo Housing Market Index. This was the highest report since July 1999, over 18 years ago.

The U.S. unemployment rate in December was 4.1%, down from 4.8% at the start of 2017. And, one dealer shared this comment on that low unemployment rate: “Those who don’t have a job, don’t want to work.”

Dealer Takeaways

- Nearly 92% of dealers throughout North America think 2018 will be as good as or better than 2017. More than 95% think aftermarket revenues will also be as good as or better than last year.

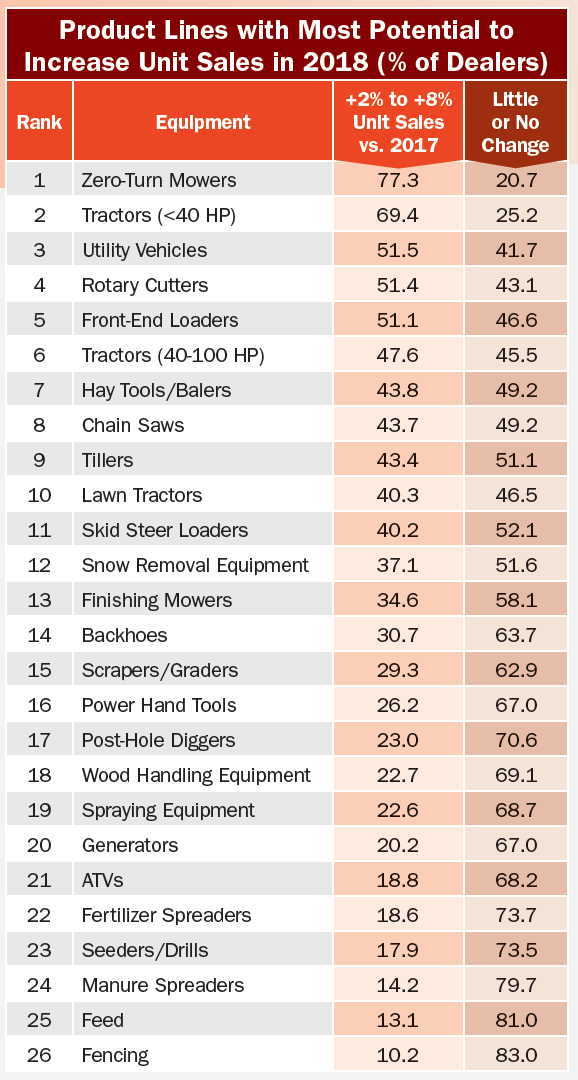

- Zero-turn mowers topped the list for product lines with the most potential with about 77% of dealers expecting unit sales increases of 2-8% or more. Utility vehicles topped the list of products being added, with half of the responding dealers forecasting they’ll add the product line this year.

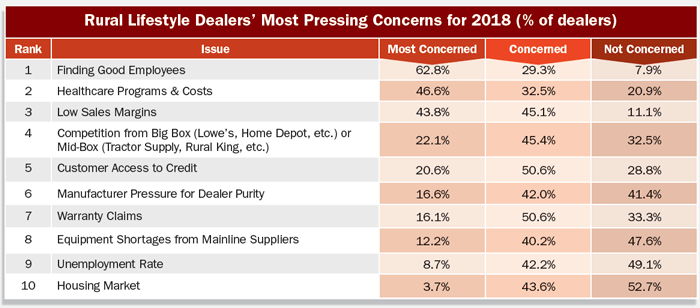

- Finding good employees ranks highest in terms of issues dealers are most concerned about. Healthcare programs and costs ranked second and low sales margins ranked third.

- About 68% of dealers say their customer base has grown 5-20% in the last 5 years.

Other factors, such as those related to government policies, have limited influence, says economist Alan Beaulieu, president of ITR Economics and author of “Prosperity in the Age of Decline.” He says what matters more is what businesses do.

“They don’t control, with ‘they’ being Washington and whomever is president, as much as we give them credit for. Many seem to think that they are masters of the economy but, in fact, they are not. They can nudge, they can tip in a certain direction, but all that takes time and is certainly not something that businesses don’t have time to adjust to,” Beaulieu says.

Stay vigilant, though, because Beaulieu’s economic forecasts show a softening toward the end of the year and a significant downturn, even a depression, in 2030. (Read more in the sidebar, “Economist Forecast: Momentum into 2020; Great Depression in 2030”.)

Bottom line: Make the most of the strong market now so you can weather any potential downturn, be it from the economy, increased competition, changing manufacturer agreements or shifting customer attitudes.

Viewing Total Sentiments

Not all dealers are expecting a strong year, but the negative forecasts for total revenue are weaker than last year. For instance, 5.6% of responding dealers expect total revenue declines of 2-7% and 2.5% forecast revenue declines of 8% or more. That compares with 10.7% of dealers who forecasted revenues to decrease 2-7% last year and 5.3% who forecasted declines of 8% or more a year ago.

In terms of aftermarket revenue, negativity is also tempered for this year. About 3% expect declines of 2-7% and about 1.3% expect declines of 8% or more. That compares with last year when 9% of dealers expected aftermarket revenues to decline 2-7%.

The weighted average perspective provides another view of the optimism. In this comparison, the forecast for increasing revenues is compared against decreasing revenues and the “little or no change” responses are not considered. The weighted average for total revenue is 2.97% for 2018 compared to 1.61% last year. The weighted average for aftermarket revenue is 3.1% compared to 2.38% for last year.

Seeing Opportunities

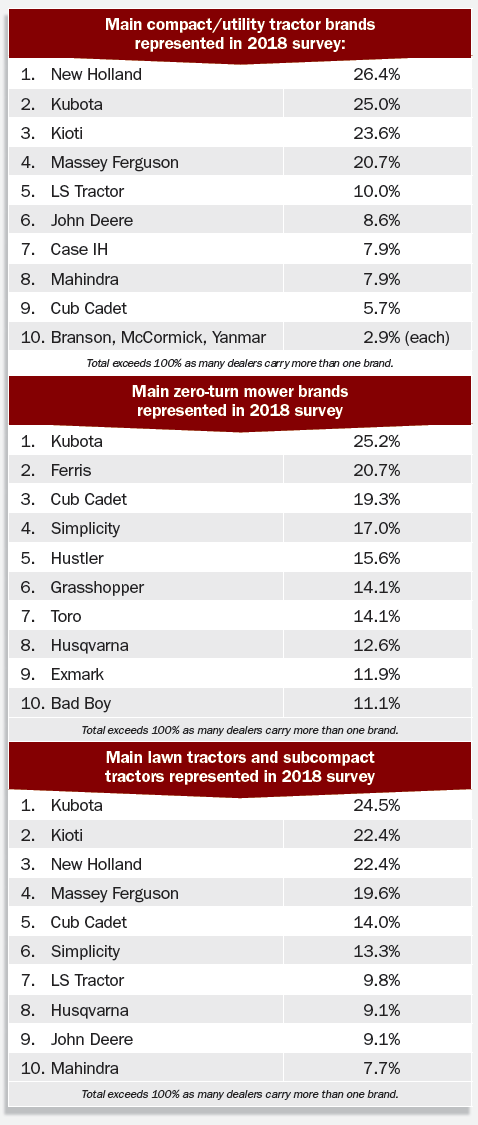

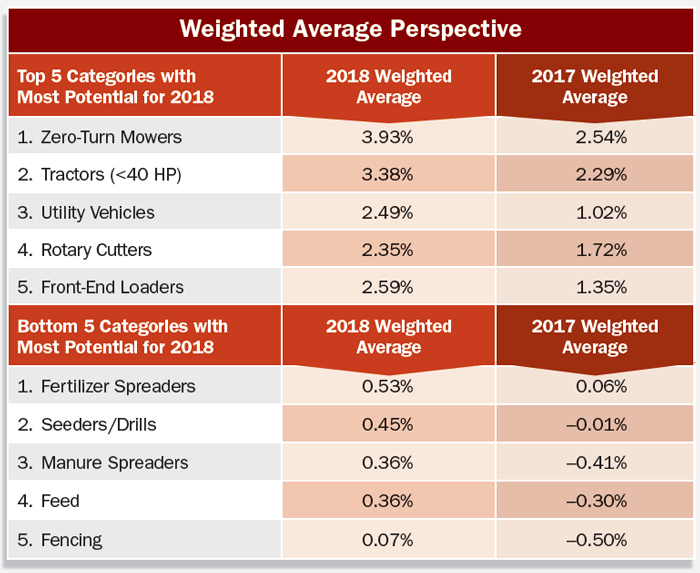

Dealers shared their forecasts for equipment, with zero-turn mowers topping the list of 26 categories. About 77% of dealers expect unit sales of zero-turn mowers to increase 2-8% or more this year. Tractors less than 40 horsepower ranked second with about 69% of dealers expecting those levels of unit sales increases. Utility vehicles ranked third, rotary cutters ranked fourth and front-end loaders ranked fifth with 51.5%, 51.4% and 51.1%, respectively. (See the table “Product Lines with Most Potential to Increase Unit Sales in 2018”.)

Zero-turn mowers and tractors less than 40 horsepower claimed the first and second spots in last year’s survey. Rotary cutters ranked third, front-end loaders ranked fourth and utility vehicles ranked fifth — so the categories moved slightly in position, but the top 5 rankings remain steady.

There was some shifting in the rankings of the other categories. For instance, tractors from 40-100 horsepower ranked 6th this year and 9th last year. Hay tools/balers ranked 7th vs. 13th last year. Chain saws ranked 8th this year and 6th last year; tillers 9th this year and 10th last year; and lawn tractors 10th this year vs. 7th last year.

When reviewing the weighted average perspective, there is optimism for product categories at the top of the list as well as at the bottom. In terms of the top 5 categories with the most potential for 2018, utility vehicles showed the largest increase in optimism over last year. At the bottom of the list, manure spreaders showed the largest increase in optimism in terms of the weighted average. (See the table "Weighted Average Perspective".}

In terms of another comparison regarding year-to-date unit sales (through November), tractors less than 40 horsepower were up 8.4% and tractors 40-100 horsepower were up 0.1%, according to the Assn. of Equipment Manufacturers.

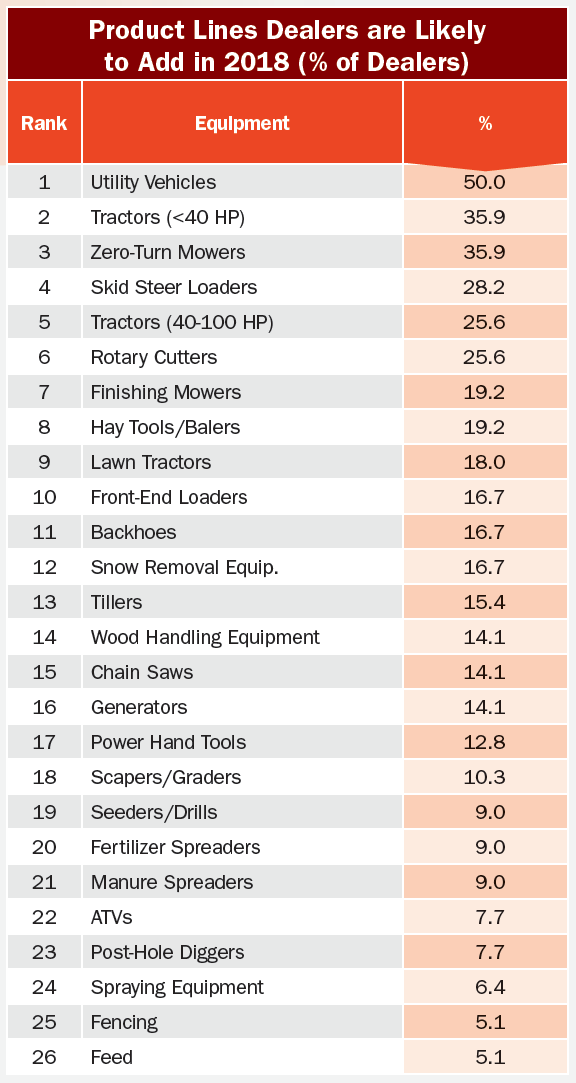

Adding Lines

Expanding lineups help dealers show off all they have to offer and the top 5 categories for expansion in 2018 include utility vehicles, tractors less than 40 horsepower, zero-turn mowers, skid steer loaders and tractors 40-100 horsepower. (See the table “Product Lines Dealers are Likely to Add in 2018”.)

Half of the surveyed dealers plan to add utility vehicles to their lineups. About 36% plan to expand their offerings of tractors less than 40 horsepower as well as zero-turn mowers. More than 28% plan to add skid steer loaders and about 26% plan to expand with tractors 40-100 horsepower.

Economist Forecast: Momentum into 2020; Great Depression in 2030

Economist Alan Beaulieu shared some good news as well as a warning in a recent Rural Lifestyle Dealer podcast. Here are some highlights about his forecast for a softening economy in 2019 with a good momentum into 2020 — leading up to a great depression in 2030. (Listen to the entire podcast here, http://bit.ly/RLDEconomicForecast.) Beaulieu is president of ITR Economics, which was founded in 1948. He is a senior economic advisor to a variety of trade associations and is the author of the book, “Prosperity in the Age of Decline.”

Rural Lifestyle Dealer: What are you seeing for the short-term and how can small businesses be ready?

Alan Beaulieu: The U.S. economy is going to expand into the first half of 2018. When I think of the economy, I’m thinking about the gross domestic product. Then, it’s going to flatten out, with a little bit of softness that will extend into 2019. By mid-2019, we’ll see the economy begin to pick up speed on the GDP basis and we’ll head into 2020 with nice momentum.

When you head into a softer economic environment, your first responsibility is to cash. Make sure you are not spending cash you should not be spending. During a softer year you should also ask yourself, “What do I need to get ready for a busy 2020?” We’re talking about efficiency gains.

RLD: You are forecasting a major downturn, a great depression in 2030. How can small businesses prepare for and weather that cycle?

Beaulieu: Businesses can prepare for a Great Depression in the 2030s by looking at their clients and saying, “Is this client in an industry that is going to get hurt?” If so, then by late 2020, they better be replacing that client with one in an industry that is not going to get hurt. For instance, client “A” may be profitable and somebody that you might have a long relationship with, but client A may not survive. And, if they do survive the great downturn, they may be giving you less business.

It’s easiest to just believe that it’s not going to happen and, therefore, businesses don’t have to do anything. However, when you see interest rates continuing to climb, that certainly means there is going to be a contraction in the housing and automotive industries. And, when you look at trends and historical guidelines, you can see that before a dramatic fall, there is this period of prosperity. During those times, some are lulled into complacency and those are the businesses that tend to fail.

One other way to prepare is to think about when you might want to sell your business. The late 2020s would be a good time to sell the business if you are considering that option.

This top 5 for expansion in 2018 matches the top 5 for last year, with zero-turn mowers and skid steer loaders swapping positions.

The categories of chain saws and ATVs had the largest change in ranking. Last year, chain saws ranked sixth and this year, they rank 15th, although the percentage of dealers adding the category was about the same for each year. ATVs ranked 22nd with about 8% of dealers expanding their lineups. Last year, the category ranked seventh with about 14% of dealers adding the equipment.

Utility vehicles, zero-turn mowers and tractors less than 40 horsepower are the “power” categories, making up the top 3 products for increasing unit sales as well as expansion in 2018.

Being Ready

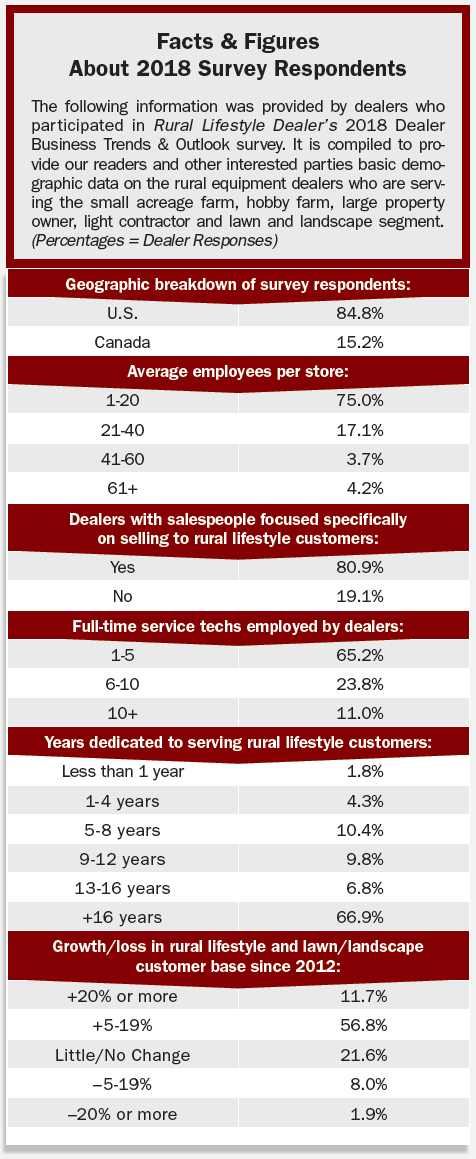

Expanding lineups mean dealers are getting ready for a big year serving their growing markets. Nearly 57% of dealers say their market has grown by 5-19% in the last 5 years, with almost 12% of dealers saying their market has grown 20% or more. That growth is similar to what was reported the last few years, so dealers are enjoying a trend of solid market growth.

Many of the responding dealers have been serving the market since its early days as a defined category. About 67% of dealers have been serving the rural lifestyle market for more than 16 years. New entrants are recognizing opportunities as well with about 6% selling to this market for 4 or fewer years. (For additional demographic information, see the chart “Facts & Figures About 2018 Survey Respondents” below.)

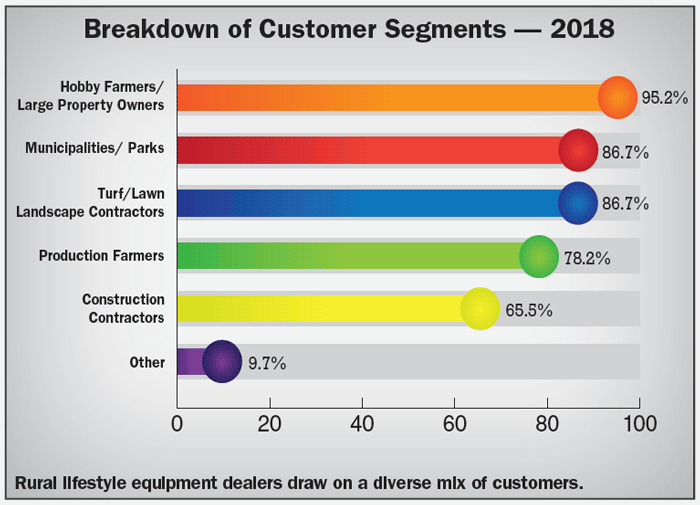

Dealers selling rural equipment understand that this niche requires special sales expertise and 80% have salespeople dedicated to the market. This expertise also has to be tailored to niches within the niche. For example, in addition to hobby farmers/large property owners, nearly 87% of the responding dealers serve municipalities/parks and turf/lawn landscape contractors. (See the chart “Breakdown of Customer Segments”.)

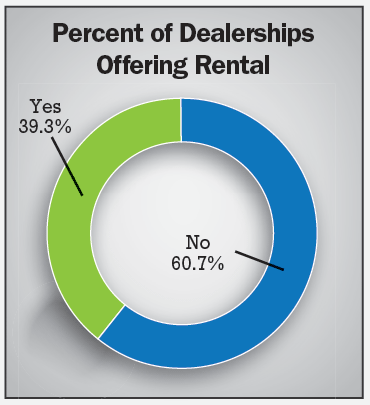

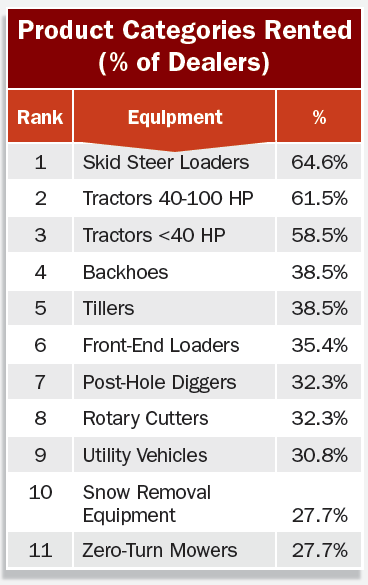

Earning Rental Business

Rental is another opportunity, but the majority of dealers do not yet have a rental department. About 40% say they rent equipment and skid steer loaders, tractors 40-100 horsepower, tractors less than 40 horsepower, backhoes and tillers make up the top 5 equipment categories rented. (See the table “Product Categories Rented”.)

The American Rental Assn. released a consumer survey report last year that dealers can put to use. For the professional contractor segment, 89% are planning to rent equipment in the next year. Location and convenience are the two largest deciding factors in choosing one rental store over another.

For the homeowner segment, when choosing one rental store over another, cost is the largest concern for customers under the age of 45, while location is more important for those over 45.

Strengthening Systems

Dealers are also shoring up their businesses in general and shared which investments are taking priority. More than 60% of the responding dealers expect to modernize or make improvements to their shops, compared with 52% last year.

This will be good news to rural lifestylers with high expectations for service at your dealership. For instance, rural lifestyler Joe Kapitany shares his perspective, “I’ve done oil changes and hydraulic fluid changes, but it’s not worth it to me. I usually rely on my dealers. Speed is the number one factor for me when it comes to maintenance and repairs.” (Read more about Kapitany and his land management projects, http://bit.ly/RLDJoeKapitany.)

About 46% of dealers expect to make improvements to their retail spaces, which matches last year’s survey. Industry consultant and RLD columnist Bob Clements comments on the relationship between your service department and retail showroom. “While most customers that come into your dealership are there for parts or service, they all will walk into and through your outside display area and, in most cases, through your showroom. The showroom becomes your showcase for current and potential new customers and represents the excitement and opportunity that customers hope to experience at your dealership and with the products you sell,” says Clements. (Learn more at http://bit.ly/RLDBobClements.)

And, about 34% will invest in business information systems, compared with 32% last year. About 90% of dealers already use a dealership management system.

Influencing Sales

Dealers also weighed in on other factors influencing sales, including brand loyalty, dealer reputation and financing. Nearly 60% of dealers say customers have a brand in mind most of the time or almost always when they visit their dealerships. That’s down just slightly from the 62% reported in last year’s survey. (See the table “Percent of Customer Visits in which a Specific Brand/Unit is Requested”.)

Dealers say many customers arrive after doing online research, which they then have to verify or clarify based on the customer’s understanding. Those conversations matter to the customer — and influence the closing of the sale. Nearly 77% of dealers say their recommendations are accepted most of the time or almost always. That rate is holding steady from last year. (See the table, “Percent of Dealer Suggested Product Recommendations Accepted".)

Word-of-mouth (WOM) recommendations are another factor influencing sales. A recent study from the Word of Mouth Marketing Assn. (www.WOMMA.org) says that WOM drives a significant portion of sales, across categories, at an average of 13%.

Brand loyalty is something that dealers have counted on for years in the agricultural sector and a recent study showed some generational changes ahead. Osborn Barr, a marketing and advertising agency whose experts contribute to RLD, found that 78% of farm-raised 18-to-22-year-olds consider brand names important when it comes to purchasing farm products, compared to 90% of older generations. (Learn more about the study in the podcast “Generation Z’s Future in Agriculture,” http://bit.ly/RLDPodcastGenZ.)

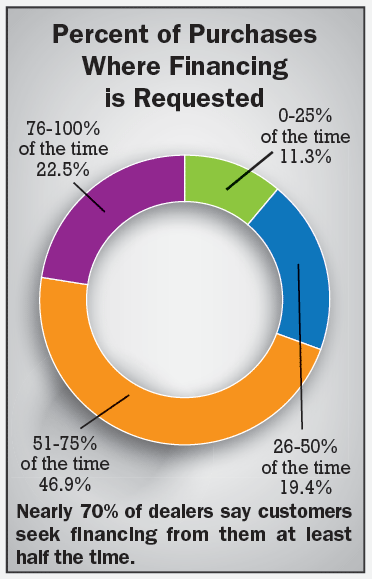

Ultimately, financing finalizes the sale, with dealers saying customers seek financing on about 70% of purchases, up from the 62% reported in last year’s survey. Dealers tell us that what’s important to them is speed of approvals and a variety of options, especially for those customers who might be less credit-worthy.

Ranking Concerns

Dealers are looking forward to a good year, but are also watching key issues. Finding good employees, healthcare programs and costs, and low sales margins are the top 3 issues that dealers are most concerned about. These are the same issues that topped last year’s list.

Dealers explain the employment dilemma in terms of the lack of applicants in general, the lack of applicants with technical experience, and the lack of applicants with motivation and a strong work ethic.

Dealers are using a variety of recruitment methods and Sara Hey, business development manager for Bob Clements International, offers other ideas. For instance she encourages dealers to watch for people that impress them at other businesses. Hand them your business card and invite them to call you if they start looking for a new position. She says not to “poach” good employees from other businesses, but to let them know you are always looking for good team members. (Learn other strategies in Hey’s webinar, “The 7 Steps for Finding and Hiring the Right Employees,” http://bit.ly/RLDFindingEmployees.)

What are you doing to help maintain strong margins throughout your dealership?

“Standard minimum margins expected on deals, need approval for low margin deals.” … “Trying to keep trade values correct.”… “Sell more attachments and wholegoods parts. Give discounts to customers who buy more because that increases profits and you’re already making the sale, so why not make more out of it!” ... “Trying to better our appearance and expand our knowledge base on equipment.” … “Open communication. Sales staff know the margins we want to make, but depending on the customer and the circumstances we may reduce our margins to get the sale. This is done after communication between staff and owners.”

“Utilizing our software system, monitoring margins and turns regularly. Spot checking to internet pricing.” … “No hassle pricing. We would rather lose the sale than lose margin. If they can sell it cheaper for the same quality & product and survive best of luck. I don’t sell cheap. I sell quality. That’s why I am a one-brand dealer. I sell only the best.” … “Differentiating our product compared to our competitors so the initial price is accepted as a good solid price.” … “Selling value packages, such as bucket hooks and rear work lights and including delivery (but price our equipment so as to include the cost of these value-added aspects). Also, provide subsidized, first routine service and free transportation on warranty related repair issues. Again, we include an average internal expense into cost calculations to take this level of service into account.”

“Looking at being very specific for the equipment offered by each manufacturer and select models that give us the highest return. Using special offers and larger buys on higher margin units.” … “Sales team pay is dependent on their margins! To maintain good margins, you can’t give the iron away. When selling new, if you make nothing, it will affect your used prices as well as potential margins.” … “Ordering quantity with pre-season discounts and terms. Paying invoices to gain term discounts. Managing pricing percentages through software.”

“Taking advantage of purchase deals such as end of line, volume or clearance. Volume ordering and free freight deals. Promote the brands and the dealership and not focus on the price.” … “Give periodic pep talks. Review financials with key people. Ask for ideas from employees.” … “We have started adding the cost of retail financing to the price of mowers and my accountant says we should add a credit card fee across the board.” … “Reducing inventory levels, improving turns, thus reducing interest. Pushing parts and service sales.”

Concerns about healthcare programs and costs linger, despite talk about the Affordable Care Act being modified — and as healthcare costs continue to rise.

Sales margins are always tight on new equipment. See what other dealers are doing to maintain margins.

Dig Deeper into the Data

A more detailed analysis by manufacturer, dealership size and other categories will be available soon in a special report and posted on www.RuralLifestyleDealer.com. Watch for an upcoming webinar on the report as well.

Energy in the Market

The rural equipment market has also been buoyed by manufacturers who are making changes to better serve you and the market. AGCO, Briggs & Stratton, Bobcat, Danuser, Echo, Generac, Husqvarna, Kawasaki Engines, Kubota, Mahindra and Yanmar all announced changes regarding renovated, new or expanded facilities.

There have been other noteworthy events as well, such as production or anniversary milestones from Briggs & Stratton, Case IH, Daedong Industrial, John Deere and Polaris.

GIE+Expo, the place where manufacturers debut their newest products and technologies, had another record-setting year for attendance and manufacturer participation.

Online Extra

Click to read an additional sidebar: What rewards or incentives do you offer to help recruit, retain and motivate employees?

All in all, rural lifestylers are ready for you — your products, parts, service and retail experience. Are you ready for them? Rob Collins, sales manager for Big Valley Tractor, the 2017 single-store Dealership of the Year, brings it down to the basics for success. He says, “I don’t have a sales pitch. I’m available and I have a good product.”

And, John Ewald, owner of Ewald Tractor, the 2017 Dealership of the Year in the multi-store category, offers this reminder about why dealers need to constantly market their offerings: “Even though we’ve been here for 60-plus years, some people don’t know who we are because they just moved here. We have to remember that we’re starting fresh with new people every year.”

Post a comment

Report Abusive Comment