Rural Lifestyle Dealer's 2018 Dealer Business Trends and Outlook Report analyzed dealer responses based on employee size. Large dealerships are more optimistic about total revenue, while small dealerships are more optimistic about aftermarket revenue. Read additional forecasts in the feature that appeared in our winter issue. For a copy of the complete report, email lwoolf@lessitermedia.com.

Dealer Takeaways

Total Revenue Forecasts

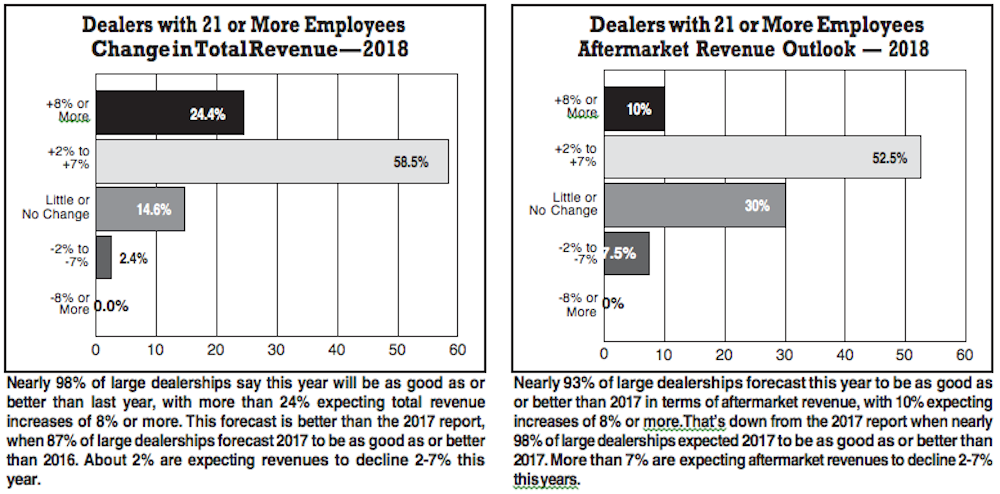

- Nearly 98% of large dealerships (21 or more employees) say this year will be as good as or better than last year, with more than 24% expecting total revenue increases of 8% or more.

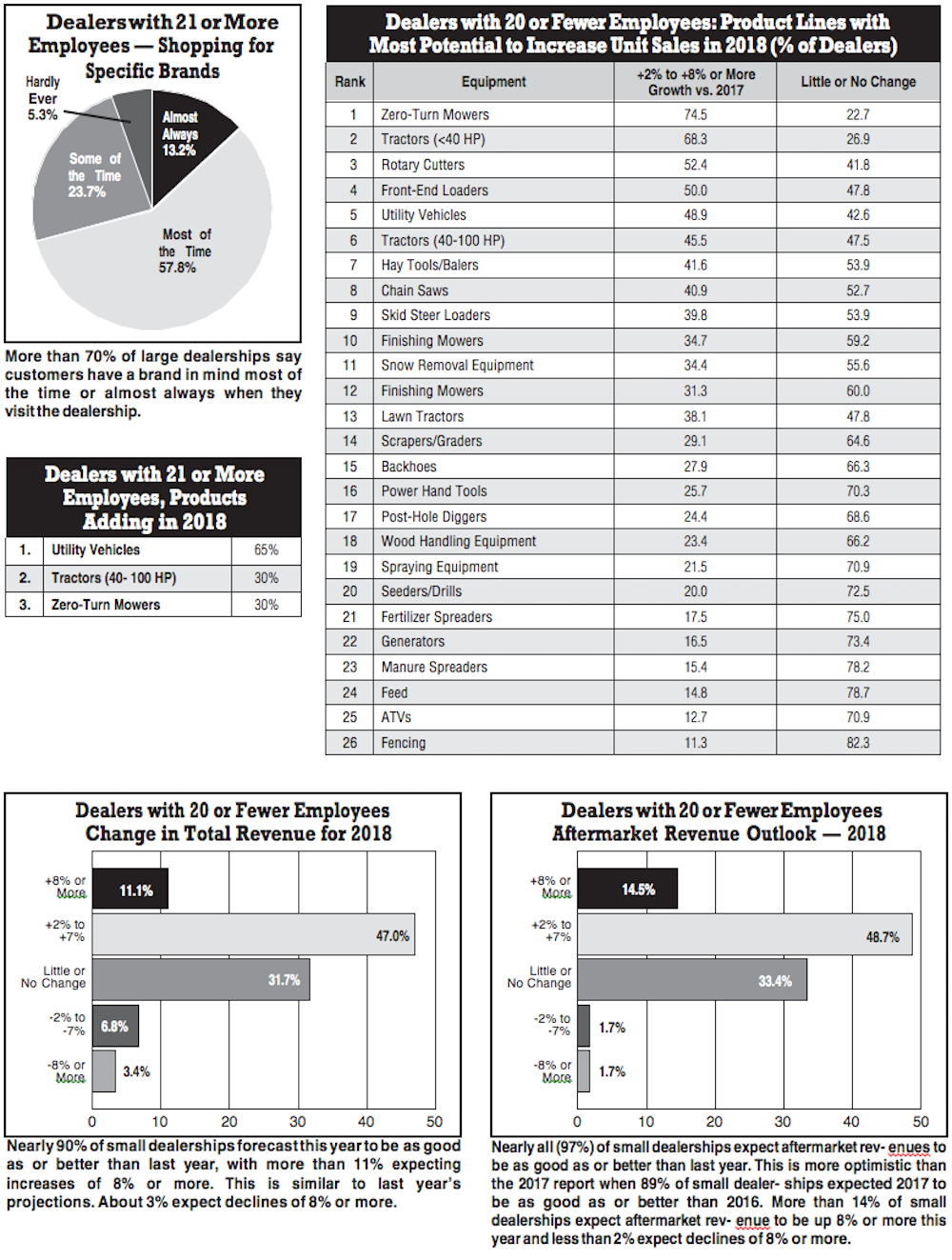

- Nearly 90% of small dealerships (20 or fewer employees) forecast this year to be as good as last year, with more than 11% expecting increases of 8% or more.

Aftermarket Revenue Forecasts

- Nearly 93% of large dealerships forecast this year to be as good as or better than 2017 in terms of aftermarket revenue, with 10% expecting increases of 8% or more.

- About 97% of small dealerships expect aftermarket revenues to be as good as or better than last year, with more than 14% expecting increases of 8% or more.

Product Potential

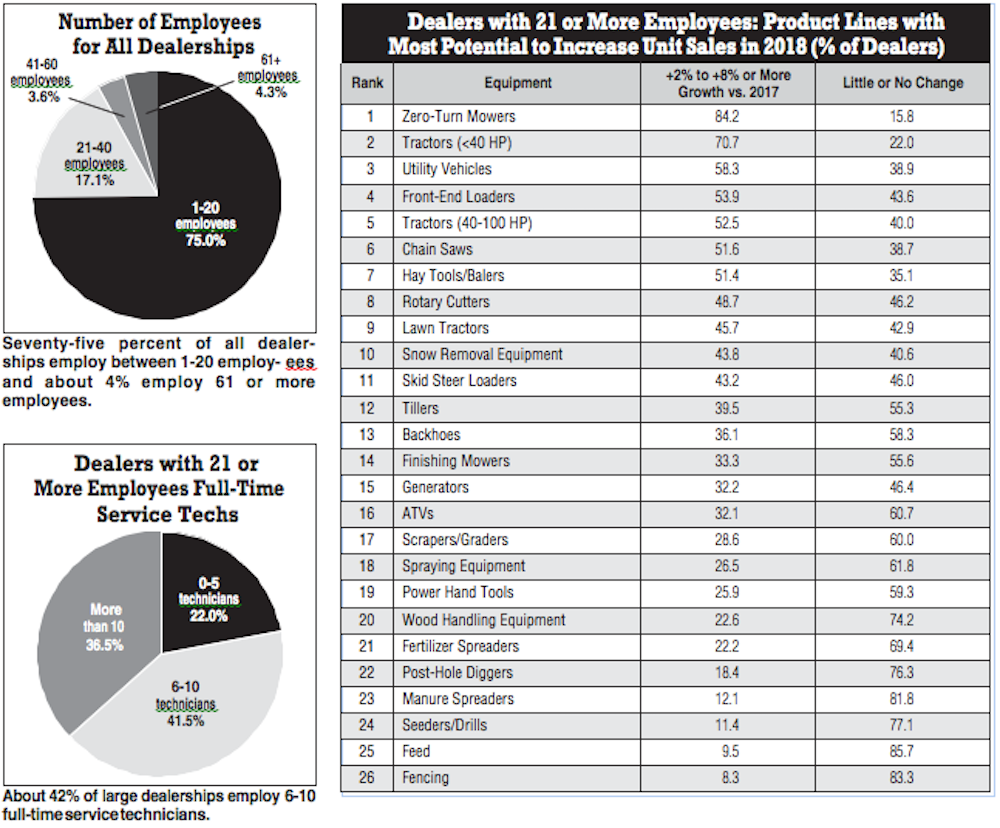

- Large dealerships rank these categories as their top 5 for increasing unit sales of 2-8% or more: Zero-turn mowers, tractors less than 40 horsepower, utility vehicles, front-end loaders, tractors 40-100 horsepower.

- Small dealerships rank these categories as their top 5 for increasing unit sales of 2-8% or more: Zero-turn mowers, tractors less than 40 horsepower, rotary cutters, front-end loaders, utility vehicles.

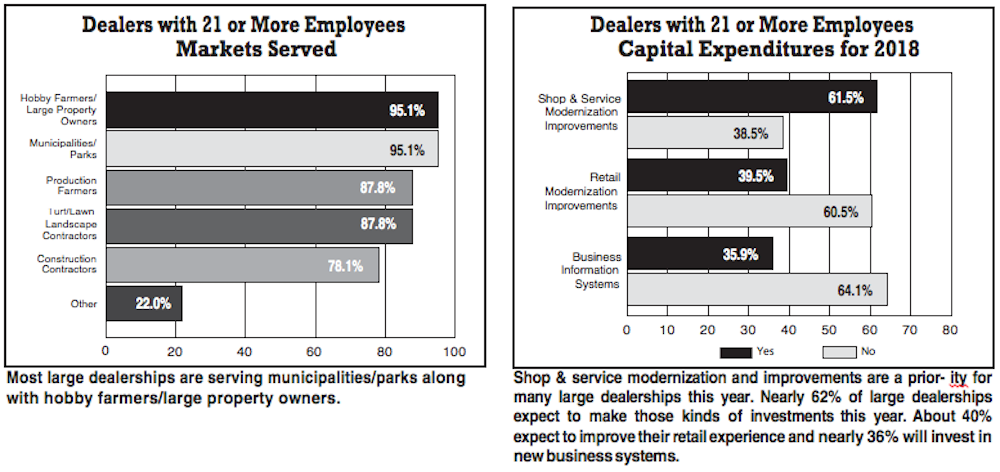

- Both large and small dealerships rank utility vehicles as the number 1 product category they will expand this year.

Post a comment

Report Abusive Comment