The rural equipment market will bring good revenues again this year, according to Rural Lifestyle Dealer’s 2019 Dealer Business Trends & Outlook Report. However, dealers are indicating some caution in their forecasts.

The 2019 report marks the 11th consecutive edition, the only one of its kind to analyze the growing rural lifestyle niche.

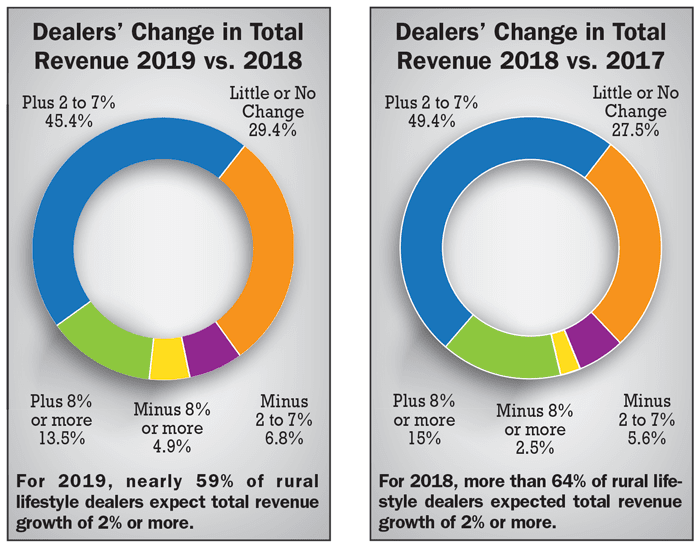

Here is the forecast for change in total revenue: Nearly 59% of rural equipment dealers expect total revenues to be up 2% or more in 2019, compared to 64% who expected similar growth for 2018. About 29.4% forecast no change, compared with 27.5% in 2018 and about 11.7% expect declines of 2% or more, compared with 8.1% last year. (See the charts above.)

Overall, about 88% of rural equipment dealers expect 2019 to be as good as or better than 2018, compared with nearly 92% in last year’s survey.

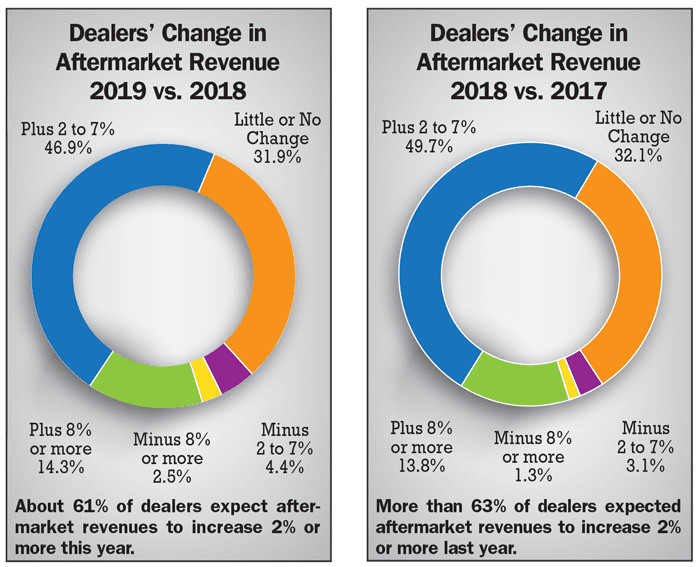

Rural equipment dealers are slightly more optimistic about aftermarket revenue. About 61% expect aftermarket revenues to increase 2% or more, compared with 63% of the respondents last year. About 31.9% expect little to no change, compared with 32.1% last year and about 7% forecast declines of 2% or more compared with about 4% last year. (See the charts below.)

Overall, about 93% of rural equipment dealers expect 2019 to be as good as or better than 2018 in terms of aftermarket revenues, compared with about 95% with the same sentiments in last year’s survey.

Compared with their production ag counterparts, rural equipment dealers are more optimistic, even when considering an improving ag economy.

A survey by Ag Equipment Intelligence, a sister publication to Rural Lifestyle Dealer, reports that nearly 45% of North American farm equipment dealers expect revenues from the sale of new equipment to increase by 2% or more in 2019. This is down slightly from the previous year (46.5%) but still up significantly from 2017, when only 22.4% of dealers projected higher revenues.

Balancing Overall Sentiments

Another way to analyze the forecasts is through the weighted average perspective, where increasing revenues are compared against decreasing revenues, with the “little or no change” responses not considered. This analysis shows some moderation from last year.

The weighted average for total revenues is 2.43, compared with 2.97 in last year’s survey. The weighted average for aftermarket revenues is 2.86 for 2019 compared with 3.10 for 2018.

Post a comment

Report Abusive Comment