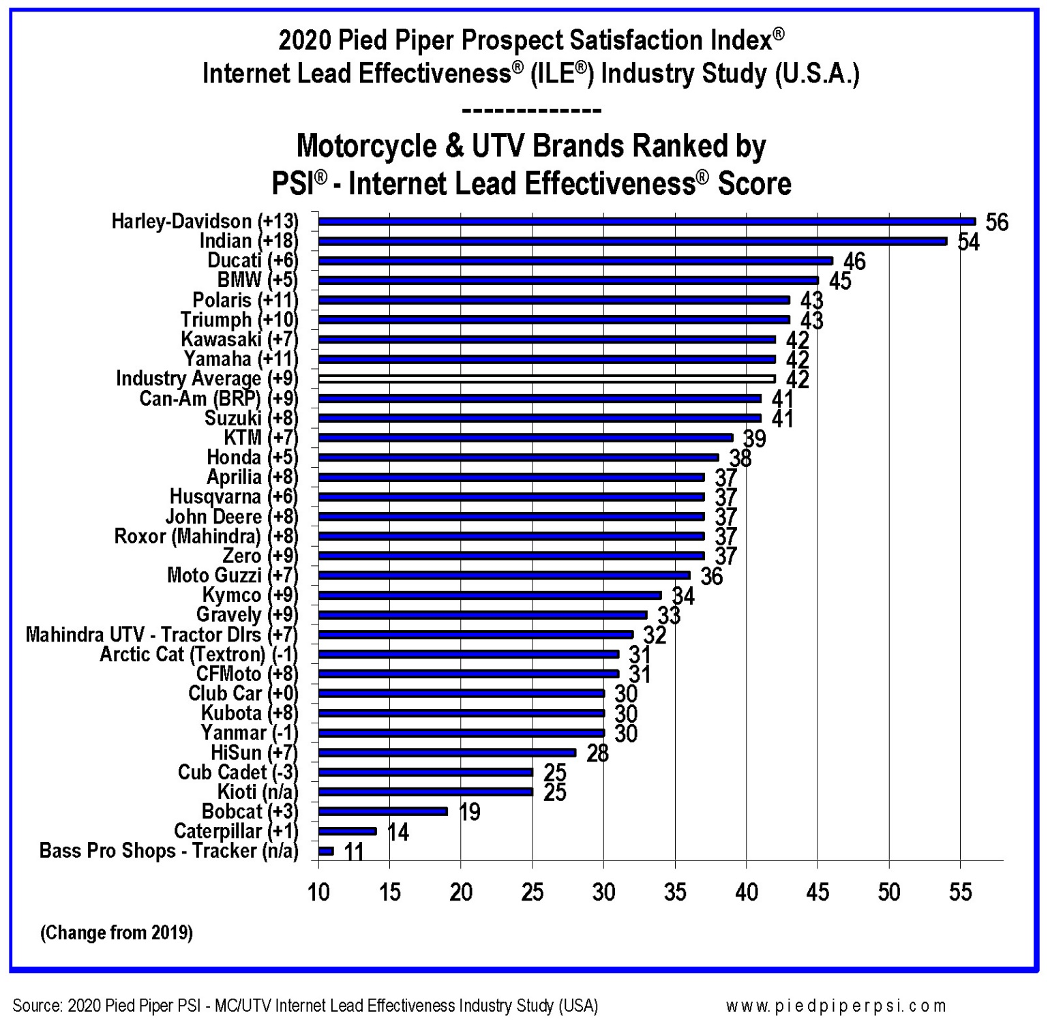

Monterey, Calif. – Harley-Davidson dealerships ranked highest in the 2020 Pied Piper PSI Internet Lead Effectiveness (ILE) Industry Study, which answers the question, “What happens when motorcycle or UTV customers visit a dealer website and inquire about a vehicle?” Dealerships selling Indian motorcycles were ranked second.

The study was completed before the appearance of the coronavirus pandemic, but in the aftermath of the pandemic dealer response to website customers has become even more critical. A recent Wall Street Journal article noted, “The new coronavirus pandemic is deepening a national digital divide, amplifying gains for businesses that cater to customers online, while businesses reliant on more traditional models fight for survival.”

Pied Piper submitted customer inquiries through the individual websites of 6,012 dealerships between July 2019 and February 2020, asking a question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone and text message over the next 24 hours. Twenty different measurements generate dealership Internet Lead Effectiveness (ILE) scores, which range from zero to 100. 13% of dealerships nationwide scored above 70, demonstrating an extensive and effective website-response process, while 36% of dealerships scored below 30, showing failure to personally respond in any way to their website customers.

The study found widespread industrywide improvement from 2019 to 2020, with the industry average ILE score increasing from 33 to 42. Brands which led the industry in improvement over the past year were Indian, Harley-Davidson, Polaris and Yamaha. Only three of thirty-three brands failed to increase their score from 2019: Club Car (Ingersoll Rand), Cub Cadet (MTD Products) and Arctic Cat (Textron).

The most basic measurement is whether a customer received an email, text message or phone call of any type within 24 hours, in response to their question. The figure for best performing brands was 97% of the time or more, while for other brands the figure was as low as 54% of the time. A more meaningful measurement is whether the customer received an email or text message answering their question within 24 hours. John Deere and Triumph dealerships were the most likely to email or text an answer to the customer’s question within 24 hours, more than 60% of the time on average, while the figure for Tracker (Bass Pro Shops), Caterpillar and Bobcat dealers was less than 25% of the time on average.

Response to customer web inquiries varies by brand and dealership, and the following are examples of performance variation by brand:

- How often did the brand’s dealerships respond by phoning the customer within one hour?

- More than 50% of the time on average: Harley-Davidson

- Less than 5% of the time on average: John Deere, Kubota, Yanmar, Gravely, Bobcat, Caterpillar, Tracker

- How often did the brand’s dealerships send a personal email response within one hour?

- More than 45% of the time on average: Triumph, BMW, Harley-Davidson, Ducati

- Less than 15% of the time on average: Tracker, Caterpillar, Bobcat, Kioti, Yanmar

- How often did the brand’s dealerships respond by sending a text message to the customer?

- More than 40% of the time on average: Harley-Davidson

- Less than 1% of the time on average: Eleven different brands

Nearly all of today’s customers first use their smart phone to shop before ever visiting a dealership in person. Pied Piper finds that most dealers today understand that responding to web customers is critical to sales success, but there is still plenty of variation in dealership behaviors. “The key to driving improvement in both web-response behaviors and sales,” said Fran O’Hagan, President and CEO of Pied Piper, “is to show dealers what their web customers are really experiencing. It’s often a surprise.”

PSI Internet Lead Effectiveness (ILE) Industry Studies have been conducted annually since 2011. The 2020 Pied Piper PSI-ILE Industry Study (U.S.A. Motorcycle/UTV) was conducted between July 2019 and February 2020 by submitting customer internet inquiries directly to a sample of 6,012 dealerships nationwide representing all major brands. Examples of other recent Pied Piper PSI studies are the 2020 PSI-ILE U.S. Auto Industry Study (Toyota brand was ranked first), and the 2019 “PSI for EVs” U.S. Auto Industry Study (Tesla brand was ranked first for selling in-person). Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations—in-person, internet or telephone—as tools to measure and improve the sales effectiveness of their dealerships. For more information about the fact-based Prospect Satisfaction Index (PSI) process, go to www.piedpiperpsi.com.

Post a comment

Report Abusive Comment