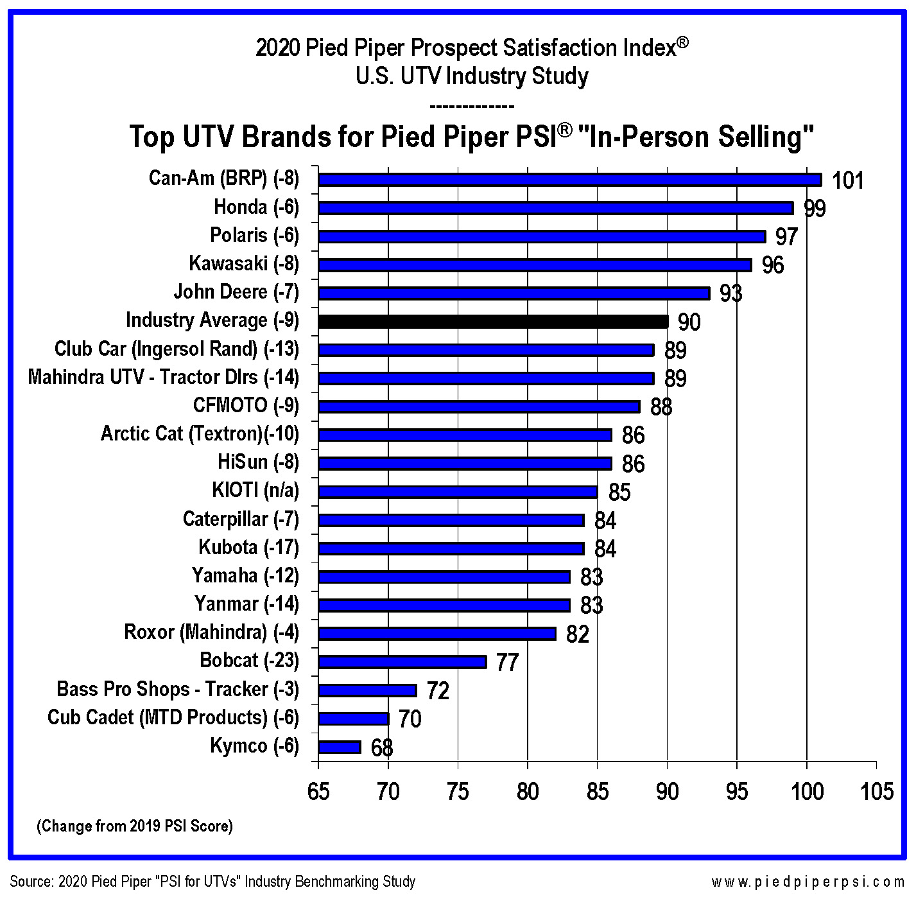

Monterey, Calif. – COVID-19 drove industrywide changes in dealership sales behaviors, but for the third year in a row, BRP’s Can-Am dealerships were the top ranked UTV brand, reports the newly released 2020 Pied Piper Prospect Satisfaction Index (PSI) U.S. UTV Industry Study. The study measured in-person treatment of Utility Task Vehicle (UTV) shoppers who visited a dealership between April and August 2020, reflecting the impact of COVID-19 on dealership behaviors. Rankings by brand were determined by the Pied Piper PSI process, which ties “mystery shopping” measurement and scoring of dealership behaviors to industry sales success.

Honda and Polaris were ranked second and third. PSI scores for all brands declined from 2019 to 2020, reflecting the industrywide impact of COVID-19 on dealership behaviors. Brands with the largest declines were Bobcat (-23), Kubota (-17), Yanmar (-14) and the Mahindra Tractor Dealers (-14).

PSI scores range from 49 to 150, and dealerships that score over 130 sell effectively, also delivering an excellent customer experience. 29% of UTV dealerships in the 2020 study scored above 130, a decline from the 37% figure from the 2019 study. Dealerships that score under 75 miss most opportunities to help their customer buy the right UTV. 52% of UTV dealerships in the 2020 study scored below 75, an increase from the 42% figure from the 2019 study.

The industry average PSI score declined from 99 in 2019 to 90 in 2020. In 2020 only the Can-Am dealers, with an average score of 101, scored above last year’s industry average score of 99. Comparing dealership behaviors in 2020 to 2019, those behaviors that decreased the most include offering a test drive, giving the customer printed materials, giving compelling reasons to buy from this dealership, mentioning unique vehicle features, and asking the customer for contact information. In contrast, examples of the few behaviors that increased from 2019 to 2020 include asking whether the customer had visited the dealer website, and specifically asking the customer to buy.

Sales behaviors vary considerably from dealership to dealership, and also from brand to brand, including the following examples selected from the 60+ PSI measurements:

- Suggest sitting inside. Dealers selling Honda, Can-Am, HiSun, Kawasaki and Polaris were most likely to encourage customers to sit inside the vehicle, on average more than 51% of the time. Dealers selling Cub Cadet, Kymco and Bobcat were least likely to encourage customers to sit inside the vehicle, on average less than 30% of the time.

- Suggest going through the numbers. Dealers selling KIOTI, Can-Am, Honda, Polaris and John Deere were most likely to suggest going through the numbers or writing up a deal, on average more than 50% of the time. Dealers selling BPS-Tracker and Cub Cadet were least likely to suggest going through the numbers or writing up a deal, on average less than 25% of the time.

- Mention financing options. Dealers selling Kawasaki, John Deere, Roxor and Honda were most likely to mention the availability of financing options, on average more than 63% of the time. Dealers selling Kymco, Caterpillar and BPS-Tracker were least likely to mention the availability of financing options, on average less than 35% of the time.

- Ask for customer contact information. Dealers selling Caterpillar, Club Car, Yanmar, Yamaha and Polaris were most likely to ask for the customer’s contact information, on average more than 40% of the time. Dealers selling BPS-Tracker, Mahindra tractor dealers and Kymco were least likely to ask for the customer’s contact information, on average less than 28% of the time.

- Tried to convince customer to buy a different brand. Dealers selling John Deere, Caterpillar, BPS-Tracker, Club Car and KIOTI were least likely to suggest a different brand instead, on average less than 5% of the time. In contrast, dealers selling Yamaha, Kymco, Yanmar, Can-Am and Arctic Cat were most likely to suggest a different brand instead, more than 15% of the time on average.

“Dealerships that sell effectively are enjoying record UTV sales in 2020 despite, or possibly because of, COVID-19,” said Fran O’Hagan, President and CEO of Pied Piper Management Company, LLC. Some dealerships have been using COVID-19 as a reason to skip sales steps. To be fair, some sales steps require additional effort because of COVID-19, such as cleaning off vehicles following a test drive. Customers were offered UTV test drives on average only 22% of the time in 2020, compared to 32% of the time in 2019. However, other behaviors, such as asking the customer how the vehicle will be used, or providing a vehicle walk-around presentation also declined from 2019 to 2020. “More customers than ever are shopping for UTVs in 2020, and the most successful UTV dealers will be the ones whose sales teams work hard to be helpful to those customers.” said O’Hagan.

The 2020 Pied Piper Prospect Satisfaction Index U.S. UTV Industry Study was conducted between April 2020 and August 2020 using 1,456 hired anonymous “mystery shoppers” at dealerships located throughout the U.S. Examples of other recent Pied Piper PSI studies are the 2020 Internet Lead Effectiveness (ILE) UTV/Motorcycle Industry Study, in which the U.S. Harley-Davidson dealer network was ranked first, and the 2020 Internet Lead Effectiveness (ILE) Auto Industry Study, in which the U.S. Toyota dealer network was ranked first.

Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations — in-person, internet or telephone—as tools to improve the sales effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the proprietary PSI process, go to www.piedpiperpsi.com.

Post a comment

Report Abusive Comment