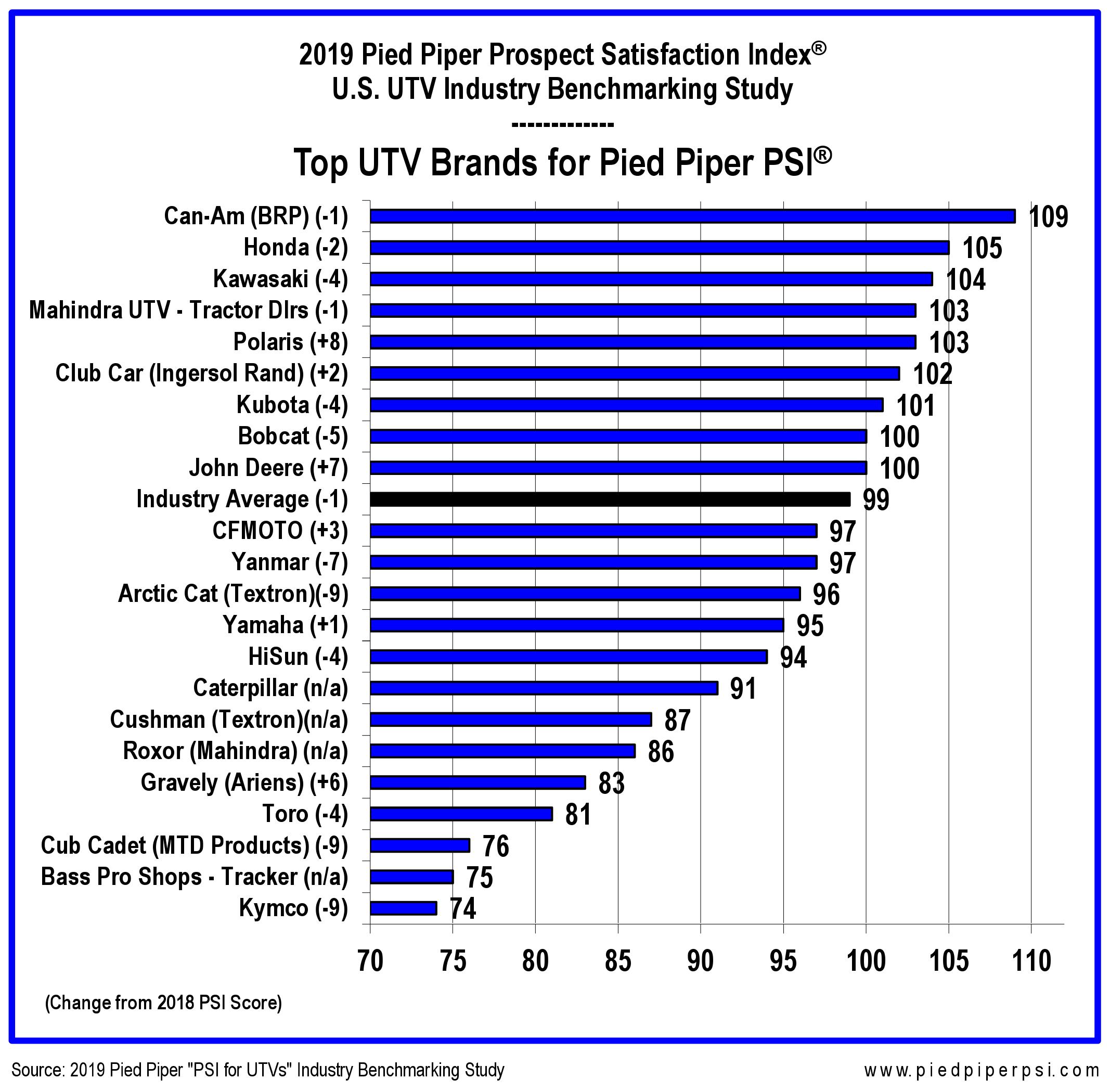

For the second year in a row, BRP’s Can-Am dealerships were the top ranked brand, reports the newly released 2019 Pied Piper Prospect Satisfaction Index (PSI) U.S. UTV Industry Benchmarking Study. The study measured in-person treatment of Utility Task Vehicle (UTV) shoppers who visited a dealership. Rankings by brand were determined by the Pied Piper PSI process, which ties “mystery shopping” measurement and scoring of dealership behaviors to industry sales success.

PSI scores range from 49 to 150, with the 2019 industry average score a 99. 37% of UTV dealerships nationwide scored over 130, selling effectively and providing an excellent customer experience. In contrast, 42% of UTV dealerships scored under 75, missing most opportunities to help their customer buy the right UTV.

Honda and Kawasaki were ranked second and third, while Mahindra and Polaris were tied for fourth. Other brands scoring above the industry average were Ingersoll Rand’s Club Car brand, Kubota, Bobcat and John Deere. Brands showing the greatest improvement from 2018 to 2019 were Polaris (+8 PSI points), John Deere (+7) and Gravely (+6). Brands with the greatest declines from 2018 to 2019 were Kymco (-9 PSI points), Cub Cadet (-9) and Arctic Cat (-9). Four brands were new to the study this year: Caterpillar, Cushman, Mahindra’s Roxor brand and Bass Pro Shops, selling their Tracker brand UTVs.

Industry average performance declined one PSI point from 2018 to 2019. Behaviors that increased the most from 2018 to 2019 included asking if the customer had visited the dealer website, attempting to set an appointment to return, encouraging going through the numbers or writing up a deal, and suggesting a test drive. Behaviors that declined the most from 2018 to 2019 included suggesting a future test drive, mentioning service convenience options, using lower cost of service as a reason to buy, and discussing features unique from the competition.

Specific sales behaviors vary considerably from dealership to dealership, and also from brand to brand, including the following examples selected from the 60+ PSI measurements:

- Suggest sitting inside. Dealers selling Can-Am, CFMOTO and Cushman were most likely to encourage customers to sit inside the vehicle, on average more than 60% of the time. Dealers selling Toro, Kymco and BPS-Tracker were least likely to encourage customers to sit inside the vehicle, on average less than 30% of the time.

- Offer a test drive. Dealers selling Yanmar, Kubota and Mahindra were most likely to offer a test drive, on average more than 41% of the time. Dealers selling BPS-Tracker, Arctic Cat and Toro were least likely to offer a test drive, on average less than 17% of the time.

- Show-off the service department. Dealers selling CFMOTO, HiSun and Club Car were most likely to show-off the service department as a reason to purchase, on average more than 34% of the time. Dealers selling BPS-Tracker, Yamaha and Roxor were least likely to show-off the service department as a reason to purchase, on average less than 17% of the time.

- Ask for customer contact information. Dealers selling Bobcat, Can-Am and Kawasaki were most likely to ask for the customer’s contact information, on average more than 51% of the time. Dealers selling BPS-Tracker, Kymco and Cushman were least likely to ask for the customer’s contact information, on average less than 34% of the time.

- Promote a brand exclusively. Dealers selling BPS-Tracker, John Deere and Bobcat were least likely to try to convert customers shopping for those brands to a different brand instead, on average less than 5% of the time. Dealers selling Toro, Arctic Cat and CFMOTO were most likely to try to convert customers shopping for those brands to a different brand instead, on average more than 26% of the time.

“Customers today complete much of their shopping online before they ever visit a dealership in person,” said Fran O’Hagan, President and CEO of Pied Piper Management Company, LLC. Fifteen years ago, customers would visit a dealership four or more times on average before buying, compared to less than two visits on average today. As a result, dealership sales teams today must work hard to be helpful to each customer, assuming it may be their only opportunity. “It’s no longer acceptable for a salesperson to act like a museum curator, saying, I’ll be over there if you have any questions,” said O’Hagan.

The 2019 Pied Piper Prospect Satisfaction Index U.S. UTV Industry Study was conducted between September 2018 and July 2019 using 2,087 hired anonymous “mystery shoppers” at dealerships located throughout the U.S. Examples of other recent Pied Piper PSI studies are the 2019 Pied Piper PSI Internet Lead Effectiveness (ILE) UTV/Motorcycle Industry Study, in which the U.S. Harley-Davidson dealer network was ranked first, and the 2019 Pied Piper PSI Internet Lead Effectiveness (ILE) Auto Industry Study, in which the BMW dealer network was ranked first.

Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations—in-person, internet or telephone—as tools to improve the sales effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the proprietary PSI process, go to www.piedpiperpsi.com.

Related story: Don't Let Your Digital Customers Become Invisible

Post a comment

Report Abusive Comment