Rural Lifestyle Dealer's annual equipment forecast finds a surge in sales confidence from North American dealers after a difficult 2009.

Just as equipment dealers in the rural lifestyle market enjoyed what some called a "generational year" of sales growth in 2008, they were faced with an equal or greater level of adversity in 2009 as the U.S. economy sunk into a historic recession.

A crisis in the housing market hit landscape contractors hard, and surging unemployment, retirement losses and tight credit meant consumers weren't spending as freely on equipment. As inventory built up on dealers' lots, most of American businesses scaled back production and laid off employees.

But there may be a light at the end of the tunnel. Results from Rural Lifestyle Dealer's (RLD) 2010 Annual Business Trends & Outlook survey shows equipment retailers are far more optimistic about equipment sales than they were a year ago.

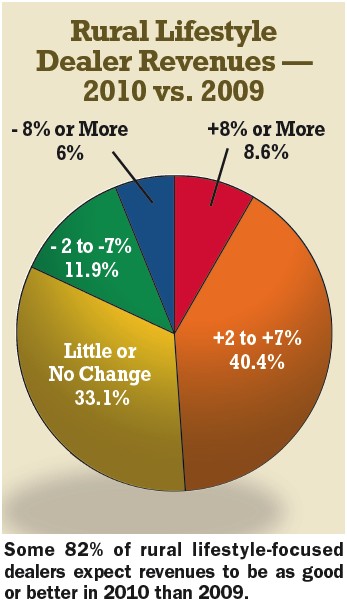

Of 260 dealers responding to the December survey, 85% expect as good or better revenues from rural lifestyle customers in 2010, with nearly half of them forecasting revenues to be up 2% or more. About 10% of those dealers believe revenues will increase by 8% or more.

Dealers' unit sales projections for 2010 are bullish for several lines of equipment, including utility and compact tractors, rotary cutters, front-end loaders, tillers and zero-turn mowers.

As Rural Lifestyle Dealer has done the past 2 years, this report focuses on the dealerships that derive 25% or more of their sales revenue from hobby farmers, large-property owners and landscape contractors. Of the 260 responses, 151 dealers earned onefourth or more of their revenue from these segments.

This year's survey shows a big jump in dealer confidence compared to 2009, when only 53% of rural lifestyle-focused dealers surveyed believed their revenues would be maintained or increase. In written comments accompanying this year's survey, equipment dealers say they're still concerned about the economy, tight credit conditions, floorplanning costs, and even the weather.

But some are looking on the bright side. "The outlook is good, as it seems our customers are starting to get back on track," writes one dealer. "It won't be 2008, but we should see growth of 3-10%, with a possibility of gaining back some margin with inventories being back in check."

"The slowdown in 2008-09 has allowed us to train our employees, to purchase shop tools and equipment at low prices. We've been able to upgrade our delivery trucks at bargain prices, too," another dealer says. "There is always an upside to a down market, so long as it does not stay down for too long."

Growth in the Market

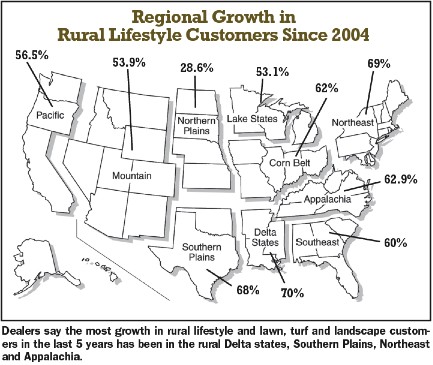

New information Rural Lifestyle Dealer assembled this year shows how the rural lifestyle market has grown over the past 5 years in the U.S. and Canada. The survey asked dealers how the number of rural lifestyle and lawn, turf and landscape customers in their area has increased since 2004.

Of all the rural lifestyle-focused dealers, 66% say the numbers of rural lifestyle and lawn, turf and landscape customers in their area has increased 5% or more since 2004. Just over 23% of dealers say that customer base has grown 20% or more.

In Canada, 55.5% of dealers have seen an increase of 5% or more in rural lifestyle and lawn/turf/landscape customers in their area, and 22.2% have seen an increase of 20% or more.

In the U.S., 42.9% of dealers surveyed saw an increase of 5% or more in this customer segment, and 17.6% had an increase of 20% or more.

When broken down by U.S. region, growth in the number of rural lifestyle customers has been hottest in the Delta States, the Southern Plains and the Corn Belt. About 35% of equipment dealers in the Delta and 24% of dealers in both the Southern Plains and Corn Belt report 20% or more growth in rural lifestyle customers. Some 60-70% of equipment dealers in the Delta, Southern Plains, Northeast, Appalachia, Corn Belt and Southeast regions have seen growth of 5% or more in rural lifestyle customers.

The slowest growth in this customer base has occurred in the Northern Plains, according to the survey, with only 28.6% of dealers reporting 5% or more growth in rural lifestyle customers. When it comes to forecasting revenue growth from rural lifestyle customers in 2010, the picture varies also by region, with anywhere from 28-59% of dealers forecasting an increase of 2% or more.

The brightest outlook is in Appalachia, where 18.5% of dealers expect revenue to increase by 8% or more and 40.7% expect a hike of 2-7%. Dealers in the Northeast and Southern Plains reflect a similar outlook, with revenue growth from rural lifestyle customers mostly in the 2-7% range in 2010 compared to '09.

Canadians More Optimistic

As was the case in Rural Lifestyle Dealer's 2009 survey, Canadian dealerships serving rural lifestylers were a bit more optimistic in their outlook for 2010 than their U.S. counterparts.

About 85% of U.S. dealers surveyed predicted revenues derived from rural lifestyle customers would be as good or better in 2010 than last year, with 46.7% calling for 2% or more growth, and 10% of dealers forecasting growth of 8% or more.

With Canadian dealers, 86% see revenues from rural lifestyle customers staying the same or growing next year, while 55.5% predict growth of 2% or more and 8.3% believe revenues will grow 8% or more.

Canadian retailers also forecast slightly higher levels of inventory and growth in their aftermarket business. They also plan to invest more to improve their dealerships' shop, retail area and business information systems.

Tractor Sales to Rebound?

As the buying public's ability to purchase big-ticket items soured during the tough economy last year, sales of compact and utility tractors also plummeted in North America. According to the Assn. of Equipment Manufacturers, sales of compact tractors (<40 horsepower) in North America have been falling every year since 2005, a continuing trend in 2009. Utility tractor (40-100 horsepower) sales in North America increased every year between 2004 and 2007, but began a downward trend in 2008 that continued in ’09.

But Rural Lifestyle Dealer’s survey shows that dealers believe a boost in unit sales of both compact and utility tractors will occur in 2010 — although a significant portion (41-45%) of dealers still believe there will be “little or no change” in sales levels this year. More than 52% of rural lifestyle focused dealers predict unit sales of compact tractors to grow 2% or more in 2010, while 43.1% predict 2%-or-more growth in utility tractors.

Some 45% of U.S. dealers surveyed expect sales of compact tractors to increase 2% or more, and 41.5% predict the same level of growth for utility tractors.

The outlook is more optimistic for Canadian dealers. Some 48.6% project sales increases of 2% or more for compact tractors — with half of them expecting a hike of 8% or more — and 54.2% expect an increase of 2% or more for utility tractors.

Best Bets for Increasing Sales

When it comes to dealers’ expectations for unit sales, Rural Lifestyle Dealer’s forecast for 2010 is much more optimistic in nearly every product category than last year’s survey.

Sales of front-end loaders, zero-turn mowers, utility and compact tractors and utility vehicles are all projected to have increases of 13% or more in unit sales in 2010 when compared to 2009 levels, according to rural lifstylefocused dealers.

Zero-turn mowers replaced snow removal equipment atop the list of the hottest sellers for the coming year, with 18.8% of rural lifestyle-focused dealers projecting unit sales to increase 8% or more. About 94% of dealers say zero-turn mower sales will be as good or better than 2009, compared to 72.7% of dealers predicting those results for 2009.

Utility tractors zoomed from near the bottom of 2009’s list to third place this year. About 91% of rural lifestyle focused dealers expect unit sales of utility tractors to be as good or better in 2010, compared to only 61.1% at this time in 2009. Over 43% of dealers see measurable growth of 2% or more in this tractor category.

The biggest turnaround in the dealers’ outlook for 2010 is with compact tractors. More than 88% of dealers believe sales will be as good or better this year, compared to only 58.3% predicting the same outcome in 2009. Nearly 16% of dealers see sales increases of 8% or more for 2010.

There were double-digit increases in dealer optimism for increased unit sales in several other product categories, including lawn tractors, rotary cutters, front-end loaders, posthole diggers and tillers.

The outlook for sales is also better this year for fertilizer spreaders, seeders/drills, manure spreaders, backhoes, ATVs and skid steers, although the projections for these are more conservative.

Snow removal products and chain saws were ranked first and second, respectively, in 2009 by dealers in terms of projected unit sales increases, but they fell to the middle of the pack for this year. Big snowstorms since December could test the forecast for snow removal equipment.

This year, Rural Lifestyle Dealer added electrical generators to the list of equipment being rated for sales potential. While there’s no 2009 data for comparison, 86.6% of dealers surveyed believe unit sales of generators will be as good or better in 2010, with 23.2% looking for 2%-or-more growth.

Dedicated Selling Efforts

Selling equipment to rural lifestylers presents some special challenges, especially to traditional farm equipment dealers who may not fully understand the buying habits of the hobby farmers or large-property owners walking through their doors.

Many dealerships wishing to gain market share in the rural lifestyle equipment sector have dedicated salespeople working with these customers.

For the second year, Rural Lifestyle Dealer asked dealerships how many full-time sales people they employ, and how many of them were focused on selling equipment to rural lifestylers.

This year’s survey found 90% of rural lifestyle-focused dealerships have an average of 1-5 salespeople, with 2.1 of them devoted to working with rural lifestylers. That’s a decline from the 2009 survey, when RLD found an average of 3.2 rural lifestyle “specialists” on board at dealerships.

A major advantage dealerships have over competing retail models like box stores is the opportunity for salespersons to be experts on the equipment they’re selling. And it’s still clear that dealers play a big role in customers’ choices.

Some 76.8% of dealers surveyed for 2010 say customers accept their salesperson’s recommendation about a specific product brand “almost always” or “most of the time.” That figure is down slightly from 77.7% for 2009.

About 67% of customers follow the dealership’s recommendations on brands “most of the time,” the 2010 survey shows.

The number of customers “almost always” having a brand or unit in mind has increased to 7.3% in 2010, compared to 6.4% in 2009. While it’s clear that a lot of uncertainty still exists with buyers, in all likelihood this indicates customers are researching equipment and brands before coming into a dealership.

Spending & Inventory Plans

Rural Lifestyle Dealer’s survey shows equipment dealers plan a stable level of investment in 2010 to improve their dealerships, with an emphasis on shop and service — another area a dealership can differentiate itself from the competition. The survey shows 55.7% of dealers plan to increase their investment in shop and service by 2% or more, and 12.1% plan to increase spending by 8% or more in that area.

About 46% of these dealers plan a 2% or more investment hike in the showroom, with 10.8% planning an 8% or higher investment.

Nearly 36% of dealers will increase investment by at least 2% in business information systems (BIS), with one-third of those dealers planning to hike BIS investment by 8% or more.

When it comes to dealers’ inventory plans for 2010, 53% expect to maintain the same level as last year, and 13.9% say there will be an increase. Some 33% plan a decrease in inventory.

Aftermarket Growth in ’10

While wholegoods sales recover from a major slump last year, many rural lifestyle-focused dealerships expect to grow aftermarket revenues in 2010. This follows the logic of industry experts who’ve been urging dealers to invest in the profit-generating service end of their businesses and build some cushion for the up-and-down cycles of equipment sales.

Some 53% of rural lifestyle-focused dealers expect their aftermarket revenues to increase by 2% or more this year, while 11.3% are planning revenues increases of 8% or more. Just under 36% expect “little or no change” in aftermarket revenues this year, and only 11.2% are predicting a drop of 2% or more.

In the U.S., 54% of dealers expect aftermarket revenues to increase 2% or more this year. The numbers are nearly identical among Canadian dealers.

Outlook for the Majors

Rural Lifestyle Dealer also asked equipment dealers to identify which tractor brands they offer customers. The information was broken out for AGCO/Massey Ferguson, Case IH, John Deere, Kubota and New Holland.

Participation by the majors was fairly uniform, with Deere and Kubota dealers each accounting for 22% of the surveys returned, followed by New Holland (21%), AGCO/Massey Ferguson (19%) and Case IH (11%). Dealers for Kubota, Deere, New Holland and AGCO, which manufactures the Massey Ferguson brand, all predicted similar growth in sales revenue from rural lifestylers in 2010, while Case IH’s outlook was a bit higher.

Anywhere from 43-46% of dealers for AGCO, Kubota, Deere and New Holland believe revenue from that market segment will grow by 2% or more.

But 55.6% of Case IH dealers predict a 2% or more increase over 2009, including 47% of Case IH dealers calling for a revenue hike of 2-7%.

Kubota (13.4%) and Deere (10.3%) had the most dealers predicting sales revenue growth of 8% or more from rural lifestyle customers in 2010. Looking at market segmentation among the majors, the dealerships carrying Kubota had the largest share of revenue coming from hobby farmers and large-property owners at 31.6%. Those dealers also had the highest percentage of revenue coming from municipalities/park districts (9.2%) and turf/lawn/landscape contractors (12.3%).

Dealers carrying AGCO equipment reported the second-highest amount of revenue coming from hobby farmers and large-property owners at 30.9%, followed by those with New Holland (28%), John Deere (19%) and Case IH (16.6%). Survey responses also suggest that dealerships with a tractor line will focus on their aftermarket business in 2010. Over 40% of those dealerships predicted aftermarket revenues will grow by 2% or more this year. Dealers carrying Case IH (20.6%) and Kubota (21.2%) reported aftermarket revenue projections of 8% or more this year.

All of the majors’ dealers are predicting growth in the sales of compact and utility tractors in 2010. Deere’s dealers are the most optimistic with 56.1% of dealers calling for 2% or more growth in unit sales of compact tractors, and 59.1% expecting the same level of growth for utility tractors.

Kubota and AGCO were nearly as optimistic, with more than 40% of dealers calling for 2% or more growth in unit sales of compact and utility tractors.

Predictions from Case IH and New Holland were more conservative.

Dealers Looking Ahead

After one of the most trying times that rural lifestyle-focused dealers have seen in a decade, most have high expectations for 2010, but it won’t come easy.

Nearly half of the dealers participating in this year’s survey say their biggest challenge coming into 2010 will be customer credit availability for their customers and working business capital.

Not only have lenders tightened up requirements for borrowers, but dealers fear rising interest rates will stunt any expected sales growth as already cautious buyers may continue to put off planned purchases.

“Customers being able to get credit for financing because of the economy,” and “Getting customer financing approved,” are typical comments offered when the dealers were asked what their biggest 2010 challenges would be.

One dealer says rising interest rates could be the last straw for his dealership. “If interest rates stay low or affordable, I’m expecting a slight upturn. If interest hits double digits, we’re done.”

Leftover equipment inventory also remains a significant concern for dealers. Only 13.9% of dealers plan to increase inventories over what they stocked last year. Some 53% say they’ll hold inventory levels close to last year’s figures. About 33% will carry less inventory than in 2009.

“Inventory has stacked up and needs to be moved,” says one dealer. “Incoming inventory is at the same or lower price than our aged inventory.

Because we didn’t move it last year, we’ll take a bigger hit than normal to move it now. After what’s happened this past year, we’ll be changing how we handle aged inventory.”

But several other dealers fear that if the economy turns around quicker than anticipated, they’ll be unable to get the equipment they need when they need it.

“Our supplier’s current inventory levels and production schedule are scaled back to very low levels,” says one dealer. “If there’s an unexpected increase in demand for the spring season, we’ll be unable to respond.”

Post a comment

Report Abusive Comment