Dealers are again seeing strong growth for the rural lifestyle market, with nearly 84% of dealers expecting revenues to be as good as or better than last year, according to Rural Lifestyle Dealer’s 2015 Dealer Business Trends & Outlook survey. The growth forecast for 2015 is significant especially considering 2014 was already a strong year.

Economic forecasts support dealers’ positive outlooks. Homebuilding trends are a key indicator for the rural lifestyle market and in December, builder confidence in the market for newly built, single-family homes was at 57 on the National Assn. of Home Builders/Wells Fargo Housing Market Index.

Any number over 50 indicates that more builders view conditions as good than poor. “Members in many markets across the country have seen their businesses improve over the course of the year and we expect builders to remain confident in 2015,” says NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del.

Unemployment rates are another factor to watch. Rates have declined 1% since the beginning of 2014, according to the Bureau of Labor Statistics. The unemployment rate released early this January was 5.6%.

After steadily trending lower since reaching 60.5 in June 2013, in November the Rural Mainstreet Index from Creighton University increased to 50 from October’s 43.4.

John Deere expects sales of turf and utility equipment in the U.S. and Canada to be anywhere from flat to up 5% for 2015. This compares with its forecasts for agricultural machinery sales in the U.S. and Canada to be down 25-30% for 2015.

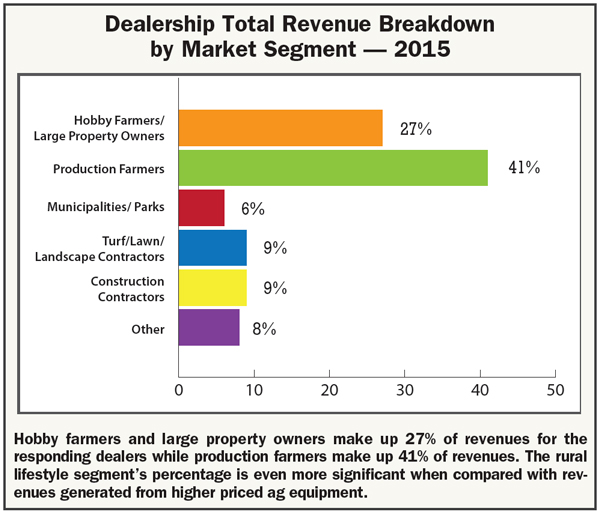

The rural lifestyle market is the place to be to take advantage of a customer base that continues to grow and to weather uncertainties in the ag economy. Our 2014 Dealership of the Year, Armstrong Implements, has had double-digit sales growth for 3 years selling compact equipment to a traditional agriculture customer base. An Illinois dealer says that farmers in his area are spending money on compact equipment and holding off on purchasing higher priced larger machines. It all comes down to running a solid dealership, says an Ohio dealer: “Control costs while picking up market share by concentrating on the customers’ needs vs. the manufacturer’s desire to just sell the product.”

Defining Market Potential

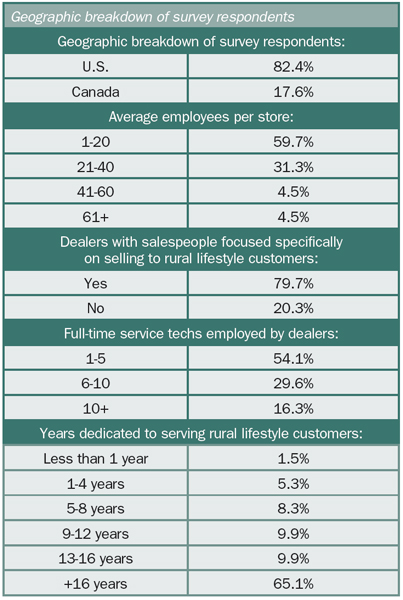

The rural lifestyle market continues to grow at a rapid pace. Slightly more than 13% of dealers say their market has grown by 20% or more in the last 5 years. That compares with about 7% indicating similar growth last year. And, new dealers are tapping into the market, with 6.8% joining the segment in the last 4 years. Many dealers are already established and 65.1% say they’ve served the rural lifestyle segment for 16 or more years.

The number of dollars being spent is growing right along with the market size. When asked what change they expect from rural lifestyle and landscape customers in 2015 vs. 2014, nearly 84% expect revenues to be as good as or better than last year. In 2014, 91.4% expected steady to increasing revenues for last year. The number of dealers who are very optimistic, expecting growth of 8% or more, increased to 8.1% from 7% last year. However, more dealers than last year think they may face declining revenues of 2-8% or more — 16.2% this year compared with 8.6% last year.

The weighted average scale indicates some caution for the coming year. In a weighted average, the forecasted increasing levels of business are compared directly with the forecasted decreasing levels of business and the “about the same” or “flat” responses are not considered. The weighted average for 2015 revenues is positive at 1.6%, but down from the 2.4% that was forecast for 2014.

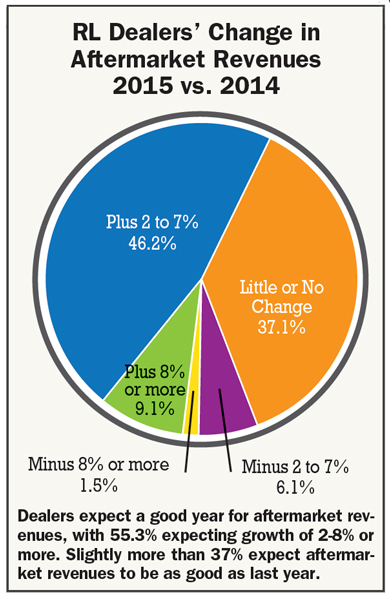

Dealers say revenues from aftermarket sales should be strong in 2015, with 55.3% expecting increases of 2% or more. Nearly 1 in 10 dealers think growth could be as high as 8% or more. That’s down slightly from last year when 59.8% expected aftermarket revenues to increase and about 13% expected increases of 8% or more. A large group, 37.1% of dealers, expects a repeat of last year’s good aftermarket revenue stream. The amount of dealers who think aftermarket revenue could decline is at 7.6%, slightly higher than 6.3% last year. (See chart on page 12.)

On a weighted average scale, dealer forecasts for aftermarket revenues are still strong at 2.4%. Last year’s weighted average was 2.8%.

Products Driving Growth

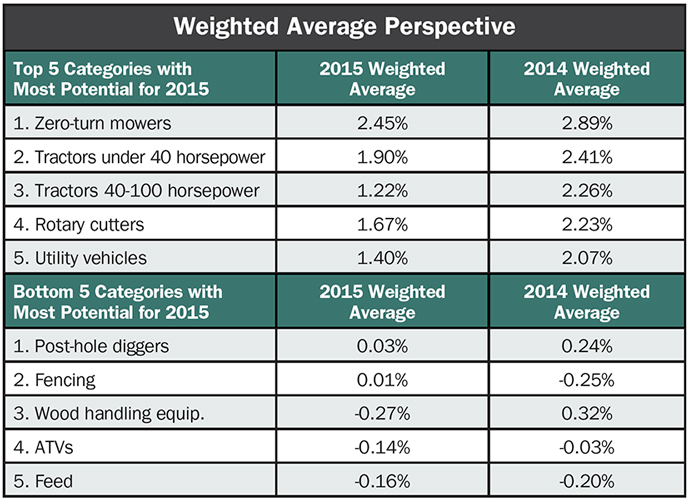

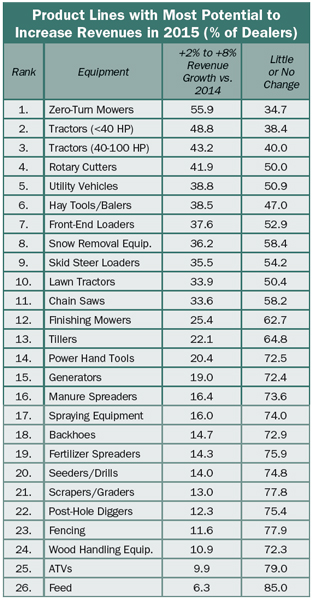

The survey ranks the potential of 26 product categories and for yet another year, rural lifestyle dealers link the greatest revenue potential to zero-turn mowers. More than half of the dealers in the survey (55.9%) expect zero-turn mower sales to grow 2-8% or more. That’s a strong ongoing statement following last year, where 64.9% of dealers forecast similar growth.

The other equipment in the top 5 also ranked in last year’s top 5, with some switching of positions. More than 48% of dealers expect revenue from tractors under 40 horsepower to increase 2-8% or more with 38.4% expecting little to no change from last year. Tractors in the 40-100 horsepower range ranked #3 with 43.2% of dealers expecting revenues to increase 2-8% or more and 40% expecting steady revenues. Rotary cutters ranked #4 and utility vehicles rounded out the top 5. About 42% of dealers expect rotary cutter sales to increase 2-8% or more and half of dealers say their cutter sales will be similar to 2014.

In terms of utility vehicle sales, 38.8% expect increases of 2-8% or more and 50.9% of dealers expect little to no change from last year. (See table on page 21.)

The weighted average perspective, looking at the positive vs. the negative forecasts, shows the top 5 categories (zero-turn mowers, tractors under 40 horsepower, tractors 40-100 horsepower, rotary cutters and utility vehicles) as all remaining positive in terms of revenue for 2015.

However, dealers’ level of optimism is slightly down from last year. Tractors in the 40-100 horsepower category had the greatest change in the weighted average perspective, down 1% from last year. (See table on page 10.)

Dealers list post-hole diggers, fencing, wood handling equipment, ATVs and feed at the bottom of the list of 26 categories in terms of revenue potential. In terms of weighted averages, forecasts for these categories, with the exception of fencing, are down from last year, as well.

Expanding Lineups

Like any retail business, top dealers find ways to promote repeat business — and encourage “window shopping.” Keeping inventory fresh with new products is one way to accomplish that and manufacturers oblige by constantly offering new lines and new models. In fact, some dealers say it can be difficult to keep up with the constant stream of models. Regardless, new is necessary and dealers share what they’re planning to add in 2015.

Watch These Economic Indicators

The ag equipment market is coping with lower commodity prices, weak global demand and the increasing value of the dollar, but other economic indicators show opportunities for rural lifestyle dealers, says Ernie Goss, Ph.D., MacAllister Chair and professor of economics at Creighton University.

Goss says rural lifestyle dealers should watch these numbers in particular: wage growth from the Bureau of Labor Statistics (BLS) and 10-year U.S. Treasury rates. The January 2015 BLS report showed that over the year, average hourly earnings have risen 1.7%, which is well below expected and optimum forecasts, according to Goss.

“For the lawn and garden market, there are some real keys with wage growth growing healthier and fuel prices coming down. This could be very important for the buying of consumer durables. They can make do with an old lawn mower, but when things look better, they’ll buy.

“The short-term interest rates are moving a bit higher as we move through the first half of the year — and they could move a bit faster than what we are currently thinking they will do, but the long-term interest rates remain fairly low,” Goss says.

After steadily trending lower since reaching 60.5 in June 2013, in November the Rural Mainstreet Index increased to 50 from October’s 43.4. Goss has published the Rural Mainstreet Index report each month since 2005. He surveys community bank presidents and chief executive officers from Colorado, Iowa, Illinois, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming. Their feedback is reflected in an index that measures from 0-100. An index below 50 is negative growth; 50 is neutral; and above 50 is positive growth.

“Things have stabilized and numbers are getting a little better off the record lows. We’re probably going to continue seeing much of the same,” he says.

Goss says other issues affecting the ag economy include federal policies related to the EPA’s “Waters of the U.S.” rule of the Clean Water Act, production of biofuels, regulations on rail transport and the administration’s stance on the Keystone oil pipeline.

One concern dealers have raised — finding qualified workers — is something Goss says is a perennial concern in rural areas. Competition for qualified workers from oil and gas companies has made the situation worse. “If oil prices move down to the sub $60 per barrel level and stay there for some time, some of the skilled workers in places like North Dakota may move to other regions.”

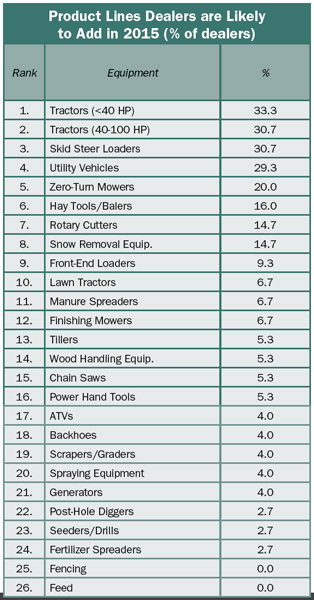

Zero turns topped the list of the product lines with the most potential, and they also made the top 5 list of products dealers plan to add in 2015. The top position, however, goes to tractors. More than 33% of dealers (33.3%) plan to add tractors in the under 40 horsepower category. Tractors in the 40-100 horsepower range and skid steer loaders tie for the #2 position, with 30.7% of dealers planning to add those categories to their lineups this year. Nearly 30% of dealers plan to add utility vehicles in 2015. (See table on page 21.)

When compared with 2014, the top 5 products to add for this year matches last year, although zero-turn mowers dropped in position.

One “mover” to watch: snow removal equipment. This category made both the top 10 list of products with the most revenue potential and the products dealers are likely to add in 2015. More than 36% of dealers expect revenue growth of 2-8% or more for snow removal equipment. That’s up from 23.3% of dealers who expected similar growth last year.

The jump is justified after extreme winters over the last several years. The 2013-14 winter season, with its brutal polar vortex weather pattern, set new records for snow and cold temperatures. And, this winter season began early with record lows across much of the U.S. in November, followed by record snowfalls — more than 7 feet of snow covered the Buffalo, N.Y., area.

Investing in Facilities

Dealers plan to invest in their shop and service departments to ensure they have the resources to support their current and new product lineups. Nearly 70% are planning capital expenditures for shop and service modernization. That level of investment follows last year when nearly the same percentage of dealers planned to invest in shop and service department improvements.

Dealers are also planning to invest at the front of the dealership, with nearly half (45.8%) planning capital expenditures to modernize and improve their retail space. That’s down from last year when about 54% planned similar improvements.

And more investments are on the horizon, with more than one-third of dealers (36.6%) planning capital expenditures for business information systems. Last year, more than half were expecting to invest in dealer software.

These strong investments show that dealers are ready to do what it takes to keep their businesses successful. Investments during years of growth show optimism and commitment to the market for the long term.

Monitoring Concerns

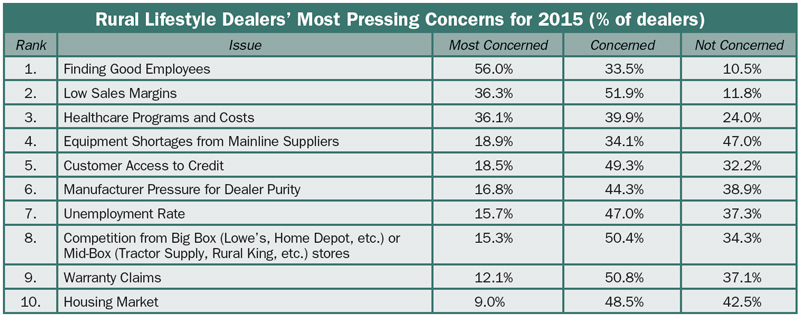

The survey tracks sentiments on 10 topics, asking dealers to rate based on their level of concern. Fifty-six percent of dealers say that finding good employees is the challenge they are most concerned about this year. Several dealers have shared their frustrations over competing with the booming oil and gas industry and the high wages that most dealers can’t match. More complicated equipment could be another factor in terms of both selling and servicing equipment that incorporates more and more technology.

Low sales margins are the second most pressing concern according to 36.3% of dealers — and a tough one to deal with. Dealers have to find a price that brings profit and still convinces the customer to buy. Rural lifestyle dealers also may face unrealistic price expectations from customers who may be more familiar with big box prices. Concern over low sales margins ranked #3 last year.

Healthcare programs and costs is the #3 most pressing concern for about 36% of dealers, down from its #1 spot last year. The Affordable Care Act compliance deadline was Jan. 1 for employers with 50 or more full-time employees and full-time equivalent employees, so these dealers should have programs in place. However, paying for the programs now becomes the challenge for dealers.

Equipment shortages from mainline suppliers, listed by 18.9% of dealers, and customer access to credit, listed by 18.5% of dealers, complete the top 5 list of issues garnering the most concern. They replace last year’s fourth and fifth issues, which were competition from big box stores and the unemployment rate.

Concern over big box competition, a perennial top concern of dealers, saw the biggest shift, dropping from #4 in 2014 to #8 this year. Maybe the declining concern reflects the overall optimism of dealers or that they have adapted to big box competition. This trend will be interesting to watch as manufacturers continue to incorporate large retailers into their sales strategies.

For instance, this past year, Hustler Turf announced it will now sell certain models at Lowe’s and Home Depot. Polaris announced a new twist on the strategy with its partnership with the Costco Auto Program for its Polaris, Victory and GEM products. Those products will be on display inside select Costco warehouses, showing a discounted price for Costco members and then referring members to a participating dealer for purchase.

Leveraging Your Advantage

There are many factors outside a dealer’s control that influence success, but customer relationships are one factor they can control. Dealers report positive figures on that front. First, brand awareness is strong, thanks to an educated rural lifestyle segment and increased manufacturer mass market advertising, such as Kubota’s new “We Are Kubota” campaign for 2015.

Choosing the Next Stage of Growth

Rural Lifestyle Dealer’s 2015 Dealer Business Trends & Outlook survey asked dealers to share their strategies for the next stages for their dealerships and whether growth would come through new locations or by expanding offerings at their current location.

Many dealers believe their future is based right where they are. A Missouri dealer says, “We’re not looking for added locations. We have learned more and more customers want to do business with single-store locations because they can talk to management anytime they visit. It’s a value-added benefit to be a single store and we are selling this feature. The best thing happening to our business is ‘mega-dealer brand strategy’ by the competition. They are driving business to us at a record pace.”

A Wisconsin dealer says, “We can grow in our own market area. Additional dealerships are not a magical ticket to growth or success. Seeing more ‘buy one and then close one’ antics all the time.”

A dealer from New York says this: “One quality dealership — well managed — that successfully addresses the needs of a primary area of responsibility is sustainable. Personnel, extended lines of supervision, overheads, financial commitments and competition may strain the strength of the core store. A single independent store has a more nimble response and correction period, while holding more direct control over its destiny. While some have been successful in multiple store ownership, most seem susceptible to independent prophesy rather than synchronistic prosperity.”

A Pennsylvania dealer explains this about his expansion: “Our growth is tied more to expanding our business to include another service person/parts person. We want to focus more on satisfying our customers and to keep them coming back to our location for future purchases and recommending us to other people they know.”

A single-store dealer in Illinois also thinks growth will come through parts and service revenue. “We are one of the holdouts — a single store dealer, but the big boys are making it harder and harder to keep it that way. I just have a hard time seeing all the multi-store mentality. You lose all the personal factor with the customer in the big store environment. Customers are like family, we all know them by name. We try to grow by providing above average customer service and having parts on hand. The parts business is where our growth has been. This year our parts sales will increase by almost 15%. Not leaps and bounds, but when you’re talking over $1 million in parts, it is a sizable increase.”

Other dealers say that adding locations is their plan for success. A New Brunswick dealer says, “Scale is critical to being/staying competitive.”

A Texas dealer says, “We plan to focus in the next 2-3 years on our location, then acquire additional locations in the area. We want to secure sales and service in a larger area and it’s only possible with multiple locations that are strategically placed around the target area.”

Finally, there’s this comment from a dealer in Indiana: “Yes, we will look to expand our facilities and also are always looking to expand our footprint. We are a long-term player and intend to continue to grow.”

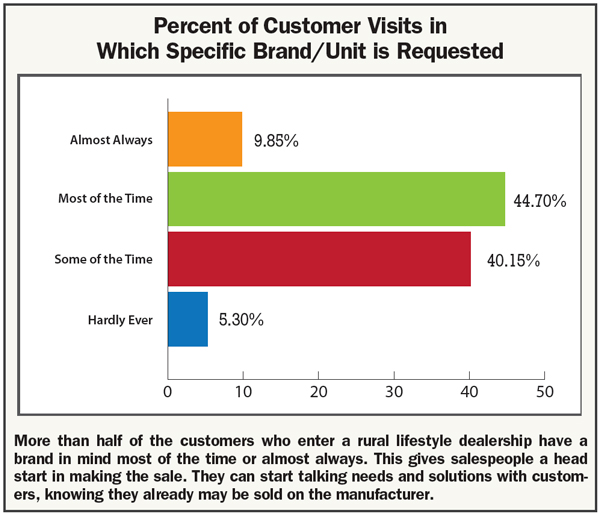

Dealers say more than half of customers (54.6%) arrive at their dealership with a specific brand or unit in mind either most of the time or almost always. That compares with similar numbers for 2014, when 59.4% of dealers reported the same brand awareness. (See chart on page 14.)

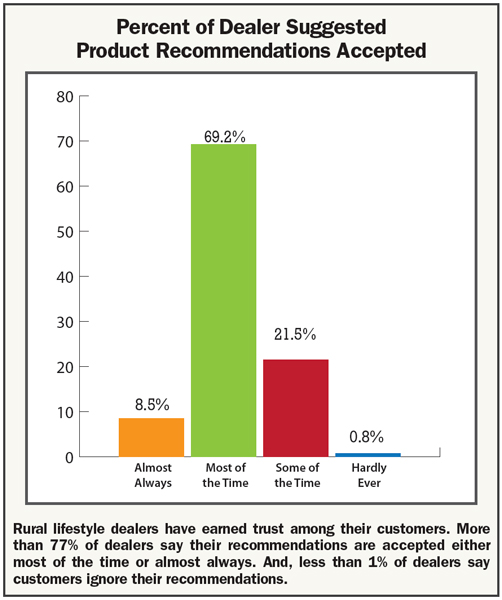

Dealers are converting that interest into sales because of their expertise and relationships. Dealers say that nearly 78% of customers accept their product recommendations most or all of the time. And, dealers have been able to maintain that high level of respect. Last year, dealers said that about 76% of customers accepted their product recommendations most or all of the time. (See chart on this page.)

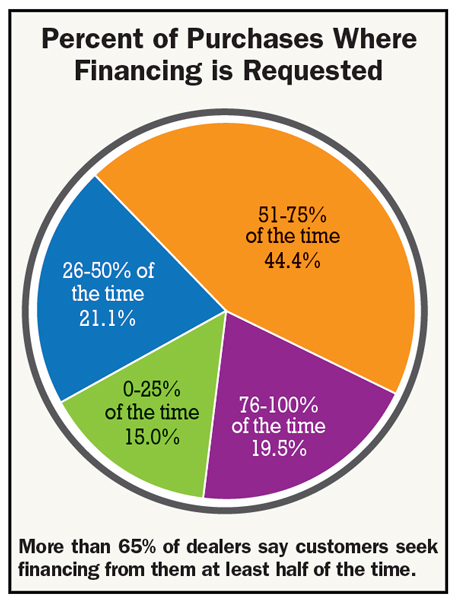

The final seal on the deal is financing. According to 65.5% of dealers, customers seek financing from them at least half of the time. That’s slightly higher than the 60% rate last year. (See chart on page 16.) Dealers can win when they’re part of the complete “life cycle” of the purchase — from brand awareness to product availability to financing options.

In a November survey from the Equipment Leasing & Financing Foundation, 22% of survey respondents believed demand for leases and loans to fund capital expenditures would increase for the following 4 months.

Expanding Product Segments

The industry’s main event, GIE+Expo, held each October in Louisville, Ky., underscores dealers’ optimism. The number of exhibits, 675 in 2014, was a 6% increase from 2013 and registrations at more than 19,000 people were up 11% over 2013. The event showcased three trends:

• Manufacturers continue to incorporate technology to improve fuel efficiency, serviceability and functionality

• The introduction of equipment for new segments is part of the “one stop shop” strategy for many manufacturers

• UTVs are the “hot ticket” item, with equip-

ment manufacturers partnering with UTV

manufacturers to add the vehicles to their offerings for spring

Technology is going beyond engines and dashboards and extending to things like tires and mobile applications. John Deere announced the Michelin X Tweel Turf airless radial tire is now available for its commercial ZTrak mowers. Cub Cadet demonstrated a Bluetooth application for its XT Enduro series of lawn tractors that alerts owners about maintenance.

What Would You Change About Your Manufacturer?

Dealers sounded off to that question in Rural Lifestyle Dealer’s 2015 Dealer Business Trends & Outlook survey. Many of the responses were related to inventory ordering requirements and delivery times. A dealer in New York says, “Seems like all manufacturers are trying to run ‘lean and mean’ just-in-time inventory. That’s good on paper, but does not allow for quick opportunities like rain in late summer or snow.”

A dealer in Illinois says, “Lead time on ordering tractors … they have to be ordered 6-8 months ahead of time. Seems like it always happens that you’ll have a run on a particular model right after you last ordered and you won’t have enough on order. I have learned in the small tractor market you’ve got to have a lot full of tractors to get people to stop in.”

Others were concerned about the business requirements from manufacturers. A dealer in Ohio says, “Manufacturers are requiring more work to be a certified dealer. Some of this is beneficial and some of it is over the top and a waste of time. Some manufacturers are pushing more costs on to dealerships and shrinking margins. We still have a business to run and need to take care of customers. Sometimes manufacturers lose site that at the dealership we answer to the customer first.”

A Wisconsin dealer shares this perspective on manufacturer demands: “They threaten us with market share performance when we always do well and they know that market share alone is not grounds for termination. Manufacturers support us a little, but they demand a lot.”

Warranty work is another area in which dealers are at odds with manufacturers. A Kansas dealer says, “The flat labor rate for warranty repairs has no basis in shop reality. The time is not relative to the actual work that needs to be done. New equipment is different than a unit that is 2 years old. Dirty, gummed up and hard to diagnose equipment is not being timed for the dealer to capture his real costs. Manufacturers do not pay for diagnoses, they only cover the repair. Retail prices should be used for reimbursement of warranty parts. We have to buy the part or stock the part and should not have to reduce the profit when using the part on a manufacturer’s warranty repair.”

A dealer in New York says that manufacturers are saturating the market “…too many models to select from and customers get confused. They do not want to make a mistake about their purchase and walk out the door overwhelmed. I have had potential purchasers actually purchase a brand with less selection.”

Comments from another New York dealer summarize overall dealer sentiments: “Manufacturers need to realize that we can only succeed if we work together. We have to communicate successful and unsuccessful product offerings in our market areas and establish credible goals for both sides of the relationship. Dependable supply chains and delivery targets must be met for a dealership to serve its customer base better and earn respect within the marketplace.”

Those manufacturers with entries into new segments included Billy Goat with its new Plugr brand of aerators, allowing the company to expand beyond its traditional fall clean-up products. Toro announced its acquisition of the BOSS snow and ice management business from Northern Star Industries.

Facts & Figures

About 2015 Survey Respondents

The following information was provided by dealers who participated in Rural Lifestyle Dealer’s 2015 Dealer Business Trends & Outlook survey. It is compiled to provide our readers and other interested parties basic demographic data on the equipment dealer universe serving the hobby farm, large property owner and lawn and landscape segment. (Percentages=Dealer Responses)

UTVs are the big push in reaching new customer segments. Gravely is branding a new category with its Atlas JSV (job site vehicle) that it developed with Polaris. Exmark and Toro unveiled their new UTV models in partnership with Arctic Cat. Hustler purchased a European equipment line and Mahindra recently announced its partnership with Intimidator.

Funding Growth

USDA recognizes the power of the small ag segment. The 2014 Farm Bill provides $30 million annually to the Farmers Market and Local Food Promotion program, up from the $10 million provided annually for the previous program. The Specialty Crop Block Grant Program is now receiving $72.5 million annually to promote fruit and vegetable production, compared with the $52 million that had been allocated. USDA also established new resources for organic farmers, including funding the Organic Cost Share program at $11.5 million annually.

The European market is taking advantage of the growth in the U.S. For instance, exports from Italian equipment manufacturers increased 23.6% for the first 8 months of 2014, compared with the same time frame in 2013. Italian trade agency executives cite Italy’s “simple machines” as a niche advantage and they expect to target their efforts beyond just the east and west coasts into states such as Texas, Colorado, Tennessee and Georgia.

Dealers are also aggressively funding growth beyond equipment sales and service through offering rental equipment. In this first year of measuring the trend, nearly half of dealers (45.2%) say they rent equipment, with tractors in the 40-100 horsepower range and skid steers topping the list of equipment offered for rent.

Trending Up

There’s no doubt that rural lifestyle dealers are optimistic and industry barometers support that optimism. What’s more, manufacturers are banking on demand by expanding their product lineups. Customers are seeking out those brands — and they trust you to help them make the right purchase. That’s a winning formula for your dealership.

Post a comment

Report Abusive Comment