Dealers selling to rural lifestylers think 2016 will be another good year, with significant growth forecast for revenue at a time when the production ag equipment market is experiencing declines by as much as 20% or more.

This is according to Rural Lifestyle Dealer’s 2016 Dealer Business Trends & Outlook survey, the magazine’s ninth annual survey and the only one of its kind in the industry.

The market is diverse and includes small acreage farms, hobby farms, large property owners, landscapers and light construction contractors — and production farmers turn to compact equipment as well. This formula of serving the rural equipment buyer is a profitable one as more than 88% of dealers throughout North America expect total revenues to be as good as or better than last year, according to the survey. That optimism follows the 2015 survey when nearly 84% expected total revenues to be as good as 2014. (Jump to the charts below)

Dealers have good reason to be optimistic as the economy overall is sending good signals. For instance, 2015 started and ended with an unemployment rate of about 5%, according to the Bureau of Labor Statistics. Economists consider that level a fully employed economy. The retail and hospitality sector, professional and business services and health care sectors all experienced job gains. Perhaps there is even good news in statistics about the average hours worked, about 34.5 hours. That leaves plenty of time for rural lifestylers to play and work on their properties.

New home construction, another good indicator for the market, is also positive. Over the last few months, builder confidence as measured in the National Assn. of Home Builders/Wells Fargo Housing Market Index has been near 60 with 50 being neutral. NAHB Chief Economist David Crowe said in the December report, “With job creation, economic growth and growing household formations, we anticipate the housing market to continue to pick up traction as we head into 2016.”

|

Another potential industry barometer, the Green Industry & Equipment Expo (GIE+Expo), a leading trade show for the industry, saw registrations up 11% in 2015 and the number of exhibitors increased 4%.

Here is a closer look at how dealers are defining optimism in their own stores.

Trending Up

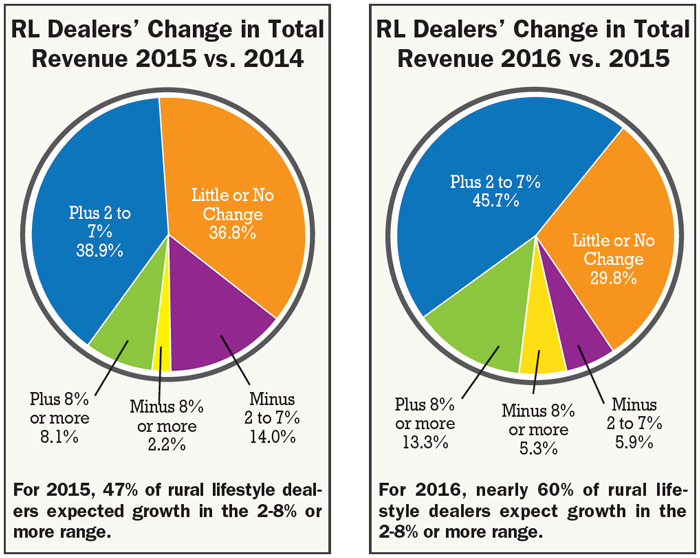

Rural lifestyle dealers are strongly positive about 2016. Nearly 46% of responding dealers expect revenues to increase 2-7%, compared with about 39% who expected similar increases for 2015. More than 13% expect revenues to increase by as much as 8% or more in 2016, compared to 2015 when 8% of dealers expressed that high level of optimism. Nearly 30% are expecting this year to be as good as 2015, compared with 37% in last year’s survey.

|

There are fewer dealers this year than last year who are pessimistic about sales. About 11% expect revenues to decline 2-8% or more, compared with more than 16% who forecast similar declines for 2015.

Another way to view the numbers is to look at the weighted average scale, where the forecast increasing levels of revenue are compared with the decreasing levels of revenue and the “about the same” responses are not considered. This analysis verifies the upward trend as the weighted average for 2016 overall revenues is 2.4% compared with 1.6% for 2015 overall revenues.

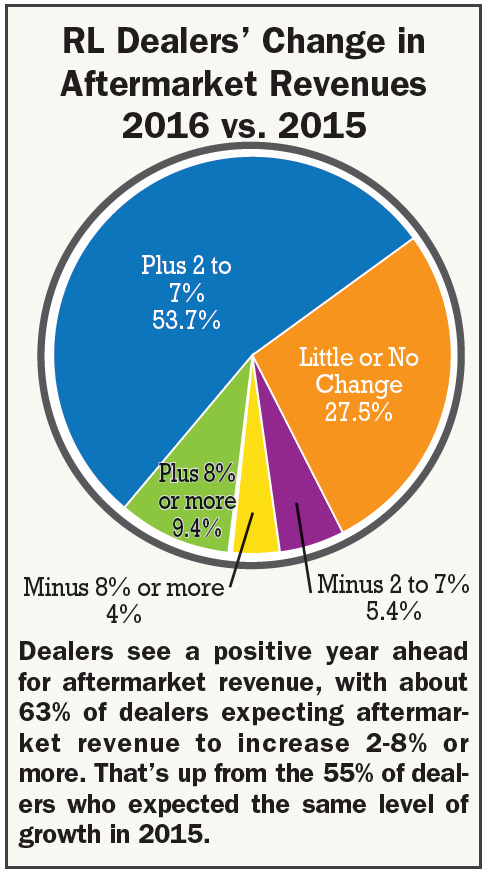

Dealers’ optimism extends to aftermarket revenues as well. More dealers than last year are expecting growth in the 2-7% range for service and parts revenues, nearly 54% for 2016 vs. about 46% for 2015. Those who are most optimistic, expecting growth in the 8% or more range, remained about steady at 9% of dealers. There are slightly more dealers expecting aftermarket declines in 2016. About 9% are expecting aftermarket revenue decreases of 2-7%, compared with about 8% in 2015. (Jump to chart "RL Dealers' Change in Aftermarket Revenues 2016 vs. 2015")

|

The weighted average, only looking at positive and negative forecasts, again bears out the optimism — 2.6% for 2016 compared with 2.4% for 2015.

|

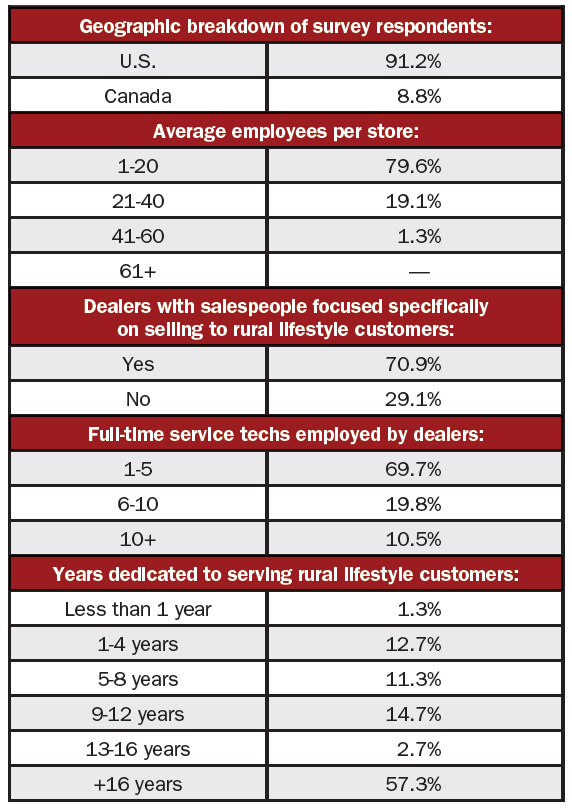

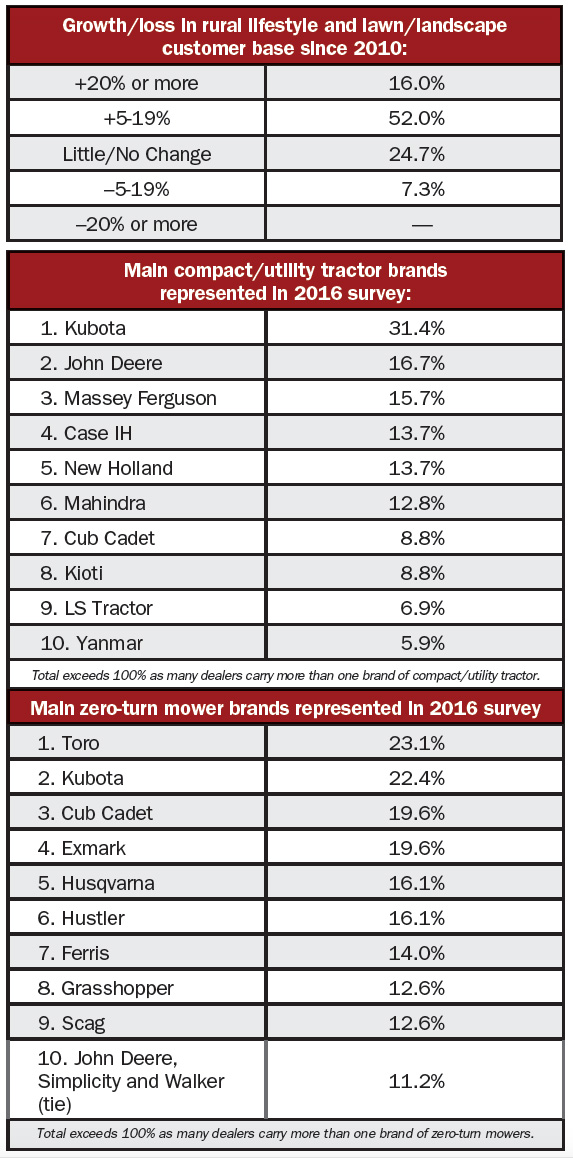

One factor contributing to the upward trend is the growing customer base. Sixty-eight percent of dealers say their markets have grown 5-20% in the last 5 years, compared with about 64% for 2015, and 16% report market growth of 20% or more, compared with about 13% last year. Fewer dealers reported a shrinking market, 7.3% compared with 10.4% in the 2015 survey. (Refer to the table "Facts & Figures About 2016 Survey Respondents" for more demographic data about the survey respondents.)

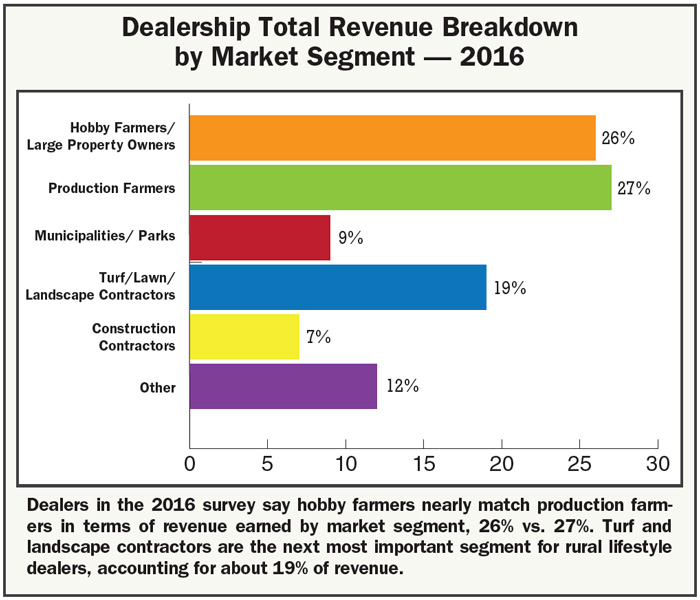

In terms of customer makeup, dealers say the hobby farm segment makes up almost as much of their base as production farms, 26% vs. 27%. Turf and landscape contractors make up about 19% of their customer base while municipalities and parks make up 9% and construction contractors make up 7%. A solid 12% of customers fall outside these categories. (Refer to the chart "Dealership Total Revenue Breakdown by Market Segment — 2016".)

The segment has a good share of established dealers, about 57% have served the rural equipment market for more than 16 years. Nearly 13% of dealerships are newer to the market, selling to rural lifestylers for 1-4 years, and are gaining the experience they need to compete.

Products Pushing Revenues

Dealer TakeawaysMore than 88% of dealers throughout North America expect total revenues to be as good as or better than last year and more than 90% of dealers expect aftermarket revenues to be as good as or better than last year. About 70% of dealers expect unit sales of zero-turn mowers to increase 2-8% or more. About 46% expect to add utility vehicles to their product lineups in 2016. Dealers are most concerned about finding good employees, followed by low sales margins and healthcare programs and costs. About 68% of dealers say their markets have grown 5-20% in the last 5 years. |

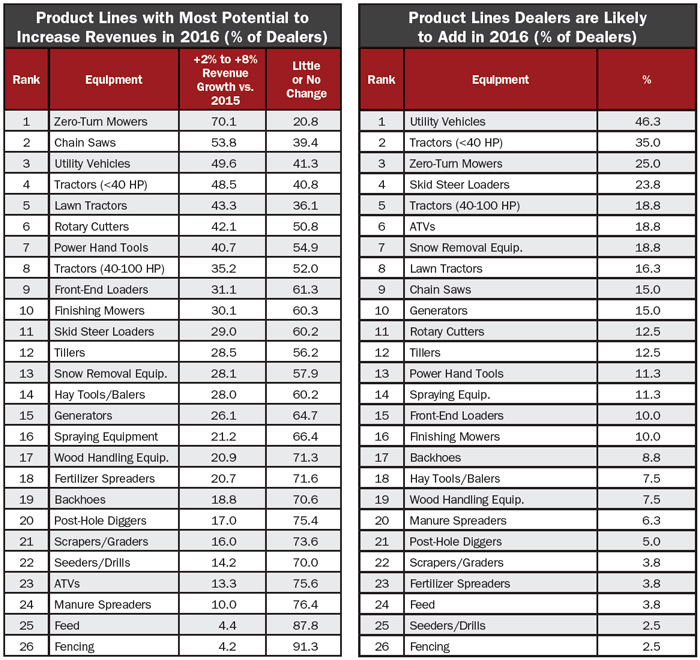

The survey asked dealers to define their optimism even further, rating revenue increases based on 26 categories — products that are typical for a rural lifestyle dealership. Zero-turn mowers captured the top spot, with more than 70% of dealers expecting increases of 2-8% or more. Chain saws hold the number two spot, with nearly 54% of dealers expecting similar increases. The products rounding out the top 5, based on percentage of dealers expecting increases of 2-8% or more, are utility vehicles (about 50% of dealers); tractors less than 40 horsepower (about 48% of dealers); and lawn tractors (about 43%) of dealers. (See the table "Product Lines with Most Potential to Increase Revenues in 2016")

Zero-turn mowers also held the top spot in the 2015 survey for growth in the 2-8% or more range. However, dealers are expressing some shifts regarding other top products. Last year, tractors under 40 horsepower, tractors 40-100 horsepower, rotary cutters and utility vehicles made up the top 5.

Bucking the TrendThe Rural Mainstreet Index, a barometer of the rural economy, was at 43.7 in the December report, below the growth neutral level of 50. This is the fourth straight month the index was below 50. The index ranges between 0 and 100. The downturn is related to lower ag commodity and energy prices and from downturns in manufacturing, according to Ernie Goss, Ph.D., MacAllister Chair and professor of economics at Creighton University. Goss surveys community bank presidents and chief executive officers in rural areas of a 10-state region dependent on agriculture and/or energy. The rural equipment market has been insulated from this downturn. “The consumer is buying, while the farmer is not,” says Goss. “I would have expected to see some spillover, such as in cities like Omaha, Neb., where the farm economy is much closer, but I haven’t seen it yet. We may see some in the months ahead, but it looks limited and will be offset by job gains in the healthcare and professional and business services sector.” Goss watches job growth figures as one of the indicators of how the economy is faring. The U.S. economy added 211,000 jobs in November, according to the Bureau of Labor Statistics. That’s lower than the 298,000 jobs that were added in October. He says dealers should watch the Federal Reserve. “If interest rates are raised more dramatically than expected, it would push up the value of the dollar even more and could increase borrowing costs for equipment.” Goss adds, “In the interview after the December hike, Janet Yellen, head of the Federal Reserve, indicated that 2016 rate hikes would likely be measured and driven by changes in economic data.” He’s also watching President Barack Obama’s actions regarding the economy. For instance, the president approved the Trans-Pacific Partnership Agreement (TPP), the trade agreement between the U.S. and 11 other countries, including Canada, Mexico and Japan. “The TPP is a game changer for rural areas,” says Goss. |

Zero-turn mowers also topped the list in terms of the category offering the highest level of optimism with nearly 23% of dealers expecting growth of 8% or more.

In looking at optimism for some of the lesser categories on the list, seeders/drills, ATVs, manure spreaders, feed and fencing rounded out the bottom of the product list.

|

|

In looking at products with negative forecasts for 2016, declines of 2-8% or more, dealers showed some split opinions regarding lawn tractors. The category made both the top 5 for revenue increases of 2-8% or more and led the categories for declines of 2-8%, with about 19% of dealers forecasting that drop. Seeders/drills, tillers, snow removal equipment and manure spreaders made the top 5 list for which dealers expect declines of 2-8% or more.

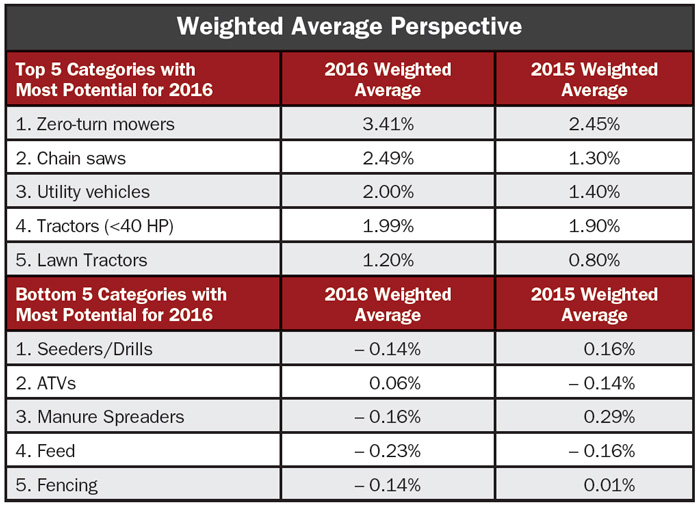

The weighted average perspective — positive vs. negative forecasts — further supports the positive outlook for all of the top 5 products with the most sales potential. For instance, zero-turn mowers and chain saws are up nearly 1% or more on the weighted average scale from last year’s forecast. (Jump to chart "Weighted Average Perspective".)

Dealers feel sales will be about the same or slightly less for those categories on the lower end of the potential list, including seeders/drills, ATVs, manure spreaders, feed and fencing.

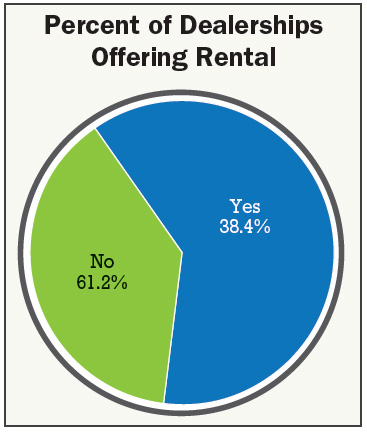

Adding Rental

Renting equipment is another revenue driver for about 38% of dealers. This is down from the 45% of dealers who said they offered rental in the 2015 survey. Last year was the first year we asked about rental, so we’ll continue to watch for trends.

Products that ranked in the top 5 for rental include skid steer loaders, zero-turn mowers, tillers, tractors under 40 horsepower and tractors 40-100 horsepower. (View the complete list here.)

Last year, tractors in both ranges and skid steer loaders made the top 5 for rental, along with backhoes and post-hole diggers.

Adding Inventory

Dealers are preparing for expected demand by making sure they have the right equipment in their showrooms and on their lots. About 46% expect to add utility vehicles to their product lineups in 2016. They’ll also expand their inventory of tractors under 40 horsepower (35% of dealers) and zero-turn mowers (25%). This aligns with the top categories for growth potential.

It’s an interesting mix regarding the other products that make up the top 5 list for products being added. Nearly 24% will add skid steer loaders and about 19% will add tractors in the 40-100 horsepower range, ATVs and snow removal equipment. Perhaps some dealers are looking to expand the range of equipment they offer. (Jump down to "Product Lines Dealers are Likely to Add in 2016".)

Snow removal equipment continues to move up regarding importance to dealers, making the top 10 list last year. Some dealers also are positive about ATVs and adding them to their lineups, while others think the product has a lower potential for sales.

Dealers remain mostly consistent with the rural equipment they added in 2015. The top 5 list last year for products being added included tractors under 40 horsepower, tractors 40-100 horsepower, skid steer loaders and utility vehicles.

Only a small percentage of dealers are adding inventory for products that are lesser in demand, but still round out a dealership’s offering. For instance, nearly 4% of dealers are adding scrapers/graders, fertilizer spreaders and feed. About 3% are adding seeders/drills and fencing.

Making Investments

Dealers are taking advantage of the strong market by investing back into their businesses and improving how they sell to and serve their rural lifestyle customers.

Dealer optimism about aftermarket revenue has encouraged many to commit dollars to that part of their businesses this year. Nearly 73% of dealers plan to make improvements to their shop and service departments. That’s up from last year when 70% of dealers planned to make similar investments.

|

Bob Clements, consultant and Rural Lifestyle Dealer columnist, shares this about the importance of a professional service department: “The service department is an important part of the customer experience with the dealership and can help capture customers who have previously purchased through the mass merchants. While both parts and sales are important, no department has more impact on both current and future customers than a service department.”

More dealers this year than last year are planning to make improvements to their retail spaces as well. Nearly 59% of dealers plan to modernize their retail presence, compared with about 46% of dealers who planned to do so in 2015.

Investments in administrative systems are also up this year. More than 47% of dealers plan to invest in their business information systems, up from about 37% of dealers who were making that investment in 2015.

Protecting Your Reputation

Another less tangible, but equally important investment is your dealership’s reputation. According to a study by the World Economic Forum, on average more than 25% of a company’s market value is directly attributable to its reputation.

|

|

|

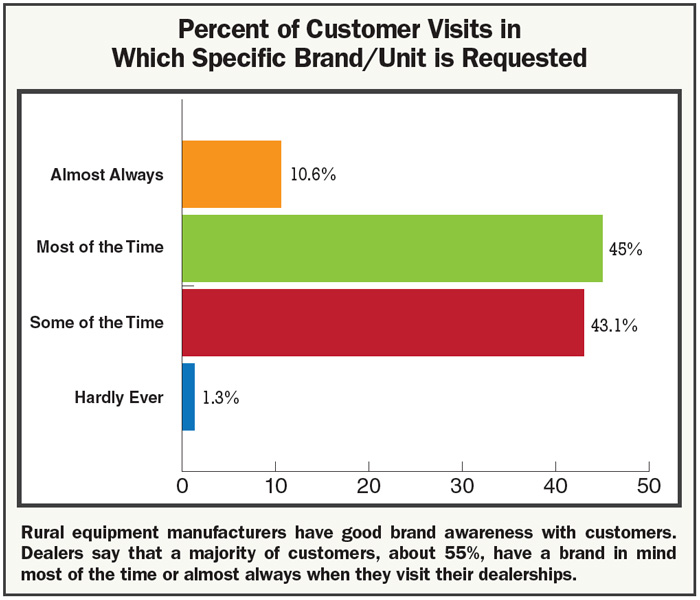

Your dealership’s reputation is linked to the manufacturers you carry and many brands are resonating with rural lifestyle customers. Dealers say that for more than 55% of visits, customers have a brand in mind most of the time or almost always. (See the chart "Percent of Customer Visits in Which Specific Brand/Unit is Requested".) That holds steady from last year when dealers noted similar findings for customer visits.

|

|

Several manufacturers are trying new ways to raise brand awareness, such as through promotional partnerships with music celebrities, support for military veterans and college sports affiliations.

For instance, Kubota sponsored the 2015 tour of country music star Alan Jackson. Kioti is supporting the Wounded Warrior Project through a promotional partnership with another country music star, Trace Adkins. Mahindra also has a military and first responders appreciation program. Kioti and Mahindra also both initiated college sports promotions in 2015.

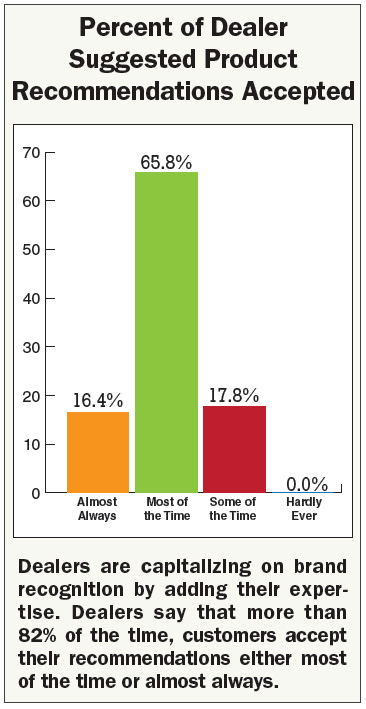

Dealers are capitalizing on brand recognition by adding their expertise. Dealers say more than 82% of the time, customers accept their recommendations either most of the time or almost always. This level of respect and trust is even higher than last year when dealers said 77% of the time customers accepted their recommendations most or all of the time. (Jump to the chart "Percent of Dealer Suggested Product Recommendations Accepted".)

Seeking Financing

In addition to expertise, customers also seek dealer support in affording the equipment they need — and want. Like many of today’s expensive purchases, the monthly payment dictates the level of purchase.

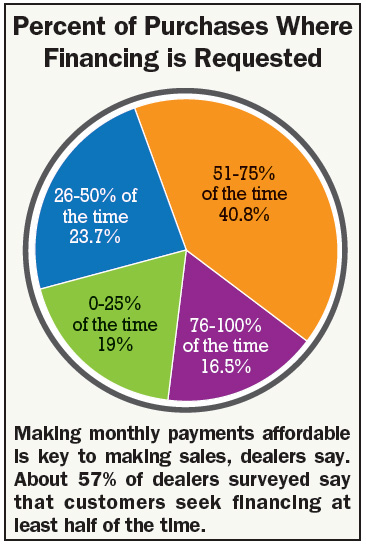

About 57% of dealers say that customers seek financing at least half of the time. This is down from last year’s survey, when about 65% of dealers said customers sought their financing help at least half of the time. (Jump to the chart "Percent of Purchases Where Financing is Requested".)

Dealers have mentioned that the industry could benefit from additional financing options, similar to the extensive network the auto industry can tap.

Watching Issues

Rural equipment dealers are making the most of the strong market, but keeping a close watch on the issues.

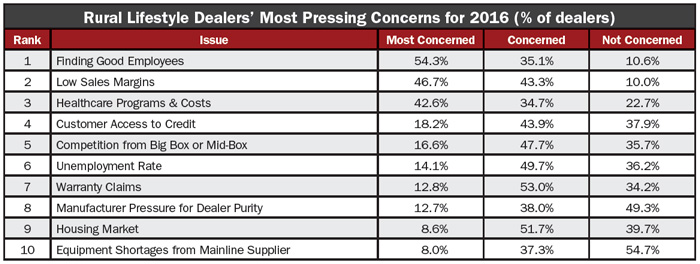

Again this year, finding good employees is the top issue that dealers are concerned about. About 54% of dealers say they are most concerned about this issue, compared with about 56% of dealers who were most concerned about this issue in the 2015 survey. (Jump to the chart "Rural Lifestyle Dealers' Most Pressing Concerns for 2016".)

In other years, competition from the oil and gas industry played a role, but that competition has subsided. Many dealers addressed this concern when we asked them the question, “What is holding you back from moving to the next level with your dealership?” Lack of vocational training in their areas and the lack of interest in seeking careers at dealerships were some of the reasons cited. (See the full story here.)

The number two and number three issues that concern dealers the most are also ongoing from last year’s survey — low sales margins and healthcare programs and costs. Many dealers are hoping to make up for the lower revenues from wholegoods with higher margins in the parts and service departments.

Healthcare programs and costs are another issue that dealers may feel they have little control over. The costs U.S. dealers dreaded when the Affordable Care Act was being introduced are now a reality. It’s a tough balancing act to offer programs you can afford, while also making sure to take care of your employees.

One issue that dealers are significantly less concerned about are equipment shortages from mainline suppliers. About 8% of dealers said this is the issue they are most concerned about compared with nearly 19% who said so last year. Perhaps dealers are improving on their inventory planning processes. Manufacturers also seem to be taking note of the issue as many have recently opened new assembly and distribution centers.

Fine-Tuning Sales

Rural Lifestyle Dealer has been tracking trends in the rural lifestyle market since its initial survey in 2008. Since then, categories such as zero-turn mowers and utility vehicles, are now dominating new product introductions at the industry’s major trade show, GIE+Expo. The trend this year was to enhance the zero-turn experience with suspension seats and more ergonomic designs. UTV enhancements this year centered on adjustable bed and seating configurations and racks and accessories.

Cost-savings were also promoted with more EFI engines as well as a wider array of battery-powered commercial equipment. And, more new models of tractors on either end of the horsepower spectrum continue to hit the market.

All in all, the economy is good and the number of rural lifestyle customers continues to expand. Manufacturers are working to stock your lots and showrooms and introduce enhancements to give you new ways to sell. You may, at times, feel overloaded in trying to keep up with sales and technician training, but it’s still a good problem to have. Your decision to pursue the rural lifestyle market was a smart one.

Click here to view bonus content

Post a comment

Report Abusive Comment