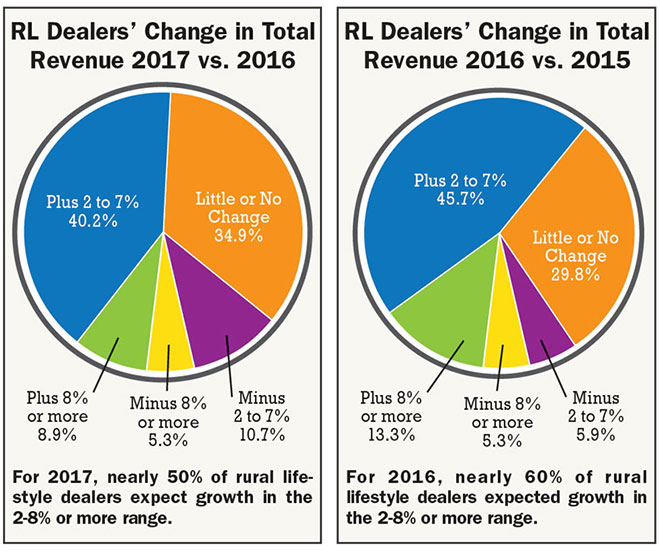

Rural equipment dealers forecast another good year for overall and aftermarket sales, according to Rural Lifestyle Dealer’s 2017 Dealer Business Trends & Outlook survey, the magazine’s 9th annual. Despite the economic and social turbulence of an election year, these optimistic forecasts follow a very strong year for growth in 2016. Eighty-four percent of dealers think 2017 will be as good as or better than 2016 for total revenue and more than 90% think aftermarket revenue will also be as good as or better than last year. This compares with last year’s survey in which more than 88% of dealers expected 2016 to be as good as or better than 2015 for total revenue and more than 90% expected aftermarket revenue to be as good as or better than 2015. (Refer to the charts below and RL Dealers' Change in Aftermarket Revenue and Breakdown of Customer Segments).

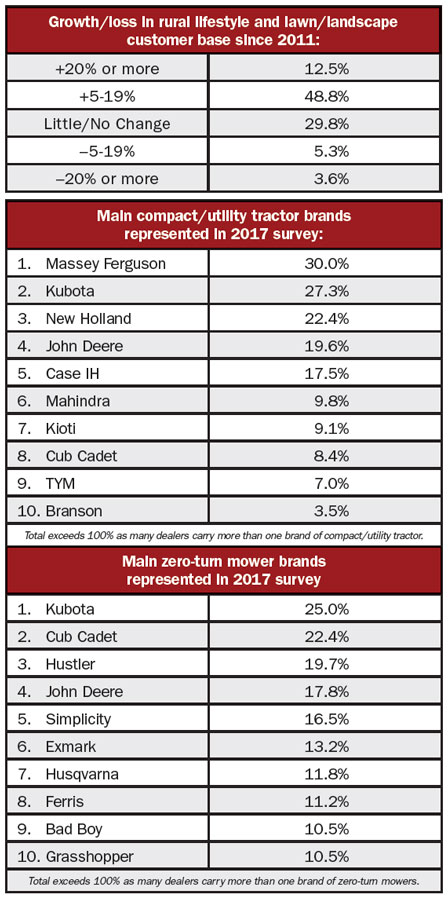

Several key economic statistics support dealers’ optimism. Market growth is one of those factors with nearly 50% of dealers saying their number of rural lifestyle customers has increased 5-19% in the last 5 years.

Current homebuilding surveys are positive, according to the National Assn. of Home Builders/Wells Fargo Housing Market Index. The December index came in at 70, with any number over 50 indicating more builders viewing conditions as good than poor. The unemployment rate has held mostly steady throughout the year, with the Bureau of Labor Statistics reporting 4.7% for December.

The Assn. of Equipment Manufacturers reported that November U.S. retail sales of farm tractors under 40 horsepower were up 22.6% compared to last year, with year-to-date gains of 11.7%.

Let’s dissect the numbers to see what’s driving the optimism and what opportunities await you in 2017.

Expecting Growth

More than 40% of dealers expect their total revenues to increase by 2-7% this year, with more than 8% expecting growth of 8% or more. A solid 35% expect revenues to be on par with 2016. These numbers are good, but tempered a bit from last year’s survey.

In the 2016 survey, about 46% expected growth of 2-7% and more than 13% expected growth of 8% or more compared with 2015. About 30% expected revenues to be about the same as 2015.

Some dealers are more pessimistic about 2017 vs. last year’s survey. More than 10% expect revenues to be down 2-7%, with more than 5% expecting declines of 8% or more.

Dealer Takeaways

- Eighty-four percent of dealers throughout North America think 2017 will be as good as or better than 2016. More than 90% think aftermarket revenues will also be as good as or better than last year.

- Zero-turn mowers topped the list for sales potential with about 60% of dealers expecting sales increases of 2-8% or more. Utility vehicles topped the list of products being added, with 36% forecasting they’ll add the product line this year.

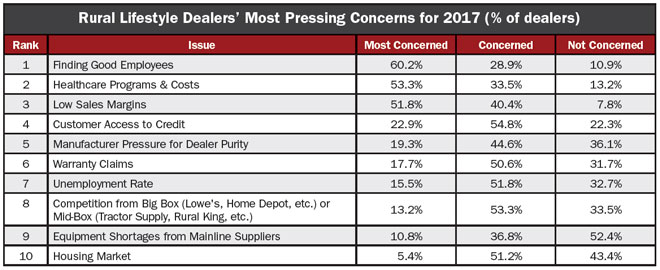

- Finding good employees ranks highest in terms of issues dealers are most concerned about. Healthcare programs and costs ranked second and low sales margins ranked third.

- About 63% of dealers say their customer base has grown 5-20% in the last 5 years.

In the 2016 survey, about 6% expected revenue declines of 2-7% and about 5% expected declines of 8% or more.

Watching Changing Policies

A new presidential administration in the U.S. means changing policies. Which of these new policies could help or hurt your dealership? Ernie Goss, Ph.D., MacAllister Chair and professor of economics at Creighton University, shares his thoughts on policy changes and the overall economy.

“There are several policy changes that are very likely and one of them is on the fiscal side. There is going to be a cut in corporate tax rates on repatriated earnings, or earnings of U.S. firms held abroad. What does that mean to rural America? The conversion of these foreign earnings to U.S. dollars will mean the value of the dollar will be increasing and that will tend to put downward the pressure on ag commodity prices. That will be a strain on dealers that sell to farmers,” Goss says. Those weak commodity prices will continue to spill over to the broader economy. However, he says the outlook for rural lifestyle equipment dealers looks reasonably good based on other factors, including job growth.

Another area to watch is interest rates. Goss expects short-term interest rates to rise 0.5% in the first half of 2017. He says small businesses that are considering borrowing may want to do that now rather than waiting.

Long-term interest rates (such as for mortgages) are more difficult to forecast. However any increases would affect residential, commercial and industrial building. Related industries, such as landscape contractors, would then be affected as well.

“On the flip side, it’s likely the new administration is going to do something about infrastructure spending as early as the first half of 2017. That would have spillover impact on related industries,” Goss says.

Paying for those infrastructure improvements could come from reducing tax deductions as opposed to increasing tax rates, although which deductions will be targeted are still unknown. However, Goss expects the Section 179 Deduction for equipment to remain.

Another way to view dealer sentiments is to look at the weighted averages. In this comparison, the forecast for increasing levels of revenes are compared with the decreasing levels of revenues and the “little or no change” responses are not considered. This analysis shows a positive sentiment of 1.61, although down from the 2.42 weighted average in the 2016 survey.

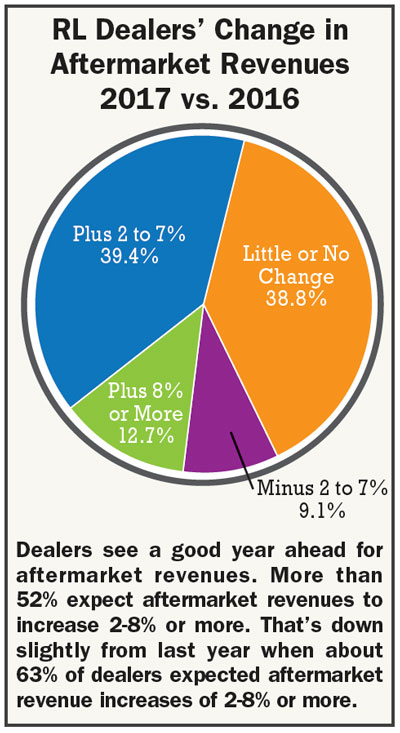

Dealers also shared their outlooks for aftermarket revenues. Similar to overall revenues, about 40% expect aftermarket revenues to increase 2-7% in 2017, and nearly 13% expect aftermarket revenues to climb 8% or more. About 39% expect aftermarket revenues to be about the same as 2016.

These forecasts are slightly less optimistic than the strong numbers reported in 2016. In that survey, about 54% of dealers expected increases of 2-7% and more than 9% expected aftermarket increases of 8% or more.

The number of dealers who are pessimistic about aftermarket revenues were generally similar to last year. Nine percent of dealers expected declines of 2-7% and no one expected declines below that level.

In 2016, about 9% of dealers expected aftermarket declines, but it was split based on the level. About 5% expected declines of 2-7% and 4% expected declines of 8% or more.

When comparing the weighted averages, dealers are more optimistic about aftermarket revenues vs. overall revenue in 2017, although down slightly from the 2016 survey. The weighted average for aftermarket revenue forecasts is 2.4 for 2017 vs. 2.6 for 2016.

Expanding Market

The rural lifestyle customer base has grown at a solid clip for many dealers. Nearly half say their base has grown by 5-19% in the last 5 years, and nearly 13% say their base has grown by 20% or more. For about 9% of dealers, the market has declined in the last 5 years.

This market growth rate is similar to what dealers reported last year, when 52% of dealers said their customer base had grown 5-19% and 16% reported a growth of 20% or more. About 7% reported a decline of 5-19% in the 2016 survey and none of the responding dealers reported any losses above that level.

Many of the responding dealers are experts in serving the rural lifestyle market. Nearly 70% say they’ve been selling to rural lifestylers for more than 16 years. On the other end of the timeline, about 2% say they’ve been selling to the market for less than a year. Dealers are also dedicating resources to the market. About 70% say they have salespeople focused on selling to rural lifestyle customers. (Refer to the table "Facts and Figures" for additional demographic data.)

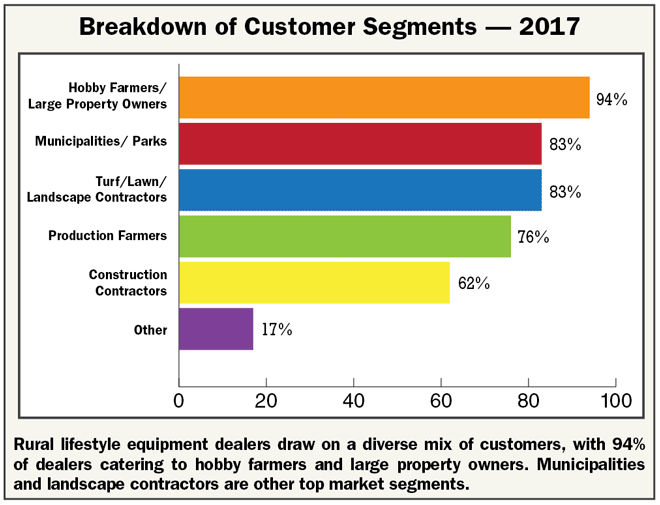

Rural lifestyle equipment dealers serve a varied customer base. For instance, most of the dealers in the survey (94%) cater to hobby farmers and large property owners. About 83% sell to municipalities and parks as well as to landscape contractors; and 76% sell to production farmers. (Refer to the chart "Breakdown of Customer Segments" for details.)

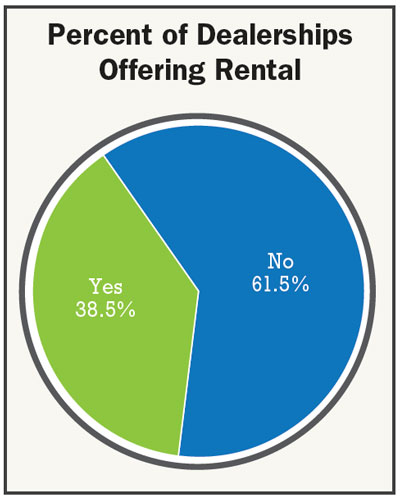

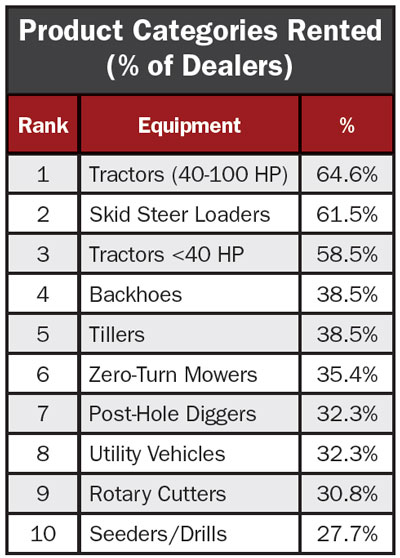

An area where dealers are holding steady is marketing equipment through a rental department. This year, 38.5% of dealers say they have a rental department and last year, 38.4% said they did. For those offering rental, the top 5 categories rented include tractors 40-100 horsepower, skid steer loaders, tractors less than 40 horsepower, backhoes and tillers. (See the table "Product Categories Rented" for an expanded list of top rental offerings.)

What’s the Best Mistake You Have Ever Made?

In the 2017 Dealer Business Trends & Outlook survey, we asked dealers to tell us about the best mistake they ever made — and how that mistake ended up benefiting the dealership. Here are highlights of the responses.

“We would try and source any brand/product someone wanted and then tried to support it. We tried to be everything to everyone. This just set us up for failure with the customer and the business. We reviewed our inventory turns, revenue and margins per vendor and reduced as needed. We then put a database together for all staff to see showing brands we now support with stocking parts and warranty information. We still service most brands.”… “As a small business, it becomes common practice to take shortcuts. We learned the hard way on how some ‘old school’ business practices can impact the financials, valuation, etc., of a business and the importance of running a tight ship if the dealership is on a growth trajectory.” … “It was a huge mistake to not have a plan for handling employees. In the past 3 years, we have developed and continue to finetune how we engage employees. We have job descriptions we hire from and use them when we evaluate our employees. We have also added incentives. Taking the time to really manage our employees has made a big difference for us.” … “I think the biggest mistake we made was believing that a mainline supplier is there to help the dealer and customers and that we can’t survive without a mainline. A year ago our mainline supplier terminated our agreement. Initially, we thought ‘Now, what?’ Make no mistake, our wholegoods and parts sales have declined, but our service department revenue is increasing. Rental revenue is increasing as well and our margins are getting better. We have a few shortline suppliers now that are great to work for; our business stress has declined dramatically; and our focus now is more about supporting our customers rather than supporting the supplier.” ... “Firing an employee that everyone said we couldn’t survive without. We replaced him with an employee that has a positive attitude.”

Boosting Sales

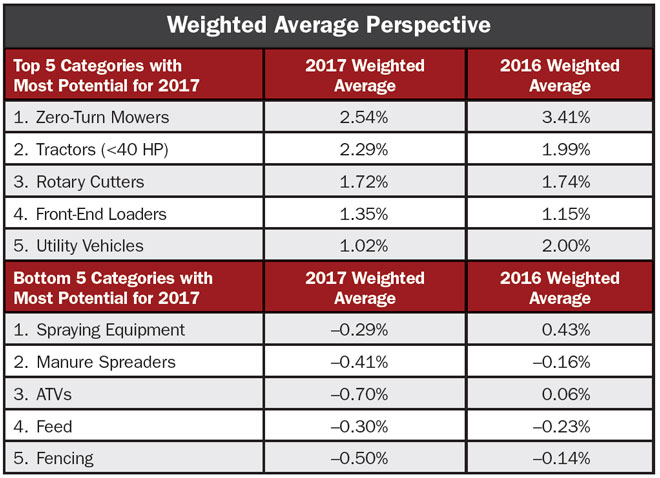

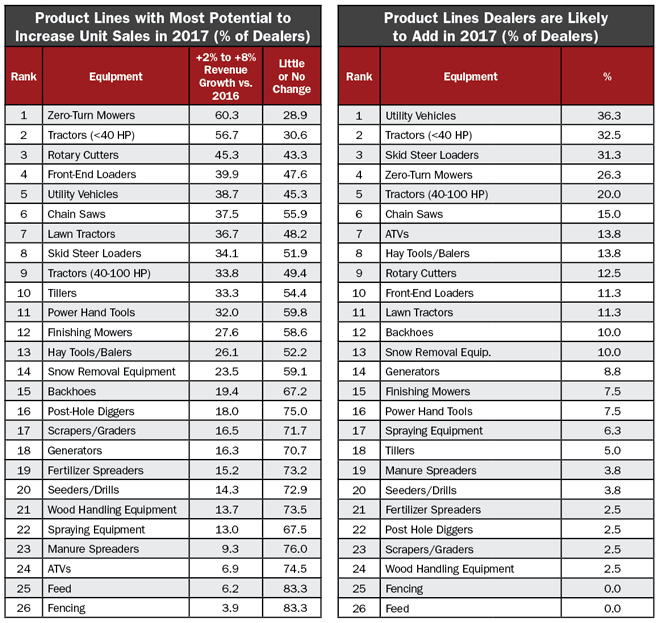

Dealers shared details about the specific rural equipment categories they think will increase revenues in 2017. Of the 26 categories, zero-turn mowers topped the list with about 60% of dealers expecting unit sales increases of 2-8% or more. Tractors under 40 horsepower ranked second, with about 57% of dealers expecting unit sales increases of 2-8% or more. Rotary cutters ranked third with about 45% expecting increases of 2-8% or more and front-end loaders ranked fourth with about 40% expecting increases of 2-8% or more. Utility vehicles rounded out the top 5, with about 39% expecting unit sales increases of 2-8% or more. (See the table "Product Lines with Most Potential to Increase Unit Sales in 2017".)

Zero-turn mowers topped the list in the 2016 survey as well. Rotary cutters and front-end loaders making the top 5 list for 2017 pushed down the rankings of chain saws and lawn tractors from the 2016 survey. Last year, chain saws ranked number 2 but dropped to number 6 this year. Lawn tractors ranked 5th in the 2016 survey and dropped to 7th this year. Utility vehicles and tractors under 40 horsepower made the top 5 last year at 3rd and 4th place, respectively.

Two other products that gained ground this year are backhoes and post-hole diggers. Backhoes ranked 19th last year and moved up to 15th this year. Post-hole diggers ranked 20th last year and climbed to 16th this year. Spraying equipment had the biggest drop, falling from 16th last year to 22nd this year.

In the weighted average perspective for the top 5 categories, (looking at increases vs. declines), the unit sales potential for zero-turn mowers and utility vehicles are down from last year’s averages. Tractors under 40 horsepower and front-end loaders are up vs. last year and rotary cutters are about the same. (See the table "Weighted Average Perspective" .)

The weighted averages for the bottom 5 categories for sales potential — spraying equipment, manure spreaders, ATVs, feed and fencing — are all down from last year.

Adding Lines

A good share of rural lifestyle equipment dealers are committing resources to expanding their product offerings. Like last year, utility vehicles top the list for 2017, with more than 36% of dealers expecting to add the product line this year. In fact, the top 5 for 2017 matched the top 5 for 2016, with a few switching of positions. Tractors under 40 horsepower ranked 2nd again this year with about 33% of dealers adding inventory. Skid steer loaders ranked 3rd with about 31% of dealers saying they will add inventory (ranking number 4 last year). Zero-turn mowers ranked 4th with about 26% of dealers saying they will add inventory (ranking number 3 last year). Tractors 40-100 horsepower ranked 5th this year and last year with 20% of dealers forecasting they will add inventory.

It’s interesting to note that dealers forecast rotary cutters and front-end loaders as two strong categories for driving revenue, but neither made the top 5 list for products dealers are adding. Perhaps dealers are mostly satisfied with their current lineups, but see an increasing demand. (See the table "Product Lines Dealers are Likely to Add in 2017".)

ATVs is another category that shows discrepancy between the two measurements. Dealers ranked it low, number 24 out of 26, for products with the potential to increase revenues, yet it ranks seventh in terms of products dealers will add this year. This might be related to dealers rounding out their product offerings to capture every segment of buyer.

Watching Issues

Running a dealership requires more from owners than moving equipment off the lot, and dealers are keeping watch on other issues that impact their businesses. A top concern for dealers year after year is finding good employees, with about 60% of dealers saying this is the issue that they are most concerned about. We’ve heard a variety of underlying factors in our conversations this year, including lack of interest in working at a dealership; lack of work ethic; and technician training concerns. Dealerships large and small are also struggling with the new work environment with its constant distractions from mobile devices.

Healthcare programs and costs ranked second this year and third last year. Larger dealerships in the U.S. continue to struggle with the additional costs of the Affordable Care Act (ACA). And, rising healthcare costs affect dealerships of all sizes. The new administration says it will revisit the ACA, however, significant changes will probably be long in coming.

Low sales margins ranked third this year and second last year. There is a segment of customers who purchase equipment based on factors other than price, and dealers tell us they encourage their salespeople to sell features and brand over price. However, sales negotiations often include discounts and, in the process, margins take a hit.

Another concern for dealers relates to the credit worthiness of customers, with customer access to credit ranking fourth this year and last year. Even with a full portfolio of credit options, some customers’ credit histories stand in the way of a sale.

Concerns about manufacturer pressure for dealer purity rose into the top 5 this year, ranking eighth. This has traditionally been more of a concern for dealers carrying larger production agriculture equipment. However, it seems rural equipment dealers are also feeling some pressure.

Relying on Strengths

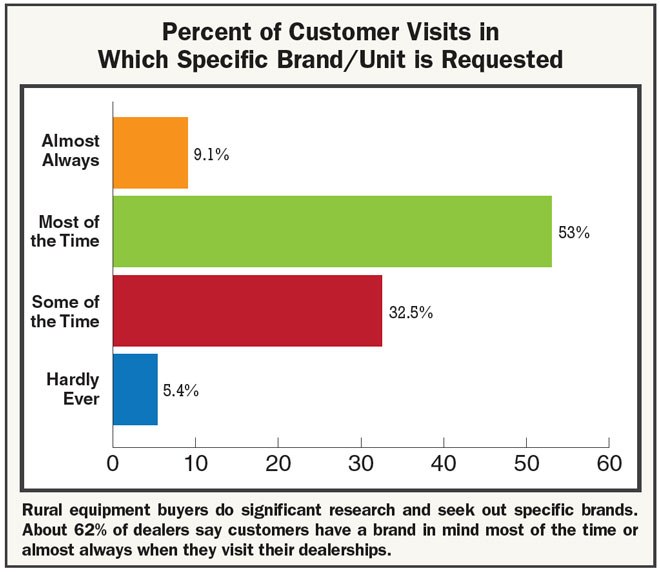

Dealers are playing to their strengths, including the reputation of their brands and their dealerships. The survey asked, “How often do your rural lifestyle customers arrive at your dealership with a specific brand/unit in mind?” About 62% of dealers said most of the time or almost always. That’s up from 55% last year. (See the chart "Percent of Customer Visits in Which Specific Brand/Unit is Requested".)

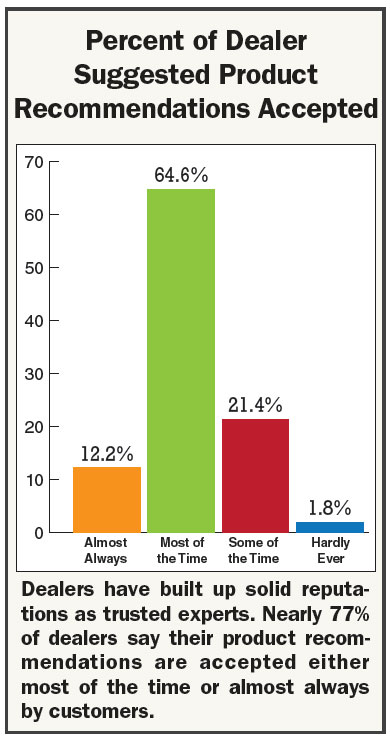

Rural equipment buyers do a significant amount of research online as well as seek “word of mouth” recommendations. Dealers have mentioned that customers are not just “kicking tires” when they visit their dealerships. They’re looking for a brand and they’re also seeking out advice from dealers and their sales teams. Nearly 77% of dealers say their recommendations are accepted either most of the time or almost always, down some from last year’s 82%. (See the chart "Percent of Dealer Suggested Product Recommendations Accepted".)

Combining those statistics of brand recognition and expertise, it seems dealers could at least be halfway to a sale when a customer visits. And, financing is often what seals the deal. More than 62% of dealers say customers seek financing from them at least half the time. That’s up from last year when 57% of dealers said customers seek financing from them at least half the time. (See the chart "Percent of Purchases Where Financing is Requested".)

A feature in Rural Lifestyle Dealer’s Fall 2016 issue looked at the topic of retail financing in more depth. Experts from Wells Fargo, Mahindra, DLL and Sheffield Financial shared how they are improving processes and accessibility and expanding programs. Go to http://bit.ly/2idAyYX to view the story.

Investing in the Dealership

What else is on dealers’ minds? They are making sure they invest wisely back into their own businesses. About half of dealers (52%) expect to modernize or make other improvements to their shop and service departments. That’s down from last year when 73% of dealers expected to make similar improvements. Perhaps that signals dealers have made progress in the last year or so on those key areas of their dealerships.

Bob Clements, Rural Lifestyle Dealer columnist and industry consultant, has been offering tips and strategies on how to develop a high performing service department. Check out his columns and webinars at www.RuralLifestyleDealer.com.

“The parts counter is often the first interaction new customers have with many dealerships. If there is a place to make a good first impression inside your dealership, this is where it would happen,” says Clements.

The dealership’s retail environment, one that is attractive, inviting and intuitive, is also something dealers will improve on this year. About 46% expect to modernize and improve their dealership’s retail spaces. That compares with about 59% of dealers who planned to make improvements last year.

Mike Wiles, Rural Lifestyle Dealer columnist and retail expert, has also been sharing his expertise with readers and offers this advice, “Make your place look as good as, or better, than the local car dealerships. Any money invested in additional indoor display areas will yield big returns.”

Business information systems is another area for investment and about 32% of dealers expected to make investments in technology this year. That’s also down from the 47% of dealers who expected to make similar investments last year.

Collecting and monitoring data is critical to driving the right decisions and to understanding your customer base as a whole as well as individual customers’ buying habits. (View a round-up of the latest innovations in dealership management systems.)

As a whole, investments in dealership improvements are slightly down, but a good share of dealers recognize the importance of ongoing internal investments.

What Recent Changes Have You Made in Your Service or Parts Departments?

About 40% of rural lifestyle dealers expect aftermarket revenues to increase 2-7% in 2017, and nearly 13% expect aftermarket revenues to climb 8% or more. We asked dealers to share ideas about what they’re doing to keep aftermarket revenues strong.

“Specific people for specific jobs makes everything run smoothly.” … “First, we have culled out the break-even or loss leaders in the service department. Second, the parts department makes sure to keep incoming parts prices as low as possible and to keep as close to our established profit margins. There have been too many instances where the supplier suggests you work on a 10% margin.” … “Departmentalizing expenses, budgeting, sharing monthly data and reports. The managers are more aware and make more of an effort to make things work properly.” … “Our biggest issues were related to the bottleneck at the service writer position in the number of transactions that needed to be processed by one person and the follow-up customer interactions. We have backfilled these people with additional counter staff and are retraining them to assist in the initial service transaction.”… “Added air conditioning to our shop. Mechanics working in the heat during the summer are less effective. This increased productivity by 15% year-over-year. We changed all lighting to LED for electricity cost savings as well as to provide better lighting for techs and customers. We added a full-time setup person to complete jobs that mechanics were doing.” … “Adding younger, more energetic people to our front line to work with customers. Older, more experienced employees tend to be less flexible in their answers to customer problems. Younger employees seem to think out of the box. They seem to show more concern for customer care.”

Seizing Opportunities

The rural lifestyle market continues to be full of energy. For example, the industry’s biggest trade show, GIE+Expo, had a 12% increase in attendance, following a previous record-setting attendance year.

This year’s Expo showed off several trends that signal more opportunities for dealers. For instance, new technologies are fueling product development, such as better options for battery-powered outdoor power equipment as well as EFI engines that offer more power and better serviceability.

Mower manufacturers are increasing the power of commercial and consumer units and adding comfort and diagnostic features — improving the overall user experience. Many also are equating power and value, promoting return on investments.

Tractor manufacturers continue to expand their product lineups, throughout the horsepower range, and are also promoting power, diagnostics and comfort features.

The same holds true for utility vehicle manufactures as the product segment continues to grow. And, robotic mowers seem to be gaining momentum at GIE in terms of product offerings.

Other major happenings this year revolved around acquisitions, partnerships and sales. For example, TYM completed its acquisition of Kukje Machinery, the parent company of Branson. Kubota acquired Great Plains Manufacturing, including its Land Pride Division. Kioti is teaming up with Woods Equipment to offer an expanded lineup of attachments.

Wells Fargo completed its purchase of the North American portions of GE Capital’s Commercial Distribution Finance and Vendor Finance businesses. Outdoor retailer giant Bass Pro Shops acquired Cabela’s.

On the aftermarket side, Ariens has entered into an agreement to sell its aftermarket parts business (including the Stens and JThomas Parts brands) to Arrowhead Engineered Products. An agreement was recently finalized for SMA to acquire certain assets of Blount’s TISCO aftermarket parts business.

All of this activity in the rural equipment market underscores dealers’ optimism for this year, building on the growth dealers are achieving year after year. Leverage your dealership’s strengths, prepare your teams and continue offering great customer service and 2017 should be a good year for you.

Post a comment

Report Abusive Comment