The following story is an excerpt from the 40-page 2017 Rural Lifestyle Dealer Business Trends & Outlook Report. Email Lynn Woolf for a copy of the complete report, lwoolf@lessitermedia.com.

John Deere dealers are very optimistic about 2017 and think tractors less than 40 horsepower will bring strong sales this year.

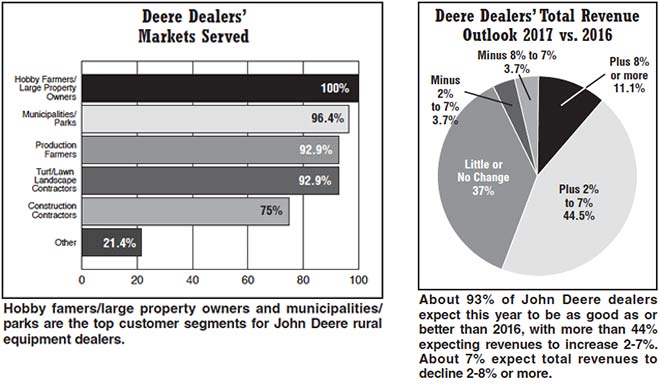

About 93% of John Deere dealers expect this year to be as good as or better than 2016 in terms of total revenue. More than 44% expect revenues to increase 2-7% and another 11% think sales could increase 8% or more. About 7% expect total revenues to decline 2-8% or more.

Those forecasts are better than North American dealers as a whole. More than 84% of North American dealers expect 2017 revenues to be as good as or better than last year and 16% expect declines of 2-8% or more.

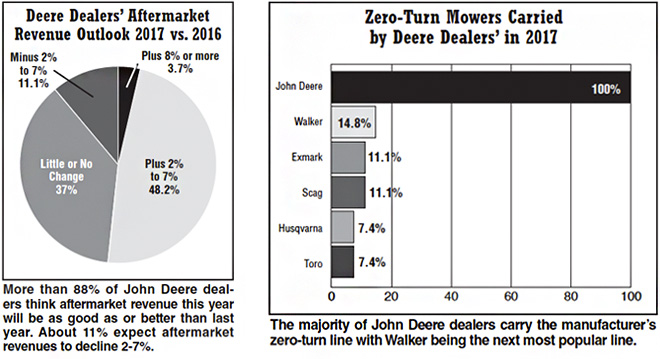

John Deere dealers are just slightly less optimistic about aftermarket revenues when compared with North American dealers as a whole. More than 88% of John Deere dealers think aftermarket revenue this year will be as good as or better than last year compared with 90% of North American dealers who expect those results.

About 11% of John Deere dealers expect aftermarket revenues to decline 2-7% compared with 9% of North American dealers.

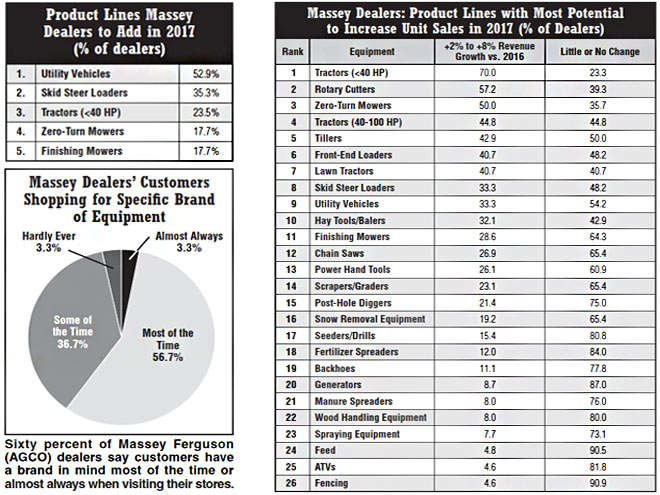

When asked about how each equipment category would fare next year in terms of unit sales, tractors less than 40 horsepower topped the list in terms of growth of 2-8% or more, followed by zero-turn mowers, chain saws, lawn tractors and rotary cutters.

The bottom 5 categories in terms of sales potential are seeders/drills, feed, ATVs, manure spreaders and fencing.

Tractors less than 40 horsepower also ranked first when dealers were asked which products they plan to add in 2017. Skid steer loaders and front-end loaders ranked second and third in terms of products being added.

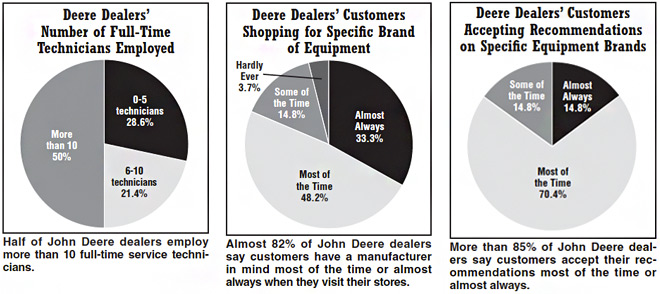

John Deere dealers experience very strong brand awareness and respect for their expertise. For instance, almost 82% of John Deere dealers say customers have the manufacturer in mind most of the time or almost always when they visit their stores. That compares with about 62% for North American dealers as a whole.

And more than 85% of John Deere dealers say customers accept their recommendations most of the time or almost always, compared with 77% for North American dealers.

About 85% of John Deere dealers have salespeople focused on the rural lifestyle market and half employ more than 10 full-time service technicians.

Hobby famers/large property owners and municipalities/parks are the top customer segments for John Deere rural equipment dealers.

See the charts below for additional details as well as comments from John Deere dealers.

John Deere Dealers’ Commentary:

What’s the best mistake you ever made and how did it change your dealership or how you approach business?

“We would try and source any brand/product someone wanted and then tried to support it. We were trying to be everything to everyone. That just set us up for failure with our customers and the business. We reviewed turns, revenue and margins per vendor and reduced as needed. We then put a database together for the all staff that shows the brands we now support, with stocking parts and warranty. We still service most brands.” … “Dealing with difficult potential customers and their misconceptions and go out of the way to change their thought process.” … “Letting a manufacturer use us as a warehouse for over $350,000.00 worth of obsolete inventory that was accumulated from dealer closeouts. We helped this manufacturer haul all this inventory many miles to our dealership, paid our employees during the holiday season and spent much time and money to help them get those closed dealerships cleaned out. We were promised that they would find homes for this obsolete inventory and have this out of our warehouse by spring. This never happened! Instead, 6 months later, they added this inventory on our monthly statement and this caused our floor plan to go over our credit limit and then they demanded the $350,000 plus the amount that was on our floor plan because we were ‘out of trust’ of our contract. We had 10 days to come up with the cash. This was all done without a phone call from the territory manager, regional manager or the credit department. It just showed up on the monthly statement.” … “Ordering too much inventory for the short run. With commodity prices low, our sales have nose-dived across all the horsepower ranges we sell. U.S. wheat/ corn/rice and all commodity prices need to come back soon or a lot of our customers are going to lose it.”

What recent changes have you made in your service or parts department and how has it helped your dealership?

“Enhanced training for staff using mentors and job shadowing along with a new manager program.” … “We added a new parts manager and terminated the one that would not embrace change from manufacturers.” … “We are in the process of building a completely new service shop, which is our third location to be upgraded in the past 5 years.” … “We added more storage facilities.” … “Our service administration team has committed to a tracking system to monitor work flow. By diligently logging incoming jobs immediately, they have a better handle on what is in the system to be worked on. As a result, they could more accurately forecast turnaround times to customers which is typically the biggest potential disappointment for a service customer. It also helped us from overestimating turnaround times, which would cause potential service customers to go elsewhere.” … “We installed new lighting in our complex. This really made a big difference on productivity. No more dingy conditions to work under. We added new Stanley Vidmar parts units behind the customer counter for fast pulling of parts. All fast moving parts are half a step away from the counter. This means less fatigue on our employees as well. New Stanley Vidmar service benches and tool chests separate our service department into three bay areas. This has meant more productivity and less steps for our employees.” … “We are currently remodeling our parts and showroom areas to help improve sales of tractors 40 horsepower and below.” … “We implemented a system that helps the flow of information between parts, service and sales.”

Post a comment

Report Abusive Comment