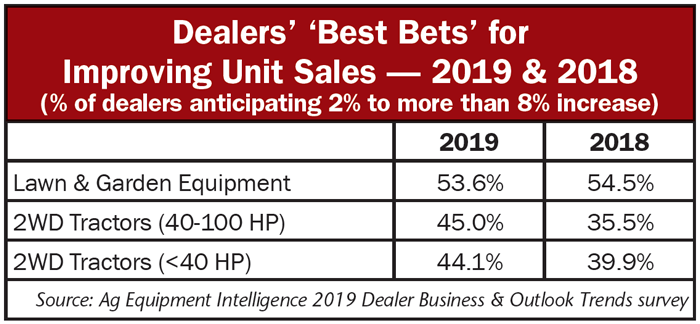

In mid-October, Ag Equipment Intelligence released its 2019 Dealer Business Outlook & Trends — Farm Equipment Forecast report. Based on the survey responses from about 200 dealers, three equipment categories of smaller equipment are at the top of the dealers’ “Best Bets” list for improving unit sales in 2019.

These best bets include lawn and garden equipment (#1), 2WD mid-size (40-100 HP) tractors (#2) and 2WD compact (<40 HP) tractors (#3). These three equipment categories also headed up the dealers’ list a year ago, though not in the same order.

The categories are ranked by combining the percentage of dealers who projected a gain of 8% or more in unit sales in 2019 with the percentage of dealers who projected a gain of 2-7% in the year ahead.

Overall, 53.6% of all respondents expect unit sales of lawn and garden equipment to increase during the next 12 months. This is nearly identical to dealers’ projections a year ago when 54.5% expected unit sales growth in this segment of their business.

The next two equipment categories where dealers expect increased unit sales in 2018 demonstrated notable growth in the number of dealers anticipating higher sales in 2019. With mid-range tractors, a year ago 36% of dealers forecasted growth. This year, that percentage grew to 45% of dealers.

The same trend is evident with dealers who expect increased sales in compact tractors. For 2018, 40% of dealers were projecting growth vs. the previous year. Looking toward 2019, 44% of dealers are expecting sales of this equipment to improve.

This survey was conducted in the last week of August and first 2 weeks of September. Nearly 200 dealers responded to this most recent survey. In breaking down the business segments of this group of dealers, 17% of their revenues in 2018 came from hobby farmers and large property owners, about 9% from lawn, turf and landscape contractors, 5% from municipalities and parks maintenance crews and 6% from construction contractors. In total, nearly 40% of their revenues came from customers that fall into the rural lifestyle equipment categories and that are not related to production farming.

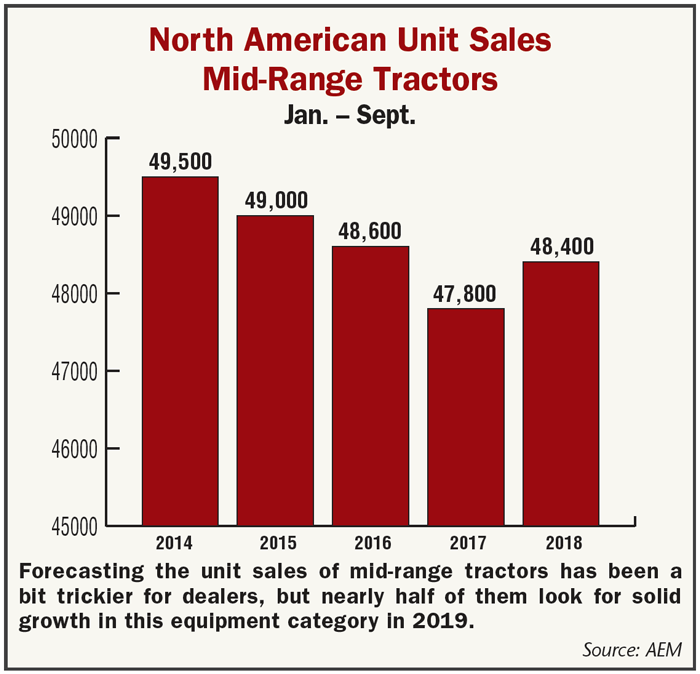

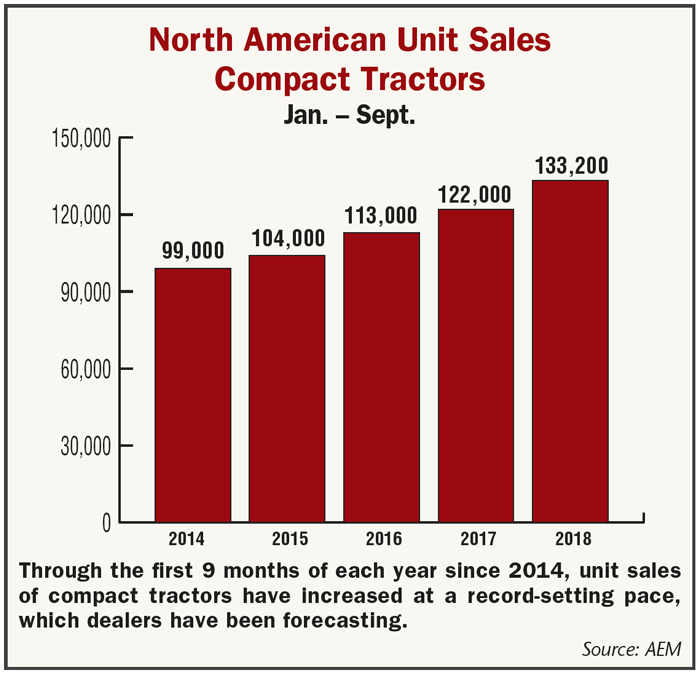

Dealers’ Outlook on Track

At least when it comes to smaller tractors, dealers who have participated in the Ag Equipment Intelligence surveys over the past 5 years have a pretty good track record when it comes to forecasting growth. This hasn’t been a major challenge as unit sales of compact tractors during the first 9 months of each year since 2014 have grown by 35%. Unless some unforeseen event takes place in the last quarter of 2018, sales of this equipment will set another record. They’re already up more than 9% vs. the same period of 2017.

Growth in the mid-range tractor segment has been quite a bit trickier. Unit sales for this category is actually down about 2% over the last 5 years (2014 vs. 2018). Nonetheless, nearly half (45%) of the dealers polled this year expect unit sales to grow from 2% to more than 8% in 2019.

Post a comment

Report Abusive Comment