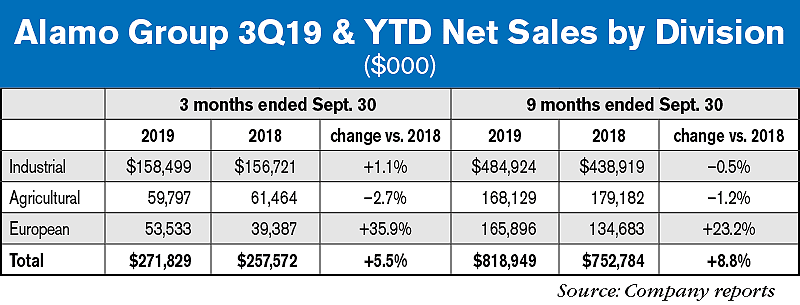

SEGUIN, Texas — Alamo Group Inc. (ALG) reported record net sales for a third quarter of $271.8 million, up 5.5% for the third quarter ended Sept. 30, 2019. By operating segment Industrial Division net sales of $158.5 million were up 1.1%; Agricultural Division net sales of $59.8 million were down 2.7%; European Division net sales of $53.5 million, up 35.9%.

Alamo also reported net income for the third quarter of $17.4 million, down 26% and net income for the first 9 months of year came in at $53.3 million, down 6.3%. At the same time, the company achieved record net sales for the first 9 months of $818.9 million, up 8.8%.

The company is reporting a backlog at $215.3 million, down 14.3% compared to the previous year's third quarter.

The results for the third quarter and first 9 months of 2019 included the effect of the acquisitions of Dutch Power, which was completed in March 2019, and Dixie Chopper, which was completed in August 2019, though Dixie Chopper's results are immaterial for the quarter and year-to-date. In the third quarter of 2019, Dutch Power contributed $10 million to net sales and ($0.2) million to net income due to lower net sales and integration costs. For the first 9 months of 2019 Dutch Power contributed $27.7 million to net sales and $0.8 million to net income.

The company's 2019 results have also been affected by unfavorable changes in currency exchange rates which negatively impacted net sales by $2.7 million in the third quarter and $12.9 million for the first 9 months of the year.

Alamo's Agricultural Division net sales in the third quarter of 2019 were $59.8 million compared to $61.5 million in the prior year, a decrease of 2.7%. The Division's income from operations for the quarter was $6.1 million compared to $6.6 million in 2018, a decrease of 7.1%.

For the first 9 months of 2019 the Agricultural Division's net sales were $168.1 million vs. $179.2 million in the prior year, a decrease of 6.2%. Income from operations was $12.5 million in the first 9 months of 2019 compared to $18 million in the first 9 months of 2018, a decrease of 30.5%. The Division's results continue to be impacted by weak overall agricultural market conditions and lower farm incomes. In addition to unfavorable sales volume, operating margins were further impacted by production cuts and unfavorable product mix which more than offset lower material costs and spending reductions.

Comments on Results from President & CEO

Ron Robinson, Alamo Group's president and chief executive officer, commented, “Our third quarter results were definitely a mixed bag. While there were a number of accomplishments during the quarter, including record net sales and successful negotiations toward completing our largest acquisition to date, there were certainly some disappointments in the quarter as well, which resulted in lower earnings. In the past few years we have produced an impressive stream of record results despite a variety of headwinds that have impacted us and our markets. But, in the third quarter these challenges all came together to culminate in reducing our results, that appear even worse due to a large $3 million one-time gain from tax reform that boosted our 2018 third quarter results.

“Among the challenges which impacted our results were the ongoing weak agricultural market conditions that continue to dampen our sales in this sector made worse by an unfavorable product mix which saw the market for our higher margin flex wing mowers soften more than our other agricultural products. Lower quarter-over-quarter volumes are starting to cause some erosion in our margins due to under absorption of overhead costs. Weather conditions have also further dampened our agriculture results as the floods earlier this year in the U.S. Midwest reduced the acres of crops under cultivation and droughts in Australia continue to impact that market, among other areas.

“We are also continuing to feel the impacts in the U.S. of the trade disagreements with China as each quarter the tariffs are becoming more of a factor. This has disproportionately affected our Agricultural Division's costs as they are sourcing more components from China that are subject to trade tariffs. The situation is also negatively affecting the overall market for farm commodities.

“Softening overall economic conditions are being felt in our European markets as well where several countries are already in, or approaching, recession. This is being further affected by the Brexit situation which is still unresolved. Even in North America there is evidence of softening economic conditions that seem to be affecting the manufacturing sector more than some other areas. We certainly experienced softer bookings, even in our Industrial Division which has been showing good stability and still has a healthy backlog, though somewhat below last year's record level at this time. Our inquiry level, across the Company, remains reasonable; however, some of the headwinds we experienced in the third quarter are likely to continue for at least the balance of the year.

“We also faced a few more internal challenges than usual that affected our results in the third quarter, including higher health care costs, some delayed product deliveries, certain inventory adjustments and various legal expenses. None of these issues in themselves were unusual, but the number of them that occurred in the third quarter certainly was.

“All in all, this variety of issues dampened our results at a time when we also were incurring significant acquisition related expenses. While this constrained our third quarter results, we are very excited about the results of this effort. As we announced last week, we completed the acquisition of Morbark, our largest such endeavor. Morbark is a very good company and an excellent fit with Alamo Group. We feel they will be accretive to Alamo's results starting in 2020 and provide new growth opportunities for our companies on a combined basis as both companies should benefit from the capabilities in both products and markets that the other brings. However, with only two months left in the year and with related closing and integration costs, Morbark is not expected to be significantly accretive to our results for the balance of the year, but we believe that it should begin to contribute nicely starting next year.

“Although we are disappointed with our 2019 third quarter results, we remain optimistic about the long range outlook for our company. We have a proven track record of ongoing margin growth and improving operating efficiencies and feel our focus in this area will continue to bear fruit. While some of the short term market weakness we have been experiencing will continue to affect us, the stability of our core products should provide a solid base for our operations. And, with the addition of Morbark, Alamo Group is well positioned to prosper in the future.”

Post a comment

Report Abusive Comment