The cracks in the U.S. economy were just starting to show at this time last year, but equipment dealers serving the rural lifestyle market were still high on their prospects for increasing sales revenue.

With small equipment's fortunes so closely tied to housing and related markets, those prospects faded as real estate markets took it on the chin for much of the year. And when the economic malaise began last fall, loans became a problem, housing sank further and the entire economy found itself facing a recession.

When Rural Lifestyle Dealer released the results of its annual outlook for the industry last year, nearly 90% expected sales revenues in 2008 to be as good as or better than they were 2007.

More than half of those dealers projected sales revenues would improve by 2% or more during '08. A full 15% projected revenues from sales to hobby farmers and large-property owners to increase by 8% or more.

This time around, only slightly more than half see sales revenues holding their own or improving in 2009. While this is a considerable dropoff from expectations of a year ago, considering current economic conditions, it still demonstrates dealers' confidence that they can at least maintain what they accomplished in 2008 in an extremely difficult economic environment.

One of the most revealing aspects of this year's survey is the significant influence dealers wield over the choices made by rural lifestyle customers. Once dealers get them in the door, not only is their opportunity to make the sale excellent, but they're also able to direct the customer to the brand the dealer is carrying. While a customer may have a product in mind when they enter the store, the dealer who takes the time to understand their application and intended use can steer the sale in another direction, including "talking them out" of buying a competing product.

A Challenging Year

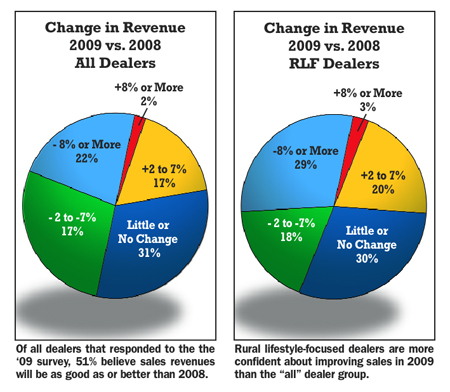

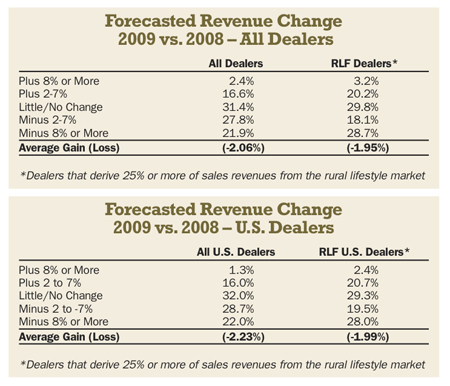

A new dimension to this year's survey is dealers are segmented into "All" dealers and "Rural Lifestyle-Focused (RLF)" dealers. "All" dealers is a composite of the responses of all participants in the survey, while RLF dealers are those that derive 25% or more of their annual sales revenues from the hobby farm and large-property owner (LPO) market segments.

Despite all of the challenges confronting the rural lifestyle market in 2009, slightly more than half — 50.4% — of all equipment dealers are forecasting revenues to be at least as good as or better than 2008. Of these, 19% expect to see sales improve more than 2%, with nearly 17% projecting sales improvements of 2-7%. Overall, dealers see sales revenues dipping by 2.06% during the year.

When examining dealers that derive more than 25% of their revenues from hobby farmers and LPOs, however, expectations are a bit higher. For this group, 53.2% see sales revenues to this market being as good as or better than 2008. More than 17% expect sales to rise 2% or more. On average, this group sees sales falling by 1.95% during 2009.

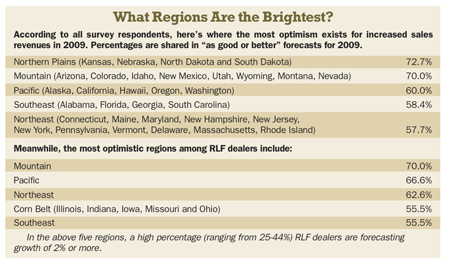

Comparing the outlook of U.S. dealers vs. Canada, it's clear that the Canadians are more optimistic about prospects for improving revenues in 2009.

Slightly less than half of all U.S. dealers — 49.3% — are projecting that their sales revenues in '09 will be as good as or better than 2008. About one-third, or 32%, of these dealers expect sales to be about the same in 2009, while 17.3% see overall revenues improving more than 2%. In total, all U.S. dealers are forecasting sales to decline by 2.23%.

Segmenting U.S. dealers that earn 25% or more of their revenues from the rural lifestyle market shows that more than half, or 52.4%, project their 2009 sales to this market will be as good as or better than the previous year. Nearly one-quarter of these dealers — 23.1% — are projecting sales to improve by 2% or more, with 20.7% seeing revenues rising by 2-7%. On average, U.S. RLF dealers see sales slipping 1.99%.

Overall, more Canadian dealers are forecasting better results from the rural lifestyle market for 2009 than their southern counterparts. Nearly 60%, or 57.9%, of the dealers in Canada expect their revenues to be as good as or better than what they experienced in 2008. More than 31% are forecasting revenues to grow 2% or more during the year and 10.5% say their revenues to rural lifestyle markets will grow by 8%. Overall, Canadian dealers say revenues will drop less than 1% (0.85%).

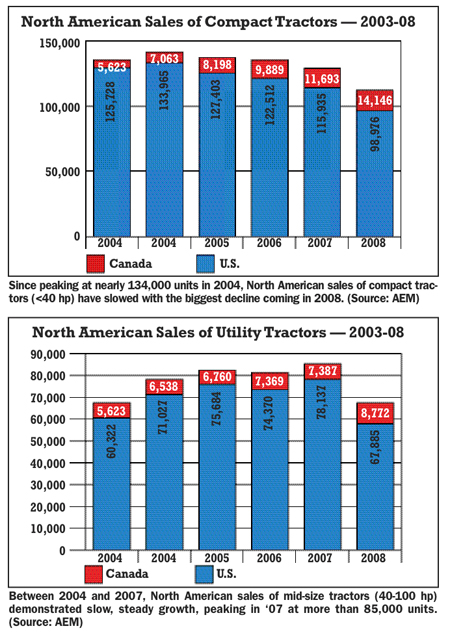

Fading U.S. Tractor Sales

If the sale of compact tractors (<40 horsepower) and utility tractors (40-100 horsepower) can be used as a barometer for the overall health of the market, than dealers serving the rural lifestyle customer had a particularly tough year in 2008.

Statistics from the Assn. of Equipment Manufacturers show that overall sales of compact tractors in the U.S. dropped last year by nearly 15% vs. 2007. This was largest decline experienced by dealers since sales of under 40-horsepower tractors peaked at 134,000 units in 2004, which was a 6.6% increase over the previous year.

Since 2005, sales of compact equipment in the U.S. have fallen off each year: -5% in '05, -3.8% in '06, -5.4% in '07 and -14.6% last year.

Compared to the sales peak of 133,965 units in 2004, retail sales of compact tractors have fallen to 98,976 units in 2008 — a decline of more than 26%.

On the other hand, U.S. retail sales of utility or mid-size tractors, those between 40 horsepower but under 100 horsepower, showed steady growth during this same period until 2008. Unit sales of mid-size tractors rose by 17.7% in 2004. This was followed by reasonably good year: +6.6% in '05, -0.4% in '06 and +3.7% in 2007. During 2008, sales of mid-size tractors dropped more than 13%.

While unit sales of compact tractors in Canada represent only a fraction of those sold in the U.S., the Canadian market showed steady double-digit growth between 2003 and 2008. Starting with 5,612 units sold in '03, this market for Canadian dealers has almost tripled in 6 years — to 14,146 units in 2008.

While not nearly as dramatic compared with the growth of compacts, unit sales of mid-size tractors in Canada have shown steady, sustained growth in each of the last 6 years. Since dealers there sold 6,518 tractors between 40-100 horsepower in 2003, the market grew to 8,772 units sold in 2008 — an increase of nearly 35% from 2003. Sales of utility tractors posted an 18.7% increase in 2008 alone.

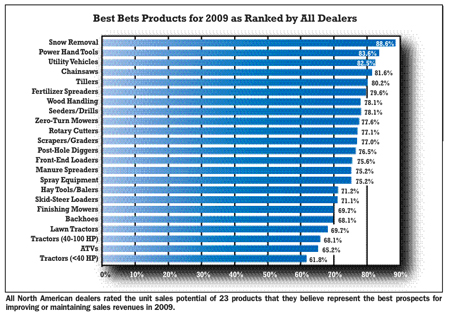

2009's Best Sellers

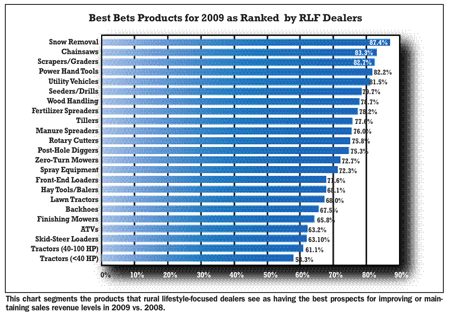

Dealers' "Best Bets" for products with potential to improve sales revenues are lower in nearly all categories vs. 2008. Again, considering the state of the general economy, this should come as no surprise.

For example, the highest rated items in 2008 all scored in 90s, with even those rated near the bottom scoring in the high 80s. This year, the highest rated items are in the 80s.

The ratings are based on dealers' projections for each of the 23 categories to achieve higher sales or be at least as good as they were in the previous year.

Somewhat surprising (or perhaps not given the heavy snow that hit in December) was that "all" dealers and RLF dealers alike rated snow removal equipment at the top of their list for best bets for improving sales in 2009. This category of equipment placed sixth in 2008.

Utility vehicles (UTVs) were rated by both dealer groups in the top-5 with solid prospects for sales growth. When they were combined with all-terrain vehicles (ATVs) in a single category a year ago, they placed eighth on dealers' best bets list.

This year, when they separated, UTVs moved up to fourth, while ATVs fell to the 20th spot on the all dealers list and 23rd on RLF dealers' rankings. While sales of ATVs have slowed, the newer UTVs are in the middle of a breakthrough situation.

It would appear that the UTV market holds good potential for growth for RLF dealers. With their superior service capabilities, these dealers have a message to sell, but they'll have to work hard to get these customers in the door.

Other products rated highly by both dealer groups for 2009 include chainsaws, power hand tools, tillers, fertilizer spreaders and wood handling equipment. Dealers might also look toward seeders/drills, scrapers and graders, and post-hole diggers for improving sales in the coming year.

Generally, dealers rated bigger ticket items, like tractors, skid-steer loaders and backhoes, near the bottom of the list.

As might be expected, with the track record that compact tractors have posted in the last 4 years, it's no wonder that dealers aren't holding out a lot of potential for them in 2009. Asked to rate the potential for maintaining or growing sales of the 23 different products, compact and utility tractors are at or near the bottom on the lists of both all dealers and RLF dealers.

The Dealer's Edge

Despite a challenging sales environment, equipment dealers recognize that they have significant influence on customer product choice — once they get them in the door.

Generally, dealers say that prospective rural lifestyle customers arrive at the dealership with some notion of what they want to buy. At the same time, these same customers are almost always willing to accept a dealer's product recommendation.

Overall, dealers report that nearly 93% of the time a prospective customer walks into their store they either have a specific equipment brand or unit in mind or some idea of what they're looking for. Only 6.4% of the time do they have their mind made up about a specific piece of equipment or brand before they arrive at the dealership. This would point to these customers conducting research — probably via the Internet — before they begin shopping.

These customers, however, accept the dealer's recommendation on their purchases at an impressive rate of 80% of the time. On average, dealers say that their recommendations are "always accepted" 7% of time. Meanwhile, their recommendations are "mostly accepted" 72.7% of the time. Still, the dealer's recommendation is usually accepted in 20.3% of all cases.

What this seems to demonstrate is that nearly all hobby farm and LPO customers are "still shopping" when they visit an equipment dealership, and therefore open to proposals from salespeople. It would also indicate that the dealer may convince them of a different product altogether once the application and intended use is understood.

The skills and product knowledge of salespeople are critical when working with rural lifestyle customers. Most dealers agree that demonstrating the equipment — getting them in the seat — is probably the most convincing sale technique in selling this type of customer.

Devoted Sales & Service Staff

This year's survey asked how many full-time salespeople are employed by the dealership and how many specialize in selling equipment to the rural lifestyle customer.

On average, dealers responding to the 2009 survey report that they have 4.3 full-time salespeople on staff and 3.2 are considered "specialists" on rural lifestyle equipment.

For dealerships where 25% or more of annual revenue comes from the hobby farm and LPO customer base, 3.6 salespeople was the average of their total sales force and 3.2 of these focus on rural lifestyle customers.

Because these consumers often choose to do business with a farm equipment dealer because of its promise of after-sale service, dealers were also asked about the size of their service staffs.

Dealers whose revenue from this segment is 25% or more of their annual sales revenue report that they employ 6.3 service techs, on average. This compares to an average of 9 service technicians for all dealerships, who generally have many more farm and commercial customers where service is of paramount importance.

Getting the Word Out

While the traditional farm equipment dealerships that are aiming to expand into the rural lifestyle market and those that are already focused on this segment possess several significant advantages over competing retailers like big box stores, rural retailers and lawn and garden dealers, the biggest challenge remains "getting these prospective customers in the door."

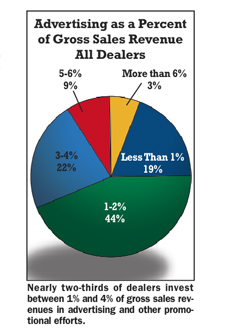

In terms of what dealers invest in advertising and other promotion efforts, there was little very difference between the responses of the "All" dealer category and those of RLF dealer group.

Overall, two-thirds (66%) of dealers spend between 1% and 4% of gross revenues in advertising. The largest percentage of dealers — 44% — report an average of 1-2% invested in advertising and promotional programs.

For those spending a larger portion of sales revenues on advertising, 15% reported allocating 5% or more on advertising and promotional efforts. Less than 20% invest less than 1% on these programs.

Staying Power

This year's survey also explored how dealers plan to tackle the challenging year ahead and what efforts they'll be focusing on to grow or maintain sales levels during 2009.

Their answers were wide ranging, from more direct contact with customers through an increased presence at county fairs and home improvement shows to just holding on or cutting back staff.

A preponderance of the responses, though, revolved around more effective marketing through advertising and promotion. Last year, dealers ranked their most effective marketing tools as newspapers (37%), direct mail (21%), the Internet (21%), radio (13%), television (7%) and telemarketing (1%).

While it's anybody's guess when the housing market will pick up, the chief economist for the National Assn. of Home Builders reported in late January that he expects a "bottom" in 2009.

David Crowe says that housing starts are expected to fall nearly another 30% in 2009 and new-home sales will drop 14%. But he said he expects the trough of the market to occur sometime in the middle of the year.

David Crowe says that housing starts are expected to fall nearly another 30% in 2009 and new-home sales will drop 14%. But he said he expects the trough of the market to occur sometime in the middle of the year.

"We should come out of 2009 on an upswing. It won't be strong, and we will still have home-price declines throughout the year, but it will be an upswing," he said. As critical as new homebuilding is for growing rural lifestyle markets, there are dealerships that are demonstrating staying power and will weather the storm.

Two examples are Rural Lifestyle Dealer's Dealerships of the Year in 2007 and 2008. They report that business is tough but still pretty good in spite of the challenging economic environment.

Last year's Dealership of the year, Little Tractor of Metropolis, Ill., had its best sales year ever, selling nearly 300 compact tractors. They were doing it while the sale of compact tractors industry wide fell by 15%.

Dave Siemens, owner of Dave's Tractor of Red Bluff, Calif., and 2007 Dealership of the Year winner, specializes in serving rural lifestyle customers in Northern California.

"Local walnut orchardists are seeing about half the money they expected for their crops. Our focus remains on the rural lifestyler and I think we saw the bottoming out of the market from about September 15 through mid-November when we experienced two months of 'very' slow sales," says Siemens.

"The second half of November and December were relatively good. Calendar year 2008 finished 5.8% higher in gross sales and profits compared with 2007. While this may not have been stellar, we are pleased," he says.

Post a comment

Report Abusive Comment