OPE Dealers’ Cost of Doing Business

The United Equipment Dealers Assn.’s (UEDA) Cost of Doing Business Study presents the annual financial and operational profile of independent, retail equipment dealerships. The 2016 study assesses the financial performance of outdoor power equipment dealers (OPE) who submitted confidential financial reports for 2015 to the association for tabulation by a certified public accounting firm. The study presents composite income statements and balance sheets in addition to averages for key financial performance ratios. The year the studies were released reflects the prior year’s results.

The results shown include outdoor power equipment dealers from 4 states — Kentucky, Indiana, Michigan and Ohio — comprising the UEDA members who participated in this study. Complete copies of the reports are available by contacting UEDA.

A 5-year packet of the studies included in this report is available to dealers from UEDA for $299. Please contact Bill Garling at 800-606-6332.

Over the past 5 years there has been nothing steady when it comes to the business levels for dealers selling outdoor power equipment (OPE). They’ve witnessed a swing in annual revenues of 31% on average between 2012-16 ($3.32 million vs. $4.34 million). But this wasn’t the worst of it. Between 2013-15 alone, total revenues, on average, fluctuated by more than half ($2.85 million vs. $4.34 million).

Fortunately, dealers have seen some growth during the past 2 years, according to the Cost of Doing Business Studies conducted by the UNITED Equipment Dealers Assn. (UEDA). Their numbers show that after 2 years of declining revenues in 2012 and 2013 ($2.9 million and $2.8 million, respectively), revenues on average increased to $3.3 million in 2014 and $4.3 million in 2015.

To determine which of the wide-ranging measurements covered in UEDA’s Cost of Doing Business Study were most relevant to OPE dealers, Rural Lifestyle Dealer conducted a survey of a small sample of dealers. The operational and financial metrics covered in this report reflect those selected by the dealers who responded to the survey.

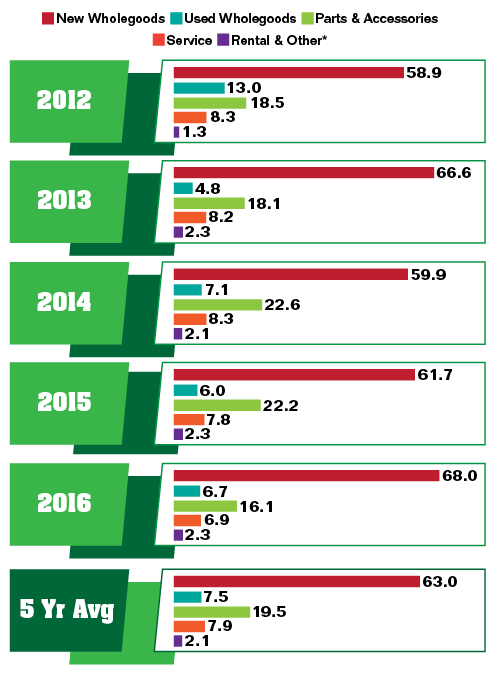

Revenue Mix

Over the course of the past 5 years, results of the studies show that sales of new equipment wholegoods increased in both total dollars and as a percentage of total revenues in 3 of the 5 years considered in this report. Overall, revenues generated by sales of new wholegoods ranged from $1.95 million in the 2012 study, or about 59% of revenues, to $2.95 million or 68% of total revenues in the 2016 study. During the 5 years, annual revenues from new wholegoods averaged $2.12 million, or 63% of total revenues. (See "OPE Revenue Mix — 2012-16".)

At the same time, sales of used wholegoods as a percent of total revenues was erratic throughout the period studied, from a high of 13% in 2012 to a low of 4.8% in 2013. On average, sales of used wholegoods comprised 7.5% of total revenues over the 5 years studied.

OPE Revenue Mix — 2012-16

Over the 5 years studied, dealers showed an increasing reliance on new wholegoods to meet their revenue goals. During this period, new equipment made up 63% of sales.

*Other includes freight, delivery, warranty, outside labor and cash/volume discountsLooking at the sales of parts and accessories between 2012-16, it appears in the years when new wholegoods decline, dealers have a greater potential to increase parts sales. For example, in 2014 when sales of new wholegoods fell close to their lowest levels, 59.9% of total revenues, parts and accessory sales peaked at 22.6% of total revenues. When sales of new equipment peaked at 68% of revenues, part and accessory sales dropped to their lowest level of the 5-year period, at 16.1% of revenues.

On average, over the 5-year period studied, revenues from parts and accessories averaged 19.5% of total revenues, second only to new equipment sales.

Sales of technical services would also seem to hold solid potential for increasing OPE dealers’ bottom line. Over the 5 years in question, service represented slightly less than 8% of total revenue. Service revenues held steady at about 8.3% during the first 3 years when sales of new wholegoods never got past $2 million. But as new equipment sales surpassed the $2 million mark in 2015 and reached nearly $3 million in the 2016 report, service revenues dipped below 8% and 7%, respectively.

OPE Total Expenses — 2012-16

Controlling expenses during the ups and downs of the past 5 years demonstrated good dealer discipline.

| 2012 | 2013 | 2014 | 2015 | 2016 | 5 Yr Avg |

| $674,057 | $673,175 | $515,934 | $711,055 | $691,562 | $653,156 |

This is most likely due to the fact that newer equipment requires less service compared to older products. However, this may also present an opportunity for dealers to increase preventative maintenance-type packages and sales to take advantage of the higher margins typically available with service.

Rex Collins, head of the Dealership Industry Group at HBK CPAs & Consultants, says as a percent of total revenues, a balanced revenue mix for OPE dealers would fall into the range of 62-68% for new equipment, 6-7% for used wholegoods, 16-22% for parts and 6-8% for service operations. Collins also suggests that given the higher gross profits generated in the service and parts departments, the most successful dealers are looking to grow those portions of the business.

OPE Total Interest Expense — 2012-16

With the downturn in sales, starting in 2013, dealers consistently reduced their interest expenses.

| 2012 | 2013 | 2014 | 2015 | 2016 | 5 Yr Avg |

| $22,514 | $15,784 | $14,972 | $17,251 | $14,005 | $15,409 |

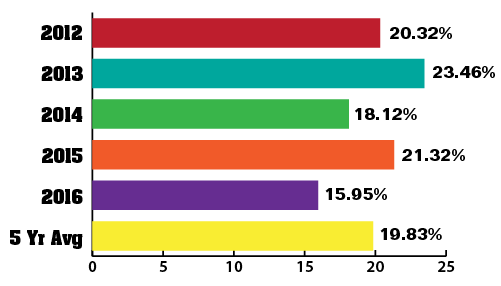

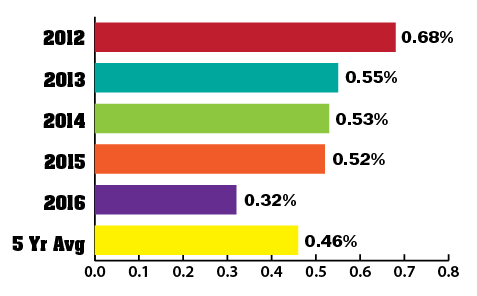

Interest & Total Expenses

Total expense through the 5 years studied ranged from a high of 23.5% in 2013, the first year of the downturn, to a low of 15.95% in 2016, easily the year when dealers saw their largest gain in revenues. Over the course of the period, total expenses averaged 19.8%. (See "OPE Total Expenses — 2012-16" and "OPE Total Interest Expense — 2012-16".)

Expenses associated with salaries and benefits, as dealers have come to expect, represent the single highest expense in any given year. Ranging from 12.9% in 2013, the first year of the sales downturn, to less than 8.5% as the industry entered full recovery mode. On average, total salaries and benefits were 10.9% during the period.

Interest expense, which includes floorplan costs, can reflect the rate of inventory turnover, among other things. In 2012, dealers incurred the highest level of interest expense at 0.68%, which was more than halved (0.32%) by the time the sales recovery was in full swing, as recorded in the 2016 study.

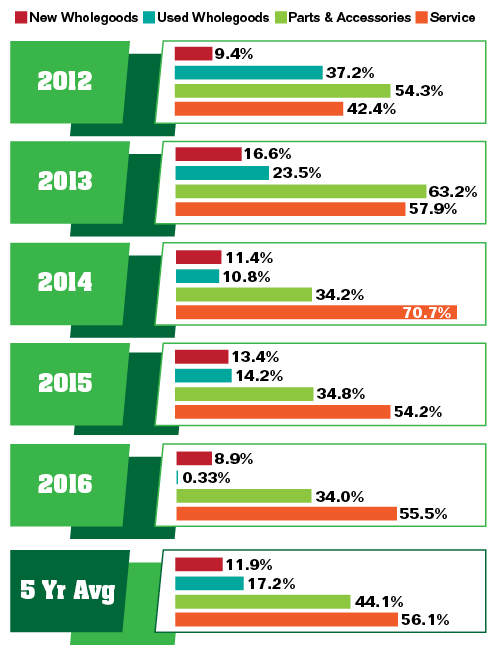

OPE Gross Margins — 2012-16

On average, OPE dealers were only able to maintain about a 12% gross margins on new wholegoods.

On average, OPE dealers were only able to maintain about a 12% gross margins on new wholegoods.

Gross Margins

Through the first 4 years of the 5 years considered in this report, gross margins ranged from 21-25%. But in the 2016 study, margins saw a significant decline to 17.5%.

By revenue segment, gross margins on new wholegoods averaged almost 12%, ranging from 16.6% in 2013 and then bouncing around to 11.4% in 2014, 13.4% in 2015 and hitting a low point in 2016 at 8.9%. Used wholegood gross margins saw a wider range during the 5 years, finally averaging at 17.2%. (See "OPE Gross Margins — 2012-16".)

Margins on parts and accessories showed some erratic results during the years considered, but levels between 2014-16 averaged 34.3%. Gross margins on service activities showed some irregular trends as well, but over the 5-year period, service margins averaged 56.1%, which would be considered reasonable and healthy.

Inventory & Asset Turns

Inventory and asset turns (turnover) are critical measures that every dealership needs to monitor. Inventory turns are calculated by dividing cost of sales by inventory. This ratio shows the number of times inventory is bought and sold during the year, and is shown on the dealership’s balance sheet.

OPE Inventory & Asset Turns — 2012-16 |

||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 5 Yr Avg | |

| Inventory | 2.91 | 2.15 | 2.40 | 3.02 | 3.34 | 2.76 |

| Total Assets | 2.81 | 2.26 | 2.44 | 2.93 | 3.20 | 2.73 |

Inventory Turns. The industry benchmark for inventory turns is 2.5-3.0. The 5-year average was 2.76 turns, within the industry’s benchmark goal.

In looking at the industry’s performance between 2012-16, it was within range at the start of the period at 2.91 turns in the 2012 study. Inventory turns then fell below the benchmark as sales declined in 2013 and 2014, at 2.15 and 2.40 turns, respectively. It should be noted that when inventories were quite high (81.3% of total assets) is when inventory turns fell to their lowest level (2.15 turns), which, of course, is never a healthy combination. (See "OPE Inventory & Asset Turns — 2012-16".)

The following 2 years, inventories as a percentage of total assets fell to their lowest levels of the 5-year period studied — 74.1% in 2014 and 75.6% in 2015 — and turns improved, reaching 2.4 and 3.02, respectively. This indicates dealers carried lower inventories and began to turn it more effectively.

As sales revenues rose rapidly as indicated in the 2016 study to $4.3 million on average, inventories also grew to their highest level (81.8% of total assets) during the 5-year period examined. The higher inventories were justified as the average turns easily exceeded the industry benchmark, rising to 3.34 turns.

Asset Turns. Asset turns are calculated by dividing sales by total assets. This ratio is a measure of efficient use of assets. However, as the UEDA study indicates, a high rate of turnover is not necessarily the key to profits as a high turnover may be an indicator of inadequate capital in relation to sales. Also, high use of rental property by a dealer often results in a high rate of turnover.

For the period, total asset turnover ranged from 2.26 turns in 2013 to 3.2 turns in 2016. During the last 5 years, the industry average 2.73 total asset turns.

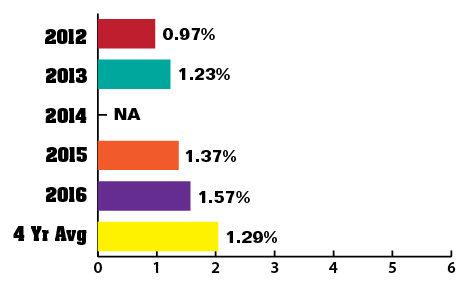

OPE Total Profit from Operations — 2012-16

Profit from operations remained slim during the 4 years numbers were available, averaging less than 1.3%.

| 2012 | 2013 | 2014 | 2015 | 2016 | 4 Yr Avg |

| $32,336 | $35,290 | NA | $45,543 | $68,287 | $45,364 |

Total Profit & Net Income

One of the anomalies in the numbers showed up in total profit from operations in 2014. While the other 4 years ranged from less than 1% in 2012 to nearly 1.6% in 2016, in 2014 calculations showed a total profit from operations at nearly 5.1%. Reducing overall expenses can help improve profits, and according to the 2014 report, total expenses fell by nearly 5.5% between 2013-14. And as reported earlier, 2014 was the lowest revenue year of the 5 covered in this report. Nonetheless, there isn’t enough other detail to determine why this anomaly showed up. (See "OPE Toal Profit from Operations — 2012-16" and "OPE Total Net Income (Pre-Tax) — 2012-16".)

OPE Total Net Income (Pre-Tax) — 2012-16

During the 4 years studied, OPE dealers’ net income improved as new equipment sales increased.

| 2012 | 2013 | 2014 | 2015 | 2016 | 4 Yr Avg |

| $47,300 | $46,254 | NA | $65,380 | $83,329 | $60,566 |

Excluding the high profit level of 2014, the average profit from operations for the period was 1.29%.

This anomaly also showed up in dealers’ net income figures for 2014. That year, OPE dealers reported an average net income of 5.43%. This compares to a low of 1.43%, which was reported in 2012 and a high of 1.96% for 2015, which was slightly higher than 2016 (1.92%) when revenues were 30% higher. Again, excluding the 2014 number, the average net income for the period was 1.73%.

ROE & ROA

The two financial ratios most often mentioned by the dealers who responded to Rural Lifestyle Dealers’ survey as being critical to their business success were return on equity and return on assets.

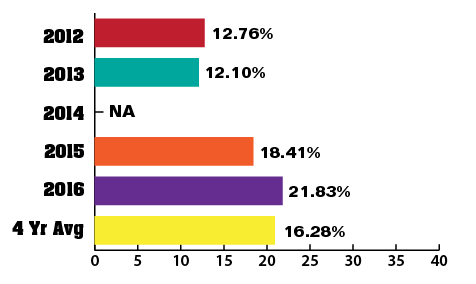

OPE Return on Equity (Pre-Tax) — 2012-16

The industry benchmark for ROE is 20%. During the 4 years considered, OPE dealers achieved only a 16.3% ROE.

The industry benchmark for ROE is 20%. During the 4 years considered, OPE dealers achieved only a 16.3% ROE.

Return on Equity (ROE). This is the amount of net income returned as a percentage of shareholders equity. It measures a dealership’s profitability by revealing how much profit a dealer generates with invested funds. It is calculated by dividing net income by shareholder’s equity.

Once again, excluding the 2014 figure, the average pre-tax ROE over the period was 16.28%. This is below the industry’s benchmark of 20%. OPE dealers in 2016 were able to surpass the benchmark, achieving an ROE of 21.83%, but this high couldn’t balance out the two much lower years in 2012 and 2013, when ROEs came in at 12.76% and 12.10%, respectively.

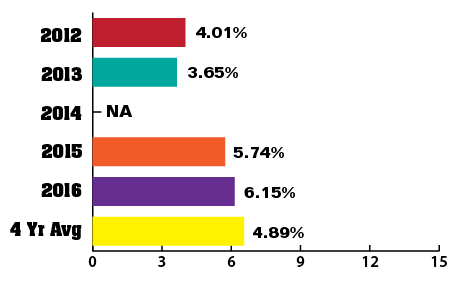

OPE Return on Assets (Pre-Tax) — 2012-16

OPE dealers’ ROA during the 4 years considered in this report averaged less than 5%, below the industry benchmark of 6%.

OPE dealers’ ROA during the 4 years considered in this report averaged less than 5%, below the industry benchmark of 6%.

Return on Assets (ROA). According to UEDA, ROA is calculated by dividing net profits by total assets. This ratio is an important test of operating efficiency. It is a test of the dealership management’s use of the assets in the business. It shows the return on total capital investment in the business, which includes both the owner’s capital and outside capital, which is represented by total assets.

The industry’s benchmark for ROA is 6%, which was exceeded only once during the period (excluding 2014 figures). Dealers’ ROA in 2012 was 4.01%, which was followed by an even poorer showing in 2013 of 3.65%. As sales revenue began bouncing back in 2015, dealers’ ROA also showed marked improvement to 5.74%. In 2016, the industry exceeded the benchmark by achieving a ROA of 6.15%.

Dependence on New Equipment

If one thing is clear in studying the performance of OPE dealers during the 2012-16 period it is that, on average, dealers remain highly dependent on new wholegood sales to remain solvent and to be profitable. Parts absorption improved slightly (2.6%) during this period, service absorption actually declined from a peak of 32.3% in 2013 to 28% in 2015 before recovering somewhat to 29.1% in 2016.

In other words, OPE dealers should be looking to reduce their dependence on new and used wholegoods sales and develop a more balanced revenue mix. As shown earlier in this report, on average, more than 70% of OPE dealers’ revenue comes from new and used equipment, a little less than 20% from parts and less than 10% from service.

One dealer who replied to the Rural Lifestyle Dealer survey said, “We strive to be strong in parts and service. Our goal is 60% wholegoods, 25% parts and 15% service breakdown.”

Should OPE Dealers Measure Absorption?

For many outdoor power equipment dealers, absorption is not a metric they monitor regularly. But should they?

For dealerships handling larger agricultural and construction equipment, aftermarket absorption is a critical measurement. It is calculated by dividing parts and service gross margins by total expenses.

The belief is the higher the absorption rate, the more fixed costs are covered in the event of a slowdown in wholegood sales. While this tends to take on more importance during periods when unit sales of new and used equipment decline, it can be difficult to increase absorption when a slowing equipment sales is evident.

The UNITED Equipment Dealers Assn. indicates that the benchmark or target for both farm equipment and OPE dealers for parts and service absorption is 80%-plus. For dealers handling large construction equipment, the benchmark is closer to 100%.

In 2015-16, OPE dealers’ total absorption was 56.2% and 58.3%, respectively. For comparison purposes, the absorption rate during those same years for dealers handling large ag equipment was somewhat better, at about 64%.

A breakdown in aftermarket absorption rates shows that parts absorption for OPE dealers was 36.3% in the 2015 study and 34.2% in the 2016 study. For service, the absorption rate was 19.9% in 2015 and 24.1% in 2016.

Post a comment

Report Abusive Comment