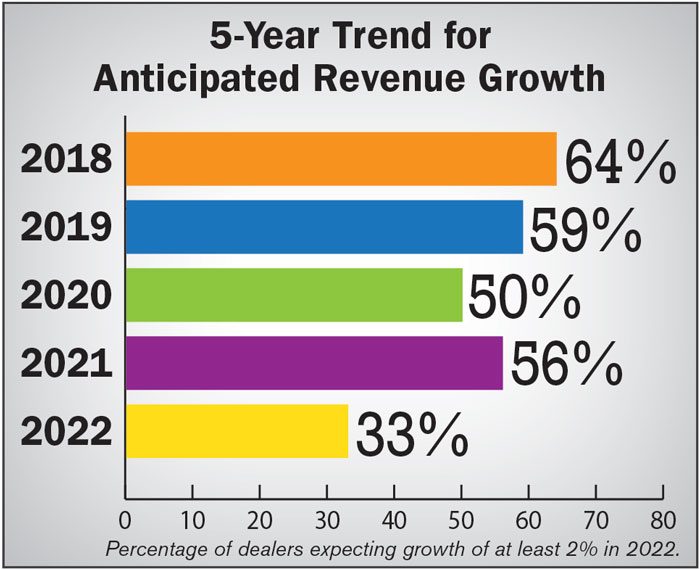

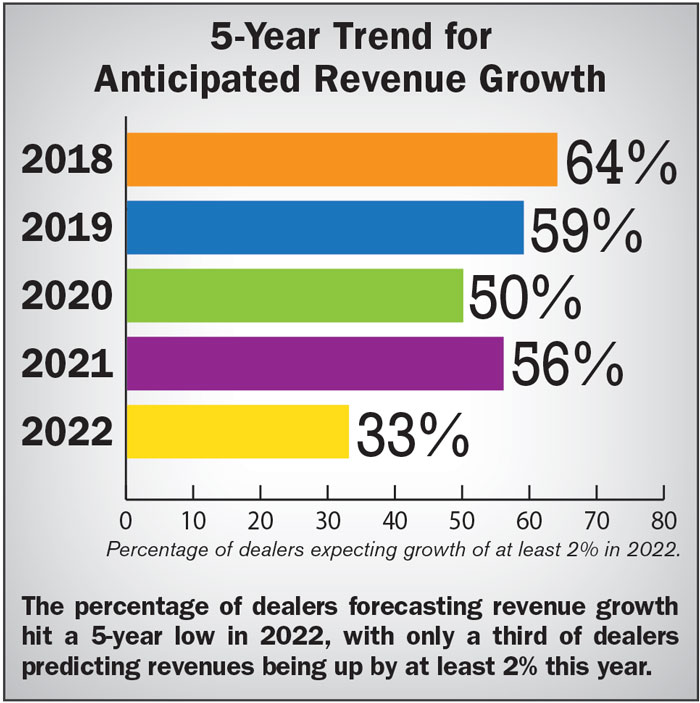

According to the results of Rural Lifestyle Dealer’s annual dealer survey, just one-third of dealers anticipate sales growth of at least 2% this year. That breaks a string of 5 straight years where at least half of dealers anticipated growth heading into the new year.

In fact, 56% anticipated growth heading into 2021 and 64% anticipated growth heading into 2018.

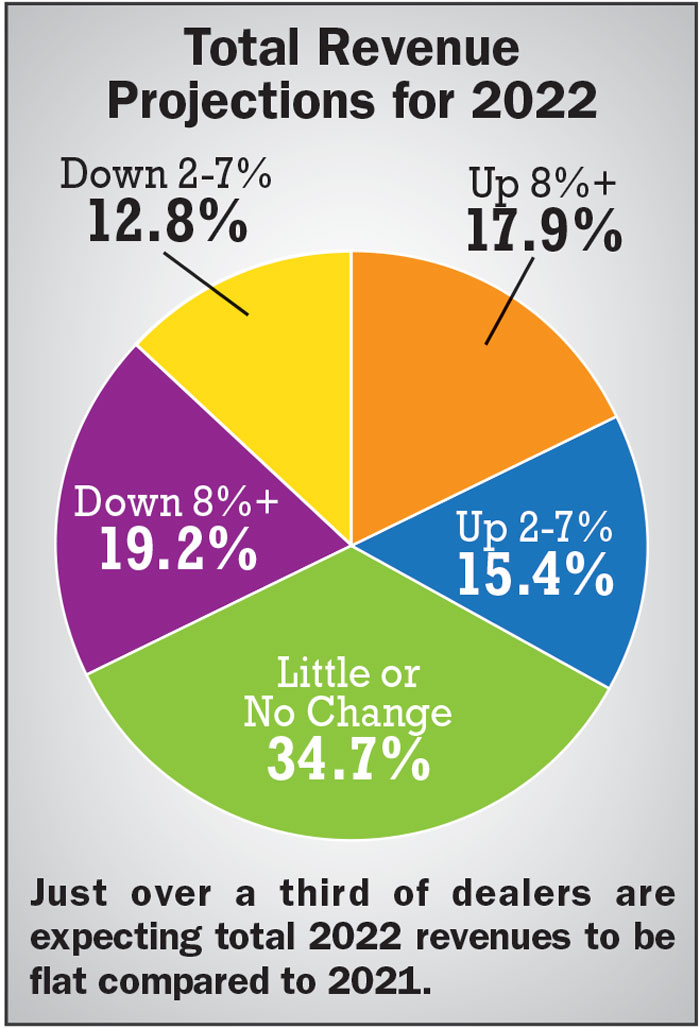

Many of this year’s more pessimistic dealers still think revenue will be in line with last year. However, more dealers are thinking they’ll have a down sales year than in years past. Roughly 32% of dealers think revenue from rural lifestylers and landscape contractors will decline this year, compared to just 19% one year ago.

Nonetheless, many dealers continue to march forward with the goal of not leaving any potential money on the table.

“Manufacturers are demanding orders, although they have no clue as to delivery or build dates,” one dealer said. “Everyone is flying by the seat of their pants. If all of these orders are somehow delivered, there will be the largest glut of new inventory ever witnessed.”

Dealer Takeaways

- 33% of dealers anticipate total revenue growth this year, down from 56% last year.

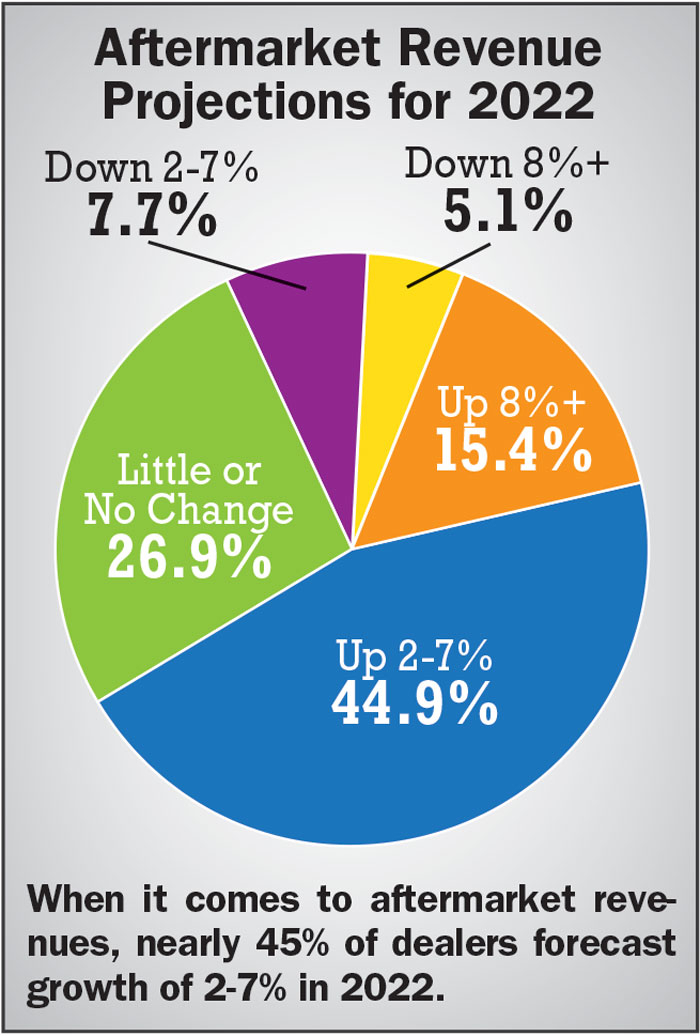

- 60% of dealers anticipate aftermarket revenue growth this year, in line with the 61% reported last year.

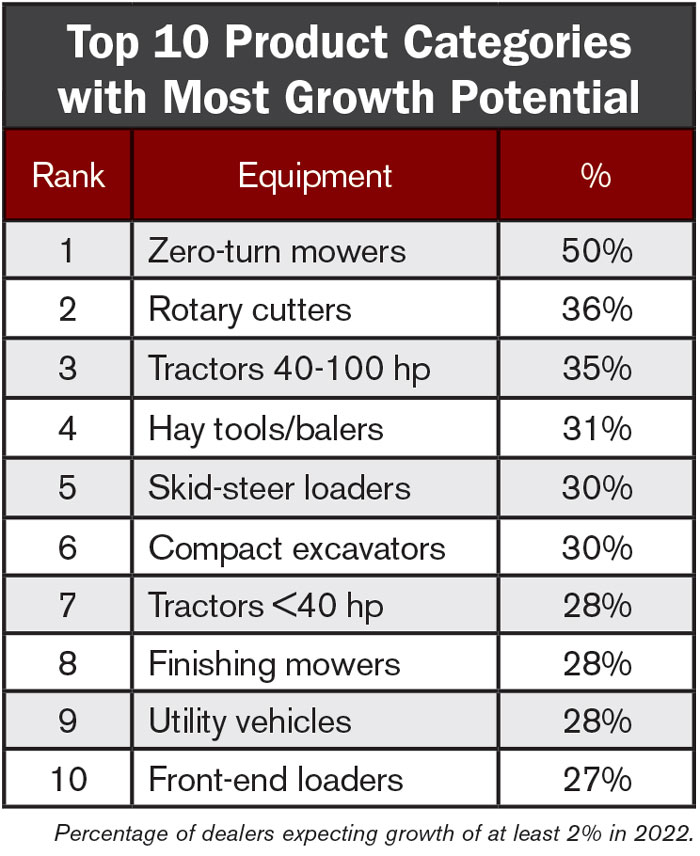

- At least 25% of dealers see an opportunity to increase unit sales in 11 product categories.

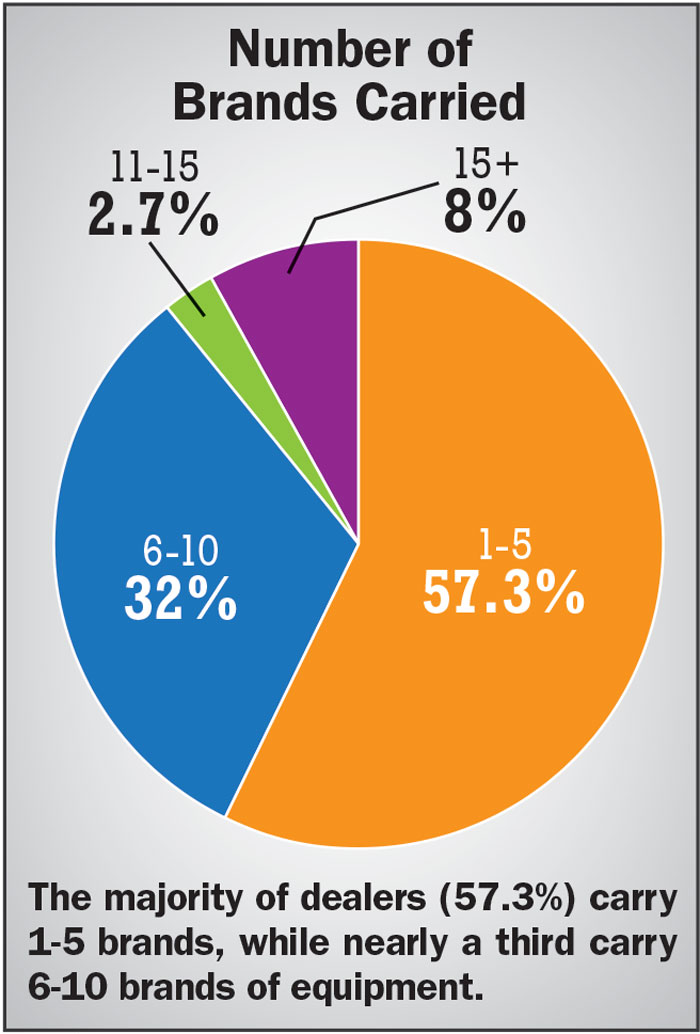

- 89% of dealers carry fewer than 11 brands, and 47% are looking to add a line within the next 2 years.

- 80% of dealers have seen a 5% increase in the number of rural lifestyle and landscape contractor customers over the past 5 years.

Meeting demand and overall customer expectation has been a challenge for dealers. “I’m expecting honest ETAs from suppliers so we can be honest with our customers,” one dealer said. “We want to under-promise and over-deliver.”

Good communication and empathy between buyer and seller won’t entirely solve the problem, but definitely helps.

“We are working closely with manufacturers to make sure we have plenty of products ordered,” one dealer said. “We are also working with customers to tweak what they want to what is available.”

“We have preordered a large amount of product,” another dealer said. “We have also ordered for delivery at various times of the year to ensure we always have product in the production line.”

“Instead of ordering 50-70% of prior-year sales on our preseason booking orders, we are ordering around 100%,” another dealer added.

Some dealers are in a better position to quickly shift from just-in-time inventory to what many dealers now refer to as “stock up and pray.”

“Fortunately, we have quite a bit of capital and can take a chance and order in larger amounts,” one dealer said. “We just built a new warehouse to help address storage issues.”

Equipment Categories with Best Growth Potential

Fewer dealers are anticipating growth in key product categories as compared to the past couple of years. That said, there are 11 categories where at least 25% of rural equipment dealers are expecting to increase unit sales in 2022:

- Zero-turn mowers – 50%

- Rotary cutters – 36%

- Tractors 40-100 hp – 35%

- Hay tools/balers – 31%

- Skid-steer loaders – 30%

- Compact excavators – 30%

- Tractors <40 hp – 28% < li>

- Utility vehicles – 28%

- Finishing mowers – 28%

- Front-end loaders – 27%

- Tillers – 25%

There are 5 product categories in particular where at least 10% of dealers are forecasting stronger growth of at least 8% in 2022:

- Zero-turn mowers – 14%

- Rotary cutters – 12%

- Tractors <40 hp – 12% < li>

- Utility vehicles – 11%

- Finishing mowers – 10%

At the other end of the spectrum are 8 product categories where at least 25% of dealers anticipate selling fewer units in 2022:

- Utility vehicles – 32%

- Tractors 40-100 hp – 30%

- Backhoes – 29%

- Tractors <40 hp – 28% < li>

- Compact excavators – 28%

- Lawn tractors – 27%

- Front-end loaders – 25%

- Finishing mowers – 25%

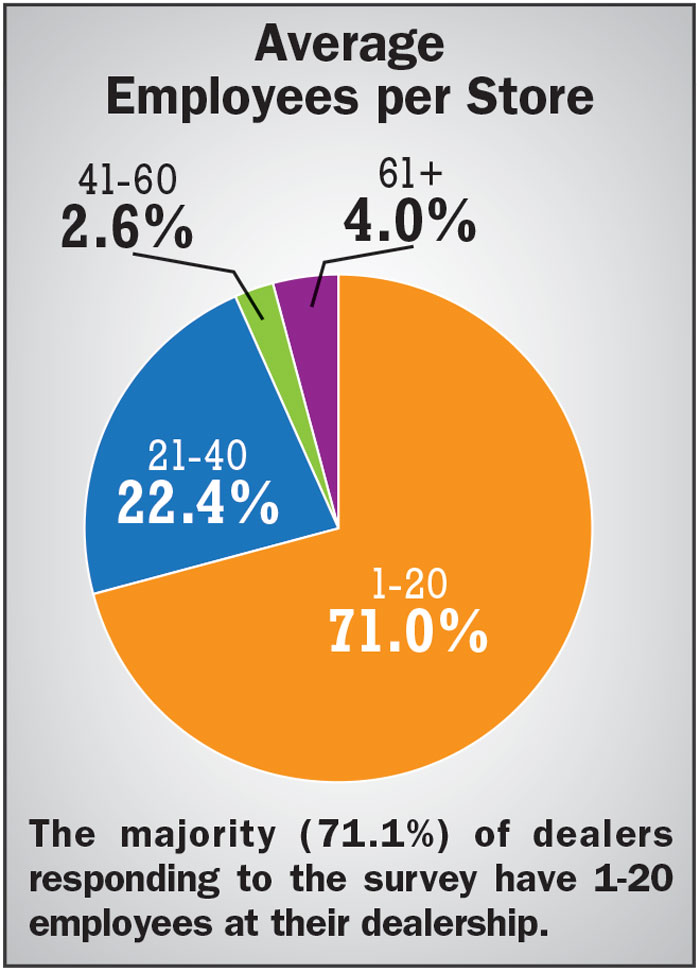

Equipment dealers need excellent staff to help sell equipment. According to survey results, the average dealer has fewer than 20 employees at a given location. Roughly 22% have 21-40 employees. Just 7% have more than 40. Roughly 78% of dealers employ dedicated salespeople who are focused on rural lifestyle customers.

Dealers see Battery as Both Opportunity & Threat

One steadily growing trend is the gravitation toward battery-powered equipment. “We actually focus more on battery than gas-powered now,” one dealer said. “Battery will continue to gain market share.”

Location is one driver that can help accelerate the market share grab.

“Demand is increasing, offerings are increasing, and small engines seem to be losing favor,” one dealer said. “This is especially the case on the left coast. That’s where things usually start and then creep their way east.”

If that is true, plenty of creep has already taken place.

“We live in Colorado which is leading a lot of states with the idea of ‘going green,’” one dealer said. “I believe battery and electric products will grow by 2-3% each year over the next 5 years.”

“We are located next to Dane County which is very ‘green’,” one Wisconsin dealer said. “So, we expect battery-powered equipment to grow rapidly.”

Some dealers feel a bit more geographically insulated from the shift toward battery.

“I think it will continue to grow, but we are in a rural area so it will be a while before it affects us,” one dealer speculated.

Regardless of the sense of urgency, many dealers have seen the opportunity battery-powered equipment presents and are taking cautious steps to begin capitalizing on it. Going forward, as technology continues to improve, many dealers plan on turning those smaller steps into longer strides.

“Battery-powered equipment is growing, but the technology needs to improve to give longer run times,” one dealer said.

“Battery equipment will continue to become a larger portion of our sales,” another dealer said. “Battery performance will improve every 3 or 4 years. We will stock parts for current models plus the new models and battery variations as they are introduced.”

Some dealers won’t deny the trend toward battery power but are still hesitant to go all in.

“I think battery will have a negative effect on parts and service income,” one dealer said. “Battery-powered products are more of a throwaway item. I wonder if the brick-and-mortar business model is even compatible if battery products take over the market.”

“Handheld equipment will become dominated by battery,” another dealer said. “Tractors and other lawn equipment will not be greatly affected, though, except in areas of government mandates such as California.”

Customer Segment Trends

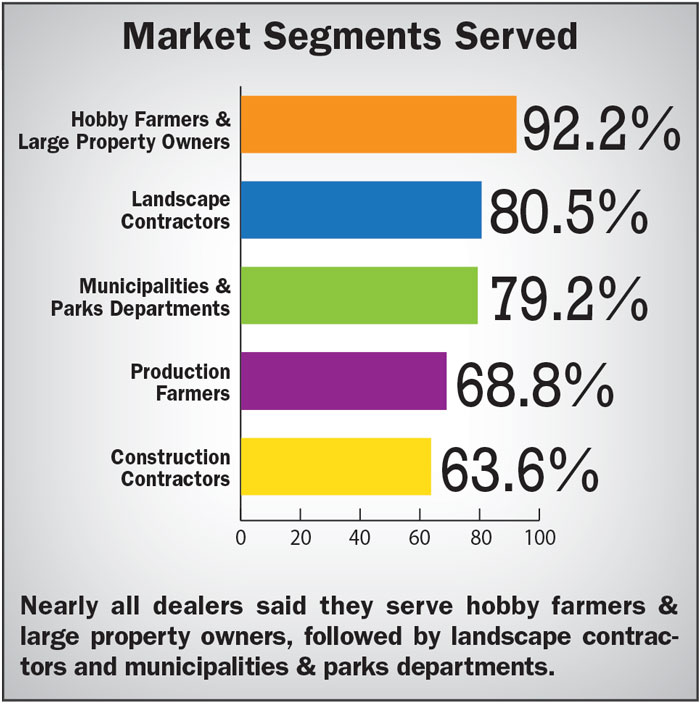

The majority of rural equipment dealers continue to serve the following customer segments:

- Hobby farmers and large property owners – 92%

- Landscape contractors – 80%

- Municipalities and parks – 79%

- Production farmers – 69%

- Construction contractors – 64%

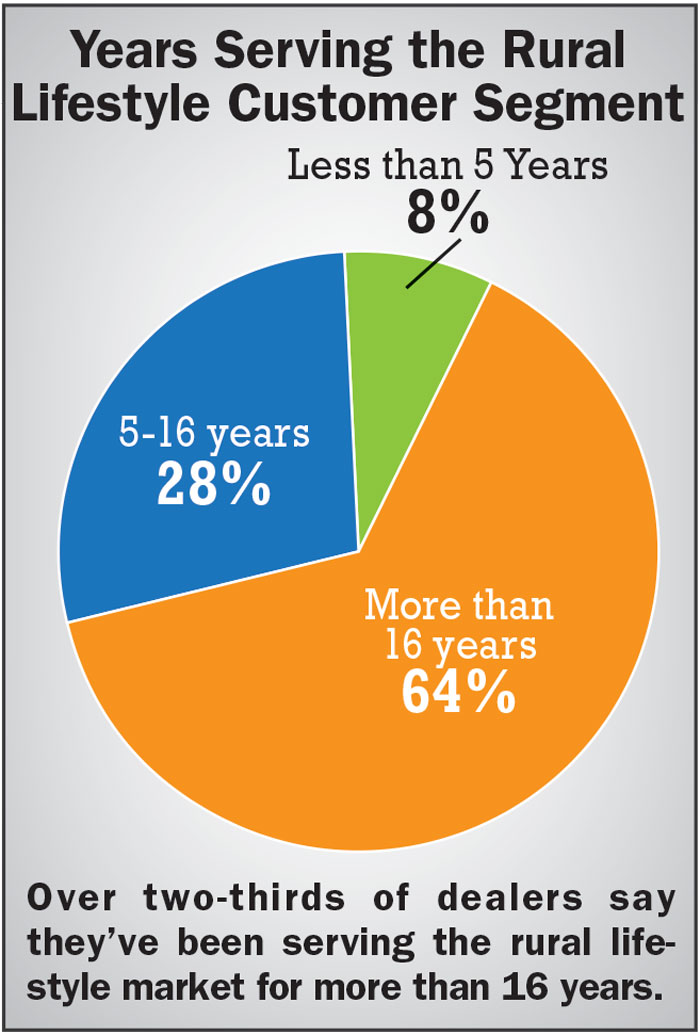

Over the past 5 years, most dealers have seen growth in the number of rural lifestyle and landscape contractor customers. Roughly 35% have seen growth of at least 20% while another 45% have seen growth of 5-19%. Just 3% of dealers have seen a reduction in customers.

Converting new customers into buyers requires the right products, brands and sales technique.

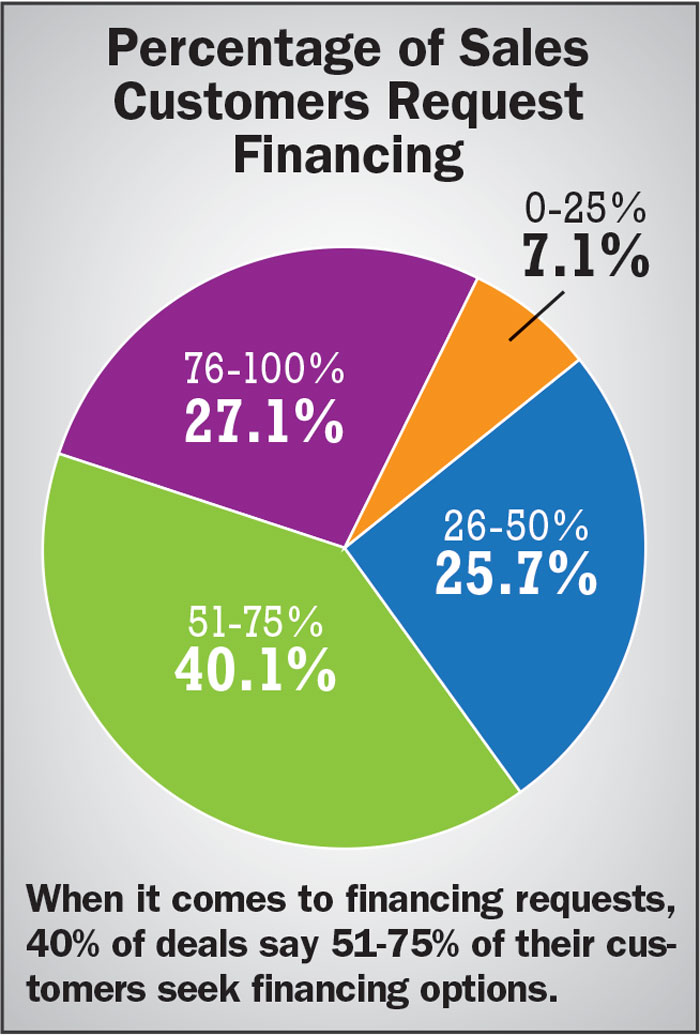

Financing has become an essential selling tool for equipment dealers. Roughly 67% of dealers said financing is requested by the customer on at least half of purchases. Another 26% said financing is requested on 25%-50% of purchases.

In addition to the need for financing, rural lifestyle customers also have a pretty good idea of what they want to purchase. But that doesn’t mean the dealer can’t play an influential role in this late stage of the buying process.

Roughly 60% of dealers said rural lifestyle customers typically arrive at the dealership with a specific brand or even unit in mind. Another 39% of dealers said customers have a brand or unit in mind some of the time. Very few dealers (1.4%) serve rural lifestyle customers who typically have no idea of what they want to purchase.

In any event, dealers can typically steer rural lifestyle customers in the right direction. Roughly 17% of dealers said their brand recommendation is accepted almost always. Roughly 69% of dealers said their recommendation is accepted most of the time, with another 14% steering customers some of the time. No dealers said their brand advice is typically ignored.

Despite their prowess on the showroom floor, dealers face some challenges in effectively serving the rural lifestyler market.

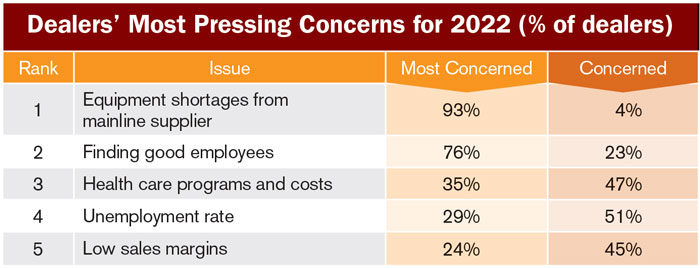

Equipment shortages continue to cause the overwhelming majority of an equipment dealer’s frustration these days. Roughly 93% are most concerned while just 3% have no concern.

Finding good employees seems to be nearly as difficult as finding inventory. Roughly 76% of dealers are most concerned about employee shortages while just 1% have no concern.

Concerns about manufacturer pressure for dealer purity really comes down to who you ask and how this issue is affecting their business. Roughly 26% of dealers are most concerned, with another 37% being somewhat concerned. But 37% have no concern at all. It’s a somewhat similar story with respect to warranty claims. Roughly 61% of dealers are concerned but 39% have no concern. Slightly more dealers share concern over sales margins. Roughly 24% are most concerned, with another 45% being somewhat concerned. However, 31% have no concern about sales margins at all.

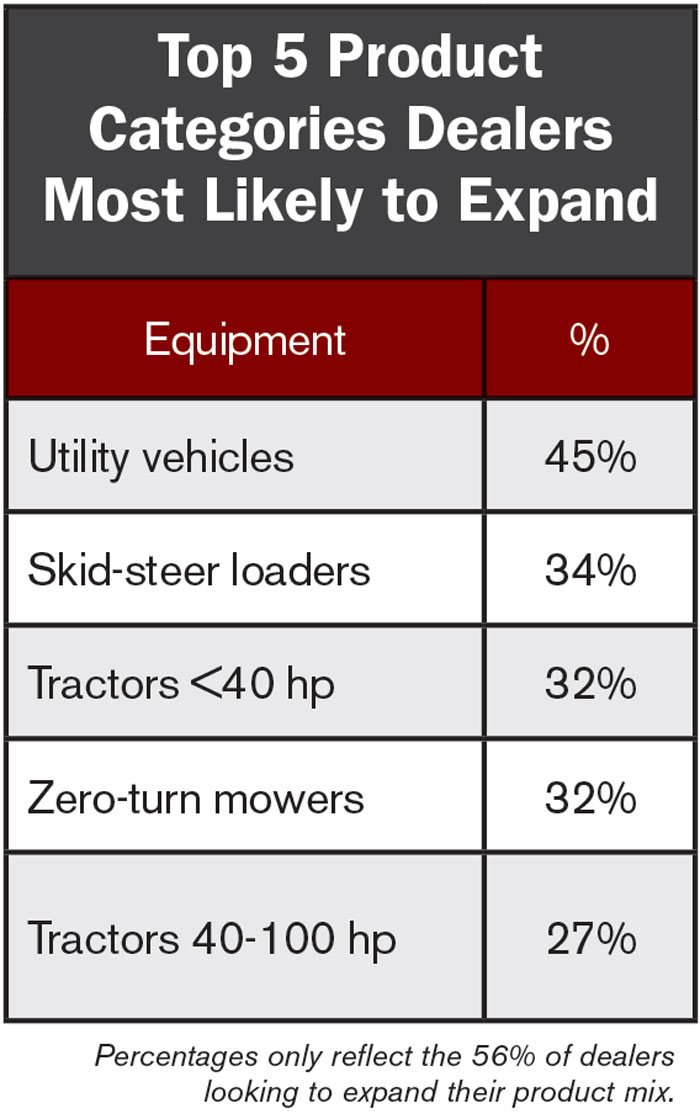

All of these concerns over manufacturer-related issues have some dealers looking to expand their product mix to create new opportunities and perhaps higher-margin returns.

Dialing-in the Right Equipment Mix

Most rural equipment dealers have a relatively focused product offering. Roughly 57% of dealers carry up to 5 brands. Another 32% carry 6-10 brands. Just 11% of dealers carry more than 10 brands.

Roughly 47% of dealers plan to add an equipment line in the next 2 years. Furthermore, roughly 56% plan to broaden their product mix in 2022. Among that 56% of expansion-minded dealers, 5 product categories stand out:

- Utility vehicles – 45%

- Skid-steer loaders – 34%

- Zero-turn mowers – 32%

- Tractors <40 hp – 32% < li>

- Tractors 40-100 hp – 27%

Most dealers turn wholegoods inventory up to 4 times per year. Roughly 31% of dealers turn inventory once or twice, and 40% turn wholegoods inventory 3 or 4 times. Roughly 29% of dealers turn wholegoods inventory more than 4 times per year.

It’s helpful when you carry strong brand names that rural lifestyle and landscape contractor customers think favorably of.

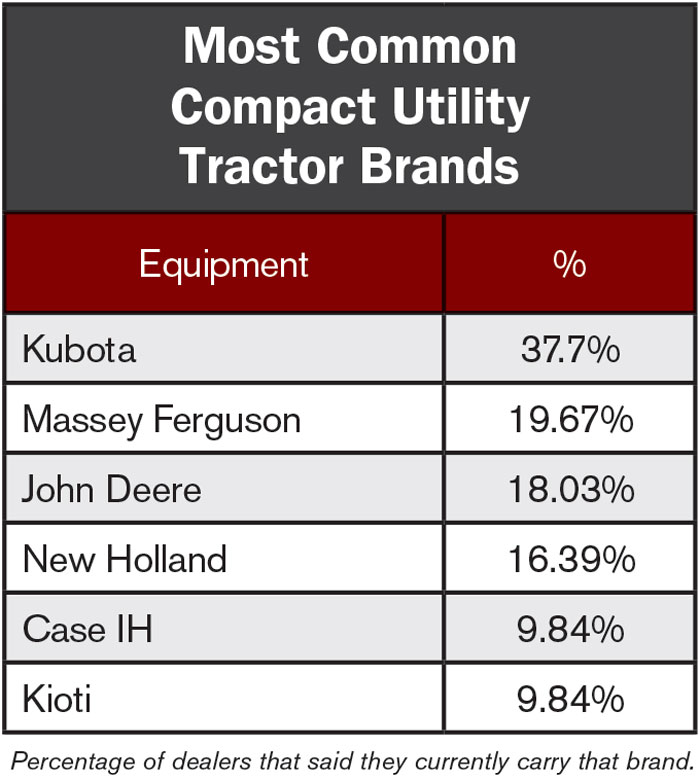

Compact Utility Tractors. Survey respondents cited 13 brands they carry. The most common are Kubota 37.7%, Massey Ferguson 19.67%, John Deere 18.03%, New Holland 16.39%, Case IH 9.84% and Kioti 9.84%.

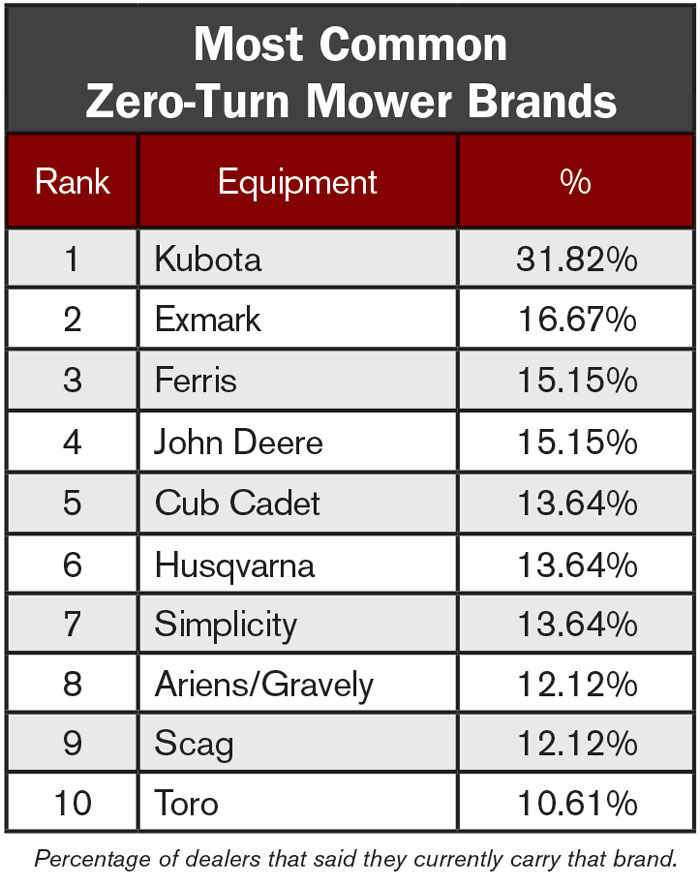

Zero-Turn Mowers. Survey respondents cited 30 brands they carry. The most common are Kubota 31.82%, Exmark 16.67%, Ferris 15.15%, John Deere 15.15%, Cub Cadet 13.64%, Husqvarna 13.64%, Simplicity 13.64%, Ariens/Gravely 12.12%, Scag 12.12% and Toro 10.61%.

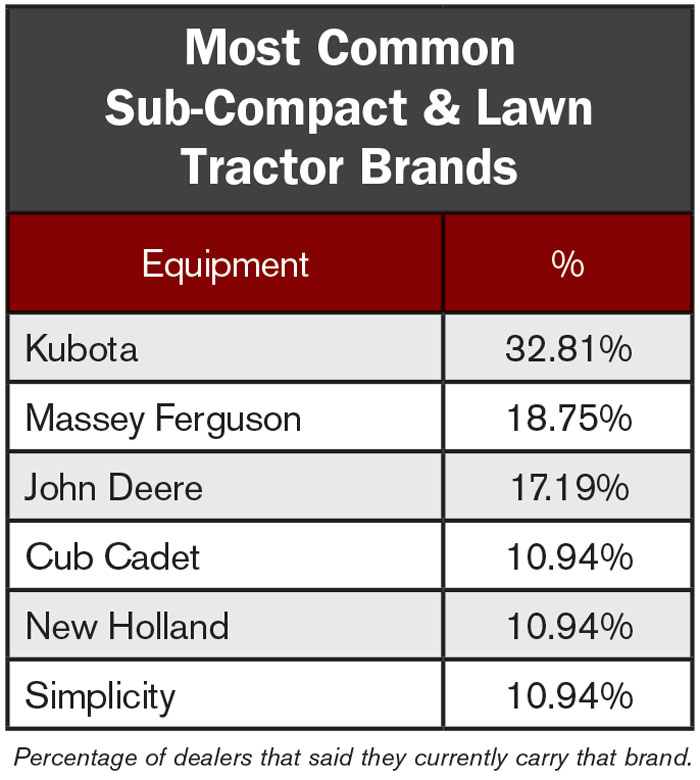

Lawn Tractors and Subcompact Tractors. Survey respondents cited 17 brands they carry. The most common are Kubota 32.81%, Massey Ferguson 18.75%, John Deere 17.19%, Cub Cadet 10.94%, New Holland 10.94% and Simplicity 10.94%.

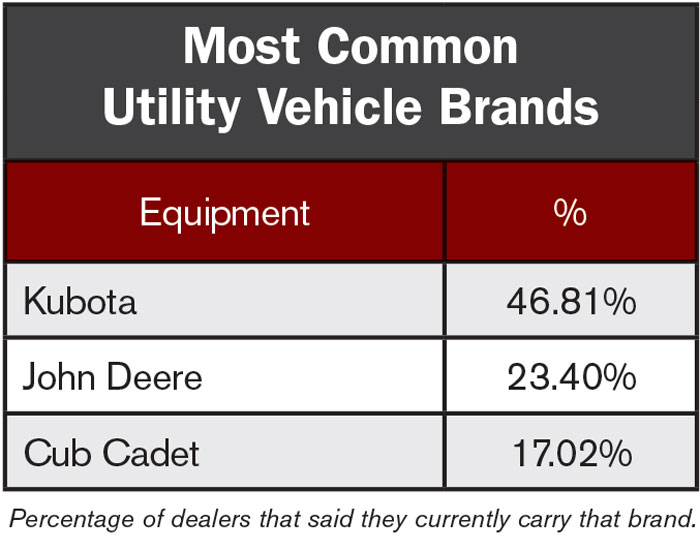

Utility Vehicles. Survey respondents cited 19 brands they carry. The most common are Kubota 46.81%, John Deere 23.4% and Cub Cadet 17.02%. Sixteen different UTV brands are each found in fewer than 10% of rural equipment dealerships.

Service Remains Steady While Scrambling for Techs

In today’s unpredictable business environment, dealers can find some semblance of normal in the back of the dealership.

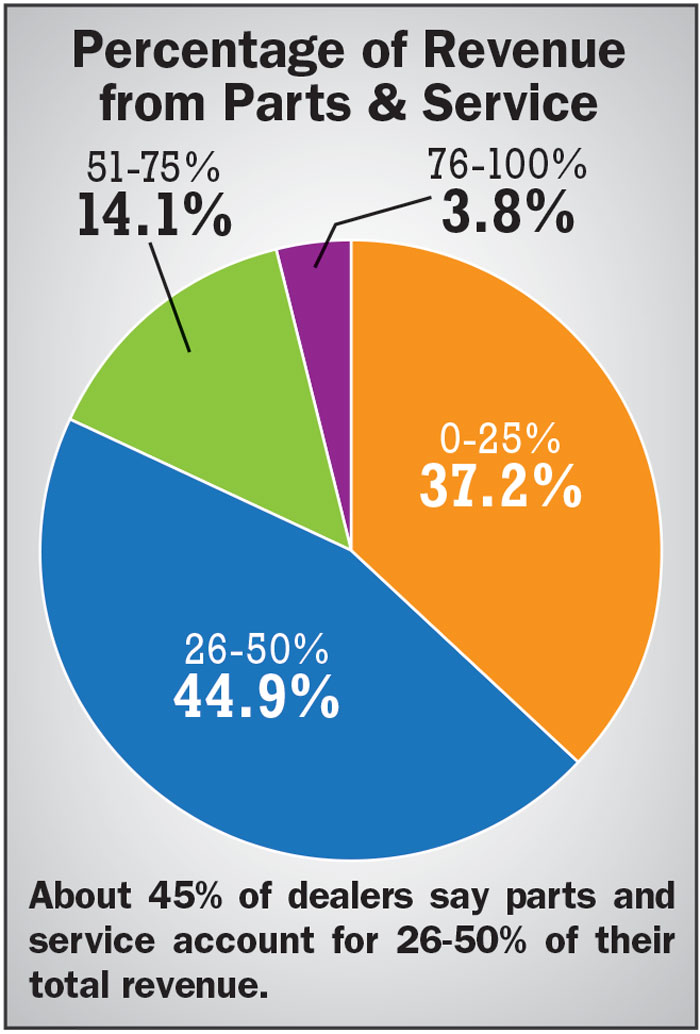

Roughly 60% of rural equipment dealers think aftermarket revenues will increase this year, right in line with forecasts at this time last year. Roughly 13% of dealers anticipate a decrease, with another 27% forecasting aftermarket revenues as flat.

Steady and predictable service business requires reliable technicians. Roughly 57% of dealers employ up to 5 full-time technicians, and just 17% have more than 10.

Minimizing the effects of the technician shortage starts with retaining the good ones you already have.

“We pay above average for our area depending on ability, experience and certifications,” one dealer said. “We also have a very basic incentive program. And as silly as it sounds, I find each one of my folks in their work area to thank them and hand them a $100 bill when we have a good month.”

“We are focused on increased pay and benefits, as well as facility improvements,” another dealer said. “We are working on improving the overall atmosphere to create an environment and team that people want to be a part of.

“We are also thinking about switching our techs to a 4-day work week,” that same dealer said. Similarly, one dealer said he is looking to hire more part-time staff to help keep up with the current workload.

To help address the tech shortage longer-term, dealers are looking at more strategic recruitment strategies.

“We are raising our labor rates to compete with the auto industry for technicians,” one dealer said.

“We have recruited technicians from area tech schools, an over-the-road trucking firm and even a neighboring dealer,” another dealer said. “We have bumped pay significantly over the past 18 months.”

Another dealer is offering tuition support for younger technicians to attend tech school. “We also offer them summer employment,” the dealer added. “We also spend time visiting and supporting local high schools that have welding, auto repair and wood craft programs.”

“We are looking harder at trade schools as well as technicians wanting to change from working in the powersports and automobile industries,” another dealer said.

“We hire high school students through a youth apprenticeship program in our state,” another dealer said. “We also participate in a program where we pay the tuition for one technician who joins our team. Finally, we pay our current employees a bonus if they recruit a technician to come work for us and stay with us.”

For some dealers, the growing lack of qualified technicians has left few options. “We are just hiring less experienced people and training them ourselves,” the dealer said.

Most dealers (74%) are planning to increase investment to modernize and improve service department operations in 2022. Roughly 60% plan to invest more to improve and modernize retail operations.

Additionally, 39% of dealers plan to increase investment in business information system technology, which goes hand in hand with improving parts and service department efficiency. Survey respondents utilize 17 different business systems, the most common being DIS 17.19%, HBS 14.06%, Charter Software 10.94%, Ideal 10.94% and BASIC Software 9.38%.

In another effort to improve service department productivity and profitability, more dealers are charging more for service labor.

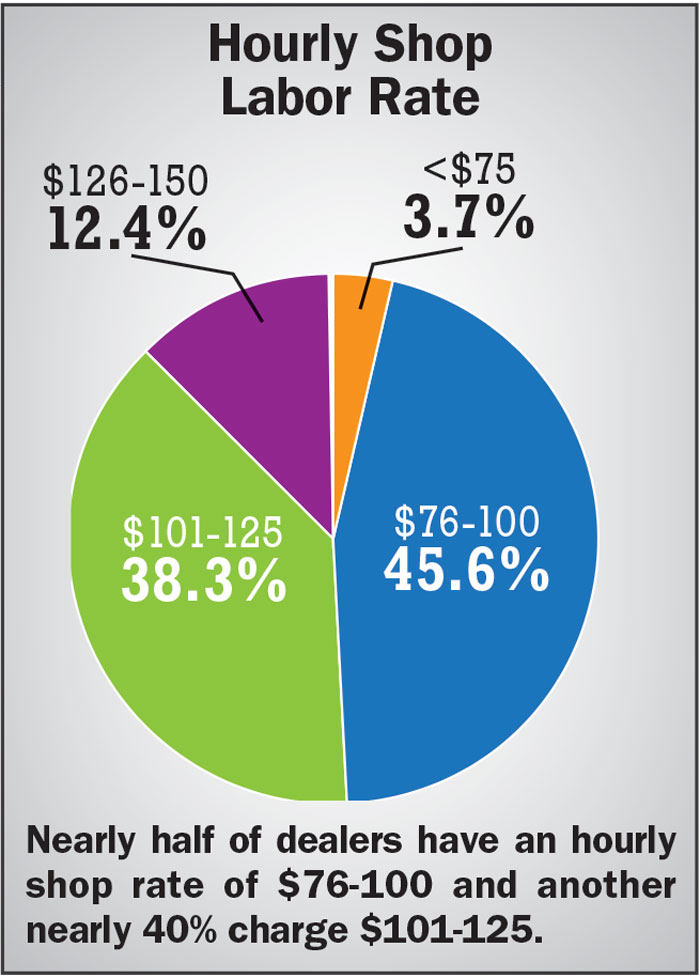

Roughly 48% of dealers charge more than $100 an hour, with another 48% charging $76-100 an hour. Just 4% of dealers charge less than $75 an hour for shop labor.

“This isn’t brain surgery,” one dealer said quite bluntly. “You have to pay enough to be enticing. To do that you need a high enough labor rate. We have no shortage of lawyers because they get paid well.

“Our technicians often have as much, if not more, training. In such a scarce market, why would we not be charging equivalent rates for our technicians’ services?”

Good question. Heading into yet another unpredictable year, rural equipment dealers are searching even harder for answers.

Post a comment

Report Abusive Comment