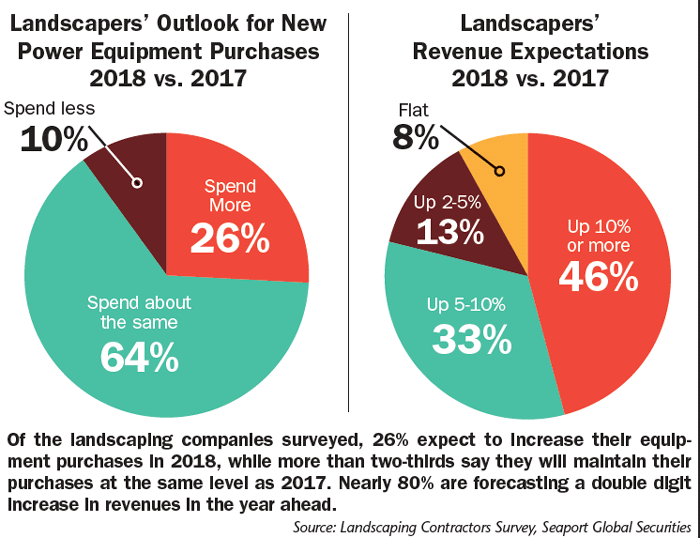

More than one-quarter of landscaping companies will up capital expenditures in the year ahead, while two-thirds will maintain their 2017 spending levels, according to the Seaport Global Securities latest survey. Only 10% say they will reduce their investment in power equipment in 2018.

“This suggests modest growth for the year, in our view,” said Michael Shlisky, analyst for the investment bank. “From a revenue standpoint, 46% of landscapers expect growth of 10% or more in 2018, and 33% expect revenue growth of 5-10%. With high employment and rising incomes, we believe more consumers are choosing to hire professionals for lawn maintenance, and more are undertaking landscape improvement projects in their yards.

“Overall, we believe our survey underscores the improving financial position at many landscapers, as well as the potential for further growth in equipment sales to this industry [in 2018],” Shlisky said in a note to investors.

Of those anticipating revenue growth in 2018, 46% see growth of 10% or more and 33% expect increases of 5-10%. Another 13% are forecasting revenue levels to rise 2-5%. Only 8% said they see flat revenues for the year (down 2% to up 2%).

Gauging landscapers’ sentiment coming into the new year, Shlisky reports that sentiment remains positive. “Among the respondents to our survey, 36% told us that they feel better about their business today than 3 months ago vs. 56% in September. About 8% feel worse about their business than 3 months ago (0% in the September survey), with the remainder noting that sentiment was unchanged.”

Landscapers say business growth and equipment replacement are the main drivers for increasing capital spending. For 2018, 64% cited improved sales levels as the primary reason for increasing spending, while 49% pointed to regular replacement.

Post a comment

Report Abusive Comment