The rural equipment market will bring good revenues again this year, according to Rural Lifestyle Dealer’s 2019 Dealer Business Trends & Outlook Report. However, dealers are indicating some caution in their forecasts.

The 2019 report marks the 11th consecutive edition, the only one of its kind to analyze the growing rural lifestyle niche.

Dealer Takeaways

- About 88% of North American rural equipment dealers say 2019 will be as good as or better than 2018. About 93% say aftermarket revenue will be as good as or better than last year.

- Zero-turn mowers topped the list of products with the most unit sales potential this year. Tractors less than 40 horsepower, utility vehicles, rotary cutters and tractors 40-100 horsepower rounded out the top 5 for unit sales potential.

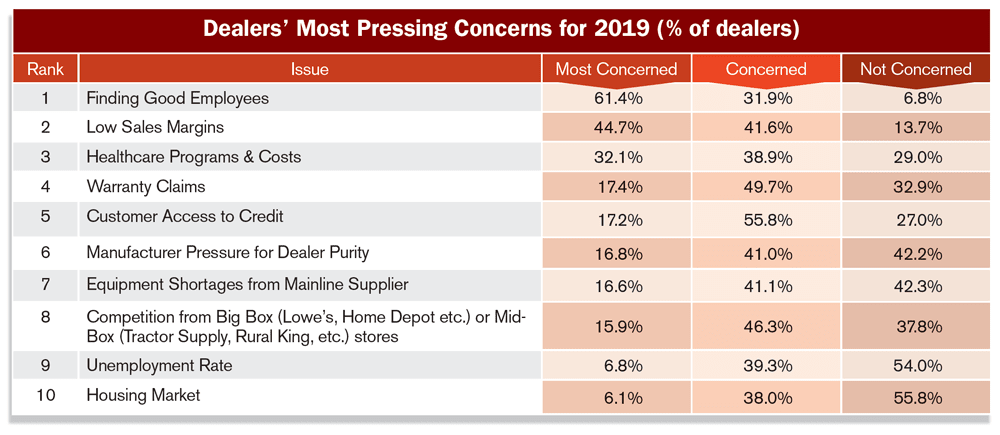

- Finding good employees, low sales margins and healthcare programs and costs are the top 3 issues dealers are most concerned about.

- More than 53% of dealers say their market has grown 5-19% in the last 5 years and nearly 17% say they’ve experienced growth of 20% or more. More than 70% have been serving rural lifestyle customers for more than 16 years.

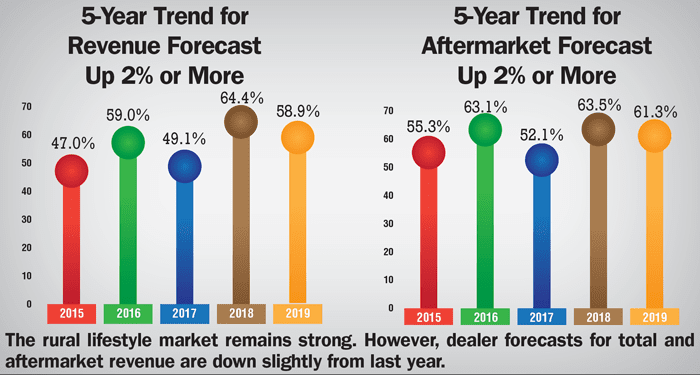

Here is the forecast for change in total revenue: Nearly 59% of rural equipment dealers expect total revenues to be up 2% or more in 2019, compared to 64% who expected similar growth for 2018. About 29.4% forecast no change, compared with 27.5% in 2018 and about 11.7% expect declines of 2% or more, compared with 8.1% last year. (See the charts below.)

Overall, about 88% of rural equipment dealers expect 2019 to be as good as or better than 2018, compared with nearly 92% in last year’s survey.

Rural equipment dealers are slightly more optimistic about aftermarket revenue. About 61% expect aftermarket revenues to increase 2% or more, compared with 63% of the respondents last year. About 31.9% expect little to no change, compared with 32.1% last year and about 7% forecast declines of 2% or more compared with about 4% last year. (See the charts below.)

Overall, about 93% of rural equipment dealers expect 2019 to be as good as or better than 2018 in terms of aftermarket revenues, compared with about 95% with the same sentiments in last year’s survey.

Compared with their production ag counterparts, rural equipment dealers are more optimistic, even when considering an improving ag economy.

A survey by Ag Equipment Intelligence, a sister publication to Rural Lifestyle Dealer, reports that nearly 45% of North American farm equipment dealers expect revenues from the sale of new equipment to increase by 2% or more in 2019. This is down slightly from the previous year (46.5%) but still up significantly from 2017, when only 22.4% of dealers projected higher revenues.

Balancing Overall Sentiments

Another way to analyze the forecasts is through the weighted average perspective, where increasing revenues are compared against decreasing revenues, with the “little or no change” responses not considered. This analysis shows some moderation from last year.

The weighted average for total revenues is 2.43, compared with 2.97 in last year’s survey. The weighted average for aftermarket revenues is 2.86 for 2019 compared with 3.10 for 2018.

You May Also Be Interested In...

Best Practices of Elite Dealerships Volume 4

Now is the time to see your dealership rise to the top. This report features three nationally recognized dealerships and reveals their strategies for success. These top dealership owners share their proven approaches on customer service, marketing and management. There’s a reason these dealerships have all earned Dealership of the Year status. Learn how these top businesses have radically grown their revenues and increased their market share. Download now »

Influencing Factors

Several economic factors could be factoring into dealer sentiment. Home building is one influencer and the National Assn. of Home Builders/Wells Fargo Housing Market Index for December was 56, compared with 72 in January of 2018. The index reflects builder confidence in newly-built, single family homes. Economists say high borrowing costs are restraining demand.

Unemployment rates, another contributing factor in the market, were at 3.9% in December and 4.1% in January of 2018. Economists suggest unemployment rates below 5% are too low and the economy is inefficient. And, low unemployment puts added pressure on the challenges of finding qualified employees.

Alex Chausovsky, senior consulting advisor with ITR Economics, says, the extended period of cyclical rise in the U.S. economy has been atypical. “Typically, if you look at the duration of a rising trend in the U.S. economy, it’s somewhere between 13-19 months. The fact that we are now at 27 months and continuing to rise is really, in my opinion, reflective of the fact that we are in this artificially extended rising streak. We do expect that this boost in economic activity, this rising trend, will come to an end imminently. In fact, we expect that to happen in early 2019. Slowing growth will then take hold, yielding some pockets of actual negativity by the time we get into late 2019 and early 2020 timeframe.”

Chausovsky says the “X factor” for the economy is the administration’s trade actions, particularly tariffs, as well as negotiations with European countries, the United Kingdom and Japan. (Read more in the sidebar, “Preparing for an Economic Downturn”.)

Preparing for an Economic Downturn

Alex Chausovsky is senior consulting advisor with ITR Economics.

The U.S. economy has been rising for 27 months, a pattern that’s at lease 8 months longer than typical, according to Alex Chausovsky, senior consulting adviser with ITR Economics. The Trump’s administration’s tax reforms have contributed to the longer cycle, but a change is expected soon.

“The transition will take place in the coming months, yielding some pockets of actual negativity by the time we get into the late 2019 and early 2020 timeframe.

“If anything is going to determine how significant the negativity will be at that time, it will be the tariff environment over the first 6-9 months of the year,” says Chausovsky.

Preparing Your Dealership

Chausovsky says dealerships should watch costs and look for available opportunities, “pivoting” what you sell and which customers you focus on to pursue the “lowest hanging fruit.”

“Companies absolutely need to be more aware of their own profitability metrics because we have rising prices all around us. We have wage-driven inflation. We have material price-driven inflation. Certainly, logistics are up significantly this year in terms of shipping. We have all these natural inflationary pressures before we even consider the impact of inflation related to tariffs. The old adage of raising your prices once a year is out the window. You have to understand where you are from a profitability perspective at all times,” he says.

Chausovsky also advises that you can outperform through the downside by re-examining your markets and the products you carry while looking for new business arrangements. “Perhaps look to lock in longer term contracts with some of your customers to create some stability for yourself. Essentially, leverage other people’s current optimism to your advantage and lock in some of that business for the next 2 years to carry you through the downturn.

“Then prepare yourself for the next upswing. We expect that the pullback in the economy will be a lull in activity, not a severe recession. Keep some ‘dry powder’ ready for those low points in late 2019 and early 2020 when you can put cash to work and prepare for that next rising trend that’s in the late 2020, early 2021 timeframe,” he says.

ITR has been forecasting a depression coming and Chausovsky says that forecast still holds. “We still believe that the 2030s will be an extremely difficult time for the U.S. economy, not just like 2008/2009 was, but more like 1929, when we have unemployment north of 10% and significant declines in the GDP (gross domestic product).

Chausovsky says dealers need to understand their business data and leverage the messages in their own rates-of-change to weather any cycle. “Your own business data will help you make more informed decisions and make better timed decisions to get ahead of the curve,” he says.

Influencing factors within the market itself include the continued growth of the customer base and the maturing of dealers serving the market. More than 53% of dealers say their market has grown 5-19% in the last 5 years and nearly 17% say they’ve experienced growth of 20% or more. More than 70% have been serving rural lifestyle customers for more than 16 years. (See the table “Facts & Figures About 2019 Survey Respondents” for more demographic data.)

Facts & Figures About 2019 Survey Respondents

The following information was provided by dealers who participated in Rural Lifestyle Dealer’s 2019 Dealer Business Trends & Outlook survey. It is compiled to provide our readers and other interested parties basic demographic data on the rural equipment dealers who are serving the small acreage farm, hobby farm, large property owner, light contractor and lawn and landscape segment. (Percentages = Dealer Responses)

Rural equipment dealerships are generally small businesses, with about 70% of the respondents employing 20 or fewer employees. The niche also offers diversity, including hobby farmers, production farmers, municipalities/parks, landscape contractors and construction contractors. (The chart “Breakdown of Customer Segments” provides more details.)

Driving Unit Sales

Dealers zeroed in on what will boost revenues in 2019, with nearly 67% ranking zero-turn mowers number 1 of 26 categories. Tractors less than 40 horsepower ranked second with about 60% of dealers expecting unit sales to increase 2% or more. Utility vehicles ranked third (about 48% of dealers), rotary cutters ranked fourth (about 46% of dealers) and tractors 40-100 horsepower ranked fifth (about 40% of dealers) in terms of unit sales increases. (See the table “Product Lines with Most Potential to Increase Unit Sales”.)

Consumer demand for zero-turn mowers continues to be strong as the category regularly tops the list. However, moderation is evident when comparing the top 5 this year with the top 5 last year (zero-turn mowers, tractors less than 40 horsepower, utility vehicles, rotary cutters and front-end loaders). The percentage of dealers expecting unit sales increases of 2% or more is down 5-10% among the top 5 categories.

Among the list of 26 categories, seeders/drills and power hand tools had the biggest shifts. Seeders/drills moved up to 18th place from 23rd place last year. Power hand tools moved up to 12th from 17th place. Manure spreaders also moved up in ranking (20th from 24th). Categories that declined in ranking for unit sales potential in 2019 include post-hole diggers (17th to 20th) and wood handling equipment (18th to 21st).

The weighted average perspective shows declines in the top 5 and bottom 5 for unit sales potential (comparing positive to negative forecasts). Zero-turn mowers showed the biggest decline from last year. (See the chart “Weighted Average Perspective”.)

Expanding Lineups

A fresh showroom every season brings in customers and dealers are boosting their offerings of tractors for 2019. About 46% of dealers expect to add tractors in the under 40 horsepower category and more than 43% of dealers plan to add tractors in the 40-100 horsepower category. Utility vehicles ranked third (41% of dealers), zero-turn mowers ranked fourth (nearly 40% of dealers) and skid steer loaders ranked fifth (about 28% of dealers) in terms of products being added. (See the table “Product Lines Dealers are Likely to Add in 2019”.)

Those same categories ranked in the top 5 for 2018, with the two tractor categories ranking above utility vehicles and zero-turn mowers for 2019. Last year’s top 5 ranking looked like this: utility vehicles, tractors less than 40 horsepower, zero-turn mowers, skid steer loaders and tractors 40-100 horsepower.

There was a good amount of shifting in the rest of the rankings. For instance, chain saws moved up to 9th from 15th last year; seeders/drills moved up to 11th from 19th; and ATVs ranked 16th this year and 22nd last year.

Dealer Q&A: ‘What are your biggest opportunities for growth?’

“New location, new products and more experienced salespeople.” ... “Technology is the largest opportunity for growth and well as offering rental units. Our 40 horsepower and down tractors are an area that will keep us afloat in the next few years.” ... “Online marketing and sales. Increased online scheduling for service.” ... “Brand loyalty.” ...

“We feel we have a great opportunity for strong growth in the coming years due to good margins, a good economy and a motivated sales department.” ... “Update our website. Update the service shop.” ... “Changes in the service department with triage and efficiency in all departments.” ... “Increase labor rates. Continue to improve shop efficiency. Increase zero-turn mower sales. We are going to continue to grow our robotic mower sales and installs.” ... “Pursuing more government bids.” ...

“Acquiring a third location in high income area. Most growth will occur in the under 40 horsepower market and zero-turn mowers. The largest opportunity is selling our ability to service and satisfy customers. Beginning in January, we are spearheading a ‘buy local’ campaign in our local county to help educate businesses and consumers on the financial and economic impact of buying local.” ...

“Moving to a larger facility with more service department and retail space. Expanding to new lines and recently acquired new lines.” ... “Light construction equipment and hay equipment.” ... “We are in a transition mode from the older generation (third generation) to the fourth and fifth generation owners.” ...

“New business system, increased margins, changes in service.” ...

“Hay equipment.” ... “Continuing to improve margins with top-of-line service.” ... “We are in the planning stages for expansion. With the new construction in the area, they (other dealers) will see 50% more customers. This is not just from one, but many that I have spoken to. We will need more staff, but, at this moment, I am moving with guarded intentions.” ... “Larger tracts of land being cut up into smaller, more affordable plots with new houses being built on the land.” ... “There is a fair amount of new construction and I see a potential to take advantage of this trend and earn more homeowner retail sales.”...

“We’re focusing on some more rental equipment that our rural lifestyle customers can utilize, but don’t want to spend the capital on. Currently, we’re trying to stay with just specialized pieces that aren’t available through the larger rental houses – no-till drills, disc harrows, manure spreaders, etc. We’re also getting back to putting more focus on government/municipality sales opportunities.”

Categories that shifted lower this year in the rankings for products being added include finishing mowers (down to 21st from 7th); wood handling equipment (down to 22nd from 14th); and scrapers/graders (down to 24th from 18th last year).

Making Improvements

Dealers are upgrading their dealerships to support their expanding lineups and growing customer bases. The Dealer Business Trends & Outlook survey shows that more than 58% of dealers plan to modernize or make improvements in their shop and service departments. A new question for this year asked dealers what they charge on a per-hour labor rate. The majority, 62%, charge between $76 and $100, but 3% are charging $126- $150 an hour. (See the chart “Dealers’ Hourly Shop Labor Rate”.)

Nearly 46% plan to update their retail space, a good move says Paige Wittman of Miller Wittman Retail Design Group. “You all have a different starting point, but you have to start somewhere. Good retail design will increase your sales and increase your profit margins,” Wittman says. They’ve seen increases of 40% on sales of wholegoods and more than 50% on parts and accessories sales.

About 37% plan to invest in business information systems. Rural Lifestyle Dealer columnist Bob Clements of Bob Clements Intl. offers this advice to dealers regarding business information systems: “It can either be the most useless expense that you’ve ever made in your dealership or the greatest investment. And it has nothing to do with the software at all. It really has to do with what you’re doing with the software.” View this webinar to help maximize the benefits of your business management software, www.RuralLifestyleDealer.com/BizSoftwareWebinar.

Promoting Your Brand

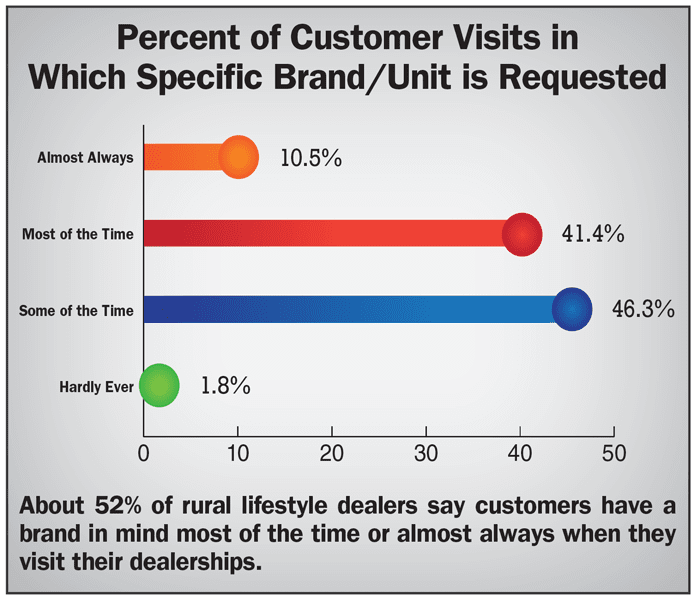

The Dealer Business Trends & Outlook survey looked at other factors that contribute to success, such as brand and dealership reputation. What you sell is important, but respondents this year had a different view. About 52% say customers have a brand in mind some of the time or almost always when they visit a dealership. That compares with 60% of dealers indicating that sentiment last year. Perhaps that means you have a chance to change a customer’s mind if they are shopping around. (See the chart “Percent of Customer Visits in Which Specific Brand/Unit is Requested”.)

So, how you sell becomes even more important and dealers are positive about their influence with customers. About 77% of dealers, matching last year’s number, say their product recommendations are accepted some of the time or most of the time. (See the chart “Percent of Dealer Suggested Product Recommendations Accepted”.)

Partnering in Other Ways

Making it easy to do business is always another influencer, with financing being an important part of that. More than 72% of dealers say customers seek financing from them at least half of the time, close to what dealers said in last year’s report.

Rural Lifestyle Dealer looked at how technology, such as artificial intelligence, blockchain and smart contracts, will drive changes in financing in an interview with two experts from Capgemini. One of the experts, Jeff Boots, says, “I think that within the next 1-2 years, people in this industry will be employing artificial intelligence and then they will start to look at smart contract and blockchain capabilities. Within 5 years, you will see people in this space utilizing one, two, perhaps all three of these technologies to service a customer base that is increasingly technology savvy and looking for optionality in their financing programs.”

Dealer Q&A: ‘What are your top concerns going into 2019 and how will you address them?’

“Keeping customers at a 90% approval rating for the dealership in total buying, parts and service experience.” ... “To try and continue the strong rural lifestyle purchasing through advertising on radio, direct mail. We need to sell service, belief in the dealership, provide valuable information other than the product advantages, sell quality product, parts and service and promote our local economy.” ... “Market share. Advertising using digital media and direct mailers. Retaining workforce using incentives.” ...

“1) Unstable ag market. Not much I can do about this. 2) Retaining good techs. Continue constant recruitment. Stay ahead of the pay curve. 3) Health care costs. Continue to monitor and shop for best program for our employees at a cost we can afford. 4) Staying healthy myself.” ...

“Free trade/tariff issues. We are being hit by increases in prices from most suppliers and will need to either pass those along, which could impact overall growth (and slow it/stop it), or cause us to cut margins, which will impact our profitability. To counteract this, we have invested in sales training and marketing.” ... “Over and above all are commodity prices and the tariff implications. Only then will farmers start buying again, and lawn and garden price increases might stop.” ... “Competition increase. We plan to increase our cyber presence.” ...

“Employees are the biggest concern. We are just entering our third year of business. Our business is exploding to the point that the principles are working 15-hour days almost every day. We need more space, particularly for service, but it doesn’t do any good if we cannot find qualified service techs. We offer higher pay, but it is still difficult to find help. We can train some help in the long-term view, but we need people with experience now.” ...

“Transitioning the ownership of the dealership is our primary concern going into 2019. We are working hard to position the next generation for success.” ... “Finding good employees. Partnering with either the college or tech high school to get techs out of school.” ... “Hire more well qualified technicians. Better cash controls. Stay on top of warranties.” ...

“1) Good help. Keep interviewing. Offer good pay. 2) Health insurance costs. 3) An improved supply of product. Ordered heavy on early order. 4) Inflation. Rising costs. Be careful on purchases.” ...

“Higher prices on tractors and equipment and higher finance interest rates, both of which I can’t control. Also, how the news media affects sales when they give positive or negative reports on the economy.”... “Employee retention, finding qualified workers. H2B Visa program.” ...

“Find a retail finance company dedicated to rural customers.” ... “Retail interest rates and rising tractor and machinery prices. Also, internet sales. Nothing we can do about the first two concerns, but we’re advertising more than ever on the internet trying to compete with the bad boys out there selling equipment in our territory. Manufacturers are not stepping up to stop the online selling out of territory”...

“Pressure by floor plan companies and cash flow. Keeping inventory lower than I normallly would.” ... “Finding service and parts personnel that are responsible and helpful in achieving the goals and standards set by the dealership.” ...

“Employee morale is too often overlooked and should be viewed as very important to success of serving the customer to each employee’s best ability..” .

“Health Insurance is going bonkers — up 32%. We will have to begin charging our employees more for their health insurance. Interest rates are also going up, which will cause less impulse buying than we have seen the past 4 years. More pressure from the manufacturers to sell the less popular units that no one can sell. ... “Big box stores are our biggest concern. The manufacturers do not care that the DEALER is who built their business and now they want the dealer to service the products that we did not retail. ... “Rising interest rates have slowed the market and government uncertainty. They are slowing the new acreage buyer.”

Tune in to this podcast to learn more, www.RuralLifestyleDealer.com/SmartFinancingPodcast.

Offering rental is another way dealers are providing equipment — in the arrangement that certain customers prefer. About 45% of dealers say they offer rental equipment, up from 40% in last year’s survey. The top 5 equipment categories rented are skid steer loaders, tractors less than 40 horsepower, tractors 40-100 horsepower, backhoes and front-end loaders. (See “Product Categories Rented”.)

Larry Kaye, CEO of Script Intl., a contractor consulting company, says dealers need to pay closer attention to what rental can do for their profitability. “In the traditional business model of sales, parts and service, the two that make the most margin are flat or in decline. That means a dealer has to make up 70% of his business through sales, the area with the lowest margin. Rental, which offers gross profit margins of 30% or more can be the solution,” Kaye says. Go here to read more on the topic, www.RuralLifestyleDealer.com/RentalGrowsRevenues.

Dealer Concerns

There are many opportunities for dealers to have another solid year. However, you also face several recurring issues including finding employees, low sales margins and healthcare programs and costs. Those issues ranked as the top 3 for issues dealers are most concerned about. (See the table “Rural Lifestyle Dealers’ Most Pressing Concerns for 2019”.)

Finding good employees has been at the top of the list for several years. Last year, healthcare programs and costs ranked second, while low sales margins ranked third.

Sara Hey, vice president of business development and operations for Bob Clements Intl., offers ways you can enhance job listings through search engine optimization. Go here to view the discussion, www.RuralLifestyleDealer.com/FindingHiringEmployees.

Industry in Motion

Several manufacturers are making big changes, directly affecting dealers this year and beyond. For instance, Textron announced that it is ceasing production for the Dixie Chopper and Jacobsen zero-turn mowers and closing a manufacturing facility.

Dig Deeper into the Data

Additional analysis will be available soon in a special report on www.RuralLifestyleDealer.com. Watch for an upcoming webinar on the report as well.

Kubota Tractor announced a new president, Haruyuki (Harry) Yoshida. Yoshida replaces Masato Yoshikawa, who was promoted.

Mahindra North America also had a change in leadership, with Mani Iyer retiring as president and CEO and Viren Popli assuming the roles.

There were numerous acquisitions as larger corporations filled in gaps in products and expertise: Stanley Black & Decker (20% stake in Cub Cadet); Generac (Selmac, manufacturer of industrial generators); Michelin (Camso, rubber track manufacturer); Briggs & Stratton (Hurricane blowers); Constellation (c-Systems Software); Husqvarna (minority stake in Franklin Robotics); Toro (L.T. Rich Products, manufacturer of spreader/sprayers, aerators and snow and ice management equipment); and Mahindra (Mitra, spray manufacturer).

These changes underscore the maturing of the rural equipment market — along with the niche’s importance to overall revenues of manufacturers and dealers alike.

Post a comment

Report Abusive Comment